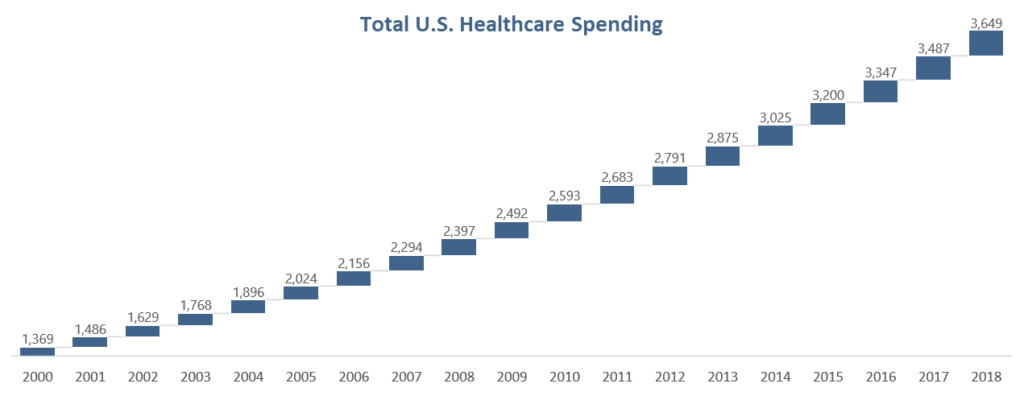

This week’s big story in the healthcare world revolved around U.S. healthcare spending. CMS released its yearly National Health Expenditures report, covering 2018’s spending on healthcare services.

The main highlights: Total U.S. healthcare spending increased to $3.6 trillion, up from about $3.5 trillion last year.

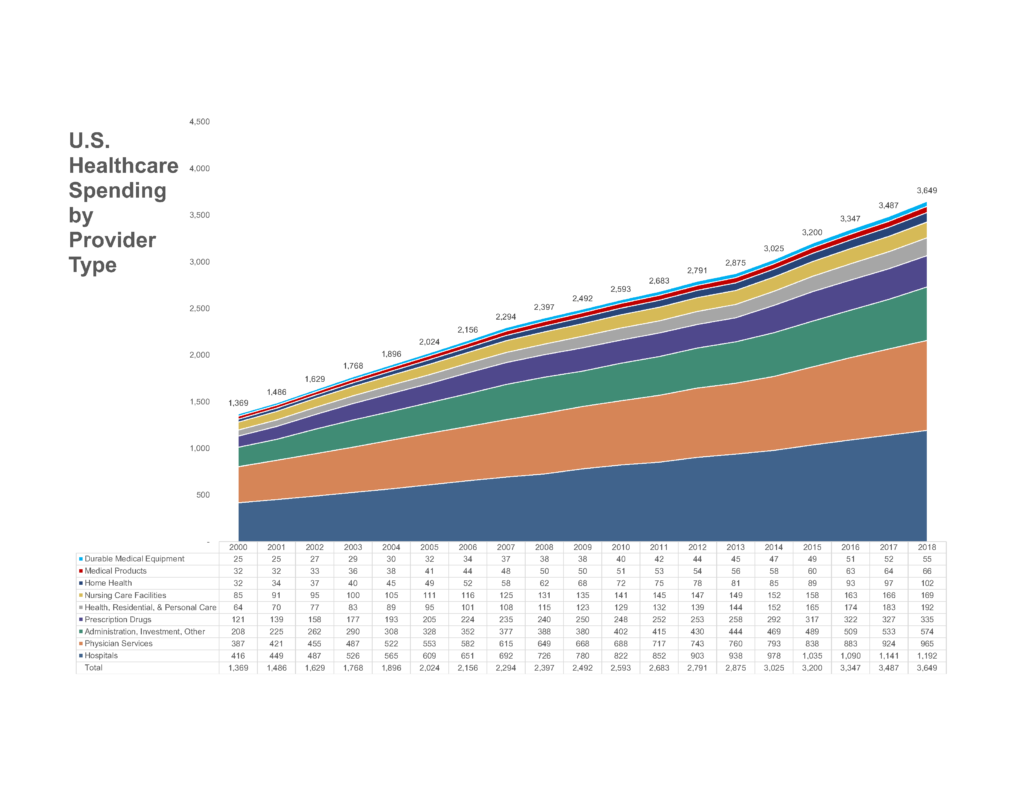

Here’s the breakdown for U.S. healthcare spending by provider type in 2018:

- Hospitals: $1.2 trillion

- Physician Services: $965 billion

- Administration, Investment, Other: $574 billion

- Prescription Drugs: $335 billion

- Health, Residential, and Personal Care: $192 billion

- Nursing Care Facilities: $169 billion

- Home Health: $102 billion

- Medical Products: $66 billion

- Durable Medical Equipment: $55 billion

And here’s how U.S. healthcare spending by provider type has trended since 2000:

U.S. Healthcare Spending Increased by 4.6% in 2018. Why?

- Results are in: Healthcare decreased 0.2% as a percentage of overall GDP, but still makes up 17.7% of our economy. That’s probably gonna get bigger too, as the U.S. population ages.

- CMS estimates that U.S. healthcare spending will grow at around 5.5% a year for the next 10 years as the lumpy Baby Boomer population gets on Medicare.

It seems like there’s a new ‘healthcare spending’ story every week while those involved attempt to figure out why the U.S. healthcare spending is higher compared to other developed countries.

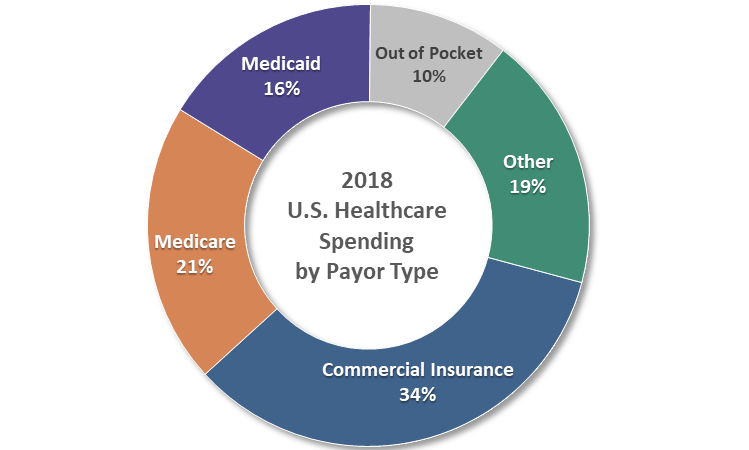

Here’s a big reason why U.S. healthcare spending is high.

Every single healthcare operator in the U.S. is trying to make a margin. Even nonprofits.

That fact extends across the continuum of care – durable medical goods producers, physician services, hospitals, drug-makers, medical device companies, drug manufacturers – you name it – they’re all trying to entice investors and maximize shareholder value. Public or private.

- So what happens when everyone tries to make money and drive growth for their part of the industry while demand stays relatively constant? A number of things. They raise prices. They create competitive advantages. They enter into exclusive arrangements with other companies. And they try to keep regulation on their side or stay in front of it. All of which more than likely contribute to higher U.S. healthcare spending.

Just like regular corporations, healthcare companies pursue their own strategies in order to maximize their benefit.

That, in and of itself, is not evil. It’s not necessarily good, either. But it DOES fit within the current economic system within the U.S.

Do you see the problem?

The healthcare cost issue is multi-faceted.

It’s not just one player or one part of the industry. The U.S. healthcare spending problem is widespread. You can’t just pin the blame on one thing.

- Take drug spending as an example. If you just looked at the above graphic about prescription drugs, a common person would probably conclude that drugs weren’t a big part of the healthcare spending pie. “So why is there so much attention around drug pricing right now?” you might wonder.

In reality, a large amount of drug spend is lumped into hospital and physician spending. Oncology treatments and other types of highly specialized drug therapies, in the billions of dollars, are included in these categories. But then hospitals and physician services get the outward appearance of making up an outsized portion of spending.

You can see how the cost problem gets hairy pretty quickly for policymakers as they try to hone in on the U.S. healthcare spending issue.