healthy muse healthcare news.

In case you missed it: I published two long pieces last week, which might not have reached your inboxes (deliverability probs). If you missed them, check ‘em out below:

- Healthy Muse Q1 in review – my picks for the biggest stories from Q1 2022. (Link)

- Breaking down the LHC-Optum deal – everything you need to know about the future of home health. (Link)

Be on the lookout for another write-up of mine. Subscribers will get it first – it’ll hit your inbox on Thursday at 11 CST, where I’ll be breaking down why inflation kills provider margins, and the dire state of provider finances if inflation persists. Subscribe to the Healthy Muse here

- This week in healthcare: Breaking down the Intermountain merger with SCL Health, Optum continues its buying spree in purchasing Kelsey-Seybold, Hims & Hers partnership with Carbon Health, a 7 hospital health system merger in West Virginia, Aveanna’s bad Q4, CMS payment updates, Memorial Hermann’s urgent care JV with GoHealth, and lots of fundraising announcements. Also, great news. I connected with Ari Gottlieb on LinkedIn. Great guy.

Let’s get after it.

Intermountain completes merger with SCL

Get used to a new giant in the Mountains. Intermountain and SCL Health finalized their merger on April 6, creating a $14 billion system in the Midwest / Mountain States region after announcing the merger late last year.

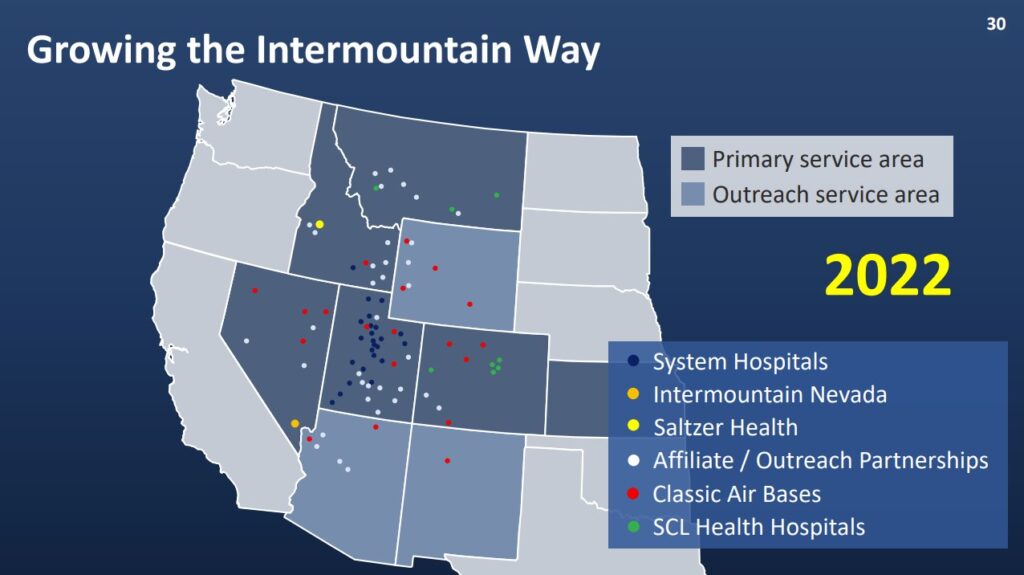

The combined system, to-be called Intermountain, will have an impressive footprint:

- 33 hospitals

- ~400 clinics

- 58,000 employees

- $14 billion in revenue

Just look at the footprint here!!

Intermountain is one of the savviest hospital operators around and has a huge 3,000+ physician base to bolster its value-based care initiatives. I love reading about the way they operate and how the health system is pushing the envelope forward when it comes to population health management. In fact, ~50% of IM’s ~$11.0 billion in 2021 revenue came from premiums & capitation, putting its money and strategy where its mouth is.

- This merger comes two years after Intermountain benefited from buying the HealthCare Partners Nevada operation as a part of the planned divestitures from the larger Optum – DaVita $4.3 billion deal.

Apart from physicians, legacy Intermountain’s footprint included 23 hospitals in 7 states, and around 1 million members on its insurance plan.

On the SCL side, the health system generated $3.0 billion in revenue across 10 hospitals and ancillary services in 3 states.

Although the Biden Administration loves to crack down on antitrust particularly in healthcare, this health system merger managed to pass through scrutiny.

Why?

- Insanely enough, the two health systems had minimal overlap in services & geographic footprint, creating a perfect storm for combining – there’s no local market power / monopoly argument to be made here.

- SCL Health will not materially change its charitable missions as a result. As a historically Catholic nonprofit, this would have created some problems had SCL changed anything related to charity care provisions or type of care.

- The combined org isn’t planning on laying any employees or or downsizing / combining clinic locations or other synergies you would expect from a for-profit entity (AKA, fire the excess personnel).

- When discussing merger motivations, Intermountain stressed the desire to advance value-based care and population health initiatives with the scale rather than JUST use that scale to negotiate favorable pricing. In a fee for service world, Intermountain would theoretically have much better pricing power with insurers post-merger.

In summary, this is a pretty impressive combination throughout the Midwest / mountain region if you ask me. I’ll be really excited to watch how Intermountain pioneers value-based care initiatives at scale within a health system strategy.

Optum buys 500-physician group Kelsey-Seybold in Houston

What the hell is United’s M&A budget? After buying LHC Group in a $6 billion + deal, Refresh Mental Health for likely $1 billion +, Change Healthcare in a $13 billion deal (pending), Landmark Health for $3.5 billion, and plenty of other under-the-radar acquisitions, Optum has tacked on another acquisition, this time in the physician space.

On April 5, Axios reported that Optum has purchased Kelsey-Seybold (”KS”), a 500-physician, multispecialty practice with a huge footprint in the greater Houston area. (Link)

About KS: Talk about another slam-dunk acquisition for Optum fresh off the LHC Group news. Not only does KS provide Optum with yet another huge physician base in a large market, KS also runs its own ~40k member, 5-star MA plan – KelseyCare Advantage – and operates a consortium of ancillaries, including:

- Two ASC’s, one of which is among the largest operating ASC’s in Texas

- 19 pharmacies

- After-hours clinics (urgent care)

- Radiation therapy & Infusion centers

- Imaging centers

Back in January 2020, private equity firm TPG purchased a minority stake in KS’s management company (not the medical group) at an alleged $1.3 billion valuation at the time. The injection helped fund KS’s expansion, and I’m sure TPG is making a nice chunk of change back from this acquisition. Just a casual 2-year flip.

Perspective: Don’t forget – in March 2021, Optum made a very similar acquisition in that of Atrius Health in Boston, a 715-physician, 30-clinic multispecialty group at the time. Based on those two acquisitions alone you can see the strategy Optum is deploying in large markets. Optum is keenly focused on expanding its physician base and has said so on multiple earnings calls over the years.

BIG PICTURE TIME: So…why are these large, financially successful practices cashing out now?

It points to the larger trend of consolidation in the physician space caused by a perfect storm of dynamics. Private equity players, strategic buyers (payors), and hospitals are prioritizing expanding their physician footprint as the front door to downstream opportunities.

- Couple this red-hot demand for physicians with current healthcare dynamics: the average physician (especially shareholder physicians) is nearing retirement. Selling the practice is a great way for them to monetize what they’ve built to achieve a succession plan.

- Along with the retirement trend, physicians are also facing margin pressures from supply inflation, labor shortages, and reimbursement headwinds from payors. Whether these headwinds are temporary or not, they’re probably not fun to deal with.

- Finally, rising interest rates will ding valuations in the near future (I suspect) and private multiples are ridiculous. Heck, I probably would’ve sold, too.

UnitedHealthcare’s stock hit all-time highs today while the S&P is down around 6%. Investors know what policymakers don’t – that United is creating an unprecedented vertically integrated TITAN in healthcare unmatched by other payors. I wouldn’t be surprised if lawmakers force a spin-off of Optum someday.

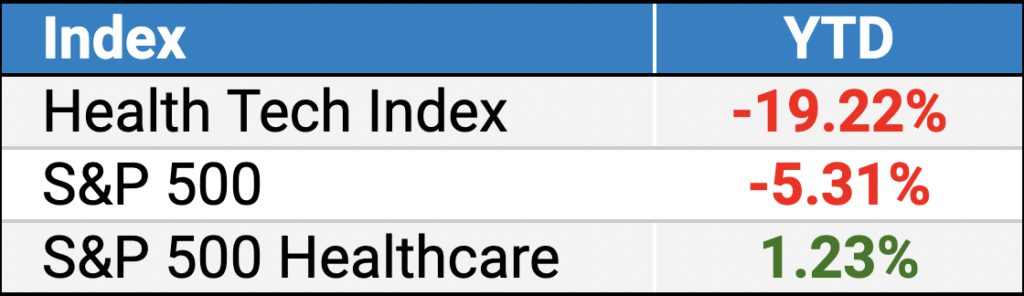

public market update.

Top 3: Change Healthcare, Augmedix, Definitive

Bottom 3: Oscar, Accolade, Cano. I mean, almost all of healthcare was down this week amid a broader market selloff.

Full List: (Link)

$UNH: As if you haven’t gotten enough United news from me lately lol, they’ve extended their merger agreement with Change Healthcare as the DOJ reviews the case. In related news, Change Healthcare is expected to sell its payments integrity business, ClaimsXTen, to New Mountain Capital for a reported $2 billion + price tag. I wonder if the divestiture will appease antitrust concerns? (Link)

$AVAH: Home health operator Aveanna had to recognize a $117.7 million goodwill impairment charge, leading to a $117 million net loss for 2021. As a result, the stock dropped 26%. I’m somewhat surprised it fell so much given that the Optum/LHC news was announced that same day, leading to all of the other home health and home care providers (Chemed, Addus, Amedisys, Pennant Group) to outperform other services biz’s that day. (Link)

$PEAR: Pear Therapeutics Q4 earnings (Link)

$CNVY: Convey Health Solutions Q4 earnings (Link)

$UPH: UpHealth dropped Q4 earnings and also dropped 30+%, down 50% on the year.

- Here are some fun UpHealth SPAC stats: At the time of its SPAC, UpHealth estimated revenues of $194 million and went public at a $1.4 billion valuation. Per its Q4 press release, the firm is filing a delayed 10-K with the SEC. Uphealth posted revenue of ~$150 million, resulting in a 22% miss in 9ish months. It’s now worth $260 million. (Link)

$HLTH: Cue Health dropped its Q4 earnings (Link)

$SLHG: Skylight Health dropped 10% after posting its Q4 earnings (Link)

$PHR: Phreesia dropped 9% after posting a bad outlook for 2022. Q4 earnings (Link)

Biz Hits

Trend Watch:

MaineHealth terminated its contract with Anthem, in what I’m sure will be the first of MANY spats this year between payors and providers. (Link)

Governmental free COVID coverage is ending. Implications include no more free vaccinations, tests, and treatment, which also affects providers who won’t get reimbursed if the patient is uninsured and can’t pay. Back to the new old new normal!! (Link)

Regulatory authorities are increasingly meddling in hospital operators’ strategic plans. In Boston, a state regulatory body rejected Mass General Brigham’s plans to develop a few surgery centers in the suburbs. Yet another example of the ‘free’ healthcare market!! (Link)

Payment Updates:

CMS proposed updating the hospice basket rate by 2.7%. Based on current labor shortages and inflation, CMS is also looking at ways to update the wage rate index portion of reimbursement to appropriately adjust to match future conditions. (Link)

CMS published a 2.8% pay bump for IRFs. (Link)

CMS will increase MA payments by 5% and won’t make any changes to controversial risk adjustment practices. In addition, MA plans are expected to see an 8.5% revenue bump in 2023.

- What the hell? If anyone can explain the disparity here between CMS basket updates for providers and MA plans, please reach out. Is it baked into the wage adjustment? Are we thinking the inflationery / labor pressures are transient? (Link)

CMS issued a permanent delay to the implementation of the mandatory radiation oncology payment model. (Link)

Strategy & Partnerships:

More Houston activity! Memorial Hermann and GoHealth, a large national operator of urgent care clinics, announced a joint venture to develop urgent cares throughout Houston. Memorial Hermann will contribute 10 of its existing urgent cares to the JV while I’m sure GoHealth provided a capital investment and will manage the operations, including new site development, I imagine.

Hims & Hers announced a partnership with Carbon in California to hand off any patients with more complex needs to Carbon’s facility footprint. You’re going to start seeing more partnerships and even mergers between virtual care providers and those with physical footprints to fill in care gaps. (Link)

After slowing its roll a bit on healthcare, Walmart Health is opening 5 new health superstores in Florida. (Link)

M&A:

Hospital M&A hit its lowest point in the last 5 years. According to Kaufman Hall, only 12 transactions were announced in Q1 2022, which continues the trend of very limited activity during Q1. Honestly I would chalk this up to 1) Omicron, and 2) the fact that most hospitals are budgeting for the year in Q1 and don’t have their strategies prioritized quite yet. Just a theory, though. Anyway, the report is a good read on the space headed into Q2. (Link)

Trinity is in LOI with North Ottawa Community Health System to purchase its $52 million operation, an 81 bed acute care hospital along with any outpatient ops. (Link)

Ascension and AdventHealth completed their JOA breakup in Chicago, formally disbanding Amita Health. AdventHealth will continue to operate the four legacy Amita Health hospitals under its brand. (Link)

Mon Health and Charleston Area Medical Center merged into one health system, announced on March 31. The two will operate under a new brand, Vandalia Health, in the West Virginia market, creating a 7-hospital system pending CON approval. (Link)

Publicly traded lifestyle and nutrition company Tivity Health was acquired by Stone Point Capital for around $2 billion, or $32.50 per share. (Link)

PE firm Thomas Lee Partners bought health data enablement firm Intelligent Medical Objects in a $1.5 billion deal. (Link)

Fundraising, Execs, & VC:

AmerisourceBergen launched a $150 million venture fund on April 7 focused on early and mid-stage healthcare startups. (Link)

Clarify Health raised $150 million. Cloud analytics and value-based care enablement platform. (Link)

ConcertAI raised $150 million at a $2 billion valuation. Data analytics firm. (Link)

IntelyCare raised $115 million at a $1.1 billion valuation. Staffing firm that matches nurses to openings in post-acute settings. (Link)

Brightline raised $105 million at a $705 million valuation. Pediatric behavioral health (which is a huge need, might I add) (Link)

Viz.ai raised $100 million. ‘AI’ powered disease detection and care coordination platform. (Link)

Neuron23 raised $100 million. Parkinson’s clinical drug development. (Link)

Brightside raised $50 million. Virtual mental health platform. (Link)

Eleanor Health raised $50 million. Value-based mental health firm. (Link)

Qure.ai raised $40 million. Medical imaging AI platform. (Link)

Evernow raised $28.5 million. Telemedicine for menopause. (Link)

VivoSense raised $25 million. Integrates wearable sensors into clinical trials, a nuanced use of remote patient monitoring. (Link)

Future Family raised $25 million. Fertility financing and care support firm. (Link)

Apploi raised $25 million. Staffing support firm. (Link)

AmplifyMD raised $23 million. Specialist telemedicine platform (Link)

Eleos Health raised $20 million. Behavioral health startup with ‘AI’ voice tech. (Link)

VideaHealth raised $20 million. ‘AI’ enabled dental care startup. (Link)

Zephyr AI raised $18.5 million. Drug discovery analytics firm. (Link)

PocketHealth raised $16 million. Medical image sharing platform. (Link)

Jeenie raised $9.3 million. Medical interpretation company. (Link)

Data, Studies, & Resources

Fair Health dropped its hospital pricing index report, showing how prices have trended over Covid. (Link)

VC: Hospital venture capital deals are increasing. (Link)

Spending: Axios jumped in to CMS’ actuarial predictions for national healthcare spending over the next decade. In summary, spending is expected to increase around 5% per year til 2030. (Link)

FQHCs: Great overview of Federally Qualified Health Centers and their payment models. (Link)

Vax: This was a good breakdown from TCWF on the impact of ‘Rona vaccination efforts and averted deaths, hospitalizations, and healthcare costs as a result. (Link)

Costs: According to the Health Action Council and UnitedHealthcare, 5 general health conditions make up 50% of all spending: cancer, MSK, cardio, GI, and neuro. (Link)

Blake’s Musings

Elon Musk is now Twitter’s largest shareholder. Wild.

Donald Trump claims he hit a hole in one in front of several tour pros, including Ernie Els. A smooth 181 yard 5 iron with a 5 foot cut!! (Link)

Walmart is offering starting pay of $110k for truck drivers, which is on par with like…investment bankers. (Paywall)

By the time you’re reading this, I’ll be on vacation in Carmel, playing Pebble on Thursday. Wish me luck, the putting has NOT been fixed. I’m just there for a good time, anyway!

Hot Takes

THCB published a series on MedPAC’s data reporting and why the PAYMENT ADVISORY COMMISSION may have it wrong on Medicare Advantage. I’m not really a policy guy but I love the spice.

MedPAC got it wrong. (Link)

MedPAC got it wrong, Pt 2 (Link)

MedPAC got it wrong, Pt 3 (Link)

Healthy Muse Top Picks

Consolidation: I enjoyed this read in not-really-my-wheelhouse digital health players and consolidation by Brendan Keeler, Ben Lee, and Megh Gupta. Writers Guild joins forces. (Link)

Olive: It’s behind a paywall, but Axios Pro dove into highly touted revenue cycle, $4 billion, AI enabled operator Olive and how the firm is allegedly misleading clients on its capabilities. (Link – Paywall)