Last week, I teased that a major announcement was coming to you guys related to the future of the Healthy Muse. While I can’t share all of the details quite yet, I didn’t want to leave my subs hanging.

I’m extremely excited to let you know that the Healthy Muse has officially been acquired!

- While this is not the official announcement drop (I’ll link that in the coming weeks – don’t hype this up too much yet), I did want to let my subscribers know first as my OG readers and a nod of my appreciation for all of you. Think of this as an open secret for now.

What this means: I’m going from full-time consulting and transaction advisory to full-time writing and content creation – focused on what I currently cover, but 10x better because I can spend WAY more time on producing dope content – AKA, weekly deep dives and perspective pieces exploring the latest in healthcare with all of you.

- I’ll continue to cover the same segments – providers, services, the latest trends affecting them, the companies involved, and plenty more. Healthcare, but with some sauce if you will.

More details to come!

This ain’t no hobby anymore.

What I need from you – a big favor

Prior to the official announcement, we’re rebranding my newsletter. Alas, the name “The Healthy Muse” will retire soon. Sorry to anyone who loved it (Dad).

If you want to vote on a name or submit your own name, the poll is below OR you can reply to this e-mail with any thoughts. I really appreciate it!

On to this week’s news!

healthy muse healthcare news.

- This week in healthcare: Encompass’ home health biz has suitors, a virtual first plan for Medicaid, State of the Union Highlights, more earnings from Bright, RadNet, Surgery Partners, Cigna expands its venture arm, Ro acquires a Dadi, and my fave HC reads.

Who’s buying Encompass’ Home Health & Hospice Biz?

M&A Rumors are swirling around Enhabit, Encompass Healthcare’s planned home health & hospice spinoff. Suitors including strategic buyers like Aveanna, and financial buyers like Advent International, appear to have big-time interest in buying the segment valued at around $3 billion.

- If Aveanna buys Enhabit, the purchase would put Aveanna on par with the likes of Amedisys and LHC Group in terms of scale. Given Aveanna’s current size (around $1.6 billion), the firm would likely need to split the cost with an interested financial party to foot the entire bill – similarly to how Humana purchased Kindred along with Welsh Carson (WCAS).

Enhabit would be a major get for Aveanna or any strategic buyer. Immediate scale and access to new markets while multiples have compressed down a bit over the last 12 months during ‘Rona headwinds makes sense for a timely buy. Although I wonder whether Encompass shareholders think more value would be unlocked via a public spin-off. Time will tell, but my money’s on the spin-off. (Link)

Virtual Care for Medicaid – a New York First

Virtual Care: MVP Health Care, a Medicaid plan in NYC, created a sweet partnership with virtual care platform Galileo. The model will provide MVP’s Medicaid members with a bilingual offering for specialty and primary care. (Link)

- Why this matters: According to MVP, a wild 40% of its Medicaid members “have not seen a primary care provider in the past 18 months due to various barriers, including transportation and language barriers.” Virtual care – especially a Spanish/English one – does a much better job of meeting these folks where they’re at and can provide whole-person care across a variety of services (AKA, hospitals, specialists, lab tests, imaging, etc.)

Bigger trend: More people than EVER are on Medicaid, and there’s a real opportunity to reach these people groups through bilingual apps and virtual care options. New virtual care capabilities will reduce care costs and expand access for these types of members. From the outside, it looks like the partnership is working – MVP is expanding the program to all of its Medicaid members including those in Vermont. (Link)

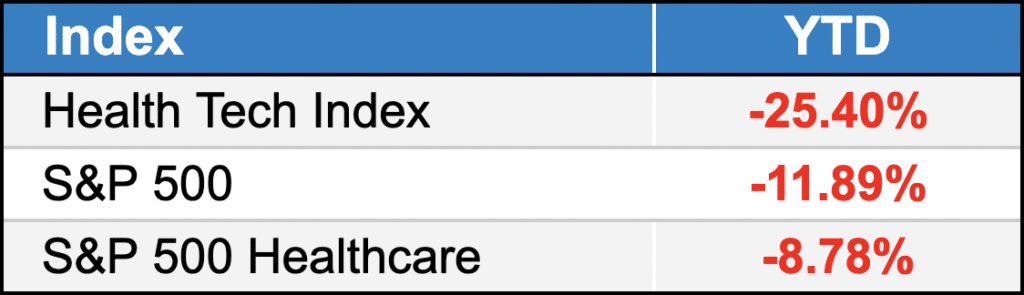

public market update.

Top 3: P3 Health Partners (+13%), Alignment (+11%), Babylon (+7%)

Bottom 3: GoHealth and Bright Health both dropped 43% in a week; Pear Therapeutics (-20%)

Full List: (Link)

Providers & Services:

Nonprofits

- Cleveland Clinic: (Link)

- UPMC: (Link)

- Trinity: (Link)

- Mayo Clinic: (Link)

- Next week I’ll do a quick round-up of all the nonprofit operators now that most of their annual releases have dropped – be on the lookout for that.

- Hospitals in general got destroyed by the Omicron wave in Q1 – just take a look at the latest KF flash report. Average operating margin was 3.3%.

$SGRY: Surgery Partners traded flat this week after its Q4 release despite a guidance raise for 2022, projecting $2.5 billion in revenue and $375 million in adjusted EBITDA, or about a 15% system-wide margin. (Link)

$RDNT: RadNet dropped 15% this week on disappointing earnings. Interestingly, RadNet had a lot to say about building de-novos as opposed to fueling the M&A pipeline via tuck-ins or joint ventures. (Link)

$ACHC: Acadia easily outperformed its financial expectations on the Q and is seeing strong tailwinds headed into the rest of 2022. ACHC popped 9% on the earnings drop. (Link)

$PNTG: As a home health and facility based post-acute operator, labor costs hit the Pennant Group particularly hard in Q4. (Link)

$ADUS: Addus was likewise hamstrung by the ‘Rona wave, noting a 6% reduction in hours served in January and increased labor costs. (Link)

$LHCG: LHC Group shrugged off short term challenges related to staffing and census constraints as a result of those labor challenges. All things considered, LHC was able to effectively manage labor challenges and is looking beyond the hot button issue. (Link)

$TOI: The Oncology Institute announced a joint venture with MaxHealth in California to provide medical oncology services at certain locations under risk-based contracting. (Link)

$THC: Tenet has confirmed its decision NOT to spin off its revenue cycle management arm, Conifer, which is slightly notable – they must still think there’s strategic value to unlock there as Tenet expands USPI. (Link)

Managed Care:

$BHG: Bright dropped 30% after posting extremely disappointing Q4 and full year 2021 earnings. Based on what I read in the transcript, Bright experienced a mass influx of members but wasn’t able to process member claims with the appropriate coding and risk adjustments, leading to an absolutely catastrophic loss in the quarter. What’s even worse in investor minds – and maybe almost borderline fraudulent – was the fact that this apprently occurred BETWEEN Bright’s investor presentation on January 10th and today. Bright management was sober during the call but noted that most of the claims processing issues should now be rectified. Personally, I stay bullish on the insur-tech despite the fact that we’re all going to be working for United someday.

$AGL: agilon ended the week on a positive note after posting 50% revenue growth, 82% membership growth, and a massive uptick in 2022 guidance. (Link)

$ALHC: Similarly, Alignment finished the week up 10% after posting a solid MLR and growth metrics across membership, revenue, and improving margin. (Link)

Digital Health:

$GDRX: GoodRx plummeted 30+% after releasing lower than expected revenues and 2022 guidance. The company missed estimates on monthly active users and revenue and issued weak AF 2022 guidance.

- I’m also bewildered by the company, which is currently a breakeven operation, decision to institute a $250 million buyback program. I get the ‘we’re undervalued’ signal, but there has to be better ways to deploy that capital? (Link)

- On that note, a few days after the earnings drop, GoodRx acquired vitaCare Prescription Services from TherapeuticsMD for $150mil, another firm that assists patients in finding low cost drugs and navigate other barriers for medication needs. GoodRx expects the firm to contribute ‘under 1%’ to its overall revenue and ‘reduce adjusted EBITDA margin’ by 2% in 2022…meaning that GoodRx bought vitaCare for north of 20 times…revenue. (Link)

$TALK: Talkspace traded flat over the week after posting revenues of $114 million and adjusted EBITDA of ($61) million. (Link)

$OSH: Oak Street wowed investors in its Q4 report, jumping 20+% after the announcement. The care platform has plans for profitability by 2025 but pared down facility growth expectations given current bear market conditions. All things considered, Oak Street is currently executing well on its laid out strategy. (Link)

Software:

$SGFY: Signify touted its recent acquisition of Caravan Health, an ACO manager and expects to drive a significant amount of growth through the platform. Makes sense when you think about the amount of hype ACO REACH is generating. (Link)

Biz Hits

Trend Watch:

- The mental health wave isn’t slowing down. Global mental health fundraising topped $5.5 billion in 2021. (Link)

Strategy & Partnerships:

- Cigna is injecting $450 million into its venture arm to invest on assets focused on data analytics, digital transformation of healthcare, and anything that makes them a shit ton of money. (Link)

- Civica Rx, a partnership between a consortium of hospital providers created to stop generic drug shortages, announced a plan to produce SIGNIFICANTLY cheaper insulin by 2024 assuming the firm succeeds during all the regulatory steps. (Link)

M&A:

Ro acquired male fertility company Dadi (c’mon guys) for about $100 million. Ro’s DTC fertility strategy is shaping up nicely. Couple this acquisition with its Modern Fertility acquisition back in May 2021 for a rumored $225 million, and you have a pretty significant footprint in the fertility space. (Link)

Health IT platform Allscripts is selling its EHR biz to Harris Computer Corporation for $700mil. (Link)

Fundraising & Exec Moves:

- Truepill moved co-founder Sid Viswanathan to the CEO role this week. (Link)

Policy Hits

SOTU: Here’s a thread of mine which broke down Biden’s State of the Union (Link)

- Highlights = mental health, VA care, drug pricing (insulin specifically), mandatory nursing home staffing ratios, and more.

Choice: The Commonwealth Fund continued its excellent series on Medicare Advantage with an analysis of choice in MA plans and who shops around versus who doesn’t. (Link)

Other Hits

Web3: CVS filed for NFT and virtual goods trademarks…into the metaverse we go. (Link)

Deleted: ZDoggMD deleted his Twitter account after getting into it over ‘Rona stuff. (Link)

Hot Takes

- A Supreme Court fight over when a doctor should be liable for prescribing meds is sure to draw a lot of attention in the medical community. What do you think?

Healthy Muse Top Picks

This was a great report from SVB on healthcare investments and exits in 2021. (Link)

Nikhil had a great sponsored breakdown of Flume Health and how it’s enabling providers to take on risk. (Link)

Related, Jan-Felix dove into the value-based care tech stack and the players associated with the various steps in the VBC claims process. (Link)