Biogen’s Alzheimer’s Drug Makes a Comeback

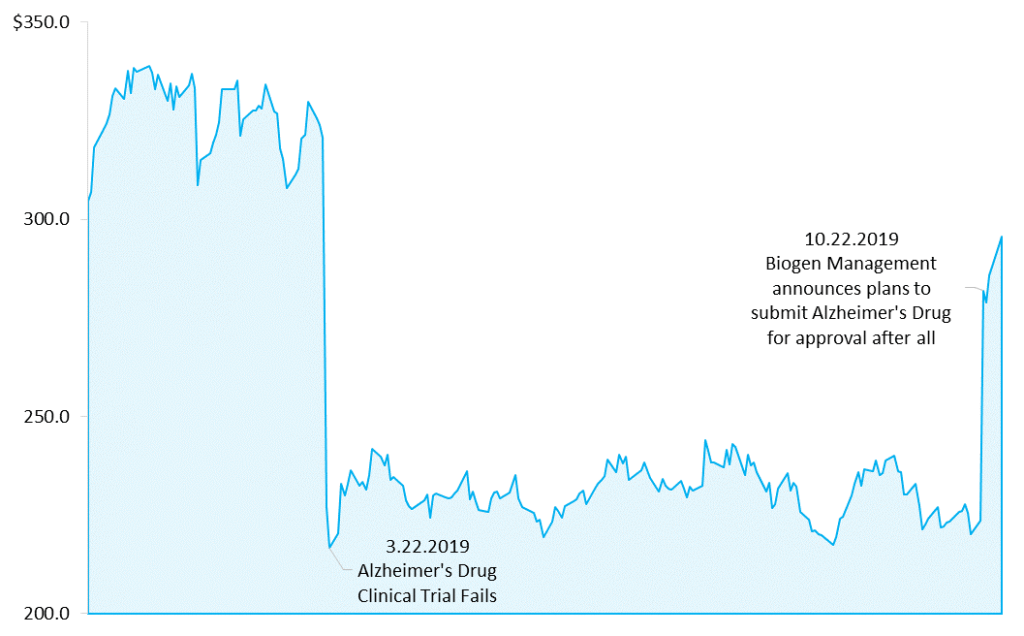

It seemed like Biogen’s Alzheimer’s drug, – a therapy called aducanumab – was dead after its March clinical trial results came back with gloomy results. All trials were stopped immediately, and Biogen’s stock got destroyed that day. For good reason, too – the drug was expected to be a blockbuster.

#ComebackSZN

Fast forward seven months later. In a reversal for the ages, Biogen announced last Tuesday that after re-analyzing the trial, there was actually data to prove that larger doses of the treatment COULD actually be effective in mitigating Alzheimer’s. The stock surged 26% on the news.

As you can probably imagine, there are some skeptics out there, especially since there hasn’t been a new Alzheimer’s breakthrough in 40 years. Biogen will have to prove to the FDA that the trial’s results weren’t just produced by luck. Even if it gets cleared by regulators, they’ll still have to fight for reimbursement from insurance companies.

The market for the drug has been estimated at around $10 billion, so a lot is on the line for both patients and Biogen. Hopefully it’s a win-win. Biogen will submit the drug for FDA approval next quarter, so keep an eye out.

Google makes a play to acquire Fitbit and challenge Apple’s smartwatch dominance

A Bid for Fitbit.

Today, Reuters reported that Google is making a bid to buy out Fitbit. It looks like the tech giant is trying to get into the wearables space, which has pretty much been dominated by the Apple Watch in recent years.

Despite creating its own watch software, I was surprised to learn that Google actually hasn’t developed its own watch yet.

In order to accelerate any wearable’s time to market, it seems as if Google is trying to sidestep any product startup and branding costs by simply buying Fitbit instead.

Fitbit is probably happy about the news too, considering that their sales have been pretty weak lately.

The bigger picture: wearables, wellness, and improving health outcomes.

Even though wearables and their data haven’t really made any push into providing meaningful clinical data for providers, Google’s competitive bid for Fitbit just goes to show that they think there’s a big potential market here. As data tracking gets better and wearables tech improves, I wouldn’t be surprised to see significant progress with wearables and the intersection of wellness and preventive care.

Amazon Acquires Health Navigator

Amazon Care is taking shape.

In its first healthcare-related purchase since PillPack a year ago, Amazon acquired a company called Health Navigator this week. The company more or less tells employees where they should go seek care based on the symptoms that they have (i.e., do you have a nail in your foot? You should probably go to the ER!) among having other virtual care functions. I’m seriously considering whether I’m in the right line of business when companies like this are getting snatched up all over the place.

Employees Only.

Keep in mind that most of these big companies are piloting these healthcare initiatives mainly through employee-only programs (Walmart, Apple Clinics, now Amazon).

With these types of acquisitions, Amazon and others are first trying to save money on healthcare for their employees. They want to provide (hopefully) a better, more comprehensive health benefit to stay competitive in the recruiting market.

Then, if these pilot programs are successful with their employees, maybe they’ll find profitable ways to expand the services to us, too.

Attack of the Drones: UPS Unveils Medical Drone Delivery Platform with Key Partners already Lined Up

Parcel Wars: Attack of the…wait for it…Drones.

UPS has been pretttttty busy this month. Earlier in October, UPS received approval to operate drones commercially – the first approval ever in the U.S. Now, in this week’s futuristic story, UPS announced its plans to deliver supplies and other things via ~DRONE~. Yeah, that means giant 4-rotor mechanisms flying in the sky to your local community hospital. Keep your curtains closed.

Okay, not quite to that level yet – but UPS does have major partnerships lined up with big-time players, including CVS, Kaiser Permanente, AmerisourceBergen, and others. The drones will carry things like prescriptions, medical supplies and instruments, and pharmaceuticals to hospitals and customers’ homes.

Remember the March pilot program?

UPS had a pilot program running with its first partner, WakeMed Health, earlier this year (yeah, I definitely reported on that story when it came out – see, I really do keep you guys in the loop!). That program apparently went really well – cutting delivery time for lab samples from 19 to 3 minutes – so it only makes sense for UPS to expand the program further and diversify that revenue stream.

Policy Corner, week of October 28, 2019: Vaping Ban? Healthcare Lobbying shoots up, the FTC wants to review the effects of hospital mergers, and CMS might start using AI for fraud.

All about Vaping: potential Vaping van is being considered (smoking is fine though, no worries), and a Vaping Tax Bill on the House Panel.

House Ways and Means committee is considering a vaping tax bill this week. The bill would tax vaping products at the same level as tobacco products.

Not to be outdone, the FDA is actually about to ban flavored e-cigs for good. This ban would exclude mint and menthol flavors (thank goodness) and is coming on the heels of over 1,600 vaping related mysterio-illnesses.

The FTC wants to take a closer look at Hospital Mergers

This week, the Federal Trade Commission phoned a few hospital friends along with major insurance companies to request data on recent mergers and acquisitions. The agency is really trying to hone in on certain states with certificates of public advantages (COPA) – namely, Tennessee, Virginia, and West Virginia – states with large rural areas. In particular, the FTC wants to research whether COPAs are good for the public or not.

What’s a COPA?

States can use COPAs to shield hospital and health system mergers from federal regulations and monopolies (basically, they take the merger approval into their own hands and keep the feds away from the transaction altogether).

Why would the states ever issue them?

It’s a bit tricky in healthcare (what’s new, right?). In most cases, states issue a COPA for a transaction because the merger is taking place in a rural area. Most of these states have large rural areas and want to keep those hospitals open. It doesn’t help that rural hospitals have been really struggling lately.

So, in an attempt to keep these rural hospitals alive, states have been allowing monopolies in these markets to have hospitals rather than none at all. There’s also no way any of these communities could support two hospitals, so introducing competition is simply out of the question.

It might not an ideal solution, but here’s how it works – a larger local health system comes in and purchases the struggling rural operation. States shield the transaction from federal antitrust oversight and allow the merger. Then the local rural community keeps its hospital, and maybe the health system benefits if it turns operations around.

Healthcare Lobbying pushes higher.

How much did the different healthcare trade organizations spend on lobbying this quarter? Glad you asked.

- PhRMA (3 guesses on which industry they rep) spent $6.2 million as drug pricing legislation bounces around Congress to no avail (currently)

- Amgen: $3 million

- Bayer: $2 million

- AbbVie: $1.8 million

- Pfizer: $1.6 million

- Gilead Sciences: $1.5 million

- Meanwhile, don’t forget about the surprise billing lobbying blitz happening at the other end of the healthcare world, totaling $4.1 million in lobbying spending in the third quarter alone.

In the miscellaneous category…

- Carcinogenic breasts: The FDA might require breast implant manufacturers to post cancer warnings on its labels.

- Rural ACOs get a lift: Senators are considering boosting payments to rural ACOs

- ACA Replacement Republican Healthcare Plan? Here’s a quick writeup on what any possible ACA replacement might look like from the Republican party. Main takeaway: give more regulatory power to the states, save pre-existing conditions, and give Medicaid block grants. Read the full report here.

- Big win for payors: The U.S. was just ordered to cough up $1.59B in subsidies to Kaiser, Oscar, and other payors

- AI and Fraud Detection: And finally, the CMS is looking to use artificial intelligence to help with fraud – especially in home health, where fraud can be rampant.

Quick Hits

Biz Hits

- Opioids Update: Last week, we touched on the ~$50 billion opioid settlement. Reuters reported this week that talks have resumed between 4 states and the drug firms. The two sides are targeting a $48 billion settlement, but not all states are fans of the agreement since it might not get split up fairly

- Hospital Profitability: Health system operating margins were up in 2018, but are still below the highs seen in 2015. Read the interesting whitepaper from Navigant here. A notable insight: smaller health systems were more profitable than larger health systems.

- CVS CEO Interview: Healthcare Dive had a nice chat with CVS CEO Larry Merlo, which gave some insights into how the business views Amazon, its integration with Aetna, and more.

- Teladoc Expands Services: Looks like Teladoc is trying to differentiate itself from other telemedicine ventures. This week, Teladoc launched a service called Teladoc Medical Experts. The service is meant to cover a broader range of medical conditions and diagnoses than the typical virtual care operator currently provides.

- Livongo Partners with Telehealth: Speaking of telehealth, Livongo is continuing its partnership spree by teaming up with MDLIVE and Doctor on Demand, giving their members access to behavioral health and then eventually diabetes and hypertension offerings.

State Hits

- From Politico – why North Carolina might be the most innovative state on healthcare in America.

- The New York Health Act – which would establish single payer in New York – is drawing crowds. Read more about it here (paywall – WSJ)

Other Hits

- Alphabet CFO Ruth Porat opens up about her bouts with cancer and Google’s work in early disease detection

- Read an interesting essay from the WSJ about the link between aging and epigenetics

- Medically necessary, or cruel? A thought-provoking article on the highly contentious issue of surgery on intersex babies.

- An update on Skilled Nursing Facility values – surprisingly, SNF values are holding steady despite the reimbursement troubles facing the post-acute industry