healthy muse healthcare news.

- This week in healthcare: Athenahealth sells for $17 billion, a new Oncology SPAC, Tenet grows its outpatient footprint, GE and JnJ plan spin-offs, a rough week for Talkspace, Teladoc’s investor day, insur-tech sophomore slumps, and more.

- Last week in healthcare: Ambulnz, now known as DocGo (lame) goes public, big Q3 earnings week, Democrats’ drug pricing package, antiviral Covid treatments, and more. (Link)

The Oncology Institute Goes Public

Oncology: The Oncology Institute officially began trading on the public exchanges after combining with DFP Healthcare Acquisitions Corp. As you can imagine from the name of the acquirer, this was a SPAC and not an IPO. Other healthcare-related SPACs haven’t gotten off to a hot start (looking at you, Talkspace, UpHealth, Clover, ATI…you get the idea), but maybe this more services-based value-based care biz will fare better (update: it’s already down 24%).

athenahealth sells for $17 billion

Health tech EHR software giant athenahealth (what’s the deal with the lowercase anyway?) is getting acquired by PE giants Bain and Hellman & Friedman for $17 billion, just a couple of years after athena was taken private by Veritas and Evergreen for ~$7 billion – a 142% appreciation. Talk about a juicy ROI. Also, I’m apparently in the wrong line of work.

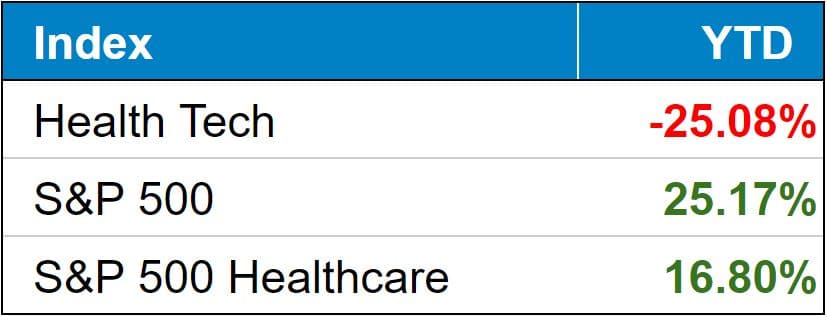

- Bain and Hellman must think that there’s juice left to grow athenahealth after the hefty sum given its current position in ambulatory settings and supporting platforms like Privia Health. The valuation makes more sense in the broader context of private digital health valuations, while their publicly traded counterparts struggled this year. I’m generally concerned with how frothy these transactions across healthcare are becoming – it seems as if someone is going to get burned here soon. (Link) (Link – press release)

Tenet grows its ASC Footprint with SurgCenter Acquisition

Ambulatory: Hospital operator Tenet Healthcare continues to triple down on its outpatient strategy under its ambulatory arm, USPI. Tenet purchased ownership interests in 92 ASCs from SurgCenter Development for about $1.2 billion.

- Further, SurgCenter and USPI plan to open an additional 50 centers over the next 5 years which indicates the level of outpatient growth these operators are expecting as the appetite for outpatient procedures grows stronger. (Link)

GE and JnJ go full high-school relationship: Breaking up

J&J: Healthcare conglomerate, maker of all things Johnson & Johnson is spinning off its consumer products division into a separate company to focus its core biz on pharmaceuticals and medical devices. (Link)

GE: In a similar fashion, GE, grandpa of the stock market, is splitting up its company into 3 distinct units, one of which is focused solely on healthcare and healthcare manufacturing. GE plans to spin off the healthcare unit by 2023. (Link)

public market update.

Top 3 weekly performers: ApolloMed (+3.2%); Alignment (+0.55%); Hims & Hers (-1.22%) …yeah…rough week

Bottom 3 weekly sandbaggers: Talkspace (-36% – more on this below); 23andMe (-21%) Clover (-19.7…but mah Chamath)

- Full Health-Tech Index performance: (Link)

$TDOC: Teladoc’s investor day unfortunately left investors…wanting. Despite plans for 30%+ top-line growth annually over the next 5-7 years, Teladoc’s stock slid as analysts question the digital health conglomerate’s struggles with Livongo integration. (Link)

$OSH: Oak Street Health is facing a DOJ inquiry into its relationships with marketing agents and its provision of free transportation for members. (Link)

Q3 Earnings:

$Insur-Tech: Although Clover, Bright, and Oscar all scored big in the special enrollment period, the insur-tech gang experience high medical costs stemming from COVID. If anything, these firms are going to be long-term investment plays as they expand beyond their initial geographies and develop the scale to weather regional risks. (Link)

- $OSCR: Oscar Health increased its members to almost 600k, but struggled to managed its high MLR amidst surging Covid cases. The stock sold off 20% after its earnings report after the company disclosed its intention to achieve profitability by 2023. (Link)

- Clover earnings. (Link)

- Bright earnings. (Link)

$TALK: Shares of Talkspace collapsed after its Q3 earnings and departure of its CEO and COO. Woof. The behavioral health app is down more than 70% since going public via SPAC earlier this year amid lower than expected growth and retention issues. (Link)

$DCGO: In its first earnings report, DocGo (Ambulnz) reported strong revenue growth from a year ago. Through its first 9 months of the year, its revenue is $197 million, up 214% from last year. Although candidly this is a company I thought would fail long-term, DocGo is currently break-even on the year. (Link)

$CVS: The retail pharmacy giant is closing 900 stores nationwide and lowered its guidance. Retail pharmacies have faced headwinds recently, so the shift in strategy makes sense given CVS’ grand plans with Aetna. Now, CVS stores will focus more heavily on healthcare offerings and will be one of three formats: HealthHUBs, MinuteClinics, and retail pharmacies. (Link)

Biz Hits

Paris: Amazon Care landed its biggest public customer – Hilton. (Link)

Diet: Ro’s diet pill is making waves – the DTC healthcare firm is ‘going all-in’ on weight management. (Link)

JV: Jefferson Health and Bayada are partnering on a new post-acute joint venture. Post acute JVs will continue for the foreseeable future, so keep up. (Link)

Hospital M&A: CommonSpirit is still shopping around its 14 hospital portfolio in the Midwest after its deal with Essentia fell through 6 months ago. (Link)

Funding: Health tech startup H1 raised $100M to expand its digital doctor network for pharma, medical device companies. (Link)

Investments: Bain Capital stays busy…the PE firm wing purchased a majority stake in InnovaCare, an MSO / physician enablement & support platform. (Link)

Policy Hits

Opioids: In a somewhat unsurprising move, the Oklahoma appellate court reversed a $465M opioid verdict against Johnson & Johnson. (Link)

Build Back Better: Things you should know about drug cost changes and the planned Build Back Better Act healthcare provisions:

The CBO estimates BBBA’s health care provisions roughly pay for themselves over 10 years:

- $75B ACA enhancements

- $33B End Medicaid coverage gap

- $37B Medicare hearing benefit

- $165B Long-term care & Medicaid provisions

- Offset by ~$300B in Rx drug savings. (Link)

Other Hits

Overdose Crisis: More than 100,000 people died of a drug overdose from April 2020 through April 2021 as the COVID-19 pandemic took hold, new figures from the federal government found. (Link)

Costs: New data from Cigna indicates that when an individual is diagnosed with a behavioral health condition and receives OP care, HC costs decrease by $1.4k. hashtag whole-person-health. (Link)

Opinions

PT: Physical therapy is about to witness the next innovation wave as sensor technology rapidly improves and reaches the masses. (Link)

ER: A new write-up from the HCCI revealed that ER spending increased 51% from 2012-2019 while utilization actually dropped. The authors attribute the increase in spending to a couple things – higher acuity and complexity of patients, and just generally higher price increases caused by out of network care. (Link)

Healthy Muse Top Picks

Medicaid: The Twitter thread and article below were good, quick, helpful breakdowns of Medicaid provisions and the future of the program.

- Cynthia Cox broke down the Medicaid coverage gap and how the Build Back Better plan expects to close the gap. **(Link – Thread)

- Jason Shafrin explained CMS’ plans for Medicaid and CHIP based on CMS leaders’ recent commentary – expanding coverage and access, ensuring equity, and innovation revolving around whole-person care. (Link)

Diabetes: Reuters’ special report on diabetes provides a phenomenal insight into the dynamics between diabetes, drugmakers, and policymakers. (Link)

Primary Care: Sebastian Caliri provided a solid framework for building a biz in primary care and how the sector is transforming into a risk-bearing ‘new world.’ (Link)

Substacks: The writers’ guild put out another solid group of write-ups this week: