healthy muse healthcare news.

- This week in healthcare: Optum buys Refresh Mental Health, Lux Capital steals my index, Oscar’s investor day, Henry Ford Health rebrands, Privia Health’s Q4 earnings, Hackensack and Englewood hospital merger called off, and more.

Mental Health Boom: Optum buys 300-clinic mental health provider Refresh Mental Health

Optum is in talks to buy Refresh Mental Health, an outpatient provider of behavioral health services, for a yet-undisclosed sum. According to Axios, Refresh, founded in 2017, “operates a network of more than 300 outpatient mental health, substance abuse and eating disorder centers spanning 37 states.”

Refresh was rumored to be generating $40 million in EBITDA and was owned by private equity firm Kelso, which bought the mental health co back in 2020 for $700 million. At the time, Refresh operated in 28 states and 200ish facilities. Assuming UNH bought Refresh for around $1B+ (pure speculation), that’s close to a 25x multiple and you can see why there’s so much activity in the space when strategic buyers like United are shelling out cash to scoop up behavioral health assets.

- For context, LifeStance Health, which went public on June 15 last year, currently operates 534 centers in 32 states through 4,790 employed clinicians. They’re currently valued publicly around $3.5 billion and generated $668 million in revenue in 2021, which is about 5.5x trailing or 4.2x forward expected sales of ~$871 million. Applying that multiple to Kelso’s purchase price probably means Refresh was generating revenue of around $150-200 million in 2020.

- Meanwhile, I’m sure Acadia Healthcare, which operates 238 behavioral health centers profitably, is wondering why its multiple isn’t 10 turns higher (probably related to growth). Sigh.

There’s also a real incentive for insurers to continue to build out mental health networks & coverage – Biden and lawmakers are starting to feel pressure to pass mental health legislation and address mental health insurance parity.

Related: This news around Refresh – and mental health tailwinds in general – shows how red hot the behavioral health market is between facility-based providers (who have better prospects IMO) and more virtual-based providers like Lyra, Cerebral, Talkspace, and others.

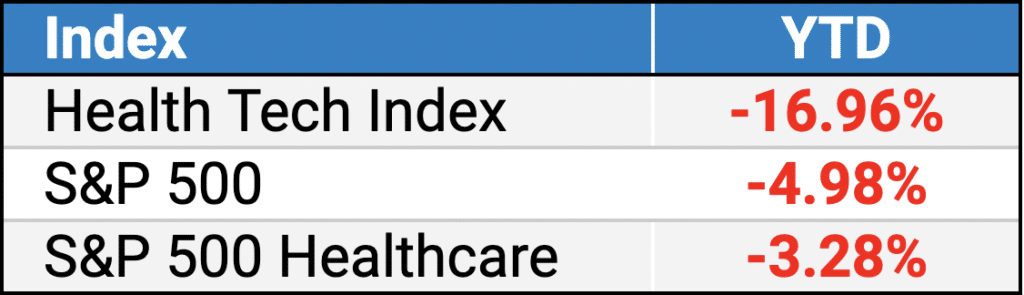

public market update.

Top 3: Talkspace, Convey Health Solutions, Skylight Health

Bottom 3: Cue Health, GoHealth, Pear Therapeutics

Full List: (Link)

I have an important announcement to make.

Lux Capital stole the Healthy Muse Health Tech Index for their own personal gain.

- The proof is clear.

- Jokes aside, the VC firm has interestingly created one of the, if not the first, digital health ETFs aimed at innovative companies across healthcare. (Link)

$PRVA: Privia Health jumped slightly after posting its Q4 earnings. (Link) (My Breakdown) (Transcript)

For 2022, Privia is expecting:

- 30% revenue growth to around $1.25B, 3700 providers, 875k lives, ~23% care margin (AKA, 77% MLR if I’m interpreting that correctly), and a ~4% adjusted EBITDA margin

- If you guys can’t tell, I’m very bullish on the care platform space and their ability to partner with health systems and incumbents to unlock value-based care. At some point in the near future, I’ll do a write-up on the space.

$OSCR: Just a month after its Q4 earnings dropped and as one of the best performers in the Health Tech Index to date, Oscar Health held its investor day and has probably the slickest investor deck I’ve ever seen. Obviously that doesn’t matter but I’m a sucker for presentation aesthetic. (Link)

Anyway here are some highlights and tidbits:

- Oscar is expecting to break-even on the operations side (AKA, revenue minus medical costs minus admin costs) by the end of 2023. To achieve that break-even status, Oscar expects to cut admin spend, increase prices (despite already pricing itself higher compared to competitors), and make other operating improvements outlined in its presentation I linked above.

- Oscar’s tech stack is way ahead of everyone else’s but that doesn’t mean much when you can’t SELL it…unfortunately, Oscar is struggling to sell its +Oscar package despite historically touting the market here. Interestingly, it looks like Oscar thinks it can sell the infrastructure to new digital health entrants and virtual providers, which could actually be a pretty big market.

- 60% of Oscar’s 1 million members exist in Florida, giving the insur-tech some major operating risk. In fact, Florida is one of the most heavily competitive markets for Medicare Advantage plans, which leads me to believe that ACA plans might be similarly competitive.

- All in all, the general consensus from folks I’ve followed seems to be…underwhelmed with Oscar’s day. While I want Oscar to be given the time and capital to succeed, it’s clear that investors don’t want to be on the hook for massive losses much longer (paging Bright Health here as well).

- By the way, Ari Gottlieb on LinkedIn does a good job of breaking down the insur-tech space. He’s bearish as hell but I still respect his opinion and analysis. He refuses to connect with me though. Maybe someday. Check out his profile here: (Link)

Other resources:

- HealthEquity’s Q4 earnings results. (Link)

Biz Hits

Trend Watch:

Rebrand: Henry Ford Health System decided to rebrand to …Henry Ford Health. Nice. Personally I kind of preferred the old logo. (Link)

HaH: Hospital at home operators are hoping for a waiver extension for the program once the public health emergency ends. From a larger perspective, I’ll be very keen to see what Congress decides to keep or change related to all of the deregulation stemming from the public health emergency – AKA, what’s next for telehealth? Mental health and prescriptions? LTACH/IRF admittance guidelines? And more. (Link)

Strategy & Partnerships:

PE: This was a great read from Med City News on private equity and where investments are headed next in healthcare with the coming virtual and at-home wave. (Link)

Galileo: Following up on its recent deal news, Galileo launched its bilingual, multi-specialty, 24/7 care platform which sounds insanely cool. (Link)

Confluent partnered with IncreMedical Therapy Solutions. (Link)

Bicycle Health partnered with 5 health plans to reduce opioid addiction. (Link)

M&A:

Hospitals: The Hackensack Meridian Health and Englewood merger in the New England area was called off after major regulatory antitrust concern in the continuing stream of mergers canceled between hospitals & health systems. (Link)

FreCrickWell: There were a few more interesting articles & content that provided an inside perspective on the Fresenius/InterWell/Cricket $2.4 billion kidney care merger:

- THCB interviewed Cricket Health’s CEO, Bobby Sepucha. (Link)

- More insights on the merger from a well-crafted article out of MedCity News. (Link)

SPAC: Not necessarily in my wheelhouse, but Ligand Pharma is spinning off its antibody unit through a SPAC merger. It’s notable as one of the few SPAC / IPOs taking place right now during insane market volatility. (Link)

Fundraising, Execs, & VC:

Cityblock, the $5.7 billion care platform focused on Medicaid patients and risk contracting, has a new CEO – former President and Co-Founder Toyin Ajayi. (Link)

Centene has a new CEO – Sarah London. (Link)

The AHA invested in SteelSky Ventures, a VC firm focused on addressing health equity. Is the AHA a lobbying group or the mafia? (Link)

- Osso VR raised $66 million. (Link)

- Podimetrics raised $45 million. (Link)

- TimeDoc raised $48 million. (Link)

- Antidote Health raised $22 million. (Link)

- Alife Health also raised $22 Million. (Link)

- Recora raised $20 million. (Link)

Want to drop your fundraising announcement in? DM me on Twitter.

Data, Studies, & Resources

McKinsey featured an analysis recently related to healthcare’s shift to the home. (Link)

Orthopedic physician practice deal activity did not slow down during the pandemic despite the near cancellation of elective procedures early on. (Link)

McKinsey had another good write-up on the future of care delivery in healthcare and where we’re headed next. (Link)

Hinge Health released a study that showed remote, digital MSK programs over 12 months were indicated to reduce pain, lower depression and anxiety, and limit medical utilization. It’s great progress for the virtual MSK space and I wonder how these results stack up against in-person physical therapy care. (Link)

Blake’s Musings

HOOVES: I can’t stop watching The Hoof GP on Youtube FIXING COW HOOVES. (Link)

SciFi: Esquire dropped their list of the 50 greatest sci-fi books of all time. As an avid sci-fi reader myself, I thought it was pretty solid. I’m personally reading through the Foundation right now and am enjoying them. Drop me a rec if you have any! (Link)

Ramp: Packy wrote about Ramp again and I found it incredibly interesting the breadth and speed of Ramp’s scale. (Link)

Weather: In case you were wondering, I did in fact survive the Texas tornadoes, but this video of a truck absolutely bodying a tornado is a must-watch. (Link)

Lefty: Phil Mickelson isn’t at the Masters…I still love Phil (as a fellow lefty) but what a fall from grace. (Link)

Hot Takes

Stat dropped a First Opinion from a couple of lawyers about how private equity is killing healthcare and that patients need to be protected.

- I think their beef is more-so with the misaligned incentives in healthcare rather than private equity itself. PE is just such a fun buzzword for ignorant people to pick on, so I’m sure it got plenty of clicks. Let’s just ignore the fact that all of healthcare is for-profit and pick on private equity players specifically. (Link)

Healthy Muse Top Picks

HCA: This was a great read from Katie Jennings on HCA’s Covid strategy and highlighted the machine that it is. There’s a reason why HCA generates $60 billion a year in revenue. (Link)

Personalities: This was a great profile from Stat on Will Flanary, the mastermind behind Dr. Glaucomflecken. He’s actually incredibly funny, but to see the human unveiled behind the character was really cool. 2.5 million subs across Youtube, Tik Tok, and Twitter!! (Link)

Hospitals: Here’s a great read from THCB on hospital consolidation and how we can maximize social benefit given the current landscape of health systems and providers. (Link)

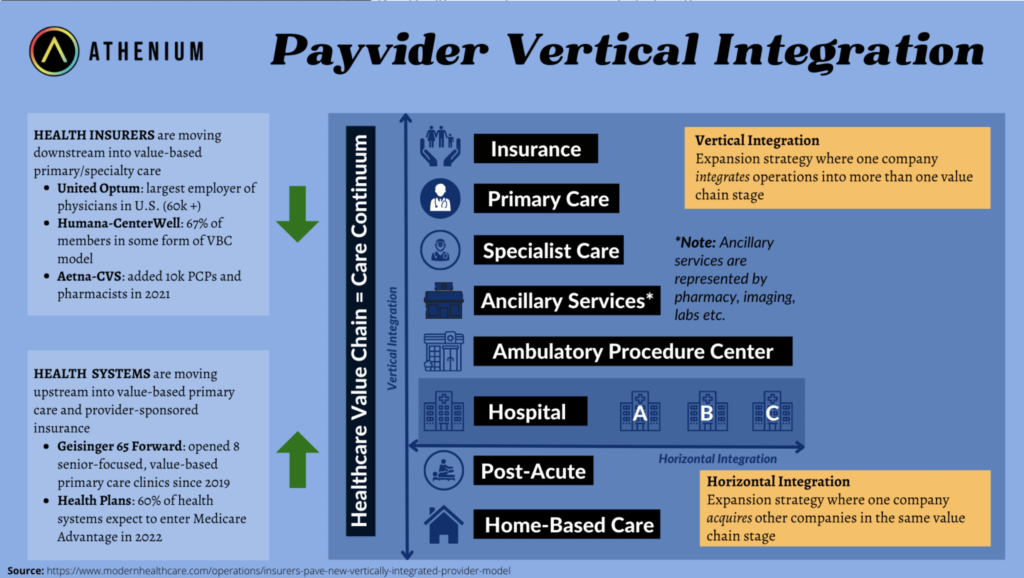

Payviders: I really enjoyed The Scroll’s recent newsletter on vertical integration in healthcare and found the below infographic extremely helpful to visualize it. Feel free to drop a sub to the Scroll as well – they’re producing great VBC content. (Link)

MA: A detailed, into-the-weeds dive into everything Medicare Advantage, comparing the program’s costs and benefits to traditional Medicare from J. Michael McWilliams and Health Affairs. (Link)