Healthy Muse Healthcare News

The U.S. is officially OUT of the W.H.O.

This week, the US notified the UN of its intention to withdraw from the World Health Organization.

Meanwhile, China defended the W.H.O and criticized the U.S. for the decision to withdraw. (The irony isn’t lost that China took weeks to send data to the W.H.O about the coronavirus in the first place).

Walgreens invests big-time in VillageMD clinics.

Walgreens is significantly expanding its partnership with VillageMD after an initial pilot run in the Houston area. The drug retail giant is investing $1 billion to build over 700 VillageMD clinics in the coming years.

- It’s a huge investment that’s sure to compete with CVS’ HealthHUBs, Walmart Health clinics, and other primary care alternatives. Read more about the deal here.

The Healthcare IPO market continues to heat up.

What recession? Keep your eyes out for two new healthcare companies hitting the public markets soon. Interestingly, both firms – GoHealth and Oak Street Health – are involved in the insurance sector.

- GoHealth will most likely IPO this coming week. If they debut like other recent IPOs (Accolade, Lemonade, etc.) then expect their stock to jump like 40% on the first day of trading. Read more about GoHealth here.

Meanwhile, Oak Street Health filed for IPO late last week. The health insurance firm is focused on value-based arrangements mainly in the Medicare population (for now).

- Read the filing here and read more from ModernHealthcare here.

How have other recent healthcare IPOs like Livongo, One Medical, Accolade, and others fared? Read our update here.

Here’s the Democratic healthcare platform to expect in November.

The Biden-Sanders joint task force released its healthcare platform recommendations for the 2020 election. If you’re a longtime subscriber to the Healthy Muse, most of these will sound familiar to you. Here’s a refresher on the 2020 Democratic healthcare platform:

- Expanding ACA coverage and subsidies.

- Instituting a public option for the middle class.

- Drug pricing: Capping out of pocket drug costs for seniors and letting Medicare negotiate directly with drug makers for pricing. Restricting drug list price increases to the overall CPI inflation rate.

- Restrictions on mega-mergers: Increasing scrutiny around mega-mergers. The task force specifically calls out the hospital and pharmaceutical industry in its plan. (This part of the platform is new.)

- Read the full task force’s healthcare recommendations here.

Supreme Court rules on religious exemptions for employers

This week, the Supreme Court ruled that insurance plans from religious groups are NOT required to cover contraceptives (birth control) as a part of its plan. Prior to this ruling, almost all Obamacare plans were required to provide free birth control coverage.

- If a religious group opted out of this coverage, then the insurance plan could still cover an individual on the plan – just separately. Now, that individual ‘backdoor’ coverage has been removed, too.

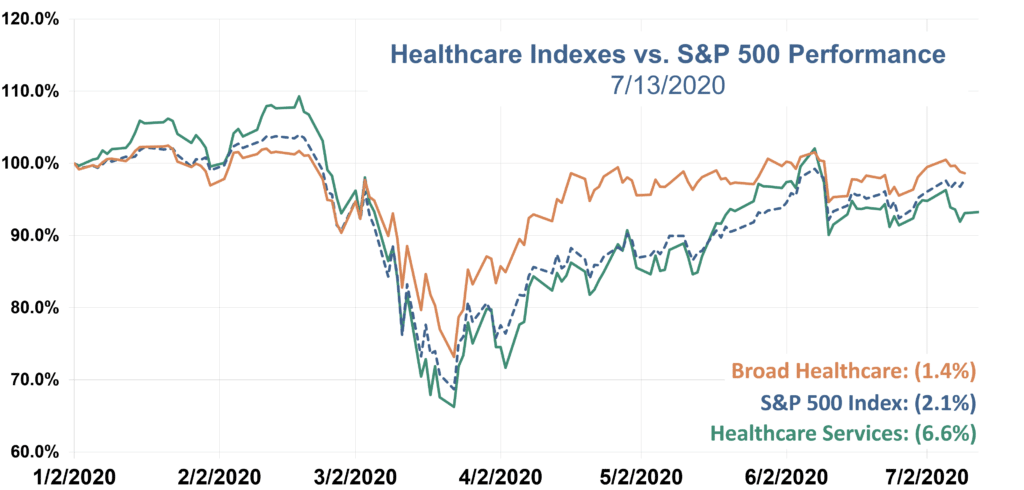

More from the Healthy Muse: How have healthcare public companies fared during the first half of 2020? We breakdown the data by sector, by company.

Coronavirus updates.

Here’s where we are today:

- The latest national scuffle is over whether schools should reopen. Cases are rising the most in states that reopened the earliest. The WHO confirmed that evidence suggests the disease is airborne. The White House wants you to know that there’s literally no downside to wearing a mask as Trump wore a mask publicly for the first time. 25 states so far have a mask mandate. Testing is taking too long.

Other things to know.

- Unlike the last surge in cases, many hospitals are choosing to continue elective procedures.

- Gilead’s antiviral treatment Remdesivir reduced the risk of death in severely sick patients by 62%. This trial showed significant improvement in efficacy over its first published study and is great news.

- Novavax received $1.6 billion in funding from the U.S. as a part of the White House’s ‘Operation Warp Speed’ program this week. The $$$ will allow the biotech firm to conduct advanced human trials.

- Hospitals are now stockpiling drugs to prepare for future waves and surges. Because of that, the cost of medical supplies (PPE, etc.) is rising industry-wide, resulting in squeezed profit margins.

Quick Hits

Biz Hits

- The W.H.O and Big Pharma are teaming up to create a $1 billion fund to help out struggling antibiotic firms. Although antibiotics are incredibly important, the companies that produce new ones are facing bankruptcies since these drugs have lower profitability.

- Telehealth claims increased OVER 8,000% in April compared to last April because of COVID-19.

- Here’s a Fortune article covering how Apple and Stanford are speeding up healthcare innovation and medical discoveries. Speaking of innovation, digital health fundraising is blowing it out of the water this year – companies have raised a collective $5.4 billion so far.

- Walmart is launching an insurance agency in Dallas with a focus on Medicare.

Policy Hits

- The interoperability final ruling took effect on June 30th, which has the potential to shake up the healthcare industry by breaking down switching costs in EMRs. Notably, the timeline hasn’t been pushed back by lawmakers.

- A California court denied Sutter Health’s request to delay its $575 million antitrust settlement

- This week, CMS proposed an add-on provider payment for at-home dialysis treatment. The Trumps admin is big-time in favor of at-home dialysis.

- A recent Senate bill will preserve 340B eligibility for hospitals affected by COVID-19

- HHS is distributing another $4 billion to hospitals in coronavirus relief funds.

- A 2021 health plan ruling may result in significantly higher out of pocket drug prices for certain people.

Other Hits

- Providence and Humana want patients to stop ‘medical distancing‘

- A recent Kaiser Foundation analysis compared inpatient payment rates at hospitals between Medicare and private insurers. The conclusion is what you would expect.

- An Oregon hospital CEO is predicting that the pandemic will force rural hospitals to consolidate into larger health systems.

- CMS’ nursing home COVID reporting site is leaving users in the dark by not reporting all of the data available.

Thought-Provoking Editorials

- An editorial from the BMJ argues that price transparency for patients won’t be enough. (BMJ)

- Many American public-health specialists are at risk of burning out as the coronavirus surges back. (The Atlantic)

- Schools can reopen safely this fall (Scott Gottlieb, WSJ)

Healthy Muse Top Picks

- The Health Care Cost Institute (HCCI) released a cool interactive report on hospital concentration in markets across the U.S. Give it a look here.

- I like reading investment analysis because it provides a different perspective on healthcare. This week, I enjoyed reading this profile on Livongo, which argues that the digital health company has big enough potential as a platform to rival that of Amazon. Note – you may need a free account on SeekingAlpha to read it.

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse was created to educate people on the healthcare system. It’s one weekly e-mail updating you on all the major election news, broader trends, big stories, and policy updates. Learn more about our vision here.

Get smarter and sign up below today.