Healthcare Headlines from Q1 2022.

In case you missed it: I wrote about every major healthcare story in 2021 in one long-form read.

This write-up is a continuation of that, but covers all of the major Q1 2022 stories.

- You can find the 2021 version here: (Link)

Welcome back to the Healthy Muse’s round up of healthcare headlines. If you enjoy the content and find it valuable, there’s plenty more where that came from – subscribe to my newsletter here, where I break down healthcare strategy.

Let’s dive in to the Q1 2022 top healthcare news stories!

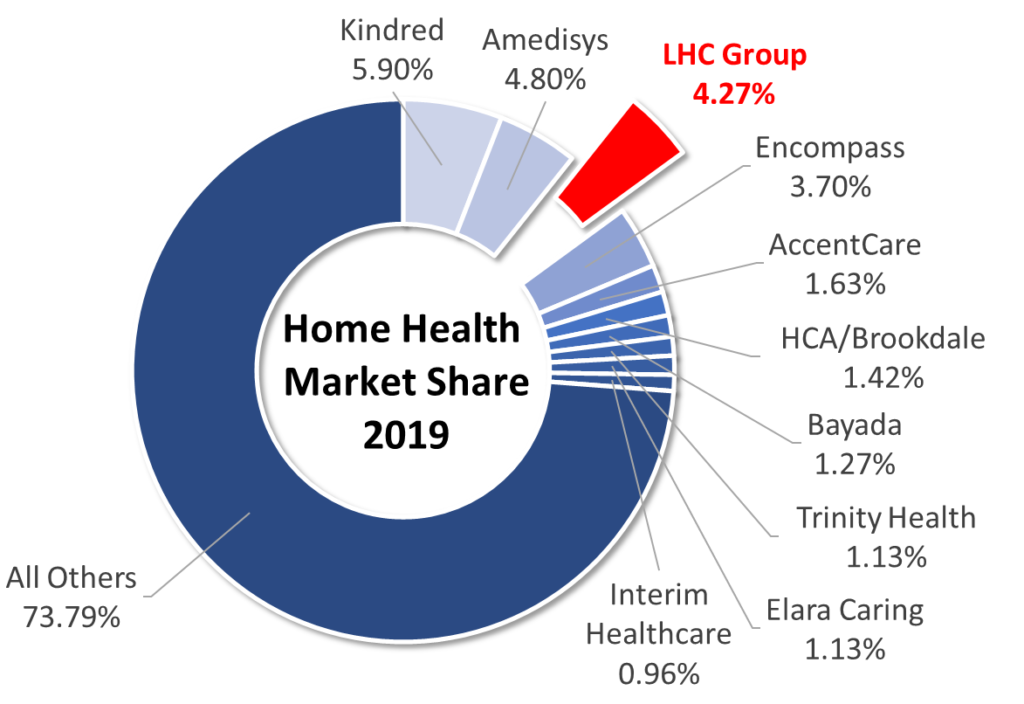

Optum Buys LHC Group in $6 Billion deal

- Read my deep dive here: (Link)

On March 29, UnitedHealthcare’s Optum (the massive, $40 billion services arm) announced the acquisition of LHC Group for $170/share, valuing LHC at over $6 billion.

- Optum acquisitions are confirming that we’re all going to one day work for United. The inevitability confirms their brand name, don’t you think?

This is a great acquisition for Optum.

Payors are continuing to morph into ‘payviders’ and UHG / Optum has a huge head start here. Acquiring LHC Group accelerates the payvider trend. Optum is deploying its grand vision of integrated care delivery right before our eyes. It’s happening whether you like it or not.

I dove in to the deal in much greater detail (3,000 words), breaking down why this acquisition is so important for Optum and fits them so well strategically. Check it out here. (Link)

United – Change Healthcare $13 Billion Deal Stalls to a halt as the DOJ gets involved

Antitrust: After what seems like an eternity since the transaction was announced, the DOJ is allegedly planning to sue to block the $13 billion United / Change Healthcare deal.

- Background: The merger announcement brought intense opposition from the AHA and other provider interest groups, claiming that an acquisition of Change would give UNH unprecedented access to data that would cause anticompetitive practices. The DOJ is sympathetic toward those concerns and has a keen eye on M&A in general across most industries. (Link)

Health Systems Form Staffing Alliance to Combat Shortages, and Earnings Round-ups

Six health systems (and I’m soon many more will join soon) are partnering to create a staffing agency called Evolve Health Alliance. Since staffing shortages have been SO bad, these health systems, which include giants like AdventHealth and Intermountain, will share their resources with one another in the instance that one of them is dealing with a COVID surge while the other systems aren’t. (Link)

- It’s a pretty smart and effective way of addressing shortages while largely getting around travel nursing fees – essentially cutting out the middleman agencies. (Thread)

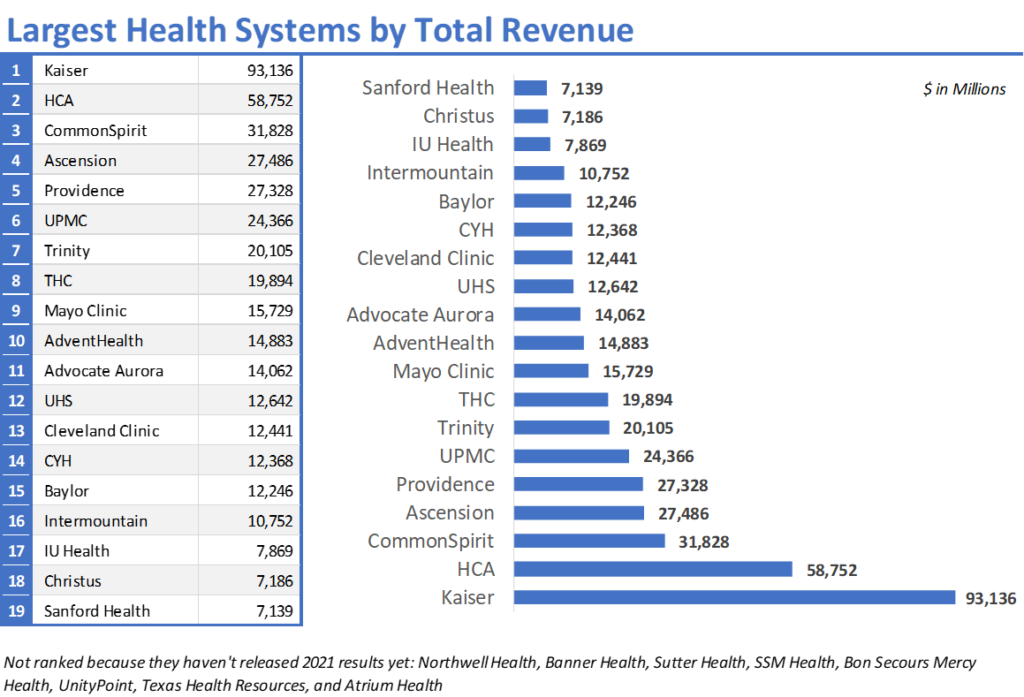

Along with the staffing news, here’s your one-stop shop for everything hospital related to 2021 earnings.

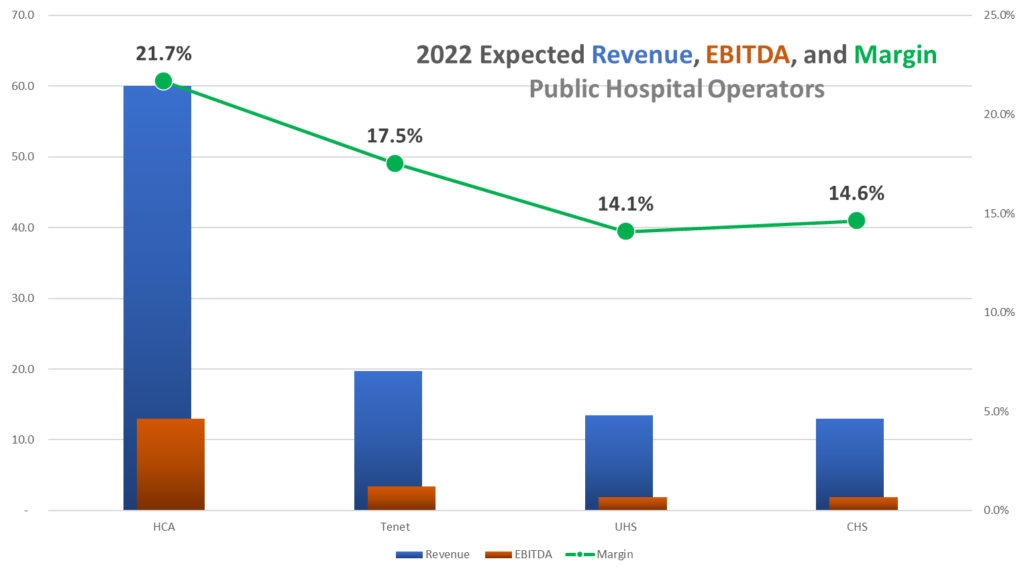

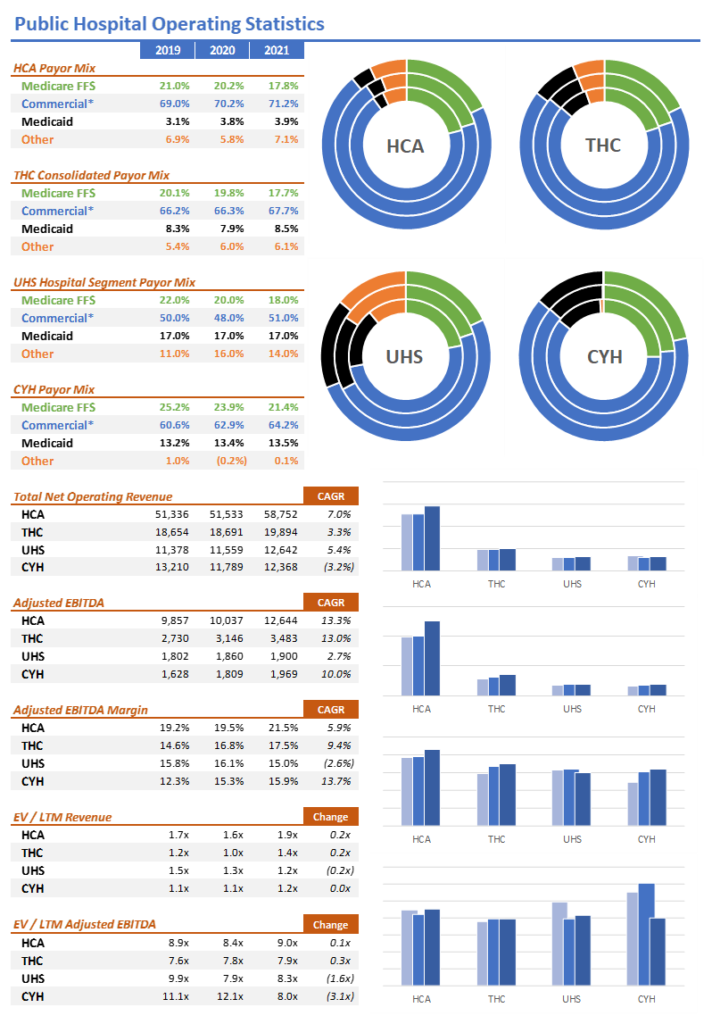

- HCA: Heavy battle-tested hospital titan HCA released earnings in late January:

- HCA is building 5 acute care hospitals in Texas in areas with hot population growth and 3 others in Florida.

- Amid broader staffing issues, HCA is still slowly integrating post acute assets into its portfolio, including Brookdale’s home health biz that HCA bought last year for $400 million

- For 2022, HCA is expecting revenue just north of $60 billion and EBITDA around $13 billion, a consolidated margin north of 21%. (Link) (Presentation)

- UHS: Universal Health execs had a lot of interesting context to say around COVID and recovery. For one, while some other hospital operators shrugged off staffing challenges, UHS sees the staffing shortage and unwind happening more gradually over time than being a singular event. Secondly, UHS execs expect discharge rates for patients to other post-acute care settings to right-size as skilled nursing, long-term care, nursing homes, and other sites of care get back on their feet.

- Overall, UHS expected muted growth for 2022 given the staffing and ‘Rona headwinds but noted optimisim as cases and outbreaks become less severe. UHS also signalled on the call that they’re only going to allocate capital to M&A where it makes sense strategically in their two fundamentally strong segments. (Link) (Transcript – soft paywall) (Presentation)

- 2022 Guidance: $13.5bn in revenue, $1.9bn in EBITDA

- Tenet: Tenet finished the quarter and year in a really solid spot, beating 2021 estimates. Its build-out of USPI continues to scale quickly through acquisitions. The hospital and outpatient giant announced the acquisition of 30 more ASCs from SurgCenter Development expected to take place this year.

- Here’s a fascinating point from the transcript – in his opening remarks, Ronald Rittenmeyer noted that he’s perplexed by the market’s and analyst’s decisions to continue to value Tenet as a hospital-based company despite their deleveraging and the growth of USPI. He thinks they’re worthy of a higher multiple. Do you? By reporting very clear, transparent segmented financial statements publicly, it’s clear what Tenet wants.

- Despite prior announcements to spin off Conifer, Tenet disclosed in early March that it intends to retain the revenue cycle management arm – AKA, kinda sounds like there were no sellers. Hmm…(Link) (Transcript – soft paywall) (Presentation)

- 2022 Guidance: $19.7bn in revenue, $3.45bn in EBITDA

- CHS: Community Health initially dropped after releasing Q4 earnings that showed weak same-store admissions growth and the expected challenges from ‘Rona. Interestingly, the hospital operator did signal expectations for lower travel / contract staffing costs later on in 2022.

- Community finished the year with $12.4bil in revenue and adjusted EBITDA of 16%, or $1.97bil.

- For 2022, CHS expects revenue around $13 billion and EBITDA around $1.9 billion, or consolidated margin just shy of 15%.

- The operator noted its main avenues for growth included increasing market share and bed capacity in existing markets, further investment into ACOs, and enhancing provider outreach programs.

- CHS also wants to crack down expense management related to its supply chain, purchased services, and nurse staff pipeline. Overall, though, it seems as if CHS has really turned things around and it’s full steam ahead for the operation. Now, to get to HCA’s level might take some time 😉 (Link) (Presentation)

Not for profit health systems round-up:

- Baylor Scott & White (Link)

- Providence (Link)

- Ascension (Link)

- CommonSpirit (Link)

- Cleveland Clinic (Link)

- UPMC (Link)

- Trinity (Link)

- Mayo Clinic (Link)

The largest health systems by revenue – (Link)

Optum buys Refresh Mental Health

Rounding out the Optum news, the services arm of United is in talks to buy Refresh Mental Health (as of this writing), an outpatient provider of behavioral health services, for a yet-undisclosed sum. According to Axios, Refresh, founded in 2017, “operates a network of more than 300 outpatient mental health, substance abuse and eating disorder centers spanning 37 states.”

Refresh was rumored to be generating $40 million in EBITDA and was owned by private equity firm Kelso, which bought the mental health co back in 2020 for $700 million. At the time, Refresh operated in 28 states and 200ish facilities. Assuming UNH bought Refresh for around $1B+ (pure speculation), that’s close to a 25x multiple and you can see why there’s so much activity in the space when strategic buyers like United are shelling out cash to scoop up behavioral health assets.

- For context, LifeStance Health, which went public on June 15 last year, currently operates 534 centers in 32 states through 4,790 employed clinicians. They’re currently valued publicly around $3.5 billion and generated $668 million in revenue in 2021, which is about 5.5x trailing or 4.2x forward expected sales of ~$871 million. Applying that multiple to Kelso’s purchase price probably means Refresh was generating revenue of around $150-200 million in 2020.

- Meanwhile, I’m sure Acadia Healthcare, which operates 238 behavioral health centers profitably, is wondering why its multiple isn’t 10 turns higher (probably related to growth). Sigh.

There’s also a real incentive for insurers to continue to build out mental health networks & coverage – Biden and lawmakers are starting to feel pressure to pass mental health legislation and address mental health insurance parity.

Related: This news around Refresh – and mental health tailwinds in general – shows how red hot the behavioral health market is between facility-based providers (who have better prospects IMO) and more virtual-based providers like Lyra, Cerebral, Talkspace, and others.

HCA snags 59 Urgent Care Centers in Florida

Diversification: HCA, the large publicly traded hospital operator, announced on January 4 its intention to purchase Florida-wide urgent care operator MD Now. The purchase price was not disclosed, but you can imagine it was a platform-level multiple to acquire such a large footprint. (Link)

- Details: MD Now operates 59 urgent care centers throughout Florida at a time when urgent cares are performing extremely well since they’re basically COVID test beacons. Free foot traffic. I guarantee we see more activity in the urgent care space among PE, health systems, and now CVS and Walgreens entering the convenient clinic setting so popular with millennials.

- The acquisition also helps HCA to continue to diversify its offerings throughout the spectrum of care delivery. Don’t forget that HCA purchased Brookdale Senior Living’s home health operations last year as well.

Humana shares plummet after reporting bad Medicare Advantage Growth

HUM: Here’s a super notable, interesting trend: Humana shares collapsed early in Q1 after guiding significantly lower Medicare Advantage growth than initially expected. The consensus from most folks is that increased competition on pricing from the new insur-tech gang and others is crowding the MA space, while others attribute some of the attrition to…well…Covid related deaths and fewer members to go around.

- Humana led all managed care providers lower this week. And here I thought managed care was impervious to bad news. I guess this is what happens when you stop hitting your growth projections, even at the very top of the food chain. (Link)

Partnerships: Humana is expanding its partnership with PE firm Welsh-Carson over its primary care senior clinics into 12 more states. I feel as if this partnership, announced in 2020, is somewhat in the radar, but it’s gaining serious traction. (Link)

After shaky Medicare Advantage membership numbers and its worst performing day ever in the stock market post-earnings, Humana bent the knee to an activist investor group, Starboard Value. Humana finally gave in to adding two directors to its board, including one from Starboard. (Link)

- Humana isn’t the only struggling managed care firm dealing with activist investors – keep in mind that Centene is also implementing certain expense improvements and c-suite transitions as a result of its deal with Politan Capital Management. Centene has really struggled to integrate WellCare and more recently, Magellan, in addition to being marred with scandal & settlements in its state PBM practices. (Link)

- Side note – I always find it hilarious when news like this is dropped and the company’s stock price immediately jumps. If I were at the C-suite I’d be thinking ‘damn, am I really doing that bad of a job?’

Privia Health Partners makes major moves

Strategy: Surgery Partners announced a strategic partnership with Privia Health on February 3rd.

- How it works: Privia will buy into Great Falls Clinic, a physician practice wholly owned by SGRY. The buy-in will give Privia the ability to expand in the Montana market, acting as Privia’s ‘anchor practice’ in the state (65 providers, 24 specialties). The two companies will also establish a management company, of which Privia will be the majority owner.

- Bigger picture: Privia’s primary pursuit is to transition traditional fee-for-service practices into value-based arrangement in order to take on risk. Surgery Partners is a significant partner to have, so keep an eye on future announcements between the two firms. (Link)

Privia Health also announced some good news on Jan. 5th – the firm entered into a few value-based risk arrangements through two of its ACOs, adding 23k members and $230 million in incremental revenue…do the math there! (Link)

Privia Health also jumped slightly after posting its Q4 earnings on March 22, near the end of the quarter. (Link) (My Breakdown) (Transcript)

For 2022, Privia is expecting:

- 30% revenue growth to around $1.25B, 3700 providers, 875k lives, ~23% care margin (AKA, 77% MLR if I’m interpreting that correctly), and a ~4% adjusted EBITDA margin

Encompass plans to spin off its home health biz into Enhabit Home Health

Breaking up: Encompass announced its plans to spin off its home health and hospice business into a separate publicly traded company called Enhabit.

- The details: If interested, I wrote a quick thread on Twitter breaking down the high points of what this means for Encompass. TL;DR, each segment’s management will be able to focus more wholeheartedly on their specific strategy. (Link)

- Link to Encompass’ announcement: (Link)

After the spin-off news dropped, rumors swirled around Enhabit and several headlines dropped related to a potential buy-out of Enhabit prior to the spin-off. Suitors including strategic buyers like Aveanna, and financial buyers like Advent International, appear to have big-time interest in buying the segment valued at around $3 billion.

- If Aveanna buys Enhabit, the purchase would put Aveanna on par with the likes of Amedisys and LHC Group in terms of scale. Given Aveanna’s current size (around $1.6 billion), the firm would likely need to split the cost with an interested financial party to foot the entire bill – similarly to how Humana purchased Kindred along with Welsh Carson (WCAS).

Enhabit would be a major get for Aveanna or any strategic buyer. Immediate scale and access to new markets while multiples have compressed down a bit over the last 12 months during ‘Rona headwinds makes sense for a timely buy. Although I wonder whether Encompass shareholders think more value would be unlocked via a public spin-off. Time will tell, but my money’s on the spin-off. (Link)

Chamath to take ProKidney and Akili Labs Public

SPAC Daddy: Chamath is taking biotech kidney firm ProKidney public at a $2.6 billion valuation. The deal will give ProKidney a pretty decent chunk of change to continue its phase 3 trials in the kidney and dialysis space. Chamath wrote up a quick one-pager on the deal. Let’s hope this one fares a bit better than Clover (lol). (Link)

- Cool tech: ProKidney is developing some tech to treat chronic kidney disease and kidney failures by repurposing the patient’s own cells to restore kidney function. Pretty amazing stuff if it ends up working.

Anotha One: On the heels of taking ProKidney public at a $2.6 billion valuation, one of Chamath’s many SPACs is taking Akili Labs, a pre-revenue digital therapeutics firm, public, at around a $1.1 billion valuation. (Link)

- About Akili: The digital therapeutics firm will become the second of its kind on the public markets. Pear, a close peer, went public in December at a $1.6 billion valuation. These companies are highly speculative in nature, similar to clinical stage biotech firms, as their products are largely unproven and they don’t have recurring cash flows. Akili’s claim to fame is its video game product that helps kids with ADHD gain focus. (Honestly they should just play Runescape instead).

More: Here’s a link to Chamath’s write-up on reasoning for the transaction. (Link)

Analysis: This was a hard assessment from Scott Xiao’s In Silico related to Akili’s FDA clearance as he displayed skepticism related to the endpoints used in Akili’s study. (Link)

Bigger picture – there haven’t been too many go-public announcements for digital health or services businesses this year. I’d expect a slight uptick over the summer and fall as geopolitical events play out and the economy (hopefully) stabilizes.

Mark Cuban gets into Affordable Drugs

Drugs: Mark Cuban just announced the launch of Mark Cuban Cost Plus Drug Company. Yeah. That’s the name of the company. Pretty amazing marketing when you can just put your first name in front of a firm and it’s instantly recognizable. #mediagoals

- Details: Through help from Truepill, MCCPDC will target the generics market and offer a flat 15% mark-up to every drug they can possibly get a hold of. It’s a cool play on transparency, and while the jury is still out as to whether or not it can make an impact when Wal-Mart’s generic list and GoodRx type players exist, I can always applaud an effort like this.

- Link to press release (Link)

- Check the site out yourself here: (Cost Plus Drugs)

Digital Health Funding hits all-time high in 2021, and the trend continues in 2022

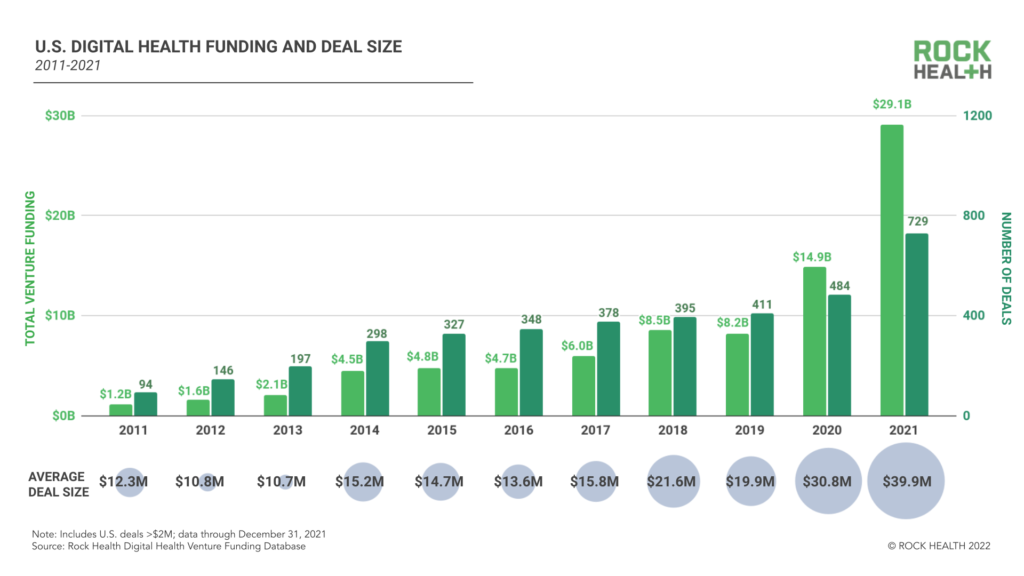

Credit: Rock Health

Funding Secured: Let the EZ money flow…according to the latest Rock Health digital health funding report, total U.S. based funding among digital health startups topped $29 billion in 2021. That’s up BIG time from 2020’s $15 billion investment estimate.

- Details: Funding is mainly being driven by larger deals rather than number of transactions, which seems to mirror the rest of healthcare deals in that regard as the industry consolidates. I’d expect this to follow a similar trend in 2022, but because of tightening money policies, funding will likely come down a bit. (Link)

Funding Secured: Digital Health unicorns Transcarent and Lyra Health both successfully raised $200 million and $235 million respectively in recent fundraising rounds.

- Lyra has raised $915 million to date, the vast majority of which has been raised in the past 12 months. The company must be absolutely trailblazing through cash to grow internationally and through acquisitions (Link):

- August 2020 ($110 million raised) – $1.1 billion valuation

- January 2021 ($187 million raised) – $2.3 billion valuation

- May 2021 ($200 million raised) – $4.6 billion valuation

- January 2022 ($235 million raised) – $5.9 billion valuation

- Related: Lyra also announced its acquisition of ICAS World to continue to expand globally. If it wasn’t the largest mental health player before, it likely is now. (Link)

Transcarent raised $200 million at a $1.6 billion valuation. The firm specializes in patient navigation for employers as an Accolade-type player. (Link)

Wheel raised $150M in to continue its investments in virtual-first care. (Link)

Funding: SoftBank led health tech unicorn Alto Pharmacy’s $200 million series E this week, joining other unicorns in raising hundreds of millions of dollars. (Link)

Kidneys: Joining the likes of Strive, value-based kidney care company Somatus raised $325 million in a Series E, putting the startup in unicorn territory ($2.5bil valuation). We’re just handing out that status these days, but kidney care is in sore need of competition so I’ll let it slide. (Link)

Livongo’s half-brother: Omada Health, another chronic care management firm, raised $192mil also coincidentally in a Series E. I wouldn’t be surprised if this capital were used to make a few acquisitions.

- Omada will hurdle the $1bil valuation mark with the raise and you can see why Teladoc has a limited timetable – Virta Health, also in the RPM space, raised $133mil at a $2bil valuation in early 2021. (Link)

Doctolib: Not really U.S. focused, but Doctolib raised $550 million at a $6.4 billion valuation. It’s one of the largest digital health unicorn outside of the U.S. and is basically another Doximity. (Link)

Minneapolis based Nice Healthcare raised $30 million. The firm wants to primarily use the funds to invest in expanding into new markets and other growth initiatives. (Link)

House Rx just secured $30 million in Seed + Series A financing. Founded by two former Flatiron Health executives, Ogi Kavazovic and Tesh Khullar, House Rx’s health technology platform empowers oncology and rheumatology physician practices to offer medically integrated dispensing. (Link)

- Shortly after their funding announcement, HouseRx also announced a partnership with Northwest Medical Specialties to offer medically integrated dispensing to all 7 locations in Washington state. (Link)

Embold Health raised a $23 million Series B led by Echo Ventures and joined by Morgan Health, the healthcare arm of JP Morgan Chase.

- Embold’s platform offers providers, employers and payers real-time, actionable data on provider quality tracked through practice patterns and appropriateness metrics. (Link)

Remote patient monitoring oncology platform Canopy raised $13m. RPM for oncology patients makes a WHOLE lot of sense and I’m excited for the applications here. (Link)

Osso VR raised $66 million. (Link)

Podimetrics raised $45 million. (Link)

TimeDoc raised $48 million. (Link)

Antidote Health raised $22 million. (Link)

Alife Health also raised $22 Million. (Link)

Recora raised $20 million. (Link)

SOC Telemed Goes Private for $300 Million

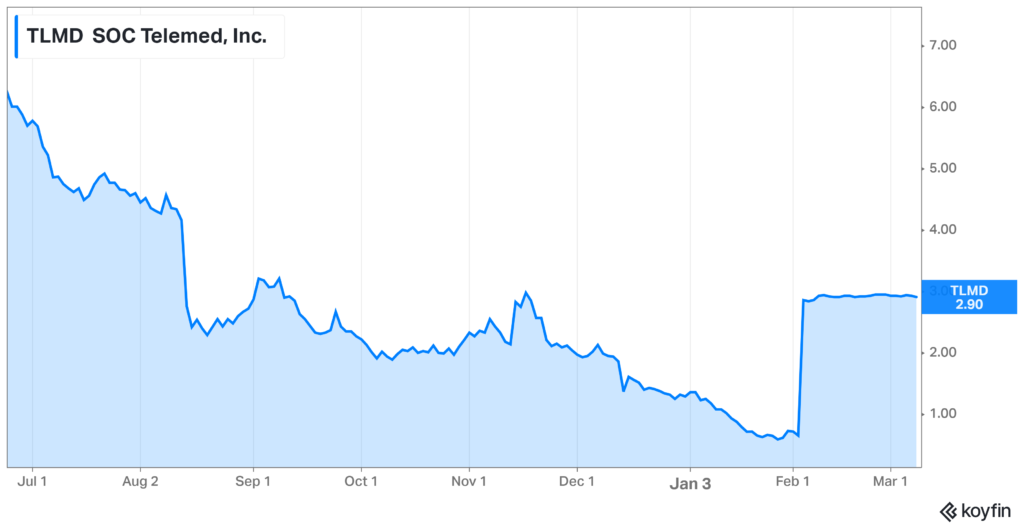

The first domino: After going public via SPAC at about a $720 valuation 15 months ago, SOC Telemed will be bought out and taken private by Patient Square Capital.

- Details: The healthcare investment firm announced its intention to purchase SOC Telemed at a 366% premium to its share price on February 3rd, or about a $300 million enterprise value at $3.00/share. For all you smart folks out there, that’s a 60% decay in value in one year.

- SOC’s stock price had tumbled from $8.33/share one year ago to $0.64/share prior to the announcement and is now trading just under the take-private price. It makes sense that the board unanimously jumped on the opportunity to go private in the market’s current state.

- The firm still has attractive assets, so it makes sense why someone wanted to buy them out. SOC Telemed bought Access Physicians, a specialty telemedicine provider, for $194 million or 2/3rds of its take private price (lol) back in April 2021.

Bigger Picture: If you’ve been following the Health Tech Index for any period of time, SOC Telemed isn’t the only publicly traded digital health company suffering in the markets. We’re going to see some more activity here in 2022 & 2023 or I’ll sell my newsletter. (Link)

Amazon Care isn’t going away.

Scaling: After reshuffling some of its executive team on the pharmacy side and naming a former head of Amazon Prime to grow its healthcare biz, Amazon announced this week that the retail giant is expanding its virtual care services nationwide. (Link)

- Details: Amazon Care will also offer a hybrid service offering (AKA, in-person and virtual) to 20 more cities this year. Basically all of the big ones. Amazon is also growing its contracted employer base by tacking on Silicon Labs and Hilton Hotels. No, I’m not counting Whole Foods in there. Amazon putting that in their press release as a badge of honor is essentially the same thing as saying that I sold my car to my wife…who happened to need a car.

Steady: Amazon is slowly scaling its health operation outside of its existing employee base and seems to be hyper focused on the consumerization of healthcare, which is the retail giant’s bread and butter. I wouldn’t be surprised to see a Pharmacy-Care-future health related offering as a tack-on to your normal Prime subscription within the next few years.

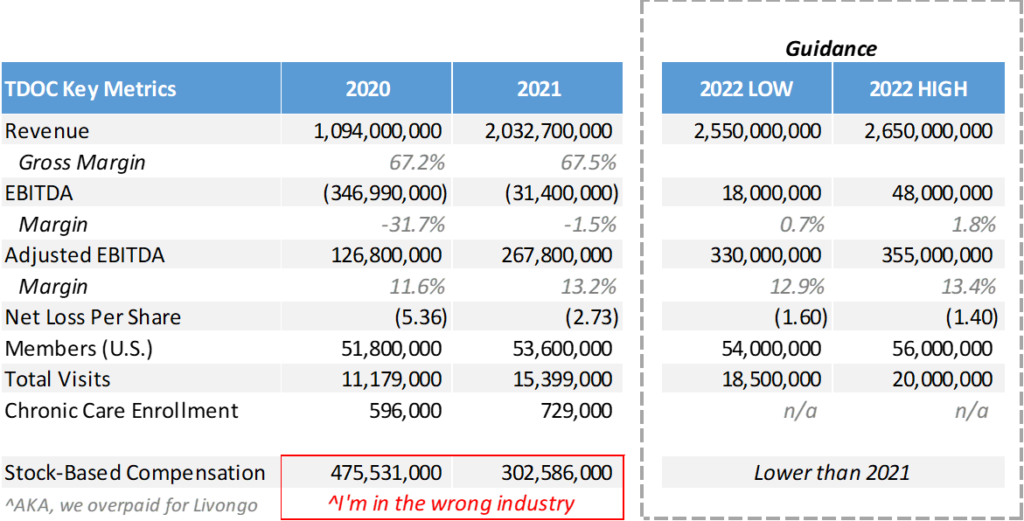

Teladoc’s Struggles continue post ’Rona

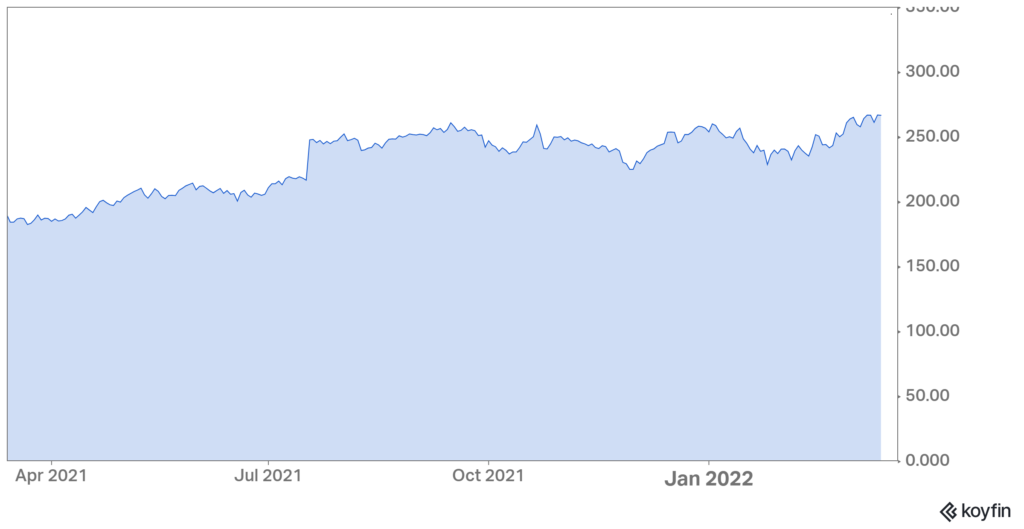

Since maxing out at almost $300 a share in early 2021, Teladoc is down bad at around $60 at last glance.

What went wrong: After its run as one of the hottest ‘Rona stock trades on the planet, Teladoc used its newfound capital to panic-buy Livongo for $18 billion. I’d consider this move more of a defensive play than anything since Livongo was courting other telehealth suitors.

- Still…if you break it, you buy it. Post-merger, Teladoc has failed to unlock Livongo’s real value during its first year at the helm. To be fair, doing so is objectively a tough ask – AKA, convincing employers and others to pay for a somewhat unproven solution. Did I mention they way overpaid?

What’s Next for Teladongo.

As one of the first true ‘whole person care’ conglomerates, Teladoc needs to take better advantage of that first-mover edge. Teladoc will 100% lose market share over the coming years if they can’t get their shit together.

Promising tailwinds I’m eyeing:

- Teladoc’s products are slowly gaining traction. There’s a clear runway toward growth in taking on more risk and cross-selling services. Really, execution and sales is the bottleneck at this point. A decent number of Teladoc’s Q4 bookings were multi-program which is a step in the right direction.

- The firm is launching new programs in Chronic Care Complete and I’m super bullish on BetterHelp (mental health, super hot space) and Primary360 (whole person care) as those programs expand.

- New programs and solutions are super easy to pilot given Teladoc’s scale and existing membership platform.

- Customer acquisition costs are shrinking.

- Valuation-wise, Teladoc sits in an interesting spot. On one hand, I’m seeing digital health unicorns like Ro ($7 billion), Cerebral ($5 billion), Lyra ($5.6 billion), and Hinge ($6.2 billion) that are likely burning through cash yet valued crazy high. Teladoc is sitting at around an $11 billion enterprise value with vast scale compared to some of its private counterparts. Where’s the disconnect? Plus, competition with firms like Amazon are likely overblown.

Concerns with Teladoc:

- They lost almost the entire executive suite from Livongo post-merger. Bad signal.

- If permanent telehealth legislation doesn’t pass prior to the end of the public health emergency, virtual care as a whole will take a step back. Also, Medicaid will lose a ton of members which is something that Jared covered recently.

- Competition is brimming beneath the surface as other virtual care operators slowly consolidate.

- I’m speculating that morale is super low after recent stock price action.

Resources:

- TDOC Q4 earnings release. (Link)

- TDOC Q4 call transcript. (Link)

- TDOC launches its chronic care program. (Link)

Bright Health’s no good, very bad quarter

$BHG: Bright dropped 30% after posting extremely disappointing Q4 and full year 2021 earnings. Based on what I read in the transcript, Bright experienced a mass influx of members but wasn’t able to process member claims with the appropriate coding and risk adjustments, leading to an absolutely catastrophic loss in the quarter.

- What’s even worse in investor minds – and maybe almost borderline fraudulent – was the fact that this apprently occurred BETWEEN Bright’s investor presentation on January 10th and today. Bright management was sober during the call but noted that most of the claims processing issues should now be rectified.

agilon announces a major partnership with MaineHealth

Agilon is partnering with MaineHealth, an integrated nonprofit health system with at least 9 hospitals and plenty of other outpatient care settings, to transition MaineHealth’s primary care delivery system to agilon’s platform.

- We’ve seen a handful of partnerships form between these tech-enabled care platforms and health systems. Privia Health and Surgery Partners partnered in the Montana marketplace earlier this year.

- These care platforms are now reaching a pretty solid scale. Agilon expects to reach 80k additional MA lives with the partnership and will now expand to 12 states, 25 markets, 23 physician groups, and 2200 primary care physicians. (Link)

More: Agilon just held its investor day too, chock full of interesting information about the business model. Give it a glance here. (Link)

Activist Investors push Cano Health to consider a public-to-private sale

- P2P: After SPAC’ing back in June 2021 and poor public performance since (down 60%), activist investor group Third Point bought a pretty decent-sized stake in Cano Health and is pushing the firm to consider a sale. (Link)

The week the activist news dropped, Cano finished up 26% on the week alongside CareMax, which finished up 30%. The obvious takeaway here is that private investors think there’s serious value to unlock in these businesses.

Despite the poor stock performance, these facility-based operators are executing on their fundamental operations JUST fine. In fact, Cano released its earnings today, providing strong 2022 guidance for the business despite some accounting irregularities related to Medicare Risk adjustments. (Link)

- I’m positive that there’s serious private equity and insurance company interest in assets like CareMax and Cano Health.

- Healthcare companies are kind of notorious for public-to-private transactions. Why is that? Are public investors too antsy / impatient to see the long-term fundamentals in healthcare companies? Do they get disappointed in how hard it is to scale operations in healthcare? Is it just easier to be a private company?

Anthem Rebrands to Elevance Health

Since we all love managed care organization rebrands, I figured “why not?” and dropped this here. Anthem is rebranding to Elevance Health to symbolize the fact that it’s …hair flip… not just another health insurer – Anthem is now a vertically aligned behemoth with investments and segments in provider orgs and other initiatives outside of the traditional insurer footprint.

Just like every company is now a software / tech company, every healthcare company is becoming a payor these days.

Fresenius, InterWell, and Cricket merge into a $2.4 billion Kidney Care value-based giant

Big news dropped on March 21 related to a new value-based care kidney merger. Fresenius Health Partners (a value-based subsidiary of the larger Fresenius), InterWell Health (a nephrology network), and privately held startup Cricket Health are merging to form a $2.4 billion VBC kidney care company. (Link)

Here’s what’s happening: The newly merged company will operate under the InterWell brand (too bad, I liked Cricket) and manage 100k covered lives currently. The combined entity has a $170 billion TAM and $6 billion in costs under management.

- To go along with the above scaled operation, InterWell 2.0 will benefit from great financial support & access to capital from the larger Fresenius org as well as several financial & healthcare investors including Cigna Ventures and Blue Cross.

Bigger picture: This is a pretty dang big deal for the VBC push in the end-stage renal disease world. Even though the $2.4 billion merger is a drop in the bucket in the context of the larger ESRD market, it’s a sign of things to come as CMS is experimenting around with alternative payment models in the space, & Fresenius is the largest participant in the new APM for kidney care.

- I have to wonder what DaVita execs are thinking right now. I mean, these are such small dollars at present but the merger really has the potential to succeed at a high level.

Resources:

- H/T to Fierce Healthcare who nabbed the exclusive interview related to the merger. (Link)

- Conspicuously published on the same day was an interview with DaVita’s CEO, Javier Rodriguez. (Link)

- THCB interviewed Cricket Health’s CEO, Bobby Sepucha. (Link)

- More insights on the merger from a well-crafted article out of MedCity News. (Link)

Komodo Preps Summer IPO

Komodo Health is prepping a summer IPO. Komodo is a data analytics firm that houses a number of actionable data points for big pharma and other research based organizations to leverage. Should be a software platform valued akin to Definitive or Doximity. (Link)

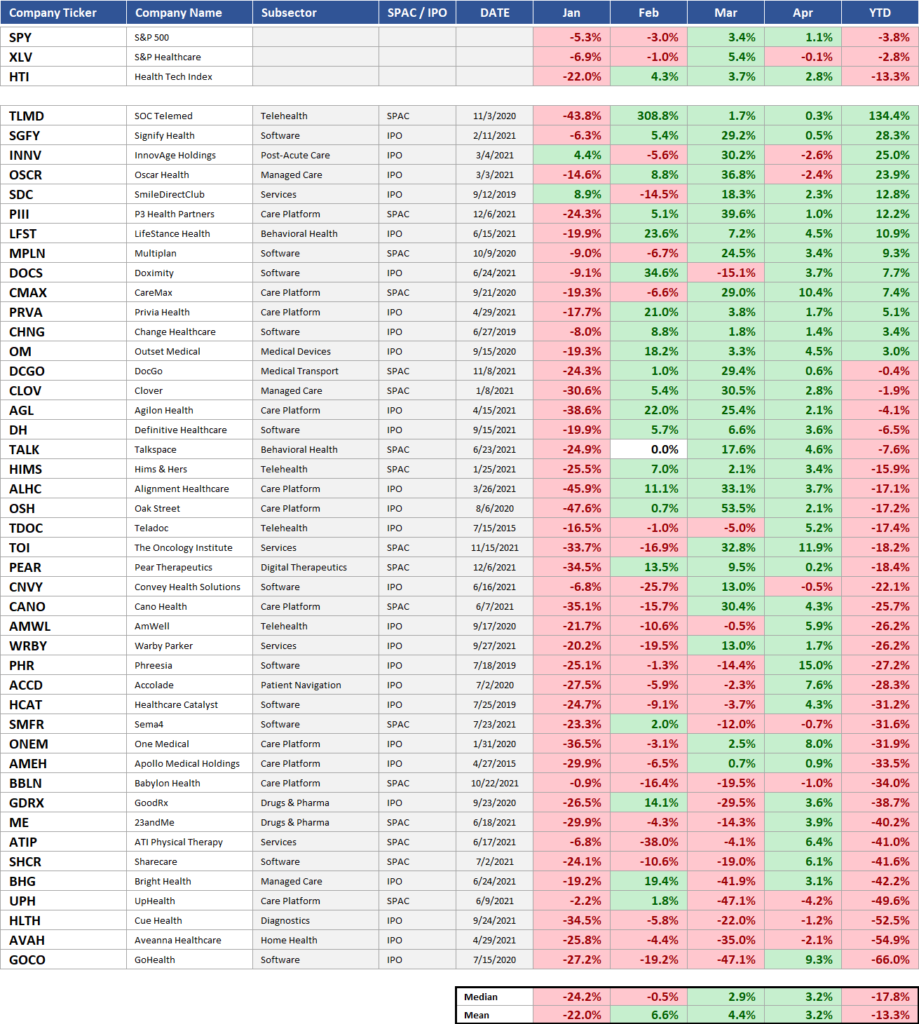

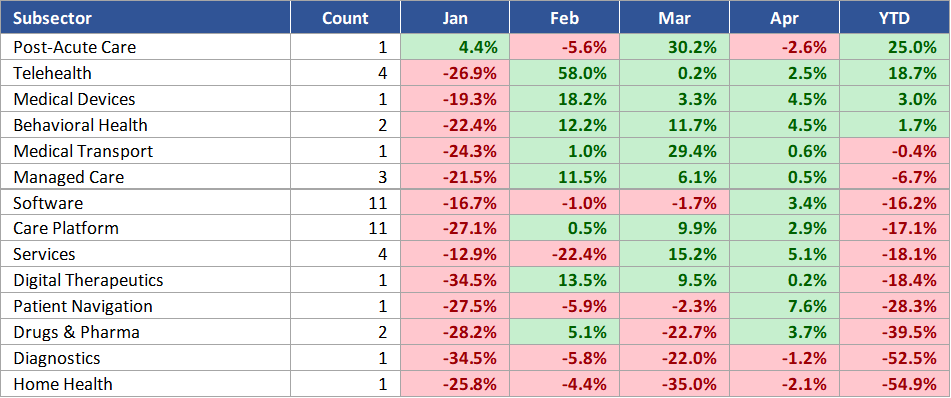

Health Tech Index Update

Health tech SPACs and IPOs continued their dry spell after inflation headwinds and turmoil in Ukraine during the first quarter of 2022.

Given the broader market sell-off in Q1, the S&P 500 finished down about 4.6% while the Healthy Muse Health Tech Index finished down 14%.

Top YTD performers included SOC Telemed (bought out at a 300% premium, returning 133% thru Q1), Signify Health (up 30% after buying ACO provider Caravan and performing well YTD), and Oscar (really just rebounding from a very dismal 2021)

Worst YTD performers included Aveanna Healthcare (down 53.8% after a poor Q4 earnings showing, labor struggles, and growth decay), Cue Health (down 54.7% after free Covid testing reimbursement from the government ended), and GoHealth (down 67.3% after horrible earnings and general selloff)

If you want to follow the Health Tech Index in real time, you can find the free resource here: (Link). It also includes links to all investor relations websites for companies included. Nifty, eh?

Digital Health Consolidation is just getting started.

Tremors in the Water: As we’re now well underway into 2022, deal-making is just getting started. Several digital health and other mergers have been announced in recent weeks, all between players making strategic acquisitions. Firms are now realizing that offering one specialized endpoint solution isn’t enough anymore:

Specialized telehealth firm Thirty Madison and remote prescription drug firm Nurx are merging into one platform caring for about 750k ‘active’ patients and $300 million in revenue.

- There doesn’t seem to be much overlap between the two as far as patients are concerned, so I imagine the combined co now has a much larger patient base to cross-sell, larger scale to negotiate with payors, and a more attractive offering to sell to employers. (Link)

Doximity bought Amion for $82.5 billion, continuing to offer lots of useful products for physicians to bolster its ridiculously profitable advertising biz

Signify Health bought Caravan Health for $250 million (including payout incentives) to help it create an “end-to-end suite of value-based care” tools (notice a theme here?). Caravan will give SGFY access to 200 health systems and 3k providers. (Link)

Bottom Line: Digital health is no longer immune to the wave – or, rather, tsunami – of consolidation happening widespread in healthcare. This trend is just getting started as frothy private valuations fall apart, rates rise, and savvy competitors snap up the strategic pieces to create attractive offerings. (Link)

Something you’ll probably read at least 20 times over the next few years: “This acquisition is just the beginning of our evolution toward a holistic, end-to-end care model…”

Under the Radar M&A deals & partnerships

M&A: IBM finally sold Watson Health to a private equity firm for about a billion. (Link)

Partnerships: Humana is expanding its partnership with PE firm Welsh-Carson over its primary care senior clinics into 12 more states. I feel as if this partnership, announced in 2020, is somewhat in the radar, but it’s gaining serious traction. (Link)

Hospital M&A: NorthShore and Edward-Elmhurst completed their merger to create Illinois’ 3rd largest health system at 9 hospitals. (Link)

It’s Over: Providence is ending its affiliation with Hoag at the end of January. (Link)

M&A: Revenue cycle operator R1 RCM is acquiring Cloudmed, a fellow revenue cycle management platform, for $4.1 billion, or about 2.5 Transcarent’s. Chump change. (Link)

M&A: Convey Health Solutions is acquiring HealthSmart International, a home health supplemental benefits company, for $77.5 million. (Link)

M&A: Circulo, a startup focused on the Medicaid population, acquired Huddle for an undisclosed sum. (Link)

Partnerships: Here’s an interesting little announcement – HCA Healthcare is partnering with Diana Health – a maternal health startup – to open a location inside of one of HCA’s facilities. Women’s health space is heating up. (Link)

$AMEH: ApolloMed, a value-based care company you really should be paying a lot closer attention to (I mean check out this spiffy investor deck), acquired Orma Health, a value-based care tech company focused on risk stratificatio and identifying patients for clinical programs. As a part of the transaction, two top execs from Orma Health will transition over to AMEH’s leadership team. (Link)

Partnerships: Big partnership news in Texas – GI Alliance and USPI are forming a partnership to expand their joint gastroenterology presence in Texas. Like I mentioned before, Texas is a hotbed for population growth and all these millennials have plenty of digestive issues (lol). (Link)

Digital Health M&A: This acquisition had the whole #healthtwitter world rockin’ Vera Whole Health is acquiring healthcare navigation company Castlight Health in a $370M deal. (Link)

SPAC: Interesting little tidbit here…Healthcare Merger II, a SPAC, withdrew its plans to go public. The folks behind this SPAC also took SOC Telemed public…so I wonder if there’s a connection there or if nothing is attractive enough valuation wise to take public. (Link)

Hospice: Another interesting tidbit from this week – Humana is looking to offload Kindred’s hospice segment and fetching a multiple reportedly up to 12x EBITDA, implying around $3 billion purchase price. (Link)

Physician staffing firm US Acute Care Solutions acquired Alteon Health – forming a huge practice of post-acute care providers (9 million patients, 500 programs, 25 states). My bet is on at least a handful of PE backed physician practice platform co’s going public in 2022/2023 and my guarantee is that the multiple here was in the double digits. (Link)

Spectrum Health and Beaumont Health completed their 22-hospital merger on February 1st. The new system will be temporarily named BSHS Health until they spend an ungodly amount of marketing dollars on a spunky new name likely ending up with a circular logo and a sans serif font. (Link)

Dialyze Direct bought Compass Home Dialysis to add 9 SNFs to its portfolio. Did you know that Dialyze is the ‘leading SNF dialysis provider’ in the US with 130 SNFs in its portfolio? I truly had no idea. (Link)

Rhode Island health systems Lifespan Health and Care New England just straight up cancelled their previously announced merger plans after they caught wind of a potential FTC intervention amid local provider concerns. It’s like they got caught with their hands in the cookie jar, backed up and said “haha, my b.” (Link)

$AMED: Amedisys acquired a couple of home health biz’s in the mid-Atlantic region, including AssistedCare Home Health and RH Homecare Services.

Ro acquired male fertility company Dadi (c’mon guys) for about $100 million. Ro’s DTC fertility strategy is shaping up nicely. Couple this acquisition with its Modern Fertility acquisition back in May 2021 for a rumored $225 million, and you have a pretty significant footprint in the fertility space. (Link)

$HCAT: Health Catalyst announced a partnership with Tallahassee Memorial HealthCare to scale its data analytics platform across TMHC’s entire system. (Link)

Virtual Care: MVP Health Care, a Medicaid plan in NYC, created a sweet partnership with virtual care platform Galileo. The model will provide MVP’s Medicaid members with a bilingual offering for specialty and primary care. (Link)

- Why this matters: According to MVP, a wild 40% of its Medicaid members “have not seen a primary care provider in the past 18 months due to various barriers, including transportation and language barriers.” Virtual care – especially a Spanish/English one – does a much better job of meeting these folks where they’re at and can provide whole-person care across a variety of services (AKA, hospitals, specialists, lab tests, imaging, etc.)

Bigger trend: More people than EVER are on Medicaid, and there’s a real opportunity to reach these people groups through bilingual apps and virtual care options. New virtual care capabilities will reduce care costs and expand access for these types of members. From the outside, it looks like the partnership is working – MVP is expanding the program to all of its Medicaid members including those in Vermont. (Link)

Policy Headlines I’m Watching.

Medicaid: Georgia sued the Biden Administration this week, saying CMS pulled a bait and switch on them after previously approving their proposal for Medicaid work requirements (under Trump) and then revoking that proposal (under Biden). (Link)

CMS: After a long, drawn out saga, Medicare has decided to limit the coverage of Biogen’s controversial Alzheimer’s treatment Aduhelm to JUST clinical trial patients (AKA, only if patients are enrolled in ongoing trials). As a result of the significant coverage decrease, lawmakers are now pressing CMS to reduce Part B premiums. (Link)

Fact Sheet: CMS released its 2023 proposed MA fact sheet this week. Based on a risk score trend increase of 3.5% and general reimbursement increase of 4.75%, among other items, the total adjustment for 2023 is expected to be around 8% (inflation am I right). (Link)

Telehealth Waivers: Lots of different organizations are requesting for Congress to extend the current telehealth waivers through 2024. Current telehealth waivers only exist as part of the public health emergency

- Senators this quarter introduced a bipartisan bill to expand telehealth access thru 2024, and also introduced a separate bill to allow those with high deductible health plans to permanently have access to telehealth. (Link)

Mental Health: In the first hearing in more than a decade on mental health, Congress is tackling behavioral health inequities and other mental health related topics. Makes you wonder if mental health funding will be part of a future stimulus package. (Link)

- Related: A somewhat unfortunate side effect of the No Surprises Act – mental health providers are asking to be exempt from the bill, since the price transparency provision surrounding Good Faith Estimates disproportionately affects mental health providers over most other providers. (Link)

ACA: A Record 14.5 million people signed up for ObamaCare. (Link)

Settlement: JnJ and other distributors finalized a $26 billion opioid settlement. (Link)

Surprise Billing: In a win for providers related to surprise billing, a judge threw out part of the No Surprises Act related to arbitration, saying that it favored insurers. That’s because it does – the arbiter was directed to resolve disputes by referencing the median in-network rate for that service in that region. Which side do you think has thousands of data points of claims data to set those rates?

- This whole thing is so very messy, but I’m not surprised this provision was struck down. (Link)

SOTU: Here’s a thread of mine which broke down Biden’s State of the Union (Link)

Sutter: Sutter Health BEAT its antitrust lawsuit this week, alleging that the health system engaged in monopolistic practices in its markets. I’m sure Sutter is extremely relieved with the result given its recent history. (Link)

- Last August, Sutter settled a monopoly lawsuit for over $500mil

- A year before that, Sutter settled a False Claims lawsuit for $90mil

HaH: Hospital at home operators are hoping for a waiver extension for the program once the public health emergency ends. From a larger perspective, I’ll be very keen to see what Congress decides to keep or change related to all of the deregulation stemming from the public health emergency – AKA, what’s next for telehealth? Mental health and prescriptions? LTACH/IRF admittance guidelines? And more. (Link)

HHS Extends ‘Rona Health Emergency & SCOTUS Halts Vaccine Mandates

Emergency: HHS extended the Covid-19 health emergency for another 90 days. The emergency was about to expire on January 16 so this news was pretty expected. In fact, I was frantically Googling ‘public health emergency extended’ since I hadn’t seen anything come through yet.

- What this means: All of the loosened healthcare regulations and flexibilities around telehealth, waivers, Medicaid enrollment freezes, and stipulations in the CARES act, will remain in place for another 90 days. Set to expire April 15 as of this writing. (Link)

Mandate: The Supreme Court struck down OSHA’s vaccine mandate on 100+ employee-count employers nationwide earlier in January, ruling that OSHA, under the executive branch, doesn’t have that scope of authority.

- They argued that such a national public health measure should be implemented via an act of Congress

- Here’s a good summary of the mandate positioning (Link) and here’s a link to the full opinion. (Link)

Direct Contracting Controversy and CMS Revamps DCE to ACO REACH

Disarray: All of a sudden, Medicare’s Direct Contracting (”DC”) program, a new risk-based capitation model for primary care unveiled by the Center for Medicare and Medicaid Innovation (CMMI) in 2020, is under attack by a progressive consortium of policymakers.

- What’s DC? At a high level, the program allows primary care providers operating in Direct Contracting Entities (’DCEs’) to take on risk voluntarily – through monthly lump sum payments – for their Medicare fee-for-service patients. So, CMS and the DCE get to streamline administrative $$$, the DCE pockets a bit more cash if risk is successfully managed, and the patient stays on traditional Medicare as opposed to MA. The program is only open to about 50 of these direct contracting entities so far while kinks are ironed out and public commentary is received.

- TL;DR: CMS contracts with PCP providers. Seniors on traditional Medicare keep traditional Medicare insurance while the primary care provider entity (the DCE) gets paid per member per month for that beneficiary behind the scenes. Goal of the program = reduce costs, increase quality of care, move toward value-based arrangements.

The Attack: The cohort of progressives, including Elizabeth Warren, sent a letter to HHS accusing the payment model of catering to ‘corporate profiteers.’ They assert that the DC model will only serve to further privatize Medicare, which might result in reduced choice for traditional Medicare beneficiaries.

- There’s some other nuanced concerns in there too, like taking advantage of risk score adjustments (fair) and that the entities are able to pocket more $$$ if care is managed effectively. Here’s a good write-up of the specific grievances from Fierce: (Link)

The Defense: Of course, the letter attracted a frenzied response. Over 200 healthcare entities ranging from Intermountain, agilon, Babylon, a multitude of ACOs, and more, signed a letter urging HHS to ‘Plz fix, thx’ the program instead of ending the program altogether, arguing that ending any sort of pioneering program like this would severely affect the value-based movement as a whole. (Read the Letter Here)

Hot Take: I find the take by progressives pretty perplexing considering DCE is one of the largest tailwinds powering value-based care in the U.S. – a model that has at least shown promise in predictable cost control for a nearly bankrupt Medicare trust fund.

- Progressives of all people should want to test out new things in healthcare, even if there are kinks in the model currently.

Still, this rhetoric is not going to go away – I’m seeing headlines all over the place, like ‘Medicare privatization experiment puts Ohio seniors at the mercy of for-profit entities.’ As if damn, they forgot the entirety of healthcare is already for-profit. Let’s do some research here folks and at least attempt to align profits with quality incentives.

- This is a pioneering program in Medicare and one that needs to continue forward in some form. The progress of value-based care and related payment models depends heavily on CMMI and Medicare. There’s too much momentum (and funding) in the space to back out now.

- Keep an eye on the tweaks and mutations of the direct contracting model, because it heavily affects the prospects of companies like Privia, Oak Street, One Medical, and health systems who manage large Medicare populations or are in the value-based care space.

Handy resources & perspectives:

- Olivia Webb wrote a solid overview of the direct contracting program here. She does the best job possible explaining all of the relevant nuances. (Link)

- Here’s a viewpoint in opposition to direct contracting. (Link)

- What do you think? If you have a perspective, I’d love to hear it.

CMS Revamps Direct Contracting to ACO REACH

As if on cue, on Friday, CMS dropped a next-gen program slated to replace the current Direct Contracting starting in 2023.

- Details: CMS is replacing all direct contracting programs (Global/Professional/Geo) with a re-skinned model called ACO REACH. The new program is essentially DC with some extra bells & whistles.

ACO REACH aims to continue to move traditional Medicare toward risk-based and capitation payment models through…

- Allowing mainly provider-controlled groups into the program. 75% of applicant boards have to be provider-controlled. Non-provider groups have to demonstrate a certain level of direct patient care to be included in REACH.

- Addressing health equity (SDOH) – Every entity has to identify & determine ways to address health disparities in specific markets & geographies – dope

- Preventing the abuse of risk score adjustments. CMS is capping adjustments based on population trends & traditional Medicare risk score trends among other more specific items.

- Maintaining a similar PMPM payment structure to DC by keeping the professional and global payment tracks, but ditching the controversial geographical track.

- Alleviating Progressive concerns about ‘corporate profiteering’ and ‘getting rid of Medicare’ – Beneficiaries will keep all provider choice freedom that traditional Medicare provides. This is in contrast to Medicare Advantage programs that typically create narrower networks.

- Providing greater transparency into the program. AKA, more reporting on how entities are doing, how health equity is being addressed regionally, etc.

ACO REACH will start accepting new applicants in Jan. 2023. It’ll run thru 2026 and by that point I’m sure we’ll have some new acronym and the next iteration of VBC payments.

- Companies expected to leverage the new ACO REACH model include all of the normal VBC names – ApolloMed, Privia, agilon, Alignment, Clover, and plenty of others. I’ll personally be reading management commentary at investor days to see what the general sentiment is for each company specifically.

Resources:

- Link to CMS announcement. (Link)

- A link to the actual RFP if you’re interested in checking that out. (Link)

- A recent Aledade podcast discussing ACOs, payment models, and the future of Medicare. (Link)

Takeaways from a 604 page MedPAC report.

Everyone’s favorite payment advisory committee MedPAC dropped its 600 page report related to all of the healthcare services verticals and fee-for-service reimbursement recommendations given the current dynamics in each of those industries. If you have the time and are interested in how policymakers shape reimbursement decisions for Medicare, give the executive summary a read (about 30 pages).

My general takeaway: it seems as if MedPAC is treating the public health emergency as a one-time thing and approached the report from a business-as-usual perspective (and/or they said “we have no effing clue so we’ll just report based on previous methodologies).

- That’s fine, but do we have any finance people in there? They’re using 2020 data for payment policy decisions while every headline in America is screaming about inflation, labor shortages, and supply chain issues. I get that the committee is limited by lagging data but man…some of these recommendations are way out of touch.

I am physically ill at the fact that they recommended reimbursement cuts of 5% for some verticals while inflation sat at 8% in 2021. Physically ill.

- I mean, even if Medicare’s wage adjustment index accounts for some of the inflation, there’s still inflation in other expenses…AKA, supplies? G&A? And you can bet your bottom dollar that consultants and lawyers aren’t planning on making any less either.

- If MedPAC had its way, providers would get destroyed financially next year.

Anyway, here are 2 sentences on each vertical based on what I thought was relevant from the MedPAC report:

- Acute Care Hospitals

- Costs per hospital stay grew at almost 4% higher than revenues / payments for those stays indicating what we all already knew: hospital margins on Medicare patients are negative and according to MedPAC, hover around -10%.

- MedPAC Rec: Maintain the current updates – IPPS basket increase of 2.5% and OPPS basket increase of 2.0%

- LTACHs: MedPAC Rec: Increase the base rate by 2.0%

- Inpatient Rehabilitation Facilities

- The supply of IRFs increased for the first time in a while from 2019 to 2020 which probably is indicative of the demographic tailwinds in the industry and Florida CON repeal. Freestanding IRFs continue to grow at a steady (3-4%) clip while hospital units are shrinking. During 2020, IRFs experienced higher than normal lengths of stay, higher labor costs, and higher supply costs / usage.

- MedPAC Rec: Cut base payments by 5%. Rationale: MedPAC estimates that IRF Medicare margins in 2022 will be around 14%, a healthy margin in their eyes.

- Physician Practices

- MedPAC added a big section for telehealth in this year’s physician services chapter. Total telehealth FFS spending amounted to $4.2 billion, or 5% of FFS spending, up from just $59 million the year prior. Telehealth as a % of total primary care visits sits at just under 20% today.

- MedPAC Rec: Maintain status quo basket rate increase based on current laws (so like, 2%). MedPAC also believes that volumes will rebound to prepandemic levels, or greater, by 2023.

- Home Health

- While the report noted the difficulties associated with 2020 data given the level of visits via telehealth, MedPAC did note that PDGM changes did NOT result in significant changes to referral patterns.

- MedPAC Rec: Cut base payments for home health by 5%. Rationale: they think the home is a good setting for care, but Medicare payments are a bit too high right now as compared to institutionalized care settings. Medicare margin at ~20%)

- Hospice

- MedPAC Rec: Freeze 2023 rates at the current 2022 level, and wage adjust the aggregate cap (AKA, the total amount of Medicare payments a hospice provider can receive in a year). Then reduce that aggregate cap by 20% since around 20% of hospice providers exceeded the cap in 2019.

- Dialysis

- Dialysis patients are SUPER sensitive to COVID-19. Tragically, volumes for ESRD treatments dropped 3% as a result of excess deaths in this beneficiary segment. MedPAC wants to continue incentivizing alternative payment models for chronic kidney diseases. Interestingly, the pandemic almost forced home dialysis service adoption due to increased patient interest and general need for in-home services during the pandemmy.

- MedPAC Rec: Maintain status quo basket increase of 1.2%

- ASCs

- Lots of discussion in this section concerning freestanding ASCs vs HOPDs (hospital surgery departments) and how freestanding ASCs typically benefit physicians more, are run more efficiently, and incentivize lower Medicare spend. Here’s an interesting little tidbit though: MedPAC isn’t sure whether the lower cost setting of ASCs is offset by a higher volume of outpatient surgeries (AKA, more supply = more demand). MedPAC also wants ASCs to start collecting cost reporting and quality data to this end.

- MedPAC Rec: Congress should eliminate the 2022 Medicare conversion factor update for ASCs – essentially meaning no basket increase

- Skilled Nursing Facilities

- Median occupancy for SNFs dropped from 85% prior to the pandemic to 74% as of September 2021, an intense decline in census volumes. Despite the decline in volumes, MedPAC noted that Medicare margins for SNFs are strong at an average of 25% and that most SNF woes were related to volume drop-offs during COVID.

- MedPAC Rec: Cut base payments for SNFs by 5%. Yes, 5%!! Rationale: SNF performance improved due to the new PDGM payment policies and federal relief bailouts. Volume dropoff is not indicative of future financial earnings potential from Medicare.

Resources:

- For all of you fellow nuts out there, here’s the full MedPAC report. (Link)

- Here’s another article with a helpful summary of the report. (Link)

My Favorite Healthcare Reads.

PE: This was a good overview from Keckley on where private equity is at headed into 2022. (Link)

Telehealth: This was a great overview of the current dynamics facing the telehealth industry. Has the bubble actually popped? What do you think? (Link)

Dialysis: This was a great deep dive by ProPublica into how the pandemic ravaged dialysis and end-stage renal disease patients, an extremely vulnerable population, and that nobody really noticed how big of an impact it made on this patient population. (Link)

Noom: This article from Inc was a fantastic deep dive into Noom, a weight-loss company with real weight and lots of momentum behind it (Ha!) Read it here. (Link)

Packy’s Not Boring took a deep dive into Oscar, albeit from more of a techy perspective. Keep in mind this is a sponsored post, so the bull case is presented pretty nicely – but no real challenges or bear case was presented. Still a good overview of what Oscar does. (Link)

Health Systems: This dive into health system incentives showed that fee-for-service, at least for the foreseeable future, is here to stay. (Link)

Headspace: This was an interesting watch from THCB about Headspace’s merger with Ginger and its go to market strategy, and where it positions against the Lyra’s of the world. (Link)

Shortages: You should be aware by now of the staffing shortages going on nationwide, but especially in healthcare. Here’s a good read from NPR on how it’s affecting nursing homes. (Link)

LifePoint and Scion: This was an insightful read into the integration between LifePoint Health and Scion Health. It sounds like all systems are a go at the combined organizations. (Link)

MA: This article from Axios highlighting the Medicare Advantage space, and all of the players, was a good brief read on the current landscape. (Link)

Substacks: I tweeted about these reads earlier this week, but I really enjoyed the following from Olivia Webb and Jan-Felix Schneider:

- A timeline of web1, web2, and web3 in healthcare (Link)

- Risk adjustment – the new revenue cycle management? (Link)

Shkreli: The annual Shkreli Awards are here (#FreeShkreli) with a list of some bad actors in healthcare from 2021. (Link)

MA: Medicare Advantage, Call Centers, Startups, and the rapidly evolving space. (Link)

Watson: A great read from Slate – How IBM’s Watson went from the future of healthcare to sold off for parts. (Link)

Shortages: This from the Atlantic (soft paywall) was a solid historical overview of the physician shortage. (Link)

Hybrid: Timely as ever, Olivia Webb walked through hybrid care models and the future of primary care. (Link)

Generics: The FDA released its annual report on generic drug approvals, noting the most significant generic drugs that hit the markets in 2021. Did you know that 90% of drugs in America are generic? (Link)

Platforms: This was a good read on Amazon’s ability to deploy platforms in healthcare. I personally believe they’re the best positioned to do so as far as Big Tech is concerned. (Link)

MA: The Commonwealth Fund wrote a great overview of Medicare Advantage, including how the risk adjustment program works for payers. Highly recommend glancing at this just to understand the inner workings of MA. (Link)

VBC: Health Affairs wrote a great 2-part series on a single-payer system that already exists in the U.S. – Maryland – and takeaways we can mirror in value-based care payment models. Very timely!(Link)

- Along with the above, I enjoyed this piece from TCHB about value-based care and lessons from the pandemic. (Link)

- Final piece on value-based stuff this week – the Keckley report also dove into what to expect for value-based care in 2022 and gives some insightful context for previous value-based initiatives in healthcare. (Link)

Oncology: Olivia Webb wrote on value-based oncology arrangements and how we define value in cancer. (Link)

Single-Payer: The New Yorker dove into the history of the AMA’s dispute related to single-payer healthcare. (Link)

Placebos: Nikhil Krishnan brought out another banger, this time writing about the power of placebos in healthcare. (Link)

Therapy: With my wife being a speech pathologist, she pointed out that the CDC published HIGHLY controversial new guidelines related to child development & autism milestones without consulting any therapists prior to releasing those guidelines. Seems like an…interesting decision? (Link)

This was a great report from SVB on healthcare investments and exits in 2021. (Link)

Nikhil had a great sponsored breakdown of Flume Health and how it’s enabling providers to take on risk. (Link)

Related, Jan-Felix dove into the value-based care tech stack and the players associated with the various steps in the VBC claims process. (Link)

This was a great overview of physician services M&A from Provident across all specialties – an extremely comprehensive report. (Link)

I really enjoyed this read highlighting Epic’s CEO Judith Faulkner at ViVe: (Link)

Bain released its global healthcare private equity and M&A report, chock full of all sorts of interesting info on the state of the private markets. Really really insightful stuff despite it being super consultant-speak. (Link)

Another JAMA study found that value-based arrangements consisting of 2-sided risk models (AKA, downside risk) were associated with lower hospitalizations among beneficiaries. So…does that mean that all risk-bearing relationships should include downside risk? Seems so, but the upside reward needs to be worth it. (Link)

PCP: The Commonwealth Fund published some data related to primary care investments and access and how the U.S. compares to other countries. I’m personally bullish and excited for the primary care space as it sees increased invvestments. (Link)

Prison: Here’s a great dive into the prison healthcare landscape and the sadly dramatic disparities that exist. (Link)

Supplies: Gist Healthcare had a great dive into how health systems and providers have dealt with, and continue to deal with, supply chain issues including strategies to circumvent challenges. (Link)

Regs: Brendan Keeler shared a recording of his related to breaking down need-to-know healthcare regulations. (Link)

Fintech x Healthtech: Probably my favorite read of the week, Jacob Effron dove into the stark parallels between Fintech funding from years ago compared to health tech funding today. Turns out, there’s some pretty similar stuff going on which is extremely exciting to think about the future of the industry. Tons of momentum in healthcare lately! (Link)

HCA: This was a great read from Katie Jennings on HCA’s Covid strategy and highlighted the machine that it is. There’s a reason why HCA generates $60 billion a year in revenue. (Link)

Personalities: This was a great profile from Stat on Will Flanary, the mastermind behind Dr. Glaucomflecken. He’s actually incredibly funny, but to see the human unveiled behind the character was really cool. 2.5 million subs across Youtube, Tik Tok, and Twitter!! (Link)

Hospitals: Here’s a great read from THCB on hospital consolidation and how we can maximize social benefit given the current landscape of health systems and providers. (Link)