healthy muse healthcare news.

- This week in healthcare: HCA snags MD Now in Florida, $29 billion in digital health funding, Humana’s bad week, NFL and healthcare fraud, and more.

HCA snags 59 Urgent Care Centers in Florida

Diversification: HCA, the large publicly traded hospital operator, announced on January 4 its intention to purchase Florida-wide urgent care operator MD Now. The purchase price was not disclosed, but you can imagine it was a platform-level multiple to acquire such a large footprint. (Link)

- Details: MD Now operates 59 urgent care centers throughout Florida at a time when urgent cares are performing extremely well since they’re basically COVID test beacons. Free foot traffic. I guarantee we see more activity in the urgent care space among PE, health systems, and now CVS and Walgreens entering the convenient clinic setting so popular with millennials.

- The acquisition also helps HCA to continue to diversify its offerings throughout the spectrum of care delivery. Don’t forget that HCA purchased Brookdale Senior Living’s home health operations last year as well.

Digital Health Funding hits all-time high in 2021

Funding Secured: Let the EZ money flow…according to the latest Rock Health digital health funding report, total U.S. based funding among digital health startups topped $29 billion in 2021. That’s up BIG time from 2020’s $15 billion investment estimate.

- Details: Funding is mainly being driven by larger deals rather than number of transactions, which seems to mirror the rest of healthcare deals in that regard as the industry consolidates. I’d expect this to follow a similar trend in 2022, but because of tightening money policies, funding will likely come down a bit. (Link)

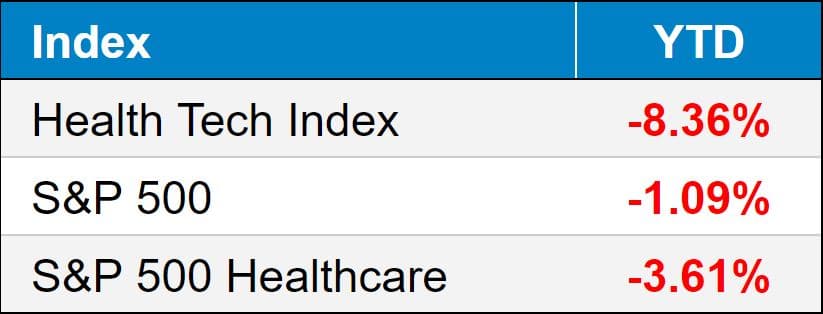

public market update.

Top 3 weekly performers: UpHealth (+5.4% lol); CareMax (+0.26%)

Bottom 3 weekly sandbaggers: Literally everyone, but the top 3 were P3 Health Partners (-29%); Alignment (-25%); and Oak Street (-23%).

- Full List YTD performance: (Link)

- The Health Tech Index is down 15%…10 days in to the year.

HUM: Here’s a super notable, interesting trend: Humana shares collapsed Thursday after guiding significantly lower Medicare Advantage growth than initially expected. The consensus from most folks is that increased competition on pricing from the new insur-tech gang is crowding the MA space, while others attribute some of the attrition to…well…Covid related deaths and fewer members to go around.

- Humana led all managed care providers lower this week. And here I thought managed care was impervious to bad news. I guess this is what happens when you stop hitting your growth projections, even at the very top of the food chain. (Link)

PRVA: Privia Health announced some good news on the 5th – the firm has entered into a few value-based risk arrangements through two of its ACOs, adding 23k members and $230 million in incremental revenue…do the math there! (Link)

EHC: Encompass and Saint Alphonsus Health announced a JV in Idaho to partner on home health and hospice care in the greater Boise area. (Link)

BHG: Bright Health released revenue guidance above its previously estimated range for 2022. Unfortunately that hasn’t helped the stock price much. (Link)

ACCD: Accolade popped after hours on better than expected Q3 results but still issued downside revenue guidance for its Q4. Still, the stock was up 12% after hours since taking a beating so far this year. (Link)

CNC: Centene settled yet another PBM price fixing allegation. Centene has now settled 5 states for $236 million, and the managed care firm expects to pay up to $1.1 billion for total settlement $$$. No admission to wrongdoing though, I’m sure. (Link)

- In other Centene news, the insurer finalized its acquisition of Magellan Health for $2.2 billion. (Link)

Biz Hits

Digital Health M&A: This acquisition had the whole #healthtwitter world rockin’ Vera Whole Health is acquiring healthcare navigation company Castlight Health in a $370M deal. (Link)

Hospital M&A: NorthShore and Edward-Elmhurst completed their merger to create Illinois’ 3rd largest health system at 9 hospitals. (Link)

Watson: IBM is trying to sell off its Watson Health division once again, for a reported $1 billion. (Link)

Molina: The managed care player closed on its $60 million acquisition of Cigna’s Medicaid contracts in Texas. I’d love to be a fly on the wall for that valuation analysis as a valuation nerd myself. (Link)

Policy Hits

Cali: Democrats are pursuing a highly progressive bill in California which would jack up taxes but also let the state fund a single-payer healthcare system. Pretty crazy stuff going down there, can’t imagine why there’s a u-Haul shortage in the state at all. (Link)

Biden: Is mandating that insurers cover 8 ‘Rona tests per month. (Link)

- In other ‘Rona news, Biden advisers are calling for several policy changes to be made, including changing risk thresholds, stepping up testing and therapeutics, and a slew of other recommendations. Read em all here and I have to say candidly it’s pretty ridiculous the state we’re in 2 years in to this thing. (Link)

Study: This was an interesting study into the differences in coverage denials between traditional Medicare and Medicare Advantage. The study, from Health Affairs, found that traditional Medicare coverage makes up the bulk of denied services, a finding that I consider to be counterintuitive but hey, that’s why studies exist. (Link)

Other Hits

NFL Fraud: A scheme involving medical devices that were never delivered caused several former NFL players to pay up big time for their role in the ring. Among them was Clinton Portis, a pretty successful running back for the Washington (ahem) Football Team. I love it when healthcare news overlaps with mainstream coverage. (Link)

Turtleneck & a deep voice: Elizabeth Holmes, former esteemed founder of Theranos, was found guilty on 4 of 11 charges, ironically none of them involving harming patients despite incredibly inaccurate blood tests. She was convicted on wire fraud involving lots of money, though. Always follow the money, folks. (Link)

Hot Takes

Goldman: Ironically, Goldman Sachs is forecasting a positive outlook for insureres in 2022 as a result of the shifting to value-based care. Not panning out so hot so far. (Link)

Healthy Muse Top Picks

PE: This was a good overview from Keckley on where private equity is at headed into 2022. (Link)

Telehealth: This was a great overview of the current dynamics facing the telehealth industry. Has the bubble actually popped? What do you think? (Link)

Dialysis: This was a great deep dive by ProPublica into how the pandemic ravaged dialysis and end-stage renal disease patients, an extremely vulnerable population, and that nobody really noticed how big of an impact it made on this patient population. (Link)

Noom: This article from Inc was a fantastic deep dive into Noom, a weight-loss company with real weight and lots of momentum behind it (Ha!) Read it here. (Link)

In case you missed it: I wrote about every major healthcare story in 2021 in one long-form read, in chronological order. Support me by sharing it!! (Link)