healthy muse healthcare news.

Happy tax day, you procrastinators.

- Last week in healthcare: Breaking down the Intermountain merger with SCL Health, Optum continues its buying spree in purchasing Kelsey-Seybold, Hims & Hers partnership with Carbon Health, a 7 hospital health system merger in West Virginia, Aveanna’s bad Q4, CMS payment updates, and Memorial Hermann’s urgent care JV with GoHealth. (Link to Last Week’s Edition)

- This week in healthcare: UnitedHealthcare earnings, Carbon Connects with Froedert Health, NPs get full practice authority in New York, Bright Health is exiting 6 markets after a dismal 2021, public health emergency gets extended, and DaVita gets acquitted.

UnitedHealthcare’s Q1

Everyone’s favorite diversified healthcare behemoth reported earnings this week in typical leading fashion for healthcare. UnitedHealthcare posted revenues of $80 billion, double-digit growth for both Optum and UHG. Revenue per consumer grew 33%, and the primary growth driver here continues to be value-based care arrangements as noted by management on the call.

- In fact, Optum expects to add 600k patients under VBC arrangements during 2022, significantly higher than their initial expectation of 500k.

Other notable tidbits I found interesting:

- UHG is on track to grow by 800k more members in its MA segment and 350k more members in its commercial segment

- UHG is seeing popular growth in its virtual-first offerings, as more than 30% of individual market participants are choosing that option. Expect to see a big expansion of virtual-first plans in 2023.

- United is already steering members away from certain post-acute settings like SNFs. In VBC arrangements in Ohio and New York, management touted its ability to decrease admits into these settings by 25%. United’s continued and growing ability to steer members into lower cost settings is good AS LONG AS that patient doesn’t need a more intense care setting that UHG denies. I really hope that isn’t the case here, and this type of trend has significant downstream effects on post-acute providers like Kindred, Select, and Encompass. This is only going to continue as United integrates its recent purchase of LHC Group.

- Notably, United lost 3 customers on the commercial side. Even though everything else is running full-steam ahead for UHG, its commercial book of business seems to be stagnant and a slower growth segment. Is this a chink in the armor, or just part of a broader trend related to Medicare enrollee and individual market growth?

- United is still optimistic and remains committed to its acquisition of Change Healthcare. If you recall, it’s caught up in antitrust review after the AHA called foul.

- As far as overall healthcare utilization is concerned, United echoed similar sentiments to what hospital operators and other providers mentioned – big spike in hospitalizations from Omicron, then fizzled out in Feb/March. UHG mentioned that utilization typically returns to normal 2-3 months after a spike in cases.

Resources:

NPs get full practice authority in New York

Physicians hate this one thing! The public health emergency loosened healthcare regulations in several states. One of the more interesting rollbacks relates to practice authority of mid-levels (AKA, nurse practitioners and physician assistants). Historically, NPs had to sign a contract with a physician in order to prescribe medications and were limited in other ways.

- Now, states like Kansas, Massachusetts, Delaware, and most recently New York, have vastly expanded the NP’s ability to practice with full authority outside of the watchful eye of a physician. In total, 26 states hold legislation related to Full Practice Authority much to the chagrin of physicians who think the move infringes on their territory and hurts patient care.

My thoughts: I can definitely see both sides of the argument here, but overall view the move as a net positive. We’re all well versed in how big of a physician shortage is looming with the double whammy of retiring MDs and Baby Boomers aging into Medicare. Since most (75%) of NPs work in primary care, states consider it a way to expand primary care access to these groups.

The question is whether or not NPs can provide an adequate level of care. Will they be able to catch the more subtle, complex cases presented to them that a physician might have managed to diagnose?

Resources:

- New York grants nurse practitioners full practice authority (Link)

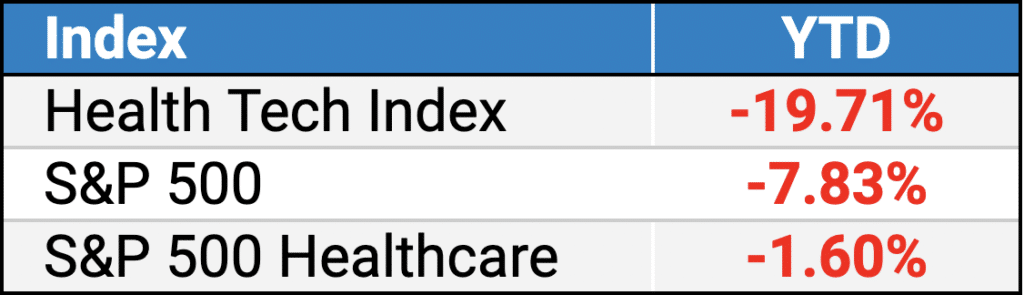

public market update.

Big Winners: LifeStance, InnovAge, Aveanna

Big Losers: Accolade, GoHealth, Pear Therapeutics

Full List: (Link)

Bright Health is exiting 6 markets after losing $1.2 billion in 2021 related to faulty claims processing. (Link)

Ironically, Bright Health’s services division Neue Health is participating in CMS’ direct contracting model in 6 markets as well. (Link)

Aveanna Healthcare is participating in an interesting new caregiving model in Arizona. The Family Licensed Health Aide Program will train ordinary family caregivers (staying at home taking care of loved ones) to operate and get reimbursed in their homes as Licensed Health Aides and get reimbursed for that care.

Another one of Centene’s board members resigned. Between its CEO transition, activist board fight, and now this, the managed care Medicaid giant has seen a ton of turnover at the top. (Link)

DaVita was acquitted on all three counts related to an antitrust suit brought by the government accusing DVA of antitrust practices by making arrangements with other healthcare orgs ‘not to poach’ certain executives and employees. (Link)

Encompass Healthcare opened up a new 85-bed (MASSIVE) inpatient rehab facility in Huntsville – North Alabama, continuing its rapid building and deployment of IRFs throughout the US. (Link)

UpHealth is transitioning its CEO. lmao. (Link)

Biz Hits

Trend Watch:

Disputes: You heard it here first: 2022 will be the return of the nurse / labor strike and out-of-network spats between payors and providers. In fact, Stanford is the fun recipient of a 4,000-nurse strike, and MaineHealth terminated its contract with Anthem. So far so good!

In a move that surprised no one, HHS renewed the public health emergency for 90 more days. Democrats are under heavy political pressure and I imagine they’ll use healthcare to bolster their platform for the upcoming election cycle. Still, at some point we’re going to have to figure out how to unwind the PHE – what de-regulation should stay, and how best to make them permanent. (Link)

- Related, here’s a good article on wind-down for Medicaid coverage when PHE ends (Link)

The 340b Program now accounts for 15% of all pharmaceutical sales in what is fast becoming a hot battleground between hospitals, big pharma, and the government. (Link)

CMS proposed a 3.9% payment increase for SNFs offset by PDPM payment adjustments of 4.6%, resulting in a net decrease in funding to SNFs of about $320 million. I told you guys – SNFs don’t seem to be having any fun right now, and they’re only facing more headwinds amidst the growth of at-home programs and home health – which I covered in my LHC-Optum analysis. (Link)

Strategy & Partnerships:

Carbon Health announced a partnership with Froedert. In what I imagine is similar to an expanded version of a urgent care management model, Froedert Health will join Carbon Health’s management platform called Carbon Health Connect. Carbon Health will manage new and existing primary care and urgent care clinics while expanding into other markets in Froedert’s footprint in the greater Milwaukee area. (Link)

- Carbon Health also launched a diabetes program. (Link)

- In general, Carbon has been making tons of moves and is emerging as a big player in healthcare on multiple fronts. Theirs is a name to continue to watch and I love hearing about the plays being made.

BSHS System (yes, I was confused too – it’s the new name for Beaumont Health and Spectrum Health) invested in Grand Valley State’s nursing program in a $19 million play (Link)

Thirty Madison launched a virtual dermatology platform. (Link)

Kidney care co. Strive Health partnered with Evolent Care Partners in Michigan and North Carolina to care for chronic kidney disease patients as a part of Evolent’s ACO. (Link)

Insur-tech co. Sidecar Health launched a new commercial plan in Ohio. (Link)

M&A:

Hackensack sold its long term care facilities to Complete Care. (Link)

Option Care Health completed its acquisition of Specialty Pharmacy Nursing Network. (Link)

Fundraising & VC:

Northwell Health and Aegis Ventures launched a JV planning to invest up to $100 million in seed-stage AI startups for healthcare. (Link)

Enhanced Healthcare Partners, a PE group, invested in VBC firm Vytalize Health. Vytalize raised $53 million. (Link)

Iris raised $40 million. Series B. Virtual psychiatry. (Link)

Real raised $37 million. Series B. Behavioral Health. (Link)

Season Health raised $34 million. Series A. Food-as-Medicine. (Link)

9am.health raised $16 million. Series A. RPM / diabetes virtual clinic. (Link)

DUOS raised $15 million. Series A. Aging-in-Place provider. (Link)

Forge Health raised $11 million. OP mental health and substance abuse. (Link)

Nudj Health raised $10 million. Series A. Virtual Care behavioral something or other. (Link)

Data, Studies, & Resources

KFF unveiled its Managed Medicaid Tracker, which provides Medicaid enrollees and membership by state. Pretty cool. (Link)

VMG published its annual ASC Intellimarker, giving a ton of operating and financial stats on everything ASCs (Link)(Beckers)

The Urban Institute published a report related to marketplace premiums. Because of subsidies and increased competition in the individual market, premiums fell by about 2.0%. (Link)

Blake’s Musings

My hometown of Plano, TX had an…extremely interesting guest during its city council meeting. “I’m a Zelensky Stan”

I shot an 84 at Pebble this week. The short game was working for me! Here’s a pic.

What do you make of the whole Elon Musk-Twitter-Poison Pill saga? Pretty insane stuff going on if you ask me. (Link)

Hot Takes

PBM practices are not ethical nor sustainable. (Link)

Robert Pearl and Brian Wayling argue in HBR that telehealth is just beginning and lay out several opportunities for why it can continue to expand. (Soft Paywall)

In Forbes, Sachin Jain wrote a critical piece on value-based care, how not all VBC arrangements are patient driven, and other pitfalls of the model that we need to work through. (Soft Paywall)

Healthy Muse Top Picks

This was a really great overview of insurer profits from Wendell Potter. (Link)

For any NY Times readers out there, they did a profile of recently passed former CEO Michael Neidorff and how he grew Centene into an Obamacare juggernaut. (Soft Paywall)

Ari Gottlieb wrote an overview of Devoted Health, the next up and coming insur-tech with $2 billion in funding, and compared the company to Oscar and Clover. (Link)

Morgan Cheatham wrote a super interesting piece providing insights into payor contracting best practices for virtual care companies. (Link)