If they aren’t already, providers are about to get killed by inflation.

We all kind of know what inflation is. Expenses go up, purchasing power goes down, and asset prices in general increase.

- But how do those dynamics affect healthcare provider organizations?

- How do healthcare services businesses stave off intense expense margin pressures while also increasing top-line revenue in a high inflation environment where costs increase by 8%, but reimbursement from payors lags?

Let’s dive in.

Inflation background

Inflation happens when the purchasing power of a dollar falls over time. Normal inflation (at least, normal in my past life’s consulting financial excel models) for all goods hovers between 2-3% annually, which accounts for labor salary escalators, increase in food prices, and other demand related effects.

Because of current world events, supply shortages, red hot demand from high government spending, and vastly low interest rates, the economy is on fire.

As a result, inflation is skyrocketing.

- Prior to seasonal adjustment, general inflation rose about 8.0% according to the Bureau of Labor Statistics.

In general, most healthcare providers cringe at the smallest change in expenses. So when expenses increase by 8.0% AND they’re experiencing a labor shortage, this change is a pretty big deal.

Inflation in Healthcare always Lags

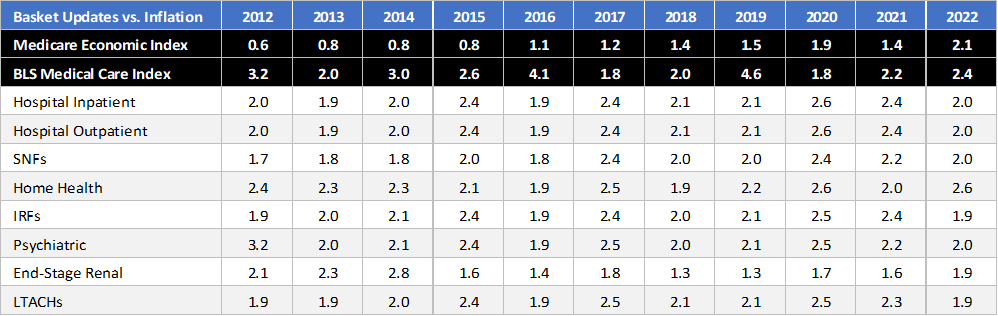

Oddly though, the BLS report only showed modest inflation for medical services of 2.4%, which is actually in-line or close to historical norms for healthcare inflation. At least thru the first part of the year.

Just take a look at how this tracks as compared to yearly CMS market basket increases:

Source: CMS and BLS

How can that be? Because healthcare always lags behind other industries.

You have to think about healthcare industry dynamics. When are prices, market basket updates, and premiums set for the following year?

- That’s right – a little after halfway through the year, meaning providers, CMS, and insurers were kind of flying blind around escalators for 2023 when thinking about inflation.

For context, CMS issues its finalized ruling for fee for service providers and hospitals around the August timeframe. And employer plan prices are locked in / negotiated closer to the end of the year, before anyone really had hard data on what was happening to prices behind the scenes.

- Because providers lock in their contracts with Medicare, state Medicaid plans, and commercial plans, healthcare isn’t really experiencing ANY topline inflation this year in revenue or prices – just their normal, run of the mill reimbursement escalators that typically sit between 2%-3%.

So, Providers literally cannot charge higher prices, because those rates are locked in for the year, or even multiple years if the insurance contract was a multi-year negotiated in 2021.

- I’m actually shocked that these contracts don’t have some sort of inflation or ‘extraordinary events’ clause where providers rand insurers must renegotiate given a certain event outside of a certain standard deviation and whatnot. If anyone knows of a contract that contains such clauses, feel free to give me a shout.

TL;DR. MAJOR topline headwinds for healthcare services this year.

- Insurance rates for HC providers are locked in at 2-3%. Medicare sequestration is on the horizon, and other public health emergency provisions will soon end (20% hospital rate bump for COVID cases, compensation for uninsured patients, etc.)

Recent CMS updates aren’t helping either. For 2023, CMS proposed a 2.7% basket rate increase for hospice and a 2.8% increase for inpatient rehab facilities.

Meanwhile MedPAC is going crazy by proposing 5% reimbursement cuts for certain providers. In THIS economy?! How can providers possibly expect to keep up? CMS better hope that this inflation is largely transitory and will phase out by the end of the year because if not…providers are going to struggle.

Expense Inflation Kills Provider Margins

Okay great, so consumers and employers aren’t going to experience exorbitantly higher prices this year. We’re a year off from that. That doesn’t mean provider margins won’t suffer.

There are still inflation dynamics at play on the expense side, which is going to kill provider margins this year while rates are locked in.

Even health systems, which have huge scale and purchasing power, should expect to see a 1.0% – 3.0% margin decline in 2022 stemming from expense headwinds according to McKinsey.

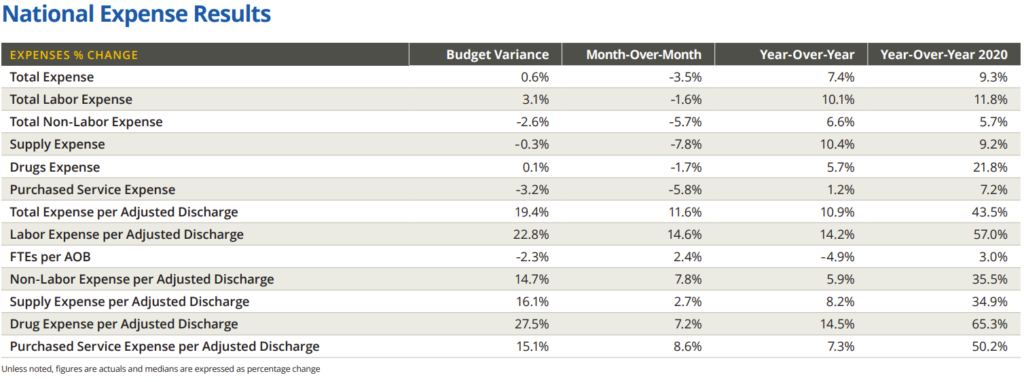

Kaufman Hall February Hospital Flash Report

Here are just a few ways expense are rising this year, most present in labor and supplies growth:

- Labor shortages. 33% of nurses are apparently planning to leave their current position. Turnover is costly as hell, so hospitals will be focused on retaining staff through signing bonuses and other initiatives. Treat ya people right.

- Labor salary escalators. The clinical and support staff that DO stay will be requesting some major salary escalators next year. Just ask my wife, who’s a speech therapist and wants to secure that bag.

- Drugs & Medical supply escalators. Yeah, you think drug & equipment distributors are gonna accept lower margins? Nah, they’re passing on the cost to providers to maintain their already-low margins. Not to mention the supply chain challenges hospitals are facing in general – almost all hospitals in the U.S. reported facing procurement issues.

- G&A escalators. You can bet your bottom dollar that professional firms aren’t cutting margins either. Hourly rates from lawyers, consultants, and other professionals will reflect the full 8% (or higher) increase. Any travel costs, insurance expenses, utility bills, and more will reflect higher expenses.

Source: Gist Healthcare

How Providers are combating inflation

So, how can providers stave off margin decay?

They’re going to have to LEAN UP, run ops more efficiently, boost productivity, and reconfigure their supplies purchasing.

Streamline Ops. Health systems will continue to collaborate (almost out of necessity) to share resources. We’ve already seen in the past certain systems partnering on data exchange and generic drug shortages (Civica Rx) among other partnerships. Now, a coalition of hospitals is forming a staffing partnership called Evolve. UPMC even created its own internal staffing agency.

Boost Productivity. Given shortages, providers have the opportunity to replace existing processes with tech enabled solutions (ambient documentation like Augmedix, scheduling services like Phreesia) to free up clinical time and save $$$.

- In a way, these challenges might be a blessing in disguise – as support staff & personnel quit, providers may be forced to pursue tech-enabled options to cover the gaps, which may in turn reduce some administrative spend in healthcare overall.

Supplies Savings. Providers will likely have to streamline and centralize purchasing decisions, take a hard look at their group purchasing organizations and purchasing power, and figure out the best way to plan for future procedure needs in order to prioritize what’s most important for them. I mean, there’s really only so much you can do in this bucket.

Conclusion

We’re going to see EXACTLY how inflationary pressures and rising costs play out over the next couple of years.

- Will inflation last? If so, these pressures will continue, premiums will rise, and everyone is gonna get hit hard

- If inflation resets back to 2-3%, we’re good. Valuation analysts everwhere can jump for joy as short-term inflationery margin pressures are normalized out of Adjusted EBITDA.

Hopefully the Fed can get it under control quickly so that employers and consumers aren’t hit with constant annual spikes in healthcare premiums and providers aren’t constantly looking over their shoulders, cringing at the next expense hike from suppliers and travel staffing agencies.

Bottom line. The operators who can’t handle inflation and are no longer getting bailed out by relief dollars will struggle. Others will continue consolidate to have better purchasing power on the bottom end and more negotiating leverage on rates. Survive and thrive.

Resources:

Consumer prices are rising fast, and healthcare isn’t far behind – McKinsey (Link)

Rethinking the Post-COVID Supply Chain – Gist Healthcare (Link)