Public healthcare companies during 1H 2020 – a mixed bag.

The public health crisis that formed in the first half of 2020 (“1H 2020”) affected various healthcare sectors quite differently.

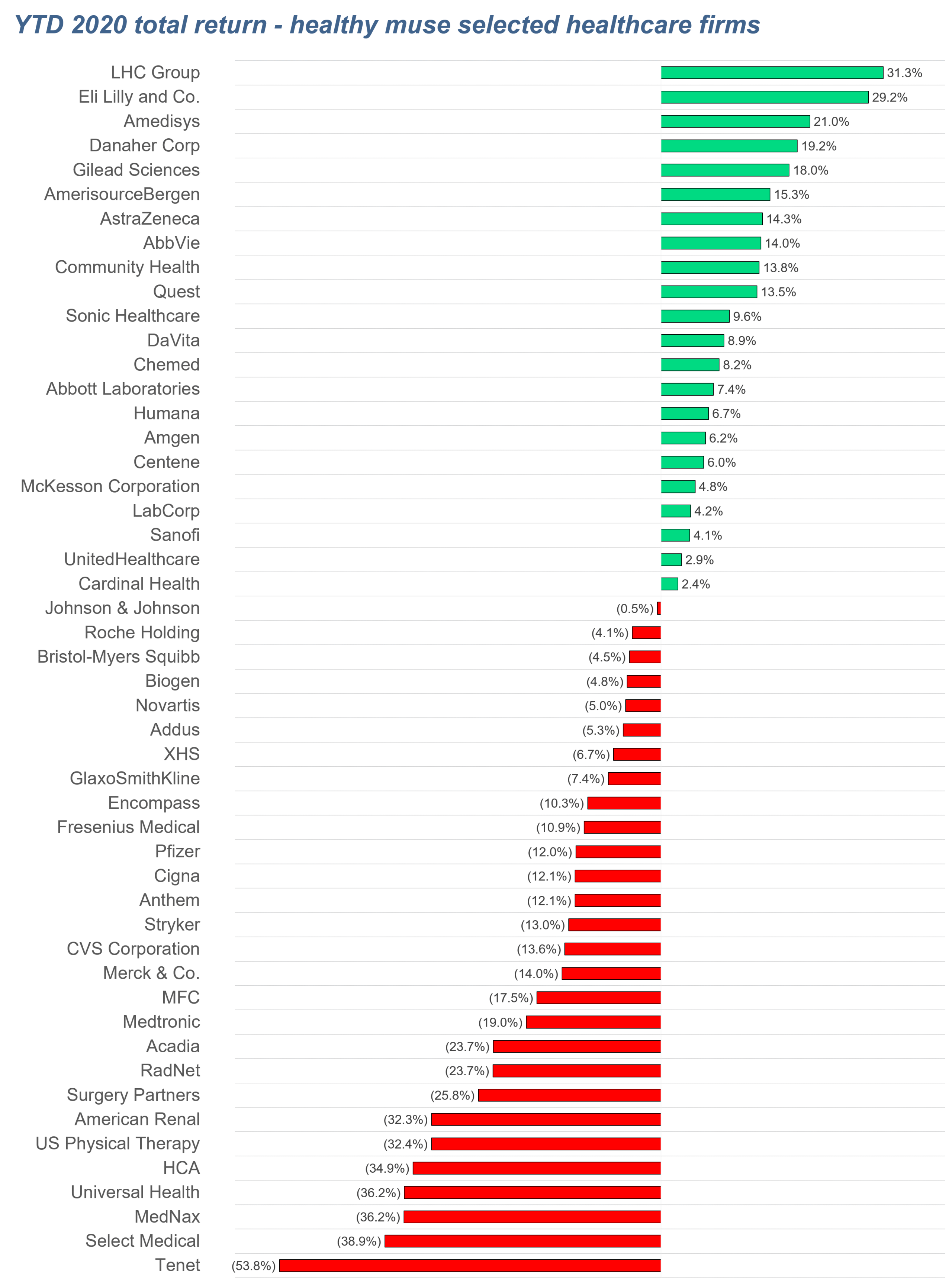

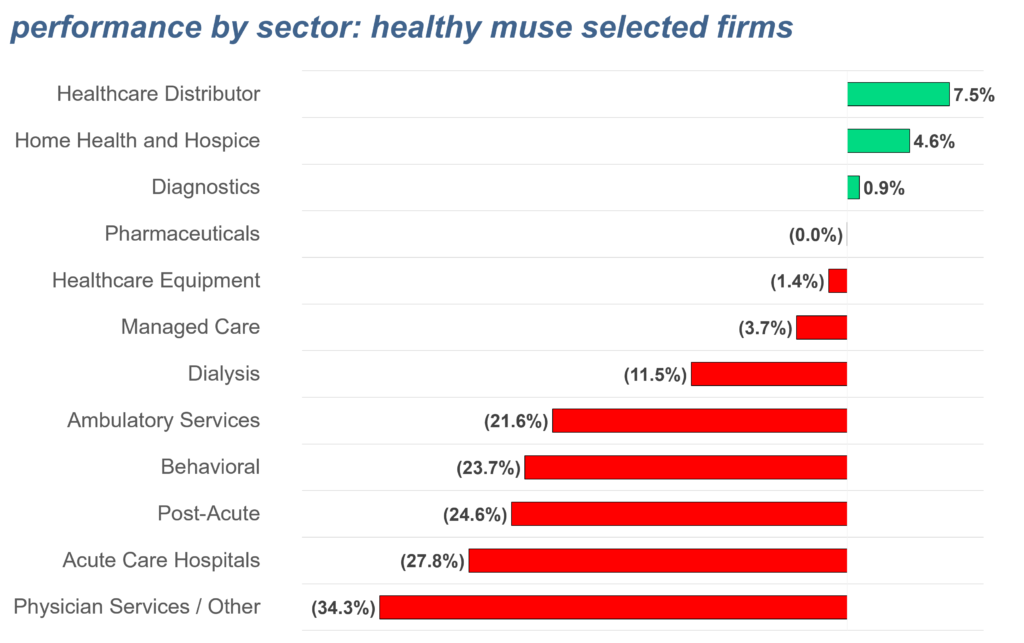

- Overall, only a select few sectors – healthcare distributors like McKesson or Cardinal Health, and home health providers such as Amedisys or LHC Group – managed to eke out positive gains in 1H 2020.

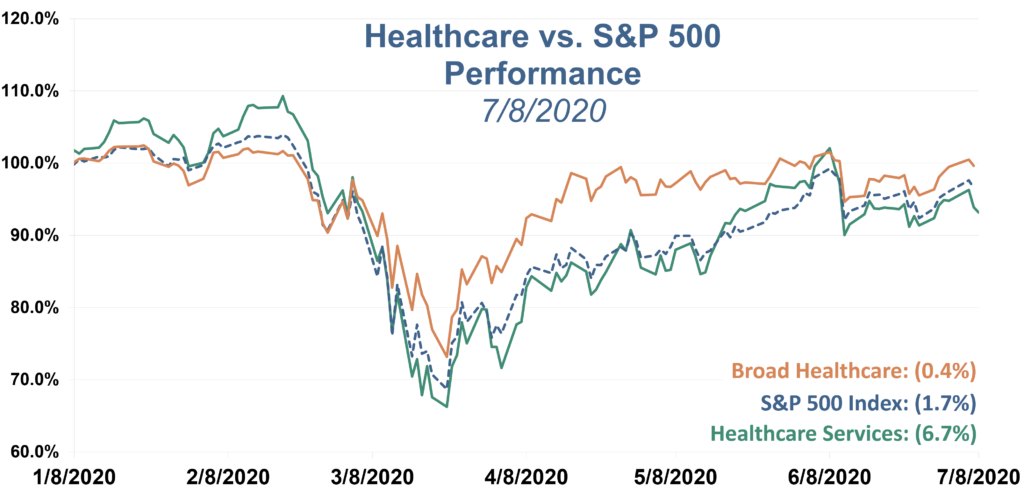

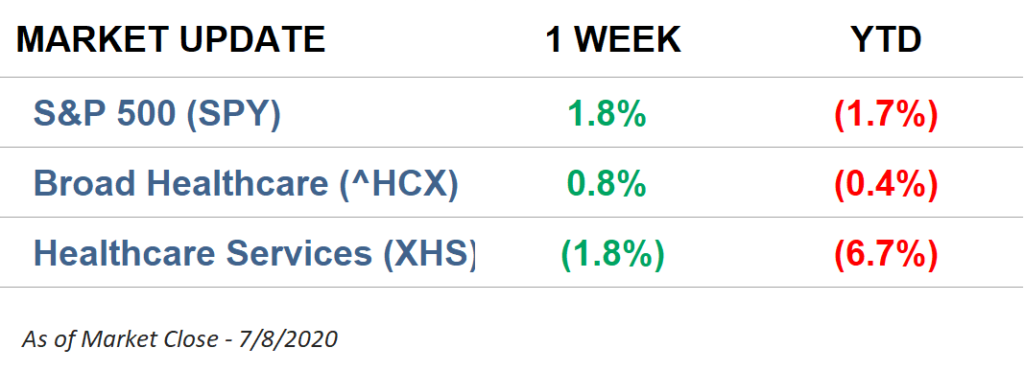

While public healthcare companies as a whole during 1H 2020 outperformed the S&P 500, healthcare services companies were not treated as kindly.

- You can see this trend by comparing the S&P 500 Health Care Sector (^HCX) to the healthcare services ETF created by SPDR (XHS).

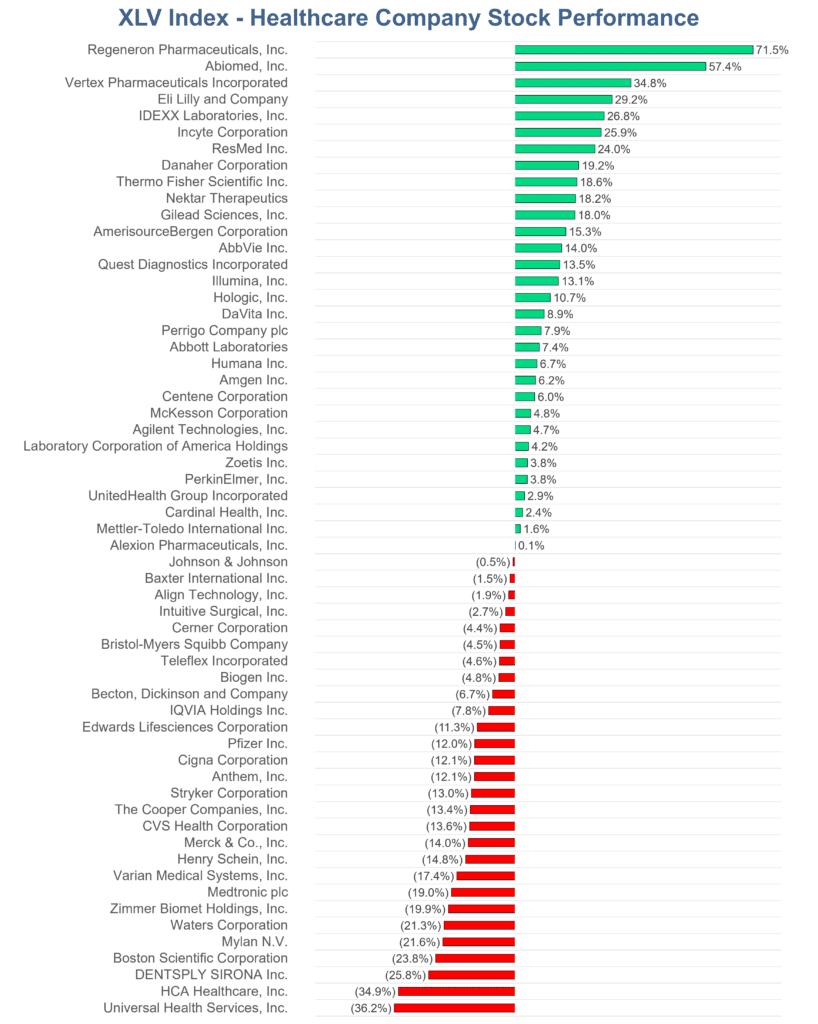

Broad healthcare company performance. ($XLV)

The broader S&P 500 Health Select Sector index contains outperformers in the pharmaceutical industry. Certain biotech firms were either (a) not affected by the pandemic given inelastic demand, or (b) benefited from higher demand for their stock due to the ongoing vaccine race.

- These factors allowed the index to perform well when compared to the more narrowly defined Health Care services ETF.

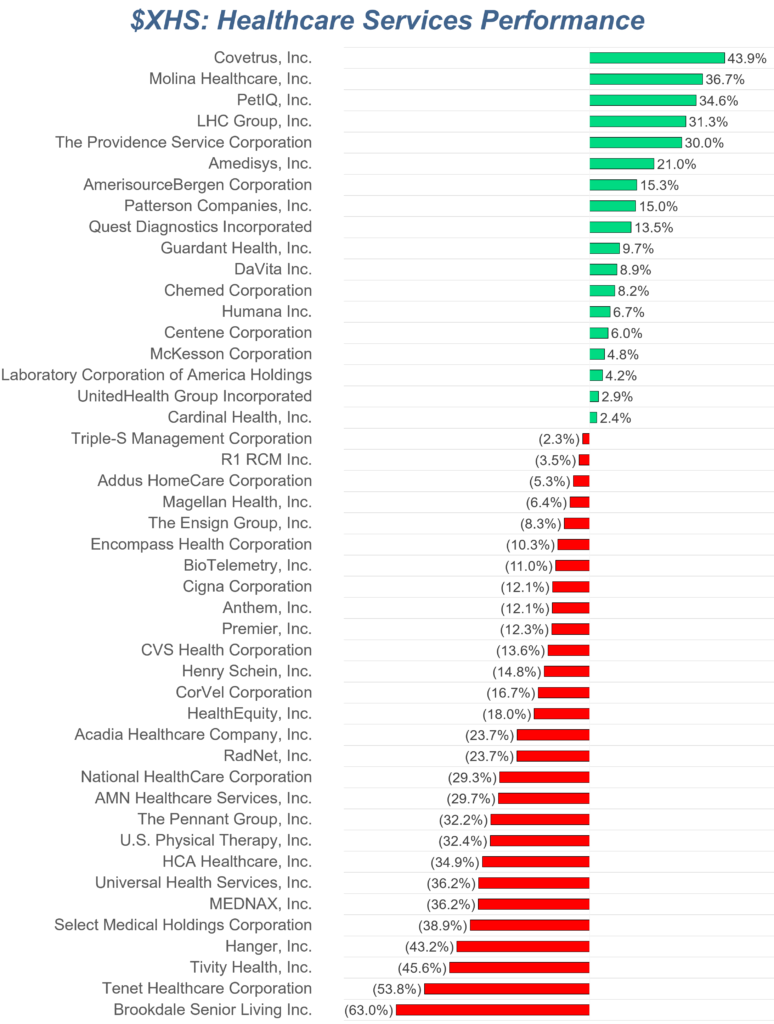

Healthcare services company performance. ($XHS)

Constituents in the Health Care Services ETF were arguably the most materially affected public sector when it comes to estimating COVID-19 impact.

- Companies such as HCA Healthcare (the largest public hospital operator), Encompass Healthcare (the largest operator of inpatient rehabilitation facilities), and all outpatient-focused firms sold off severely in the face of the pandemic.

When you look at a time-series graph, the vast underperformance by health care services becomes even more apparent.

As of the beginning of July, services underperformed the S&P 500 by a whopping 5.0%. Meanwhile, broader healthcare actually outperformed the S&P 500 over the same time horizon:

Interestingly, healthcare services were performing QUITE well prior to the onslaught of the global pandemic, outperforming broader healthcare and the S&P 500 by a wide margin even during the peak of the bull run. Of course, this changed quickly as panic gripped the public markets.

2020 (so far) is the year of the home health provider, distributor, and Big Pharma. Services continue to struggle.

Home health giants Amedisys and LHC Group continued their outperforming ways when compared to other traditional healthcare services.

- Meanwhile, sectors with less elastic demand (distributors) and vaccine hopes (pharmaceuticals) outperformed the S&P 500.