Healthcare in 2021 was a hell of a year.

Money continued to fly in to the space, leading to a plethora of deals and private equity buy-outs.

Apart from all the money flying around, there were plenty of cool digital health partnerships announced, policy proposals made, and strategies implemented.

Let’s dive in to what changed the healthcare landscape in 2021.

Q1 2021 Healthcare Stories.

Grand Rounds merges with Doctor on Demand in multi-billion dollar deal.

More digital health conglomerates: Grand Rounds and Doctor on Demand reached an agreement in March to merge into what most would expect to be a multi-billion dollar company. The synergies are interesting here, as Grand Rounds provides patient navigation services (AKA, a direct competitor to recently gone-public Accolade) while Doctor on Demand is a telehealth service.

Broader trend: Like I’ve touched on before, these digital health firms are coagulating in efforts to differentiate themselves from one another and also expand their offerings across an array of services to shop to employers. Think Teladoc-Livongo. Boom – immediately synergistic to each other and a much more compelling offering to employers. Uphealth and Cloudbreak, Teladoc-Livongo, now Grand Rounds and Doctor on Demand.

- In other digital health unicorn news…Ro announced a $500 million capital raise at a $5 billion valuation. Interesting that the firm is opting to stay private when so many other telehealth peers have gone public recently – namely, Hims and Hers, which is essentially a direct peer to Ro. (Link – soft paywall)

Notable Healthcare Policies and Biden’s 2022 Agenda.

Surprise Billing: CMS unveiled surprise billing guidance for the rollout of the No Surprises Act slated to take effect in January of 2022. It’s a huge win for the healthcare consumer (AKA, the patient), but payers and providers are still disputing some of the finer points of the proposal, namely the arbitration process.

Providers are suing the No Surprises Act’s implementation due to the way that disputes would be handled between out of network providers and insurers – the arbiter is supposed to look to median in-network rates for that service in that geography, which providers argue vastly favors insurance companies.

- Why? Providers argue that insurance companies handle thousands of claims and have access to reimbursement information from their own in-network providers, essentially already setting their preferred rate given the arbitration guidance from the bill.

- Further, providers argue that the bill dis-incentivizes insurers to even go in-network with provider groups if they can 1) delay the payments process further which makes them money through bank interest and 2) set the in-network median rate based on their own claims data. Interesting stuff and I can see where it’s coming from.

- Unfortunately any delay or injunction to this bill would impact patients, but obviously any solution is better than none here.

- This Health Affairs article does a great job of breaking down the key issues. (Link)

Price Transparency updates: CMS issued stiffened guidelines for the hospital price transparency mandate. The fine, which used to be a paltry $300 a day, now scales with hospital bed size, so fines ranging between $110k and $2 million for the biggest hospitals. Did you know that only about 5% of hospitals are compliant with the rule?

- That number will vastly improve with stiffer punishments for non-compliance and will hopefully expose and remediate the incredible variation in hospital pricing for procedures. Still, the maximum fine of $2 million may not even be enough, as insurance negotiated rates are some of the closest held trade secrets in the healthcare industry. (Link)

What’s next for Biden: The Biden Admin released its 2022 agenda for regulations in the upcoming year, and so far HHS is looking at the following issues:

- More regulation of short-term health plans, previously approved by the Trump Admin

- Prior authorization and interoperability improvements

- Dispute resolution guidelines for 340b spats between hospitals and drugmakers (this is actually a big deal)

- Updated safety and other requirements for rural hospitals (critical access hospitals)

- Full link to the Biden agenda here. (Link)

Large Health Systems form Truveta, a bet on Big Data in Healthcare.

Big Health Data: Hospitals are sitting on a treasure trove of data just waiting to be analyzed. That’s the thesis behind Truveta, anyway, which is a partnership between 14 of the largest health systems. Formed in late 2020 as a for-profit entity but officially announced during Q1, Truveta plans to aggregate clinical-level, de-identified patient data to provide meaningful insights for researchers, physicians, biotech firms, and everyone in between. (Link to Truveta Blog Post)

- This partnership isn’t the first foray into the health data space. Remember Project Nightingale, the Google-led venture with Ascension that caused a whole lot of patient privacy controversy?

- While that partnership used identifiable patient data which was accessible by Google employees, this new venture with Truveta seems to indicate that the appetite for big data insights from health data is stronger than any potential backlash from a vast amount of data sharing – albeit, HIPAA-compliant data sharing.

- Other thoughts: I’m personally curious to see whether any actionable insights come from this venture. I also wonder how much competition Truveta will take away from firms like 23andMe and Ancestry, who are trying to leverage their DNA databases into actionable data for drug and other research.

- Finally, I’m also curious whether these health system coalitions continue in the future. We saw Civica Rx form in late 2018, a partnership for addressing generic drug shortages. Now Truveta, a data sharing platform…what could be next?

Walmart scales down Health clinic expansion.

After an initial enthusiastic and promising pilot and lofty goals for its health clinics rollout, Walmart might be slowing down the healthcare venture amidst shifting strategy. A published article in March from Business Insider shed light on the operational speed bump. (Paywall)

- The initial rollout of the pilot health clinics was met with huge success. More than double the number of expected people visited the new clinics. Some drove more than 90 minutes away for an appointment as the ease of transparent, cash-pay drew in rural crowds. It seemed like a win-win – according to the article, the clinics were at a path to profitability within two years while boosting overall sales at the store itself.

Delays: Although the clinics were met with early success, a new CEO – along with the pandemic – slowed down the operation. From the article, it seems as if leadership wanted to pursue a new strategy: playing the long game by forging relationships with insurers, and slowing the rollout of new clinics as the firm worked to refine its care management strategy.

According to the article, Walmart was losing track of its ability to schedule people with their preferred doctors and keep up with communication because of the visit volume influx.

- Thoughts: I can’t say I’m not disappointed with this news. I can understand the delay from a logistical perspective (e.g., scheduling, prescription communication, etc.), but the fact that so many people were willing to travel large distances to visit your clinics indicates that you’re uniquely positioned to provide care in a transparent, cash-pay fashion while also boosting store sales.

- This quote from the article wraps up Walmart’s short-term sales-boosting strategy quite well: “One former employee who attended budget meetings said money to build new clinics dried up in favor of things like cooking devices that more directly boosted in-store sales.”

Post-Acute M&A activity in early March.

Lots of M&A in healthcare to headline early March and some interesting transactions in notable sectors to follow.

First up is the UnitedHealthcare and Optum reported acquisition of Landmark Health for $3.5 billion.

- Landmark is an in-home care provider that focuses on the sickest and most frail population of people. The firm works in 17 states and is involved in one of CMS’ new direct-contracting models. Seems like the firm is pretty scalable and with Optum backing it, we’ll probably see Landmark expand nationwide. (Link)

Next up: Cigna’s subsidiary Evernorth acquired telehealth provider MDLive for a reported $1 billion.

- The announcement is interesting as MDLive considered going public in early 2021. I’m thinking the firm left money on the table by being acquired but maybe not since the taste for telehealth is dying down a bit, especially after seeing Teladoc’s soft guidance numbers in its Q1 earnings report. (Link)

Finally, hospital operator HCA acquired an 80% stake in Brookdale Senior Living’s home health and hospice firm.

- While HCA has traditionally focused on elective surgeries and expanded outpatient capabilities, the investment signals that HCA has plans to expand into post-acute and integrate care even further. (Link)

- Side note – Hospice is a hot, hot space right now as multiples are rising. Just last week, the Pennant Group (another publicly traded home health and hospice firm) boosted its credit facility to make way for more hospice acquisitions. (Link)

- Read more – why the HCA deal is a win-win transaction for Brookdale. (Link)

Amazon Care expands Nationwide.

It’s happening: The online retail giant filed paperwork in 17 (and counting) states in order to expand the medical operation that seems to indicate that Amazon is ready to expand the clinics beyond just an employee-only benefit. (Link)

- About Amazon Care: Amazon evidently runs these clinics under a partnership with Care Medical, which is an independent medical practice that provides staffing for the Amazon clinics. The firm seems to be closely intertwined with Amazon and I have to wonder how provider costs will ramp up as the operation scales nationally. Note that Amazon Care will initially be available to its employees and any other large employers that opt in to the service.

Lobbying: In other Amazon-related healthcare news, Amazon and several other prominent public home care providers announced a coalition called Moving Health Home, which is essentially a pretty powerful lobbying group aimed at educating lawmakers on the benefit of in-home care as opposed to nursing homes and other post-acute settings. (Link)

- Specifically, Amazon and the others (Signify Health, Dispatch Health, Intermountain, etc.) will start “lobbying lawmakers to ease regulations on what kind of health services can be performed outside of a doctor’s office — potentially widening the services Amazon Care can provide.”

Big Picture: Amazon’s moves make sense given their recent investments and announcements. In November, the firm announced its Alexa Care Hub, a way to check on seniors living alone through Alexa. Just a WEEK later, Amazon launched Amazon Pharmacy. Not to mention its acquisition of PillPack in 2018 or its venture with Haven that ultimately failed but probably succeeded in knowledge gained in running medical services. Finally, don’t forget about Amazon’s new wearable Halo – announced in late August 2020.

- Get your popcorn ready? If you think about it, Amazon really is attacking healthcare from quite a few different angles. It’s fascinating to watch. Amazon has made some big moves in the past, but this flurry of activity signals major moves are happening.

Shares of publicly traded telehealth firms plummeted after Amazon announced the nationwide rollout of its telehealth platform Amazon Care. (Covered in the March 8th edition).

The question is…is this a fire sale, or a problem for telehealth firms? Other Amazon announcements have resulted in stock selloffs, so this is nothing new.

- Grocers plummeted after Amazon announced its Whole Foods acquisition.

- Then don’t forget about retail pharmacies dropping after Amazon’s move into the pharmacy space.

GoodRx in particular has been getting hammered given its seemingly-delicate positioning between Amazon Pharmacy and now Amazon Care.

- It’ll be interesting to see how telehealth firms deal with increasing competition and whether there will be multiple winners in the space as firms differentiate in order to create compelling, sustainable competitive advantages.

A bad year for nursing homes.

The 5-star rating system is broken: The pandemic really seems to have exposed major flaws in U.S. nursing homes. In March, the New York Times published a pair of hard-to-read stories related to nursing home operators’ ability to game the Medicare star rating system. (Link)

- The first report alleges the following and more:

- Much of the data nursing homes report to CMS is incorrect

- Staffing numbers are often understated

- Nursing home data is rarely audited by CMS

- Nursing homes often know when their ‘surprise’ inspections will take place

- Inspectors may find serious infractions anyway but rarely does it cause a drop in the home’s star rating (why not just…turn it into a 10-star system?)

Brookdale sued: As a closely related story, Brookdale Senior Living, the largest nursing home operator in California, was sued by the state for similar veins of ‘Medicare manipulation,’ including inappropriately discharging patients to allegedly fill those beds with higher paying patients. Brookdale denies any wrongdoing. (Link)

DOJ to review Unitedhealthcare’s $13 billion acquisition of Change Healthcare

Litigation: At the request of the American Hospital Association, the DOJ is investigating UNH’s previously announced $13 billion acquisition of Change Healthcare – a revenue cycle and data analytics platform.

About the challenge: As more of an infrastructure-esque purchase, the acquisition was more behind the scenes in nature. But the AHA claims that the acquisition may result in less competition for IT and revenue cycle management services among providers. United plans to start integrating Change Healthcare in April 2022 after DOJ review.

- The DOJ case is just delaying the inevitable: that everyone in healthcare will eventually work for United. (Link)

Q2 2021 Healthcare Stories.

One Medical acquires Iora Health.

Two Medicals: In big news released early June, One Medical announced its intention to acquire value-based primary care chain Iora Health for $2.1 billion.

- Why you should care: One Medical’s typical business model to this point has been to focus on fee-for-service primary care. This acquisition fully plunges the firm into the value-based Medicare Advantage side of things and allows for a major diversification in revenue service lines. (Link)

- Matthew Holt had some decent initial thoughts on the acquisition on Twitter (Link)

Google Plows further into Hospital Data with HCA Partnership

Data: Google and HCA are partnering to focus on building a healthcare data analytics platform. The end goal here is to streamline HCA’s provider workflow to improve decision making and cut down on admin time. Of course, the data uploaded to Google’s cloud healthcare offerings would be de-identified.

- Why you should care: Google seems to be building a treasure trove of healthcare data after announcing recent partnerships with the Mayo Clinic, Meditech, Allegheny Health Network, Ascension, and now HCA. I’m not an expert here, but I also wouldn’t be surprised if the search giant made some compelling moves over the next 5 years. (Link)

Microsoft’s Nuanced $20 Billion Healthcare Cloud Play

In big news announced in mid April, Microsoft dropped about $20 billion to acquire Nuance for $56 a share. According to folks on Twitter smarter than me, the acquisition appears to be a smart, natural play for Microsoft to dive deeper into cloud-based healthcare infrastructure and physician workflow. The firm also recently announced an integration with Teladoc, which could create a powerful clinical tool for providers nationwide. (Link to Partnership)

- I found this quote provided solid context for the acquisition: “Last year, Nuance launched nationwide an AI tool co-developed with Microsoft that — with a patient’s explicit consent — can listen in on a medical visit, transcribe the conversation into text, pull out relevant medical information and auto-populate that data into the EHR, for the physician to review and sign.”

- Link to press release

- Link to deal analysis

Accolade Buys PlushCare and Digital Health Convergence Continues.

Anotha One: In the next major push to become a digital health player offering a conglomerate of services for employers, Accolade purchased PlushCare for $450 million and became the latest firm to offer telehealth for its platform. (Link)

- The larger trend: These new-age healthcare firms are starting to compete for employers by offering a suite of services – care navigation, telehealth, chronic care management, and more – especially as the push toward value based care materializes. Read the company’s blog post about the acquisition here. (Link)

The Home Health Land Grab and Kindred Healthcare Exchanges Hands

After its transaction alongside private equity giants TPG and WCAS in 2017 to take post-acute operator Kindred Healthcare private, Humana exercised its option to purchase the remainder of Kindred at Home in a $5.7 billion deal. This transaction price valued Kindred’s home health and hospice assets at a separate $8.1 billion enterprise value. (Link)

Why you should care: Especially after Covid and the accelerated push toward home-based care, home health and hospice are a hot transaction market as major healthcare players pivot their strategies toward the home. We’ve seen quite a few acquisitions by a consortium of operators:

- Encompass purchased Frontier Home Health and Hospice, which operates in 5 states mostly in the Northwest U.S. (Link)

- Home care operator Aveanna Healthcare debuted on the public markets in late April. The firm raised about $460 million and now trades under the ticker ‘AVAH.’ (Link)

- Optum purchased Landmark Health for $3.5 billion. (Link)

- HCA also recently bought Brookdale’s home health and hospice assets for $400 million as previously covered. (Link)

As you can see, the space is only seeing an increase in activity. I have to wonder if this entices Encompass to field more offers for its home health and hospice segment, as the firm is in the process of exploring strategic options for those assets. I’m expecting EHC to make some sort of move here in 2022. (Link to transcript)

LifePoint acquires Kindred’s Facilities Service Lines.

Post-Acute Plays: On the heels of Kindred at Home’s divestiture, private, for-profit acute care hospital operator LifePoint Health bought Kindred’s facility-based post acute business (AKA, long-term care hospitals, inpatient rehabilitation facilities, and skilled nursing facilities). The deal was announced on June 21, but unfortunately no financial terms were disclosed. (Link)

- Although the deal is focused on facility based care, LifePoint’s acquisition seems to be similar strategically from an alignment perspective and also provides LifePoint with huge scale – they’ll now operate in over 200 facility-based settings.

Remember: Once this transaction clears, all of Kindred’s service lines will have changed hands, and it looks like that trend will continue – Humana indicated on its earnings call that it plans to sell off the Kindred hospice segment for a juicy valuation multiple. (Link)

- In fact, Home health and hospice multiples are the highest in all of healthcare, and really have been for quite some time. (Link)

Walmart buys a no-name telehealth provider, MeMD.

Walmart announced on May 6th its intention to purchase MeMD, which is a multi-specialty telehealth provider that nobody had really heard of until…now. (Link to press release)

- It’s an interesting addition to Walmart’s health clinic rollouts and a notable play in the retail giant’s overall healthcare strategy considering recent rumors that the firm was scaling back its healthcare clinic rollout goals. (Paywall – Insider)

Bigger picture: Based on comments from the press release and others, Walmart seems to want to complement its in-store healthcare offerings with a telehealth option for customers. The move seems to indicate that if you want to be taken seriously as a healthcare player, you NEED to have a telehealth option.

- The move could be reactive in nature too – considering that Amazon Care just announced its intention to expand nationwide for employees – and has its first B2B client – Walmart might be playing defense to stay competitive in the employment market against its #1 competitor. Also, while this is the first acquisition Walmart has made into the space, the firm has partnered with other telehealth firms like Ro and Doctor on Demand in the past couple of years.

- Both Amazon and Walmart are laying the foundation for scalable healthcare presences nationwide.

The Hospital at Home Trend.

As a new venture into the Hospital at Home care model, Kaiser and the Mayo Clinic (AKA, massive players in the healthcare space) announced a $100 million joint investment into Medically Home. (Link)

This blog post gives a unique insight into how Mayo Clinic and Kaiser will scale Medically Home’s operations.

- In order to provide higher acuity care in the home, the firm will have a centralized HUB that communicates with caregivers, and connects all aspects of that patient’s care. This care could include everything from medication delivery to dialysis treatments.

Why you should care: Obviously with Covid, there’s been a huge push for more at-home care. This partnership, and other programs similar to Medically Home, will allow seniors to age comfortably in place as healthcare innovation allows care for more complex medical conditions in the home. (Like, Best Buy?)

Hospital at Home: Adding to the trend, Amedisys announced on June 30 that the home health and hospice operator purchased Contessa Health, a provider of hospital and skilled nursing at-home services, for $250 million.

- With the acquisition, Amedisys estimates that its total addressable market just drastically increased from $44 billion to $73 billion. We’ll see if the lofty growth expectations come to fruition! (Link to Press Release)

- This was a good write-up from HHCN on the strategic benefits of the acquisition. (Link)

Amazon Care Scales its Presence Nationwide

Amazon: Another headline that made waves this quarter – after Teladoc shrugged off concerns of Amazon as an entrant into telehealth during its Q1 call, a Wall Street Journal report disclosed that Amazon had already signed ‘multiple companies’ to its new Amazon Care telehealth service.

- Remember that Amazon just took this operation nationwide and already offers it to employees. To continue scaling, Amazon will need to hire ‘thousands of employees.’ Very interesting to see the telehealth arms race heat up! (Link)

The ACA wins again at the Supreme Court.

3-0: For the third time in a decade, the ACA was upheld by the Supreme Court in a 7-2 decision. SCOTUS decided in its opinion that states did not have standing to sue over whether the removal of the individual mandate (AKA, the $$$ penalty for not having insurance) made the entire ACA illegal.

- To be candid, this prosecution was an embarrassingly weak legal argument, as the court decided that no harm had been done to the states that brought the suit. As a result, the case will be dismissed. (Link)

- It’s probably a good thing that the ACA stayed in place considering enrollees are at an all time high as of this writing – above 80 million individuals. (Link)

Outset Medical and Strive Health team up on Dialysis Home Care.

Partners: On June 16, Value-based kidney care firm Strive Health announced its partnership with publicly traded medical device firm Outset Medical

- Details: Strive Health will use Outset Medical’s kidney care machine called the Tablo Hemodialysis System, which intends to simplify the dialysis process and even allows patients to administer dialysis at home rather than in an outpatient clinic setting.

- Why you should care: The $74 billion end stage renal disease industry is mainly dominated by DaVita and Fresenius. This partnership is an extremely significant foray into challenging that traditional duopoly, so you should pay close attention to this one. (Link)

Major Hospital Mergers. Beaumont Health and Spectrum, Oschner’s 7-hospital Acquisition of Rush Health Systems, and Steward’s Acuisition of 5 Tenet-run Hospitals

Beaumont tries again: This quarter, Beaumont Health and Spectrum Health announced their intention to merge into what would create the largest health system in Michigan, with 22 hospitals and about $13 billion in revenue.

- Long time readers might remember that Beaumont Health has attempted to sell itself off twice already – once to Summa Health and then again to Advocate Aurora Health. Both attempts failed due to antitrust and cultural issues. Can Spectrum succeed where others have failed? Stay tuned! (Link)

Ochsner’s buying spree: Louisiana-based Ochsner Health announced its intention to acquire Rush Health Systems, a 7-hospital system in the Mississippi and Alabama areas. This announcement comes on the heels of Ochsner’s acquisition of Lafayette General Health in late 2020. (Link)

Steward buys Tenet hospitals: To round out the hospital activity, Tenet sold 5 hospitals to Steward Health Care for $1.1 billion in the Florida area. The hospitals will continue to use Tenet’s rev cycle software Conifer and continues to signal Tenet’s push toward outpatient operations and its focus on USPI.

- Remember that Steward was bought back from private equity group Cerberus by a group of physicians in the summer of 2020 – this acquisition marks Steward’s first real activity since then. (Link)

Q3 2021 Healthcare Stories.

Dollar General’s foray into healthcare.

Dollar General hired a chief medical officer and announced its intention to add healthcare products to its stores.

- Details: Dollar General has been on a growth TEAR lately – the retail discount store has over 17,400 stores mainly in rural areas. In this move, Dollar General aims to increase foot traffic at its stores by offering staple healthcare products like cough medicine and other nutritional products. Over time, Dollar General plans to expand this healthcare offering and hopefully continue to address the accessibility gap in rural healthcare. (Link)

A $26 Billion Opioid Settlement for McKesson, Cardinal Health, and AmeriSource Bergen.

The Grand Finale: After a multi-year slog in the courts, drug distributors McKesson, Cardinal Health, JnJ, and AmeriSourceBergen settled on a combined $26 billion multi-year payout to states involved. Assuming states approve the settlement, this agreement would largely put to bed the companies’ liability stemming from the opioid crisis. (Link)

- Deeper: The news comes at a time when drug overdose deaths were at an all time high during the pandemic. (Link)

Akumin acquires Alliance Healthcare Services to create National Imaging Company

Imaging: Publicly traded imaging operator Akumin acquired fellow radiology provider Alliance Healthcare Services this quarter for around $820 million, in what would create a major national competitor to RadNet and U.S. Radiology.

- Big picture: the transaction would expand Akumin’s national footprint from 7 to 46 states with over $700 million in revenue. Interestingly, Akumin appears to be acquiring a larger company in Alliance and is raising $700 million in debt to do so. The combined company expects to do over a billion in revenue and around 20-25% EBITDA margins (Link)

Teladoc, Microsoft Partner, Google’s Interoperability Push, and Amazon’s AWS for Health.

Integration: Teladoc announced a major collaboration with Microsoft to integrate Teladoc’s Health’s Solo platform into Microsoft Teams. The announcement is notable as Microsoft and Teladoc continue to partner on virtual care and easing administrative burden to health system clients. (Link)

- Google also announced new interoperability tools this week as well. (Link)

- Finally, Amazon unveiled AWS for Health – cloud services for a host of healthcare companies including genomics and biotech firms. (Link)

Home Healthcare startup Honor acquires Home Instead to create $2 billion Home Care firm.

Honor, a technology and back-office home care infrastructure firm, announced its acquisition of home care provider Home Instead. The acquisition gives Honor access to 1,200 locations throughout the U.S. and abroad.

This is big: The newly combined co would generate more revenue than Addus, Pennant Group, and would be on par with LHC Group and Amedisys’ consolidated reported revenue of about $2.1 billion.

- About Honor: Interestingly, Honor started as a back-office partner that provides infrastructure to home health and home care agencies. With the acquisition, Honor will pivot into a vertically integrated home-care provider and a major player in the industry. (Link)

Ginger merges with Headspace in $3 billion deal.

In a deal announced August 25, virtual mental health coaching and therapy provider Ginger merged with Headspace, a direct to consumer app that provides mindfulness and meditation programs. The merger is a notable move among two very well-known names in the digital behavioral health space. Moving forward, the combined firms will be named Headspace Health. (Link – Press Release)

- By the numbers: As a combined org, Headspace Health will generate $300 million in annual revenue (ARR) to about 100 million users worldwide. The merger creates a private valuation of about $3 billion.

- How the model works: The merger creates a vertically integrated behavioral health org for lower acuity patients. Think of the model this way – consumers find Headspace in the app store and subscribe to its mindfulness services. At that point, Headspace could funnel those patients into coaching and therapy services provided by Ginger. Although the model currently lacks services for higher acuity patients (clinical depression, etc.), Headspace Health could potentially add those offerings through partnerships or employment of psychiatrists.

More resources:

- Want to be a more holistic healthcare company? Add some Ginger. (Link)

- Ginger and Headspace plan merger to rapidly scale up digital mental health services. (Link)

- Inside the Giant Ginger-Headspace Merger, What It Means for Behavioral M&A. (Link)

Managed Care Partnerships: Aetna – Teladoc and CareMax – Anthem

Partnerships: There were a few notable managed care partnerships announced in August. First off, CVS-Aetna partnered with Teladoc to unveil a nationwide primary care telehealth service to its members. (Link)

- CareMax: In a similar vein, Anthem partnered with recent gone-public CareMax to open 50+ value-based care medical centers. Some of the identified states for this partnership include Indiana, Texas, Kentucky, Wisconsin, Georgia, Connecticut and Virginia. (Link)

Carbon Health’s Busy Summer.

As the header mentions, primary care digital health firm Carbon Health made plenty of headlines themselves all summer long. After acquiring remote patient monitoring firm Steady Health, Carbon raised another $350 million and quickly put some of those funds to use by purchasing two major urgent care retail footprints in California and Arizona.

Given the acquisition of these 13 clinics, the tech-enabled primary care platform now operates 83 clinics across 12 states.

- Bigger picture: These new-age health tech enabled services firms are consolidating and are starting to boast major market presences across the U.S. (Carbon Health, Teladongo, Ginger-Headspace, Accolade, and more). It’s a fascinating time to observe the trends and seemingly changing tides for health tech.

- More reading: about Carbon Health and its founder. (Link)

Full FDA Approval for Pfizer’s Vaccine.

After its standard review process, the FDA finally fully approved Pfizer’s and Moderna’s vaccine in the fall. Previously, the vaccines were only approved for emergency use. Now, we’re all getting boosters. (Link)

Intermountain Announces Merger with SCL Health

Big-time: Utah-based Intermountain Healthcare announced its intention to merge with SCL Health on Thursday, September 16 in what would create a 33-hospital, $14 billion in annual revenue system. The combined system would employ more than 58k caregivers across six states – Utah, Idaho, Nevada, Colorado, Montana, and Kansas.

- I know what you’re thinking: “But hospital mergers result in higher prices.” That’s the general consensus around hospital mergers. But Intermountain seems to be focused more on value-based care initiatives and population health, which this merger would allow them to execute on.

- Merger quote: “This is the opposite of those mergers where people come together and try to exert leverage over commercial insurance to get more money,” he said. “What we’d really love in the long run is for some of those payers to engage with us in risk-based contracts where we can really work hard at keeping people well. That would be the most exciting thing for us, I believe.” Marc Harrison, MD – Intermountain CEO

- Links: (Press Release) (Article Summary)

NorthShore University Health System, Edward-Elmhurst Health unveil merger plans

More: Also along the Midwest, the combined health systems of NorthShore and Edward-Elmhurst would create a 9-hospital conglomerate, serving about 4.2 million Illinois residents across 6k physicians and 300 facilities. (Link)

- Antitrust: These merger announcements are coming at a time when Biden regulators are increasing scrutiny on vertical and horizontal mergers. Hospital mergers are among the most heavily scrutinized when it comes to antitrust, so it’ll be interesting to see whether the above deals actually get done. (Link)

Q4 Healthcare 2021 Stories.

Health IT Deals Continue with Evolent.

Evolent: Reports from Bloomberg indicated that Walgreens is considering acquiring health IT firm Evolent, which assists providers with managing value-based care programs among other segments. Evolent’s stock initially rose 18% on the news and is up 20% as of this writing since the announcement on September 29. (Link – Bloomberg soft paywall)

Walgreens and CVS double down on Health SuperClinic Expansion.

Recent news, investments, and rumors have indicated that Walgreens and CVS are about to aggressively escalate their primary care and health super clinic strategy.

Walgreens doubled its stake in its health clinic partner VillageMD with a $5.2 billion investment on October 14. With the influx of cash, VillageMD plans to open 600+ health clinics called “Village Medical at Walgreens.” (Link)

- On top of this investment, Walgreens also made a majority investment in CareCentrix, which is a post-acute care platform. (Link)

CVS is also planning a rapid expansion of health clinic facilities. Rather than initially partnering, CVS chose a build strategy in conjunction with acquiring Aetna a few years back. During CVS’ Q4 investor day, the firm projected $304-309 billion in revenue for 2022..small change. The retail health giant believes the pivot to HealthHUBs will drive higher growth and consumer engagement at their stores as people view their stores more as a one-stop shop healthcare destination. They’re also going to start acquiring more primary care physicians probably to employ them in HealthHUBs or bring them in network, similar to Optum or Neue Health strategy.

- CVS probably has one of the most complicated business models on the planet between its PBM, retail footprint, health insurance business, and now HealthHUBs. It’s really interesting that CVS has an enterprise value of around $180 billion when UnitedHealth is closer to $450 billion. You could make an argument that CVS is extremely undervalued if they’re able to succeed on the pivot to HealthHUB and keep executing on the healthcare strat including the building of its provider base.

- Final point…CVS retail spaces are generally very prominently displayed, which is a key indicator of success for urgent care operations. So that’s an immediate synergy / tailwind for the pivot. The main block here is probably just getting consumers to view HealthHUBs as a place to get healthcare services when before CVS’ were just for picking up snacks or prescriptions, but that shouldn’t be an issue given Aetna’s huge captured membership base. Link to Investor Day HUB. (Link)

Bottom Line: Both Walgreens and CVS are investing more heavily in the entire spectrum of care in order to bolster their core retail pharmacy businesses amidst increasing competition from all sides. CVS seems better positioned to capitalize on the strategy given the leverage it maintains with operating Aetna.

Must Read: This was a great read from Nisarg Patel on how CVS plans to leverage its health super clinics as a part of its overall business strategy – combining full-service, consumer oriented primary care, strengthening its pharmacy operation, increasing traffic to its stores, and maintaining a strong provider based through Aetna. (Link – Medium Soft Paywall)

Rise of the Virtual Health Plan.

Virtual: Here’s a trend a long time in the making – major insurers, through built, bought, or partnered telehealth infrastructures, are launching virtual-first health plans slated to begin January 1, 2022

- UnitedHealthcare plans to launch its virtual-first primary care product using the strength of its already-existing Optum physician network. It’s a natural, organic progression for the health behemoth. (Link)

- Similarly, Cigna, on the heels of its acquisition of telehealth provider MDLive, will pursue a similar virtual first primary care strategy. In addition to rolling out the plan to some select employer sponsored plans, Cigna also aims to provide all of its plans with a broader telehealth offering. (Link)

- Finally, Aetna is partnering with Teladoc to make its primary care plan available nationwide to all benefit sponsors, as previously mentioned earlier in this post. Teladoc’s newly unveiled Primary360 service will be available in this plan and is currently being used by ‘several large companies.’ (Link)

Kindred and LifePoint spin off 79 hospitals to form ScionHealth.

Spin-off: Recently merged healthcare providers LifePoint (hospitals) and Kindred (post-acute) spun off certain non-strategic assets into a separate company called ScionHealth. ScionHealth will be comprised of 79 hospitals after the spin-off, including 61 of Kindred’s long-term acute care hospitals (LTACHs) and 18 of LifePoint’s acute care hospitals. (Link)

- It looks like LifePoint and Kindred want no more skin in the LTACH game, instead focusing on acute care and inpatient rehab operations. I wouldn’t be surprised if a Select Medical-type operator swooped in here to purchase Scion.

General Electric and JnJ Spin off their Healthcare Divisions.

J&J: Healthcare conglomerate, maker of all things Johnson & Johnson is spinning off its consumer products division into a separate company to focus its core biz on pharmaceuticals and medical devices. (Link)

GE: In a similar fashion, GE, grandpa of the stock market, is splitting up its company into 3 distinct units, one of which is focused solely on healthcare and healthcare manufacturing. GE plans to spin off the healthcare unit by 2023. (Link)

athenahealth sells for $17 billion

Health tech EHR software giant athenahealth (what’s the deal with the lowercase anyway?) was acquired by PE giants Bain and Hellman & Friedman for $17 billion, just a couple of years after athena was taken private by Veritas and Evergreen for ~$7 billion – a 142% appreciation. Talk about a juicy ROI. Also, I’m apparently in the wrong line of work.

- Bain and Hellman must think that there’s juice left to grow athenahealth after the hefty sum given its current position in ambulatory settings and supporting platforms like Privia Health. The valuation makes more sense in the broader context of private digital health valuations, while their publicly traded counterparts struggled this year. I’m generally concerned with how frothy these transactions across healthcare are becoming – it seems as if someone is going to get burned here soon. (Link) (Link – press release)

Tenet grows its ASC Footprint with SurgCenter Acquisition

Ambulatory: Hospital operator Tenet Healthcare continues to triple down on its outpatient strategy under its ambulatory arm, USPI. Tenet purchased ownership interests in 92 ASCs from SurgCenter Development for about $1.2 billion.

- Further, SurgCenter and USPI plan to open an additional 50 centers over the next 5 years which indicates the level of outpatient growth these operators are expecting as the appetite for outpatient procedures grows stronger. (Link)

Amazon Launches new Elder Care Service Alexa Together

Aging in Place: Previously announced in September 2021, Amazon is expanding its Care Hub program to create a new service to help loved ones and caregivers check in on elderly folk. Called Alexa Together, the subscription service will provide a number of convenient offerings including customized alerts, 24/7 urgent response availability, fall detection and more. It’s pretty cool and could definitely be a major catalyst in speeding up the Aging in Place movement overall. (Link)

- Check it out on Amazon’s site yourself to see the full list of features available for loved ones. (Link)

- Related Content: There’s seemingly endless upside for startups looking to make their mark on the aging-in-place market. (Link)

Oracle buys Cerner for $28.3 Billion

Cash to burn: Oracle, the traditional database software giant, is making its biggest acquisition EVER by acquiring electronic health record giant Cerner for $28.3 billion, or $95 a share in an all-cash deal. (Link)

- Why Oracle: Oracle likely thinks the acquisition gets their cloud offering on a closer playing field with that of Amazon and Microsoft According to Oracle’s disclosures, the acquisition is almost immediately accretive to earnings.

- athenahealth was just purchased by private equity for $17 billion with $1.2 billion in revenue, whereas Cerner was valued publicly at $28.3 billion with $5 billion in revenue, so on a true numbers basis, a $30 billion acquisition is a ‘value play’ – but athena is better positioned for growth

Cerner gives Oracle access to the department of Veterans Affairs, as Cerner won a huge contract with the org for EHR services…Personally, Oracle must believe that Cerner gives them a ton of synergy, because the EHR giant has been bleeding market share to Epic, its second largest competitor. Cerner experienced revenue decline in 2020 with marginal growth so far in 2021. Kind of seems like two second-tier businesses combining with the idea of making something better overall.

- I halfway predicted this acquisition in 2020. Sort of. It’s close, right?

A Big Year for Digital Health SPACs and IPOs

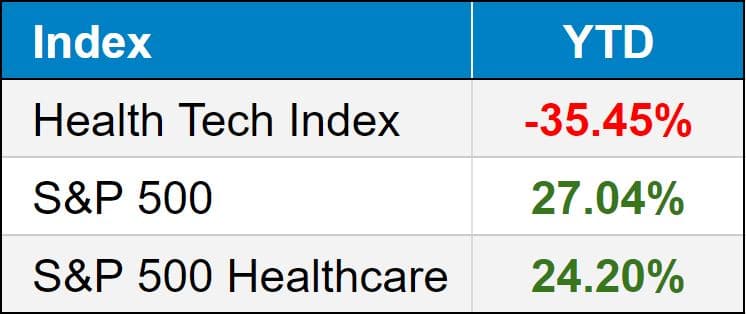

- 25 digital health and services companies went public during 2021 by way of SPAC or IPO. SPACs generally underperformed IPOs, but overall, the Health Tech Index vastly underperformed the broader stock market. Investors looking for exits dumped privately overvalued unicorns onto the public markets, leading to a steep 35% decline for the Health Tech Index as opposed to a 27% gain for the S&P 500 during 2021. You’ll notice a trend among 95% of these stocks: They almost all finished in the red.

- Will we see a repeat of this selloff in 2022? As these companies mature, they’ll slowly regain momentum and investor sentiment will pick up. I personally believe a lot of these names were simply too quick to market.

- For a summary of the Health Tech Index and the members included in the index, including performance by stock, you can go here: (Link)

Talkspace.

Talkspace, the virtual behavioral health app, went public via merger with Hudson Executive Investment at a $1.4 billion valuation. The firm was the latest in a long stretch of digital health firms to hit the public markets this year and last. The fact that Talkspace operates in the behavioral health sector is a tailwind for the firm, as the behavioral health market is expected to grow significantly in the coming years. (Link)

- Despite the growing mental health wave, Talkspace shares suffered this year. Shares of Talkspace collapsed after its Q3 earnings and departure of its CEO and COO. Woof. The behavioral health app is down more than 75% since going public via SPAC amid lower than expected growth and retention issues. (Link)

Hims & Hers.

In late January, Hims & Hers tied the knot with the public markets and started trading under the ticker ‘HIMS.’ (Link)

- What to know about HIMS. The company – which offers a variety telehealth and medication delivery services – has exhibited a meteoric rise in scale since its inception in 2017. 3ish years to go from inside someone’s brain to a $1.6 billion company today? That’s impressive.

Drastically scalable: Since its inception in 2017, Hims & Hers expanded dramatically:

- Once only known as Hims, the firm started with selling just four products, the most popular of which was its ED medication business.

- Hims rebranded into ‘Hims & Hers’ when the company added a women’s health service line.

- More recently, Hims & Hers expanded into a wide array of virtual services, including behavioral and mental health, primary care, and now a partnership with Privia Health – an extension of its primary care offering.

Bottom line: pay attention to Hims & Hers and other firms like it as COVID accelerates telehealth and digital health adoption, while easy money and low interest rate policies allow digital health players the capital to make a realistic foray into our sluggishly innovative healthcare system.

- If you want to learn more about Hims & Hers, I highly recommend this Bloomberg article (note – soft paywall) which dives into how the firm grew so quickly and effectively, but also takes a critical look at its business practices and prescription services. Ro is also a very close peer and competitor here.

- One more thing: Interestingly, during its earnings call, UnitedHealthcare mentioned that telehealth and online pharmacy services are key focuses for the business in 2021 which is…basically what HIMS offers. (Link)

Sharecare.

Sharecare: Went public via SPAC merger at a $3.9 billion valuation and received an investment from Anthem as part of the transaction. Right before debuting publicly, the firm also combined with health AI startup Doc.AI. Founded by WebMD’s founder, Sharecare is an online health & wellness platform that provides its customers with personalized programs and resources to help improve their health. The firm seems to be a conglomerate of all sorts of perks and benefits that works with health plans – including drug discounts. The co. trades under the ticker $SHCR. (Sharecare’s Background)

- Link to 8K and merger documents (Link)

- Access the investor presentation here. (Link)

- An informative Twitter thread on Sharecare. (Link)

23andMe.

23andMe: Also went public via SPAC. You’re probably more familiar with this company – it provides personalized DNA testing to individuals and is also trying to leverage that genetic data with biotech firms, launching studies to see what insights can be gleaned from DNA data and drug development.

- 23andMe’s primary competitor, Ancestry, was valued at $4.7 billion as recently as December. Still, both of these businesses seem a bit risky to me given that the consumer DNA testing craze appears to be dying down while there’s no guarantee that any of these biotech data partnerships pan out. (Link)

After 23AndMe’s announcement to go public via SPAC, a few individuals took deep dives into the DNA testing firm’s investor presentation and well, folks…there’s some definite spin going on. I found this Twitter thread especially amusing and quite the bearish opinion. (Link to investor presentation)

Incredibly, 23andMe is going public at a time when its revenues are shrinking significantly as the DNA testing fad dies out. To counter the unfortunate shrinkage, the firm is trying to pivot into a value-add for biotech giants and research into promising new drugs while adding a subscription product to its offerings which no one appears to know what it actually is.

- Then there’s the question of data privacy, too. Maybe if things don’t work out, 23andMe will sell American DNA data to China. I suppose it’s more of a threat than we might think, considering 60 Minutes just released a feature on it. (Link)

- 23andMe dropped 44% in 2021.

Oscar Health.

The long-awaited tech-full-stack-healthcare-unicorn company firm startup Oscar Health filed its IPO paperwork late in 2020 and published its S-1 form for the world to see during Q1 of 2021. (Link)

Oscar, the Good: The health insurance firm provides insurance plans mainly focused on the individual market and differentiates its product from other insurance offerings through its tech platform. Their data shows that the platform enables a better customer experience, which provides the firm with data-driven insights into care delivery patterns. Oscar’s membership base is growing big-time.

- Compared to the big insurers, Oscar claims a much better patient experience (the firm’s Net Promoter Score is 30 compared to the average insurance NPS of around 0). Its platform also seems to be scalable, which could be a yet-untapped avenue for growth.

Oscar, the Bad: Despite a decade of operation, Oscar is still hemorrhaging losses. The jury may still be out as to whether or not the product is differentiated enough to create staying power against the incumbent insurance behemoths.

As Covid and late individual marketplace additions boosted membership growth, Oscar also failed to adequately manage medical spend within its populations, leading to high losses in 2021 and dropping 77% in 9 months of being public.

More Oscar Health analyses:

- The Caseload: Oscar’s S-1: Why it matters. (Link)

- Kevin O’Leary’s bull and bear thesis for Oscar. (Link)

Clover Health.

As a part of the meme stock craze and backed by Chamath, Clover struggled this year amid short selling reports and getting whipsawed by hedge fund managers and retail investors. Overall, Clover dropped 77% on the year (not a fun year for insur-tech).

About that short selling report…Clover Health took a beating in February resulting from famed short-selling shop Hindenburg Research’s scathing short selling report on the company, which touched on:

- An undisclosed DOJ investigation connected to Clover potentially paying illegal kickbacks;

- A sketchy related party subsidiary also ‘thinly disclosed’ by the firm, Seek Insurance;

- Turnover at the executive level in the company implying inner struggles;

And more. You can read Hindenburg’s Twitter thread here, which touches on the main points from the report. Of course, Clover replied quickly with a Medium post of its own from its CEO and President claiming that the firm believes it made all appropriate disclosures and that its subsidiary Seek Insurance is truly independent. (Link to Clover Response)

UpHealth.

Uphealth: Merged with GigCapital2 (who comes up with these SPAC names?) and Cloudbreak at a $1.35 billion valuation, so a few orders of magnitude smaller than Sharecare’s transaction. The firm, after its merger with Cloudbreak, appears to be positioned in several fast-growing healthcare sectors including telehealth, behavioral health, integrated care management, and digital pharmacy. The combined co. will trade under the ticker $UPH and will close sometime in the first quarter, so pretty soon.

UpHealth was one of the worst performing names in digital health this year, dropping over 80% since its SPAC in June.

Sema4.

Sema4: Chalk another one up on the board for digital health companies I don’t understand. CM Life Sciences took Sema4 public via SPAC in a transaction valuing the firm at about $2 billion. Sema4 seems to run an operation similar to what 23andMe is trying to break into – i.e., using data analytics to help enable drug discovery for biotech firms and researchers, creating genomic maps, etc.

ATI Physical Therapy.

Next SPAC up: In another big Q1 story, Fortress Value Acquisition Corp. II (don’t you LOVE these SPAC names?) took national physical therapy operator ATI Physical Therapy public in a deal valued at $2.5 billion. (Link)

It was one of the first healthcare services-related SPACs of 2021.

- Details: ATI PT operates 900 clinics across 25 states. ATI went public at an adjusted EBITDA multiple of 14.0x…based on its EBITDA estimate for 2022. This didn’t pan out well for investors.

Trouble in SPAC Paradise: Shortly after going public, ATI slashed its EBITDA guidance in half because of COVID staffing headwinds, poor payor mix, and lower than expected clinic openings. Teh stock dropped more than 35% on the news and ATI finished the year down 66% despite just going public in June. (Link)

InnovAge.

InnovAge: At-home care provider InnovAge successfully debuted on the public markets in March at a $3 billion-plus valuation. The firm offers one of the largest PACE programs in the country and aims to be a compelling alternative to seniors facing nursing homes. (More about PACE) (More about InnovAge)

- In somewhat similar fashion to ATI, InnovAge dropped significantly during 2021 after disclosing that CMS was auditing its program in Colorado, resulting in a membership freeze for the program. InnovAge dropped 25% initially in Q2 on the news and hasn’t recovered since, leading to a 79.3% drop for the PACE program provider in 2021 after going public in March 2021.

Alignment Healthcare.

Alignment: Similar to Clover but with better financials, Alignment IPO’d in late March 2021. The managed care firm operates in the Medicare Advantage space. Alignment fared much better than most digital health, value based care platforms, dropping just 19%. Personally, this is a solid business but was just taken down with the rest of the digital health players. (Link) (Link to S-1)

The Company Formerly Known As Ambulnz.

SPAC me: DocGo, AKA Ambulnz but that was too wild for the public markets apparently, finalized its SPAC merger on November 5th to enter the public markets. Ticker: $DCGO

- About Ambulnz: The company claims to be bridging the gap between physical and virtual care, which is a niche that actually might be useful. I suppose it would have been misleading for a company to be named after the ambulance, which transports patients of all acuity types, when it doesn’t actually provide this service. Anyway, the firm transports providers to people’s homes and also transports non-emergent patients to providers where needed. The company previously known as Ambulnz raised $160 million in the merger and at last glance, was valued a bit north of a billion. (Link)

- DocGo dropped 6.5% this year after debuting on the markets in November.

Bright Health.

Managed care player Bright Health filed its S-1 in April, chock full of interesting information and commentary related to their business. Later at the end of June, Bright raised just under $1 billion in its IPO with a market cap at about $10 billion.

About Bright: At the time of public debut, the insurance platform served just over 600,000 members across 14 states mostly in the individual insurance market, but more recently started to dabble in Medicare Advantage. Structure-wise, think of Bright Health as a mini UnitedHealthcare (yes, a $20 billion company is considered mini to UHG) in the sense that Bright separates its provider platform (AKA, Optum) from its insurance business.

- Alignment: Compared to a Clover or maybe even an Oscar, Bright is focused on vertical alignment in the markets it serves – identifying quality providers, acquiring providers in markets, etc. with the goal of delivering higher quality care to its participants.

- Tech Stack: Of course, Bright has its own health tech platform to build on – called NeueHealth, the segment provides a platform for primary care physicians to transition to value-based contracts.

- Although Bright entered the public scene with a lot of fanfare and momentum, the public markets quickly shut down and reversed this sentiment. Along with the rest of the insur-tech gang, Bright Health dropped 81% on the year.

Privia Health.

Physician enablement company Privia Health debuted on the public markets via IPO on April 29. Privia’s business model is complicated but interesting, serving as a platform for physicians to perform much of the back office functions for a practice – enabling the switch to value-based care arrangements, setting up physician websites, billing and collecting on behalf of physician practices, and more. Close peers to Privia include ApolloMed and P3 Health Partners, who also went public late in 2021. (Link)

Aveanna.

Aveanna Healthcare, an in-home care firm, also went public around the same time as Privia. The home health company dropped 36% on the year. Aveanna joined the likes of LHC and Amedisys in rolling up the home health and hospice industries in healthcare. (Link)

Babylon.

Babylon: announced its intention to merge with Alkuri Global Acquisition Corp at about a $3.6 billion enterprise value and completed this transaction in October.

- About Babylon: Since starting as a virtual chatbot service in the UK, Babylon since expanded into value based primary care (aka, Capitation). The firm recently acquired two provider groups in the U.S. and is expecting continued growth in membership with a similar strategy to that of Oak Street Health or One Medical’s latest acquisition with Iora.

- (Link to Investor Presentation) – provides a solid, rosy overview of Babylon’s business and market

Babylon dropped 42% on the year since going public in October.

Doximity.

Social: Doximity went public the traditional way, via IPO at the end of June along with Bright Health. Its stock skyrocketed in its trading debut; as a result, the firm had a successful IPO.

- About Doximity: It’s essentially the Facebook or LinkedIn of physicians, APPs, and graduating medical school students with a few bells and whistles attached – including free telehealth and scheduling tools for its members. According to its S-1, the firm has 1.8 million users which makes the platform a compelling advertising opportunity for recruiters, health systems, and pharma organizations trying to reach medical professionals.

- Notably, Doximity is profitable and growing, which lends itself to a potentially robust valuation once it hits the public markets later this year. Most interesting – Doximityreserved a portion of its shares for physicians on its platform – similarly to Uber drivers or AirBnB hosts. The firm sold 10,000 pre-IPO shares to those physicians, which gives itself a compelling foothold on those physicians.

- (Link to S-1)

Doximity initially skyrocketed throughout much of the year but suffered a late-year selloff resulting in a return of just 2% since its IPO in June.

LifeStance Health.

Also going for the IPO route, LifeStance operates outpatient mental health facilities and employs about 3,300 mental health clinicians. The firm successfully began trading in mid-June.

- About LifeStance: LifeStance was founded in 2017 and has since grown to operate in 27 states and 370 facilities with almost 2.3 million patient visits in 2020. Notably, the firm operates under a fee-for-service model – 89% of its $377 million in 2020 revenue was derived from commercial in-network payors. The growth and number of increasingly larger players in the mental health spaces confirms bullish sentiment around this particular sector of healthcare, and I’m curious to see how Talkspace, LifeStance, and others grow and execute on their strategy.LifeStance dropped 62% on the year.

Convey Health Solutions.

Digital: Yet another health tech platform, Convey Holdings focuses on working with payors and PBMs to ‘improve government-sponsored health plans.’ The firm went the IPO route and debuted at a $1.1 billion value. (Link) (Link to S-1)

- Convey dropped 40% on the year.

The Oncology Institute.

SPAC: Following in the footsteps of Cano, Babylon, and other value-based care providers, the Oncology Institute was taken public via SPAC as the first value-based care oncology (cancer care) business. The transaction valued TOI at an enterprise value of about $840 million (Press Release)

- About the Biz: According the prospectus, the Oncology Institute operates out of 50 locations in four states, primarily in California. The firm did about $155 million in revenue in 2019 and expects to achieve about $350 million in 2022 through value-based partnerships with payors and expansion into ancillary service lines like pharmaceuticals, clinical trials, and M&A. (Investment Prospectus)

The Oncology Institute officially began trading on the public exchanges after combining with DFP Healthcare Acquisitions Corp.

- The Oncology Institute dropped 2.5% on the year since going public in November.

Definitive Healthcare.

Definitive Healthcare: Data analytics firm Definitive Healthcare announced its IPO filing in August. The firm boasts health systems, PE firms, and consulting firms among its clients who access its healthcare databases. (Link – Press Release) (Link to S-1 Prospectus)

- DH dropped 37% in the last quarter of 2021 after its IPO in September.

Warby Parker.

Warby Parker: In other anticipated news, Warby Parker went public via direct listing – similar to how Slack and Spotify went public. Warby Parker’s business model revolves around direct to consumer eyewear offerings – a flat price of $95 for eyeglasses, and its own line of contacts to boot. The company went public on September 27 and has dropped about 10% over that timeframe. (Link)

P3 Health Partners.

P3 Partners, a physician enablement, population health management platform, went public via SPAC with Foresight Acquisition Corp. at a $2.3 billion valuation.

- About P3: Similar to peers ApolloMed and Privia Health, the firm aims to enable physicians to take on value-based contracts and remain in independent while providing back-office support and electronic health platforms to make their lives easier. (Link)

- P3 dropped 9% on the year after debuting in December. So really, it dropped 9% in less than a month. Oof.

Cue Health.

Cue: At-home and B2B lab testing firm Cue Health debuted on the public markets on September 24. After an initial pop, the stock since drifted down below its IPO $16 reference price to $14 today. Cue is trading under the symbol $HLTH.

It seems as if Cue is trying to take full advantage of the at-home testing trend – first with Covid testing, and I would imagine expanding into other kinds of tests. (Link)

- Link to S-1 prospectus: (Link)

Ensemble Health Partners.

Ensemble: As if the space isn’t already red-hot, revenue cycle management firm Ensemble Health Partners filed for IPO. The firm currently ‘manages’ $21 billion in revenue for its health system and other provider clients. According to its S-1 (linked below), Ensemble claims the total addressable market for RCM services is $50 billion, or about 5% of net patient revenue in the U.S.

- By the numbers: Ensemble generated $600 million in revenue and adjusted (sigh) EBITDA of $210.3 million. So far in 2021, Ensemble is on pace to make over $800 million in rev and $276 million in EBITDA.

- Useful Links: Press Release (Link); S-1 Prospectus (Link)

BrightSpring Health Services.

BrightSpring: Home Health and community service provider BrightSpring Health Services also filed its IPO paperwork in late October. BrightSpring claims in ITS S-1 that there is a $1.5 trillion market opportunity across its service lines as the home health market continues to grow.

- By the numbers: BrightSpring generated $5.6 billion in revenue and made $412 million in adjusted (sigh) EBITDA in 2020 through 37,000 caregivers and clinicians (side note, that margin seems razor thin, but it was 2020 after all).

- BrightSpring’s platform includes home health, long-term and rehab care, and a pharmacy segment that I imagine isn’t too different from CVS’ long-term pharmacy operation Omnicare that it divested back in 2019. The firm operates in all 50 states and maintains a census of over 30,000 in its facilities.

- Useful Links: Article write-up on BrightSpring (Link); S-1 Prospectus (Link)

Pear Therapeutics goes full SPAC

Therapy: Digital therapeutics firm Pear Therapeutics began trading on the public markets on December 6 after its previously announced SPAC with Thimble Point Acquisition Corp.

The details: Pear Therapeutics is expecting $4 million in revenue this year and went public via SPAC at a $1.6 billion valuation. Yes, you read that correctly. Investing in Pear is very similar to investing in an early stage biotech firm developing a potentially game-changing drug. Digital therapeutics are on the cutting edge of digital health

- Link to initial press release. (Link); Link to 12/6 press release. (Link)

- Shockingly, I can’t seem to find any sort of investment prospectus or investor presentation related to this acquisition. It’s likely coming soon, but nothing currently on the Pear website or SEC EDGAR system.

- Digital Therapeutics? For a precursor on the digital therapeutics trend, and what to expect, Nikhil Krishnan put together a nice piece last year on the emerging industry. (Link)

- Pear dropped from its initial SPAC price of $9 to $6.20 at the end of the year, resulting in a 31% decrease

My Favorite Healthcare Reads from 2021.

Healthcare Newsletter Writers of the year:

- Nikhil Krishnan: Out-of-Pocket (Link)

- Jared & Brett Dashevsky: Healthcare Huddle (Link)

- Olivia Webb: Acute Condition (Link)

- Brendan Keeler: Health API Guy (Link)

- Kevin O’leary: Health Tech Nerds (Link)

Best of Q1.

Systemic: How kidney failure is the perfect storm of an unequal health care system. (ProPublica)

Politics: The crash landing of ‘Operation Warp Speed’ (Politico)

Atul Gawande: To fix our broken healthcare system, start with primary care. (Fast Company)

Caseload: Read this informative post from Steve Hardgrove’s Caseload, which breaks down Accolade’s business model and describes how the firm can create value by enabling employers to make informed decisions on health plans.

- The analysis also dives into Accolade’s decision to buy 2nd.Md and how Accolade is developing a platform for employers, including opportunities and potential pitfalls. (Link – 11 minute read)

Out-of-Pocket: Read Nikhil Krishnan’s latest on the value of patient communities and how they should evolve to better suit those they serve given the evolving social media world. (Link – 11 minute read)

Acute Condition: Olivia Webb dove into the world of specialty pharmacy – how the system works and why innovation is frozen. (Link – 7 minute read)

Fierce: How the NFL tackled COVID-19 spread among its players and staff. (Link)

Semantics: Maybe the biggest news of the week – the Wall Street Journal announced a change in its stylebook from “health care” to “healthcare.” It’s a massive rift in the industry. I’m in the one word camp – more efficient! (Link)

Noah Smith: The U.S.’ vaccine rollout is world-beating. That doesn’t mean it’s good enough. But let’s take a moment to appreciate it. (Link)

Shady: Not only did New York officials admit that they lied about nursing home deaths back in August, a state-run nursing home also gave dozens of veterans experimental treatments without their family knowing. (Link)

Heroic? Read this gut wrenching story about a doctor’s decision to find 10 people for vaccine doses set to expire in 6 hours – and getting fired for that decision. (Link)

Big Data: Read about the multitude (thousands) of health datasets across the nation, the challenges that this fragmentation provides, and the opportunities to address the scattered resources. (Link) – Medium soft paywall.

From the frontlines: Read about Clover Health’s CEO’s reaction to the recent short-selling controversy, something I covered a few weeks ago. It’s quite the entertaining read. Let me know if you can sense Mr. Garipalli’s frustration. (Link)

Corona Reads: A couple of powerful coronavirus related reads were published by ProPublic and NPR. The first article dives into physicians around the country who had to decide which patients could live or die due to limited resources and time. The second article documents a physician’s experience in the ER through words and photos. (Link)

Small-Town Hero: Read about Marilyn Bartlett, a CPA who has saved the state of Montana over $30 million by creating a reference pricing model for hospitals – and the problems with scaling such a program nationwide. (Link)

Value-Based: Read this great breakdown of value-based care models from the Prescription. Worth a (sub)scription. (Link)

Disruptor: The healthcare revolution at-home. (Link)

Behavioral Health: The money behind mental health: How the pandemic increased innovation, investment in behavioral health care. (Link)

Policy: Read about Biden’s healthcare policies in the ‘new Washington.’ Deep dives from Axios on what to expect and what’s going on. (Link)

Rock Health: Read the latest from Rock Health on digital health – what’s working and how things are trending. (Link)

Report: Read McDermott, Will & Emery’s 2021 Health Report, which provides a spin on the legal ramifications of 2020 in healthcare. (Link)

Transparency: Here’s a super interesting read on the wide variation in pricing by hospital for the same procedures. (Link)

Logistics: Read this informative summary from Acute Condition of the vaccine distribution and absolute pandemonium of the patient intake process. (Link)

Consolidation: This Health Affairs article offers a somewhat contrarian viewpoint of health system consolidation in healthcare by arguing that consolidation allowed these health systems the scale to efficiently allocate resources to fight COVID. Quick actions included rapidly expanding ICU capacity and managing cases over a wide region. The article goes on to argue that maybe consolidation isn’t so bad – when it doesn’t increase consumer prices. (Link)

Teens: My final pick for the week comes from ProPublica – highlighting the emotional toll the pandemic took on crucial developmental years for teens. (Link)

Delivery: What it’s like to have a baby during a pandemic. (Link)

Family Feud: America’s Covid swab supply depends on two cousins who hate each other (Link – Bloomberg Paywall)

Doctor Fentanyl: The untold story of the doctor who fueled a drug crisis. (Link)

Best of Q2.

Epic: This was a fascinating read about one of the most successful female entrepreneurs in the U.S.: Judy Faulkner, who founded Epic Systems. (Link – soft paywall – Forbes)

Therapy Apps: How great are therapy apps, anyway? Diving into the therapy app fantasy. (Link)

Telehealth: employer tele-mental health is new branding on an old model. (Link)

Supply Chain: Read this fascinating deep dive into the drug industry: a drug’s convoluted journey from factory to patient. (Link)

Digital Health: This is a fantastic overview of digital health from Triple Tree – trends to watch, major players to follow, and more. (Link)

Status Vax: This was a fascinating read about how Pfizer’s vaccine somehow became top tier from a social perspective – the Pfizer elites (full disclosure, I’m a Pfizer elite – sorry to all you JnJ peasants). (Link)

A New Era: Here’s a good well thought out essay from Joe Connolly about healthcare’s movement toward a virtual first ecosystem – how a host of anti-consumer factors are causing a paradigm shift in the industry. (Link)

All about the FDA: This write-up was a great dive into how the FDA works – the article starts from the ground up and left me with a solid understanding of how things get done at the agency. (Link)

Racism: There were a few thought-provoking articles involving racism in healthcare. I’ve linked both of them below:

- The world’s leading medical journals don’t write about racism. That’s a problem. (Link)

- Race and Healthcare in America. (Link)

M&A: Learn more about the newly formed health system Virginia Mason Franciscan Health up in the Pacific Northwest – how the two systems integrated, the first 100 days, deciding on a dual-CEO model, and more. (Link)

GoodRx: This profile of GoodRx from Fortune was interesting, especially because while GoodRx helps patients navigate an extremely difficult drug industry, the firm technically shouldn’t need to exist. (Link)

Sewage: Here’s an interesting long-form read about sewage in the U.S., and using the system to improve our healthcare system and public health infrastructure. (Link)

The Flu: An interesting read on the potential return of the flu, with experts weighing in on what kind of flu season we might expect – if any. (Link)

Public Option Opinions: This was a pretty engaging piece from the Brookings Institute on thinking about smartly designing a public option policy that would actually set out to reduce prices for healthcare consumers. (Link)

New Look, who dis: Go check out Out-of-Pocket’s revamped site which has a fantastic design. Nikhil Krishnan does great work with his newsletter and describing healthcare business models – I highly recommend dropping a subscription if you haven’t already. Also, check out the most recent article on SWORD Health – which provides MSK care via smart sensors and virtual therapies. (Link)

Increased Complexity: This was a great (but revealing) read from ProPublica about the increased complexities in cancer cases being found in patients now after going undiagnosed during the first year of the pandemic. (Link)

Pharmacies: Here’s a good read from the NY Times highlighting the various ways that CVS, Walgreens, and others are targeting the mental health market, including providing therapy within their retail footprints. (Link – soft paywall)

Faxes: Here’s a great read from substack guild aficionado Brendan Keeler about legacy standards in healthcare, the fax machine, and why things move so slowly in our world. (Link)

Machine Learning: An interesting deep dive into the world of the FDA and how medically based machine learning devices are being regulated by the governing body. (Link)

Direct Contracting: We’ve heard a lot about the new direct contracting model (capitation, value based arrangements) coming out from CMS and the parties involved are very bullish on the program. This article breaks down the Direct Contracting program and what to expect with its implementation. (Link)

One Medical: This was a good read from the Washington Post on One Medical, and diving into whether a subscription model is the right approach for primary care in the U.S. (Link)

Value-Based: Since we’re apparently obsessed with value based care this year, Olivia Webb posted a good write-up on primary care capitation. (Link)

Patient Outcomes: Following up on that whole value-based care thing, here’s an equally good article from Kevin Wang about how patient surveys are converted into an actionable performance measure for providers. (Link)

Women’s health: This was a great overview of the women’s health space and a solid attempt at killing off the buzzword ‘Femtech’ (Link)

Cityblock: Here’s a solid read from a great newsletter – Not Boring – giving a great operational overview of Cityblock Health, a super interesting player in healthcare. (Link)

Iora Health: Read more about Iora’s deal with One Medical from Kevin O’leary. I really enjoy his summaries and perspectives from both a bull and bear point of view. (Link)

DTC: This piece from Ro’s CEO was a cool insight into how the firm thinks about direct-to-consumer principles. (Link)

FHIR: Brendan Keeler’s write-up on the Fast Healthcare Interoperability Resources had me rolling. Great read for anyone wanting to learn more about this standard. (Link)

Best of Q3.

The Alzheimer’s Drug: I’ve been seeing a lot of controversy and scandal surrounding Biogen’s Alzheimer’s drug, Aduhelm – how Biogen received accelerated approval despite mixed trial results, and more. Here were some of my favorite articles surrounding the topic:

- Did The FDA Mess Up With Aduhelm? (Out of Pocket)

- Background – FDA calls for investigation into controversial Alzheimer’s drug approval. (Link)

- Aduhelm approval controversy dials up as FDA seeks probe. (Link)

Out-of-Pocket: The latest from my favorite healthcare newsletter dives into healthcare data – who’s buying it, who’s selling it, and how it can be manipulated. Sign up for Nikhil’s newsletter here. (Link)

Cross Contamination: An interesting piece from Bloomberg this week highlighted a lesser-known issue in drug distribution – that drug cross-contamination is rampant. (Link – soft paywall)

Genome: This week’s cool healthcare story from Nature dives into Google’s DeepMind AI and its ability to predict structures for a vast trove of proteins. (Link)

Unvaccinated: The NY Times took a deep dive into who comprises the 50% of unvaccinated people in America, including interviews with individuals who comprise different camps of thought. Worth a read to understand the perspectives here, but what’s it going to take to end this thing? (Link – NY Times – Soft Paywall)

Insurance: This was another great read from Out of Pocket as Nikhil discusses the individual insurance market and what improvements can be made. (Link)

Dialysis: I really enjoyed this analysis of the kidney care industry by the Margins of Medicine – challenges the industry faces, interesting details on how reimbursement is structured, and parting thoughts on solutions to the above. (Link)