healthy muse healthcare news.

- This week in healthcare: New IPOs from Ensemble and BrightSpring Health, Rise of the virtual health plan with offerings from UnitedHealthcare, Aetna, Teladoc, and Cigna, Ro’s dramatic week, LifePoint and Kindred spin off ScionHealth, Biden backs down on drug pricing negotiation and supplemental benefits for Medicare, & more

Ensemble Health Partners and BrightSpring Health Services file for IPO

Ensemble: As if the space isn’t already red-hot, revenue cycle management firm Ensemble Health Partners filed for IPO. The firm currently ‘manages’ $21 billion in revenue for its health system and other provider clients. According to its S-1 (linked below), Ensemble claims the total addressable market for RCM services is $50 billion, or about 5% of net patient revenue in the U.S.

- By the numbers: Ensemble generated $600 million in revenue and adjusted (sigh) EBITDA of $210.3 million. So far in 2021, Ensemble is on pace to make over $800 million in rev and $276 million in EBITDA.

- Useful Links: Press Release (Link); S-1 Prospectus (Link)

BrightSpring: Home Health and community service provider BrightSpring Health Services also filed its IPO paperwork in late October. BrightSpring claims in ITS S-1 that there is a $1.5 trillion market opportunity across its service lines as the home health market continues to grow.

- By the numbers: BrightSpring generated $5.6 billion in revenue and made $412 million in adjusted (sigh) EBITDA in 2020 through 37,000 caregivers and clinicians (side note, that margin seems razor thin, but it was 2020 after all).

- BrightSpring’s platform includes home health, long-term and rehab care, and a pharmacy segment that I imagine isn’t too different from CVS’ long-term pharmacy operation Omnicare that it divested back in 2019. The firm operates in all 50 states and maintains a census of over 30,000 in its facilities.

- Useful Links: Article write-up on BrightSpring (Link); S-1 Prospectus (Link)

Rise of the Virtual Health Plan.

Virtual: Here’s a trend a long time in the making – major insurers, through built, bought, or partnered telehealth infrastructures, are launching virtual-first health plans slated to begin January 1, 2022

- UnitedHealthcare plans to launch its virtual-first primary care product using the strength of its already-existing Optum physician network. It’s a natural, organic progression for the health behemoth. (Link)

- Similarly, Cigna, on the heels of its acquisition of telehealth provider MDLive, will pursue a similar virtual first primary care strategy. In addition to rolling out the plan to some select employer sponsored plans, Cigna also aims to provide all of its plans with a broader telehealth offering. (Link)

- Finally, Aetna is partnering with Teladoc to make its primary care plan available nationwide to all benefit sponsors. Teladoc’s newly unveiled Primary360 service will be available in this plan and is currently being used by ‘several large companies.’ (Link)

Ro’s Rollercoaster Week

Drama: An interesting piece from Tech Crunch was published last week detailing Ro’s seemingly internal struggles over culture and its apparent inability to expand its service lines beyond its bread and butter ED pill offering.

The report prompted an almost immediate reply hours later from Ro’s CEO, Zachariah Reitano who was surprisingly transparent about Ro’s operations and a behind the scenes look into the firm. All in all, I thought his response was pretty solid and thorough, perhaps chalking up the article to some disgruntled employees. I suppose time will tell.

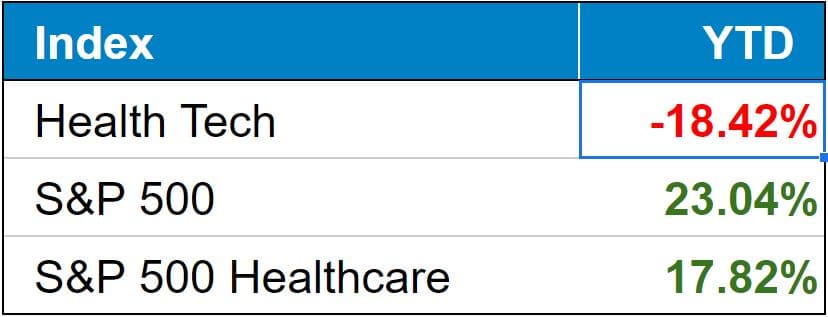

public market update.

Top 3 weekly performers: LifeStance (+9.5%), CareMax (+9.0%), Privia (+8.6%)

Bottom 3 weekly sandbaggers: Cano (-7.6% – odd to see this one decoupled from CMAX), Skylight Health (-7.6%), Signify Health (-6.4%)

- Full List YTD performance: (Link)

$PRVA: Privia Health announced its previously planned entry into the California and expansion into the West Texas market this week through strategic affiliations – BASS Medical Group in Cali (400 providers) and Abilene Diagnostic Clinic in Abilene (30 providers). (Link)

$OSCR, $HCA: Oscar Health announced a partnership with HCA to offer health insurance plans across all of the large markets in Texas. Members in these plans will have access to HCA Healthcare providers while receiving the benefit of Oscar’s digital health tools. Seems like a notable collaboration. (Link)

Earnings:

- $TDOC: After initially selling off after releasing earnings, Teladoc rallied on its Q3 earnings after displaying strong growth in its fundamental business. Teladoc also unveiled its plan to take on risk in primary care, expand its Primary360 offering, and continue to bolster its offerings to hospital clients. Really seems like the machine is churning along here, but the big question mark is obviously the continued integration of Livongo and remote patient monitoring amidst constant entrants and heavy competition. (Link)

- More on Teladoc: Read this deep dive from Healthcare Dive on Teladoc’s primary care strategy. (Link)

- $UHS: the hospital and behavioral operator performed above expectations (similarly to HCA, Tenet). (Link)

- $CYH: Fellow hospital operator Community Health posted a profit in Q3 similar to its Q3 from last year. The firm beat on revenue and earnings as the comeback healthcare kid continues to deal with labor issues and focuses on its better-performing hospitals after divesting much of its struggling portfolio. (Link)

- $CNC: Centene seems to be struggling as of late – the managed care giant is planning to divest some ‘non-core’ assets. However, analysts noted an improvement over CNC’s Q2 despite a still high MLR of around 88%. (Link)

- $EHC: Encompass filed a lawsuit against its former home health & hospice CEO for violating her non-compete. Additionally, the post-acute firm is nearing a spin-off for that same segment. (Link)

Biz Hits

Spin-off: Recently merged healthcare providers LifePoint (hospitals) and Kindred (post-acute) are spinning off certain non-strategic assets into a separate company called ScionHealth. ScionHealth will be comprised of 79 hospitals after the spin-off, including 61 of Kindred’s long-term acute care hospitals (LTACHs) and 18 of LifePoint’s acute care hospitals. (Link)

- It looks like LifePoint and Kindred want no more skin in the LTACH game, instead focusing on acute care and inpatient rehab operations.

Mental: Google is hiring a former Headspace exec to run its tech-driven mental health initiatives at the firm. (Link)

You’re done. You’re done: Ascension and AdventHealth are unwinding their joint operation Amita Health in Chicago. Looks like the 19-hospital, 7-year joint operating agreement wasn’t panning out the way the operators intended, and I’m actually really curious to know why in today’s day of constant mergers and partnerships. (Link)

Gym Membership: In an interesting, kind of wild health crossover none of us saw coming, CrossFit (yes, the gym) is launching a fully digital primary health care service. I imagine a lot of their members get injured in the same fashion by doing those weird full-body-flinging muscle up things. Can’t be good on the joints. At the same time, I do think this is an interesting, holistic approach to healthcare where CrossFit has a solid community and accountability, which could lead to better health outcomes? Hmm. (Link)

Notable Funding:

- Truepill raised $142 million in its Series D, bringing its private valuation to $1.6 billion. (Link)

- Hinge Health raised $600 million, boosting the remote musculoskeletal provider’s valuation to $6.2 billion. (Link)

Divested: TransUnion is divesting its healthcare unit in $1.74 bln deal. (Link)

Specialty Drugs: In addition to offering its virtual primary care offering, Aetna is also rolling out in-network coverage for some incredibly costly, specialized drugs that treat retinal diseases and spinal muscular atrophy. The Gene-Based, Cellular and Other Innovative Therapies network will launch starting in 2022 and I’m really intrigued to see how this plays out. (Link)

Policy Hits

Two major policy updates this week, the rest is mostly fluff:

- Drug prices: Although there’s some pushback from certain Democrats in election years, it looks like any major drug pricing policy (namely, direct negotiation) is getting scrapped from the Build Back Better Act. (Link)

- Additionally, the Biden Admin is dropping Medicare supplemental benefits from the package. So no dental, hearing, or vision will be added to traditional Medicare fee-for-service. I imagine this was dropped after major pushback from dentists and the insurance industry. (Link)

So what does the Build Back Better Act include now? Mostly stuff related to ACA expansion – more permanent subsidies, closing the gap in Medicaid coverage, and expanded subsidies for CHIP. Apart from the now-defunct aforementioned changes to the bill, KFF had a great overview of what’s included from a healthcare perspective. (Link)

Abortion: The SCOTUS will hear challenges to the Texas abortion law. (Link)

MA Fraud: the DOJ accused Kaiser Permanente of Medicare Advantage fraud – basically, upcoding patients making them seem more sick on paper than they actually were, leading to receiving more payments from CMS. Score one for the lawyers. (Link)

Antitrust: The FTC is taking a tougher stance on a few of DaVita’s recent acquisitions in Utah, requiring prior approval before acquisitions and forcing the ESRD co to divest these clinics to prevent local monopolies. Pretty interesting development. (Link)

Sued: Score another win for the lawyers – UnitedHealthcare is suing TeamHealth, stating that it overpaid for ER care by $100 million because TeamHealth allegedly overexaggerated patient acuity. (Link)

Arbitration: The Texas Medical Association filed a lawsuit against the new surprise medical billing legislation. In particular, the TMA has big reservations with the bill’s arbitration process, especially since arbitration is guided by median regional in-network rates, which are generally dictated by payors. (Link)

Vaccine Mandates: After the Supreme Court declined to hear Maine’s health worker challenging vaccine mandates (Link), the state of Texas has decided to sue the White House for the same exact issue – that vaccine mandates are unlawful.

- Main argument here: that the White House is “using subterfuge to accomplish what they cannot achieve directly—universal compliance with their vaccine mandates, regardless of individual preferences, healthcare needs, or religious beliefs.” (Link)

Other Hits

Kidneys: In what seems like a big deal, surgeons successfully transplanted a pig’s kidney into a brain-dead human. Big implications for kidney care? (Link – Youtube)

Data: Medicaid covers nearly 1 in 5 Americans, per KFF. (Link)

NFL football player Calvin Ridley stepped away from the season this week for mental health reasons. This is a major trend unfolding before our eyes – removing the stigma around mental health. (Link)

Opinions

Crossfit: More on Crossfit from Health Populi: Why CrossFit and 23andMe Are Moving from Health to Primary Care. (Link)

Healthy Muse Top Picks

Startup: This was an interesting read from a16z on how digital health startups can go to market in the current healthcare landscape. (Link)

FFS vs. VBC: This was a great overview (as always) from Out-of-Pocket on value-based care – how it works, potential pitfalls, challenges facing VBC, and mechanics associated with value-based care arrangements. (Link)

Mental Health: Axios took a deep dive into America’s mental health crisis, and how things got worse because of the pandemic. Side note, if you’re handling a ton of stress, it’s okay to seek help. (Link)