healthy muse healthcare news.

- This week in healthcare: Ambulnz, now known as DocGo (lame) goes public, big Q3 earnings week, Democrats’ drug pricing package, antiviral Covid treatments, and more.

The Company Formerly Known As Ambulnz goes Public

SPAC me: DocGo, AKA Ambulnz but that was too wild for the public markets apparently, finalized its SPAC merger on November 5th to enter the public markets. Look for their management team to ring the NASDAQ bell on Nov. 11th. Ticker: $DCGO

- About Ambulnz: The company claims to be bridging the gap between physical and virtual care, which is a niche that actually might be useful. I suppose it would have been misleading for a company to be named after the ambulance, which transports patients of all acuity types, when it doesn’t actually provide this service.

- Anyway, the firm transports providers to people’s homes and also transports non-emergent patients to providers where needed. The company previously known as Ambulnz raised $160 million in the merger and at last glance, was valued a bit north of a billion. (Link)

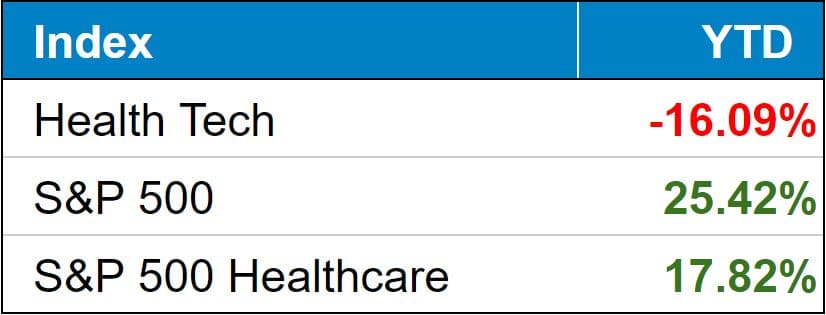

public market update.

Top 3 weekly performers: ApolloMed (+25%), UpHealth (+17%), 23andMe (+14%, sigh)

Bottom 3 weekly sandbaggers: Skylight Health (-14%), Bright Health (-14%, can’t catch a break), Pennant Group (-7%)

- Full List YTD performance: (Link)

$PRVA: Privia Health was up 13% today on a big earnings beat and guidance raised. (Link)

$OM: Home dialysis innovator Outset Medical won a CMS dialysis add-on payment and is poised to take on the dialysis duopoly. (Link)

$CNC: An activist investor group Politan Capital Management disclosed a $900 million stake in Centene. Should get interesting (Link – Paywall – WSJ)

$AMEH: ApolloMed is buying the rest of Diagnostic Medical Group within the next 3 years. (Link)

Earnings:

- $PNTG: Home Health provider the Pennant Group dropped over 20% on lower than expected earnings and dropped guidance, mainly attributable to Covid cases and labor shortage challenges. Pretty crazy the number of firms dealing with this dynamic and I’m personally interested to see how Biden’s vaccine mandate slated to take effect December 4th will affect healthcare staffing further. (Link)

- $HOSPITALS: Hospital operators experienced higher volumes (and higher Covid volumes) while also dealing with supply chain constraints in PPE and labor shortages in emergency departments. Makes you wonder how long this nationwide labor shortage is going to continue. (Link)

- $INSURERS: Insurer profitability remained strong in Q3 despite unexpectedly high COVID-19 costs. Healthcare Dive created another nifty roundup for all the major insurers. (Link)

- $MRNA: Moderna missed badly on its earnings this week as Covid vaccine sales came in much lower than expected. To add insult to injury, Moderna is struggling with its vaccine supply chain and thus lowered guidance for the remainder of the year. Of course the winner in all of this is Pfizer, which is expecting $36 billion in vaccine sales next year in addition to recently disclosing a highly successful Covid antiviral pill. (Link)

- $ONEM: One Medical raised its full-year guidance after disclosing much higher than expected membership numbers despite a higher medical loss ratio in Q3. Management also had some notes on how the Iora integration is faring. (Link)

Biz Hits

Moat: This was an interesting piece on Teladoc and how it plans to continue to build its moat and retain customers by having the most comprehensive suite of telehealth and remote healthcare products. (Link)

Drug Money: Novartis is selling its stake in fellow drugmaker Roche for $21 billion. (Link)

Daddy: Senior care partner provider Papa raised $150 million at a $1.4 billion valuation this week. (Link)

Policy Hits

Back from the Dead: Congressional leaders agreed on a skinnied-down version of the once-ambitious drug pricing bill. It’s a start – Medicare will be able to negotiate on certain qualified drugs, there’s a Part D out of pocket cap, and insulin prices will be heavily regulated now. More here. (Link)

- Analysis: Democrats’ drug pricing plan, while scaled back, could still squeeze pharma top-sellers. (Link)

Telehealth: A consortium of Senators are seeking to permanently expand telehealth eligibility in what seems like the most common-sense move of all time. (Link)

CMS Final Payment Rules: Things to know about the OPPS, MPFS, and Home Health rulings.

This write-up from Beckers was a good, brief overview of the three final rules from a high level. (Link)

- Home Health: CMS is expanding its value-based care program (aka, HHVBP) and is increasing the base rate by 3.2% next year. (Link)

- Physician Fee Schedule: CMS is expanding telehealth, but decreasing the conversion factor for FFS payments. (Link)

- OPPS: CMS is significantly increasing the price transparency compliance penalty and increasing its base rate by 2.3%. (Link)

Mandates: The Biden Administration set a deadline for all Medicare and Medicaid healthcare staff to be vaccinated by January 4th or face stiff punishments. Somewhat interesting – CMS is setting the requirement for healthcare workers (those providers who accept Medicare or Medicaid) while OSHA is setting the requirement for all large employers. (Link)

- Meet me in the club: Of course, these governmental mandates aren’t sitting right with everyone. Florida’s governor DeSantis vowed to fight the federal vaccine mandate: It’s ‘going down’ (Link)

- Courts: More recently, an appeals court temporarily halted the OSHA order as it works its way through court. (Link)

Other Hits

Pfizer says its COVID-19 antiviral pill cuts coronavirus risks by 89%. The next wave of coronavirus treatments are these antiviral pills, and they’ll hopefully be a gamechanger as we enter the winter months. (Link)

MA: This was a really great analysis on KFF on just how expansive and competitive the Medicare Advantage market is this year. As Boomers age into Medicare, the land grab is on. (Link)

Opinions

PE: This was good little PDF on value-based care in private equity, and how the emerging trend is a must-watch for PE investors. (Link)

Healthy Muse Top Picks

The healthcare writers’ guild came in with some strong action this week. If I missed yours hit me up:

- Olivia Webb wrote about Sidecar Health and cash pay initiatives in healthcare. (Link)

- Brendan Keeler wrote about HIPAA, data privacy, and information blocking in healthcare. (Link)

- Caleb Banks and the Donut squad wrote about Medicare and Medicare Advantage – what they are, how they differ, and emergent trends facing the government programs. I’m really enjoying this new newsletter and it’s worth dropping a subscription for free. (Link)