healthy muse healthcare news.

- This week in healthcare: A huge value-based kidney care $2.4 billion merger, Komodo Health going public this summer, takeaways from MedPAC’s report, Q4 earnings, Google’s partnership with Meditech, is health tech following in fintech’s shoes? & more.

A $2.4 billion Value Based Kidney Merger

Big news dropped earlier today related to a new value-based care kidney merger. Fresenius Health Partners (a value-based subsidiary of the larger Fresenius), InterWell Health (a nephrology network), and privately held startup Cricket Health are merging to form a $2.4 billion VBC kidney care company. (Link)

Here’s what’s happening: The newly merged company will operate under the InterWell brand (too bad, I liked Cricket) and manage 100k covered lives currently. The combined entity has a $170 billion TAM and $6 billion in costs under management.

- To go along with the above scaled operation, InterWell 2.0 will benefit from great financial support & access to capital from the larger Fresenius org as well as several financial & healthcare investors including Cigna Ventures and Blue Cross.

Bigger picture: This is a pretty dang big deal for the VBC push in the end-stage renal disease world. Even though the $2.4 billion merger is a drop in the bucket in the context of the larger ESRD market, it’s a sign of things to come as CMS is experimenting around with alternative payment models in the space, & Fresenius is the largest participant in the new APM for kidney care.

- I have to wonder what DaVita execs are thinking right now. I mean, these are such small dollars at present but the merger really has the potential to succeed at a high level.

Resources:

- H/T to Fierce Healthcare who nabbed the exclusive interview related to the merger. (Link)

- Conspicuously published on the same day was an interview with DaVita’s CEO, Javier Rodriguez. (Link)

Takeaways from a 604 page MedPAC report.

Everyone’s favorite payment advisory committee MedPAC dropped its 600 page report related to all of the healthcare services verticals and fee-for-service reimbursement recommendations given the current dynamics in each of those industries. If you have the time and are interested in how policymakers shape reimbursement decisions for Medicare, give the executive summary a read (about 30 pages).

My general takeaway: it seems as if MedPAC is treating the public health emergency as a one-time thing and approached the report from a business-as-usual perspective (and/or they said “we have no effing clue so we’ll just report based on previous methodologies).

- That’s fine, but do we have any finance people in there? They’re using 2020 data for payment policy decisions while every headline in America is screaming about inflation, labor shortages, and supply chain issues. I get that the committee is limited by lagging data but man…some of these recommendations are way out of touch.

I am physically ill at the fact that they recommended reimbursement cuts of 5% for some verticals while inflation sat at 8% in 2021. Physically ill.

- I mean, even if Medicare’s wage adjustment index accounts for some of the inflation, there’s still inflation in other expenses…AKA, supplies? G&A? And you can bet your bottom dollar that consultants and lawyers aren’t planning on making any less either.

- If MedPAC had its way, providers would get destroyed financially next year.

Anyway, here are 2 sentences on each vertical based on what I thought was relevant from the MedPAC report:

- Acute Care Hospitals

- Costs per hospital stay grew at almost 4% higher than revenues / payments for those stays indicating what we all already knew: hospital margins on Medicare patients are negative and according to MedPAC, hover around -10%.

- MedPAC Rec: Maintain the current updates – IPPS basket increase of 2.5% and OPPS basket increase of 2.0%

- LTACHs: MedPAC Rec: Increase the base rate by 2.0%

- Inpatient Rehabilitation Facilities

- The supply of IRFs increased for the first time in a while from 2019 to 2020 which probably is indicative of the demographic tailwinds in the industry and Florida CON repeal. Freestanding IRFs continue to grow at a steady (3-4%) clip while hospital units are shrinking. During 2020, IRFs experienced higher than normal lengths of stay, higher labor costs, and higher supply costs / usage.

- MedPAC Rec: Cut base payments by 5%. Rationale: MedPAC estimates that IRF Medicare margins in 2022 will be around 14%, a healthy margin in their eyes.

- Physician Practices

- MedPAC added a big section for telehealth in this year’s physician services chapter. Total telehealth FFS spending amounted to $4.2 billion, or 5% of FFS spending, up from just $59 million the year prior. Telehealth as a % of total primary care visits sits at just under 20% today.

- MedPAC Rec: Maintain status quo basket rate increase based on current laws (so like, 2%). MedPAC also believes that volumes will rebound to prepandemic levels, or greater, by 2023.

- Home Health

- While the report noted the difficulties associated with 2020 data given the level of visits via telehealth, MedPAC did note that PDGM changes did NOT result in significant changes to referral patterns.

- MedPAC Rec: Cut base payments for home health by 5%. Rationale: they think the home is a good setting for care, but Medicare payments are a bit too high right now as compared to institutionalized care settings. Medicare margin at ~20%)

- Hospice

- MedPAC Rec: Freeze 2023 rates at the current 2022 level, and wage adjust the aggregate cap (AKA, the total amount of Medicare payments a hospice provider can receive in a year). Then reduce that aggregate cap by 20% since around 20% of hospice providers exceeded the cap in 2019.

- Dialysis

- Dialysis patients are SUPER sensitive to COVID-19. Tragically, volumes for ESRD treatments dropped 3% as a result of excess deaths in this beneficiary segment. MedPAC wants to continue incentivizing alternative payment models for chronic kidney diseases. Interestingly, the pandemic almost forced home dialysis service adoption due to increased patient interest and general need for in-home services during the pandemmy.

- MedPAC Rec: Maintain status quo basket increase of 1.2%

- ASCs

- Lots of discussion in this section concerning freestanding ASCs vs HOPDs (hospital surgery departments) and how freestanding ASCs typically benefit physicians more, are run more efficiently, and incentivize lower Medicare spend. Here’s an interesting little tidbit though: MedPAC isn’t sure whether the lower cost setting of ASCs is offset by a higher volume of outpatient surgeries (AKA, more supply = more demand). MedPAC also wants ASCs to start collecting cost reporting and quality data to this end.

- MedPAC Rec: Congress should eliminate the 2022 Medicare conversion factor update for ASCs – essentially meaning no basket increase

- Skilled Nursing Facilities

- Median occupancy for SNFs dropped from 85% prior to the pandemic to 74% as of September 2021, an intense decline in census volumes. Despite the decline in volumes, MedPAC noted that Medicare margins for SNFs are strong at an average of 25% and that most SNF woes were related to volume drop-offs during COVID.

- MedPAC Rec: Cut base payments for SNFs by 5%. Yes, 5%!! Rationale: SNF performance improved due to the new PDGM payment policies and federal relief bailouts. Volume dropoff is not indicative of future financial earnings potential from Medicare.

Resources:

- For all of you fellow nuts out there, here’s the full MedPAC report. (Link)

- Here’s another article with a helpful summary of the report. (Link)

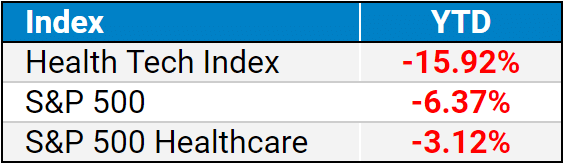

public market update.

Top 3: DocGo, SmileDirectClub, GoHealth

Bottom 3: Talkspace was the only negative performer this week in a great, broad green week for the market. lmao.

Full List: (Link)

$UNH: The DOJ is crackin’ down on the $13 billion United/Change Healthcare deal. A trial will take place on August 1st for the antitrust suit. (Link)

$ANTM: Anthem is suing a former employee, alleging they shared trade secrets while bidding for a Medicaid plan in Iowa. (Link)

$GOCO: 4th quarter earnings. (Link)

$SMFR: 4th quarter earnings. (Link)

$AUGX: Augmedix popped 25% after posting its 4th quarter earnings, reporting improved gross margin, 34% revenue growth YoY, and net revenue retention of 124%. (Link)

$WRBY: 4th quarter earnings. (Link)

$OSH: Investor day. (Link)

$EHC: Investor presentation. (Link)

$AKU: Q4 earnings. (Link)

- 2 days later, Akumin announced the departure of its President & Co-CEO, Rhonda Longmore-Grund. Seems to be part of the transition plan relate to Akumin’s prior acquisition of Alliance (Link)

Biz Hits

Trend Watch:

VC: This was an interesting interview from Dr. Justin Norden, a VC who discussed the latest in digital health investing and why he’s bullish on the Medicaid tech space. (Link)

Risk: HHS is looking into Medicare Advantage risk adjustment practices. I’ll be watching to see if anything comes from all this hubbub, but I’m willing to bet it’s all talk. (Link)

Medical Debt: The three main credit reporting agencies will remove about 70% of medical debt from individual credit reports, saying medical debt is largely an uncontrollable expense. Pretty interesting development. (Link)

- This is a great breakdown from Axios on medical debt in America. (Link)

PHE: Keep an eye on the public health emergency designation, as the end of the declaration has HUGE implications across most healthcare verticals and state Medicaid memberships. Right now it’s set to expire on April 16 but will likely get extended another 90 days. Beyond that? Somewhat doubtful. (Link)

CON: Georgia is considering fully repealing its CON laws by 2025. (Link)

Strategy & Partnerships:

EHR: Google announced a majorly cool partnership to build out its Care Studio on Meditech’s EHR platform. According to Google, Meditech owns 23% of the EHR market. (Link)

Uber: This was a cool dive into Aveanna’s workforce model that works flexibly like Uber’s to manage turnover and retain their workforce. Pretty cool stuff. (Link)

M&A:

Komodo Health is prepping a summer IPO. Komodo is a data analytics firm that houses a number of actionable data points for big pharma and other research based organizations to leverage. Should be a software platform valued akin to Definitive or Doximity. (Link)

Clarify Health acquired Embedded Healthcare to bolster its analytics platform. (Link)

Fundraising, Execs, & VC:

Doctolib: Not really U.S. focused, but Doctolib raised $550 million at a $6.4 billion valuation. It’s one of the largest digital health unicorn outside of the U.S. and is basically another Doximity. (Link)

Minneapolis based Nice Healthcare raised $30 million. The firm wants to primarily use the funds to invest in expanding into new markets and other growth initiatives. (Link)

House Rx just secured $30 million in Seed + Series A financing. Founded by two former Flatiron Health executives, Ogi Kavazovic and Tesh Khullar, House Rx’s health technology platform empowers oncology and rheumatology physician practices to offer medically integrated dispensing. (Link)

- Shortly after their funding announcement, HouseRx also announced a partnership with Northwest Medical Specialties to offer medically integrated dispensing to all 7 locations in Washington state. (Link)

Embold Health raised a $23 million Series B led by Echo Ventures and joined by Morgan Health, the healthcare arm of JP Morgan Chase.

- Embold’s platform offers providers, employers and payers real-time, actionable data on provider quality tracked through practice patterns and appropriateness metrics. (Link)

Remote patient monitoring oncology platform Canopy raised $13m. RPM for oncology patients makes a WHOLE lot of sense and I’m excited for the applications here. (Link)

Moves: Amazon hired a former Providence executive. Really looks like Amazon is about to streamline and integrate its healthcare leadership / services here. (Link)

Cool Data & Resources

Bain released its global healthcare private equity and M&A report, chock full of all sorts of interesting info on the state of the private markets. Really really insightful stuff despite it being super consultant-speak. (Link)

FFS: a JAMA study confirms the fee for service world health systems live in – 90% of physician compensation is tied to productivity metrics. (Link)

Another JAMA study found that value-based arrangements consisting of 2-sided risk models (AKA, downside risk) were associated with lower hospitalizations among beneficiaries. So…does that mean that all risk-bearing relationships should include downside risk? Seems so, but the upside reward needs to be worth it. (Link)

Blake’s Musings

Momma Says: Drew Timme tried VERY hard not to cuss during his post-game interview after the Zags’ victory over Memphis.

Drugs: Doritos are basically heroine, as broken down by Trung Phan.

Golf: I played the Texas Rangers golf course last weekend and had 46 putts, which is literally atrocious. I’m actually embarrassed. Anyone have recommendations for a new putter?

Meetups: For any New Yorkers, Rohan Siddhanti is organizing healthcare folks for quarterly happy hours. The next one is this Tuesday – **RSVP here** or sign up for the NYC community here.

Hot Takes

VBC: Where are we actually when it comes to value-based care? Is it acutally more complicated after the pandemic? Some compelling thoughts in the article. (Link)

Drugs: Drug pricing reforms should focus on expanding choice, not imposing more government controls. (Link)

My Top Healthcare Picks

PCP: The Commonwealth Fund published some data related to primary care investments and access and how the U.S. compares to other countries. I’m personally bullish and excited for the primary care space as it sees increased invvestments. (Link)

Prison: Here’s a great dive into the prison healthcare landscape and the sadly dramatic disparities that exist. (Link)

Supplies: Gist Healthcare had a great dive into how health systems and providers have dealt with, and continue to deal with, supply chain issues including strategies to circumvent challenges. (Link)

Regs: Brendan Keeler shared a recording of his related to breaking down need-to-know healthcare regulations. (Link)

Fintech x Healthtech: Probably my favorite read of the week, Jacob Effron dove into the stark parallels between Fintech funding from years ago compared to health tech funding today. Turns out, there’s some pretty similar stuff going on which is extremely exciting to think about the future of the industry. Tons of momentum in healthcare lately! (Link)