healthy muse healthcare news.

- This week in healthcare: Vaccine mandates go national, drug pricing and direct Medicare negotiation, LHC Group’s big acquisition from HCA, staffing issues at hospitals, abortion controversy, and more.

Big Policy Updates.

Lots of policy things this week amid a slow couple of weeks for partnership announcements and whatnot in healthcare. Vaccine mandates, drug pricing, and abortion policies all hit headlines:

Vaccine Mandates go national.

This week, Biden and CMS released stricter policies mandating that all federal workers must be vaccinated – with no option for testing. (Link)

- Polarization: Amid major outcry from Republican lawmakers, the policy will affect about 4 million federal workers and those with government contracts. CMS issued a further rule requiring vaccines in all healthcare facilities that accept Medicare and Medicaid (AKA, basically every hospital), so things are really heating up. (Link)

Biden had this to say regarding his thought process on the actions: “My message to unvaccinated Americans is this: What more is there to wait for? What more do you need to see? We have made vaccinations free, safe and convenient. The vaccine is FDA approved. Over 200 million Americans have gotten at least one shot. We’ve been patient but our patience is wearing thin and your refusal has cost all of us. So please, do the right thing.”

What are your thoughts?

- Finally, here’s a fantastic thread on Covid vaccine mandates from Andy Slavitt. (Link)

Drug Pricing Updates: Medicare’s direct negotiation?

Some significant drug pricing proposals reached the next step this week, as the Biden Administration and HHS released a plan for lowering drug pricing. The plan essentially champions progressive rhetoric on the drug pricing topic for some time. Here’s pretty much everything relevant:

- Direct Negotiation: Give CMS the ability to negotiate directly with drug-makers on Medicare’s behalf.

- Generics: Enable increased production of generics and biosimilars, and ban ‘pay for delay’ agreements.

- Inflation: Prevent drug makers from increasing drug list prices by more than inflation for the overall consumer price index (or something similar to CPI)

- Value: Institute value-based care programs related to drug reimbursement (a smaller part of the proposal, but still super interesting). More on this here: (LINK)

- Link to the plan here: (LINK)

Abortion.

The Biden Administration is readying a lawsuit over Texas’ new abortion law which essentially outlawed abortion after 6 weeks. (Link)

- Based on what I’ve read, it appears that the Supreme Court denied the emergency request of challengers to the law in Texas because of procedural complexities and not necessarily because of the constitutionality of the law. (Link)

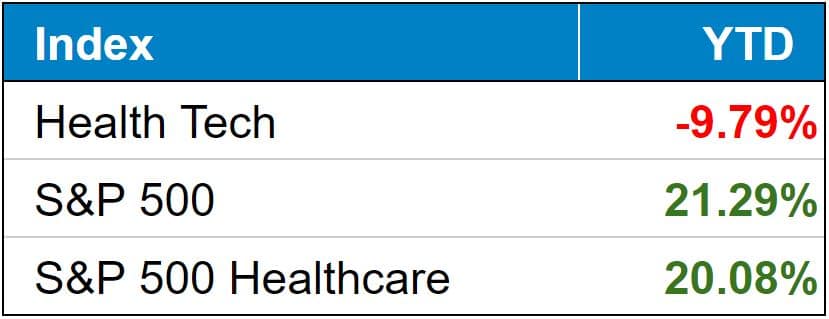

public market update.

Top 3 weekly performers: ApolloMed ($AMEH), GoHealth ($GOCO), and Skylight Health Group ($SLHG)

Bottom 3 weekly sandbaggers: UpHealth ($UPH), ATI Physical Therapy ($ATI), and agilon ($AGL)

- Both UpHealth and ATI are down over 60% since their respective SPACs and shows the danger of investing in these types of instruments – do your DD!!

- Full List YTD performance: (Link)

$LHCG: LHC Group is acquiring certain home health and hospice therapy agencies in 22 states from Brookdale and HCA. to acquire home health, hospice and therapy assets in 22 states from HCA Healthcare and Brookdale Health Care Services Venture

$OSCR: Is partnering with Cigna cobranded plans in Illinois. (Link)

$CI: Cigna is expanding its ACA exchange footprint to 3 new states and 93 counties. (Link)

$AMEH: The newest addition to the Health Tech index, Apollo Medical Holdings announced an interesting minority investment in an MSO in New York, CAIPA. ApolloMed is up almost 400% on the year. (Link)

Biz Hits

Merger: Health systems Beaumont and Spectrum are continuing to move forward with their previously announced merger. (Link)

Expansion: Amazon Care is expanding into another 20 cities. (Link)

Report: Cityblock Health, an innovative primary care platform, is now valued at $5.7B after its latest $400m round of funding led by tech industry investing titan SoftBank. (Link)

Uber: The ridesharing firm is expanding its non-emergent medical transportation to Texas Medicaid members. (Link)

WHOOP: Wearables company WHOOP raised $200 million and then immediately acquired PUSH. I’m looking forward to the firm purchasing other all-caps, simple verb operators. (Link)

Policy Hits

Relief: HHS is releasing an additional $25.5 billion in provider relief funds, aimed at smaller providers and rural healthcare providers. Reminder: there’s still about $180 billion yet to be distributed from this fund after the first few tranches. (Link)

Surprise Billing: As the new surprise billing ruling is slated to take effect next year, the healthcare industry is asking for more time to implement new billing policies. (Link)

Stimulus: House Democrats are seeking to add dental benefits to Medicare by 2028 as part of $3.5T package. (Link)

Telehealth: KHN took a dive into telehealth and the trouble telehealth has when it comes to scaling across state lines as well as patient access – as typically states have different rules and regulations. (Link)

Other Hits

Staffing: Apparently NOT having a vaccine mandate is becoming a competitive advantage in hospital nursing and other support staffing roles as some hospital staff is quitting after a mandate is implemented. I’m sure hospitals are having a pretty hard time here. (Link)

Tech: Apple is reportedly gearing up its Watch to feature blood pressure monitoring and fertility tracking. Pretty cool. (Link)

Opinions

Controversy: After being reportedly strong-armed into approving booster shots for the general public, some FDA officials published in a journal, arguing that it’s not quite time yet for boosters. Interesting stuff brewing here. (Link)

Dental: Will adding supplemental benefits – like dental coverage – to traditional Medicare spark a shift away from Medicare Advantage? (Link)

- Controversy: Republican lawmakers oppose the addition of supplemental benefits, saying that MA plans already add the bennies without the need for the government to foot the bill. Democrats say that adding supplemental benefits to Medicare is long overdue. (Link)

Second Opinion: Is it finally Remote Patient Monitoring’s moment? (Link)

Healthy Muse Top Picks

Health Tech: This article from Providence’s Health Systems’ CDO Aaron Martin was a great read on the dynamics between existing health systems and big tech. (Link)

GoodRx: I really enjoy reading investment overviews because they provide a great look into that company’s industry and this overview of GoodRx from Richard Chu was a solid read. (Link)

Definitive Healthcare: As I mentioned, I enjoy investment overviews – Vital Signs, a new newsletter that dives into healthcare S-1’s, broke down Definitive Healthcare’s upcoming IPO and S-1. (Link)

Drugs: Read Nikita Singareddy’s interesting thoughts on drugs – how they’re named – and more tidbits. (Link)

Air Quality: Nikhil Krishnan’s piece on linking air quality and health was fascinating and frankly, something I don’t really even think about that often. BRB, going to buy air filters for every zone in my house. (Link)