healthy muse healthcare news.

- This week in healthcare: CVS and Walgreens Super Health Clinics, 23andMe gets into telehealth, Oak Street acquires specialists, Q3 earnings, remote patient monitoring, & more

Walgreens and CVS double down on Health SuperClinic Expansion.

Recent news, investments, and rumors have indicated that Walgreens and CVS are about to aggressively escalate their primary care and health super clinic strategy.

Walgreens doubled its stake in its health clinic partner VillageMD with a $5.2 billion investment on October 14. With the influx of cash, VillageMD plans to open 600+ health clinics called “Village Medical at Walgreens.” (Link)

- On top of this investment, Walgreens also made a majority investment in CareCentrix, which is a post-acute care platform. (Link)

CVS is also planning a rapid expansion of health clinic facilities. Rather than initially partnering, CVS chose a build strategy in conjunction with acquiring Aetna a few years back. (Link – Fortune Paywall)

Bigger picture: Both Walgreens and CVS are investing more heavily in the entire spectrum of care in order to bolster their core retail pharmacy businesses amidst increasing competition from all sides. CVS seems better positioned to capitalize on the strategy given the leverage it maintains with operating Aetna.

Must Read: This was a great read from Nisarg Patel on how CVS plans to leverage its health super clinics as a part of its overall business strategy – combining full-service, consumer oriented primary care, strengthening its pharmacy operation, increasing traffic to its stores, and maintaining a strong provider based through Aetna. (Link – Medium Soft Paywall)

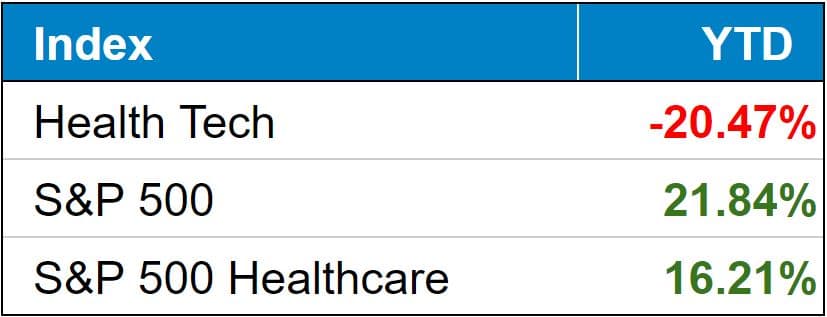

public market update.

Top 3 weekly performers: 23andMe (+18%), Oak Street Health (+14%), Bright Health Group (+14%)

Bottom 3 weekly sandbaggers: ATI Physical Therapy (-19%), Hims & Hers (-9%), Pennant Group (-8.5%)

- Full List YTD performance: (Link)

$UPH: Fell off the face of the planet after its latest secondary equity offering. UpHealth is now trading at around a $200 million market cap after going public via SPAC at a $1.4 billion valuation. (Link)

$ME: 23andMe has decided to purchase telehealth and pharmacy services operator Lemonaid Health for $400 million in a 25/75% cash/stock deal. On the outside looking in, I can’t fathom how the acquisition is strategic whatsoever, unless the DNA testing firm figures out a creative way to integrate testing kits into a fully integrated primary care / preventive care model. I’m skeptical of the longevity of $ME’s business model, so I hope the firm proves me wrong for shareholders’ sakes. Somebody let me know a bull case here? (Link)

$OSH: Oak Street Health, a value-based primary care network for seniors, has acquired virtual specialty provider RubiconMD for $130 million, integrating specialty care into its existing care model. Seems like Oak Street was able to acquire a specialty physician network for a pretty reasonable price considering the current transaction environment. (Link)

$ONEM: One Medical launched a new program called Impact – free for its customers – aimed at chronic condition management. Seems like a nice value-add for its members. (Link)

$MD: Mednax announced an interesting partnership with Brave Care to develop new pediatric primary and urgent care clinics throughout the U.S. Looks like the trend of ‘specialized primary care’ isn’t going anywhere! (Link)

$MOH: Molina is buying AgeWell’s Medicaid long-term care business for about $110 million in cash. Adds another 13k members and $700 million in premiums to the Molina pool. (Link)

Earnings:

- $UNH: UnitedHealth, with profit up 29%, expects contested Change acquisition to close early 2022 (Link)

- $THC: Tenet posted a profit of $449 million for the third quarter, rebounding from a loss during the same quarter last year, which was upended by the pandemic. The for-profit health system reported the vast majority of its hospital markets exceeded company expectations for the quarter even amid a COVID-19 surge. (Link)

- $HCA: Revenue jumped 15% in Q3, but the machine-like hospital operator also experienced rising labor costs. Continues to be a common theme in the provider world (RIP ATI). (Link)

- $ATIP: Continues to sh*t the bed, slashing guidance once again after already slashing revenue and EBITDA guidance previously. This thing just continues to hemorrhage value. Oof. (Link)

Biz Hits

Microsoft: Adding to its slew of deals and integrations, Microsoft announced a new health-specific cloud based offering with Cerner’s EHR. (Link) The announcement comes on the heels of a few other notable Microsoft and healthcare related things:

Radiology: Intelerad Medical Systems acquired Ambra Health to create a $1.7 billion imaging software giant. Per Fierce, the combined firm serves nearly 2,000 customers globally, including the top 10 U.S. hospitals. (Link)

Primary Care: Adding to the ridiculous number of deals in the back half of the year, Goldman Sachs and Charlesbank acquired MDVIP Primary Care Network – an independent association of physicians that serves 362k patients and includes 1.1k primary care physicians. The land grab is happening. (Link)

Carbon: Carbon Health continues to stay busy, this time acquiring RPM vendor Alertive Health (remote monitoring) (Link) as well as Central Jersey Urgent Care, a chain of 10 urgent care facilities in …you guessed it…New Jersey. (Link)

Best Buy: Nontraditional healthcare player Best Buy continues to speculate and dabble in healthcare – the firm just bought Current Health, which is – you guessed it – a remote patient monitoring firm! If Best Buy’s healthcare plans are anything like their oven delivery and installation service, they’re in for a rude awakening. Might be speaking from personal experience there? (Link)

HeadGinger: Headspace, Ginger finalized their merger to form a $3B mental health company. Good thing they’re not public yet because Talkspace has lost 60% of its value. Seriously though, this seems like a great integration. (Link)

Optum: Everyone’s favorite healthcare behemoth Optum is partnering with SSM Health on a new 10-year deal centered around inpatient, revenue cycle management, and digital health services. (Link)

Devoted: Private managed care firm Devoted Health raised about $1.2 billion recently and is now valued above $11 billion after the new fundraising round. (Link)

Policy Hits

Colorado: Will become the first state to require some health insurance plans to cover gender-affirming care in what I’m sure will not be controversial whatsoever. (Link)

OIG: According to the OIG, UnitedHealthcare banked $3.7B in Medicare Advantage payments in 2017 through chart reviews, HRAs inappropriately. Since this report was released, UnitedHealthcare apparently plans to return the funds. (Link)

Payments: Speaking of insurance payments, in an interesting little report from Kaiser / USA Today, Anthem, UnitedHealthcare, other major insurers are running billions behind in payments to hospitals, doctors. (Link)

Other Hits

Boosters: J&J is asking the FDA to authorize its COVID-19 booster shots. Also, it looks like we’re about to start mixing and matching vaccinations. (Link)

PE: This is a great, current overview of private equity’s investment in urology from some of my teammates at my firm. (Link)

Alexa: Amazon is planning to launch Alexa at senior living facilities and health systems. Will be interesting to see how much traction lexie gains. (Link)

Opinions

Drugs: How should we think about re-imagining drug plan design? The Donut Hole takes a deeper dive into the problem. (Link)

- One of the hottest topics of conversation as of late revolves around drug price negotiation. KFF wrote a deep dive on how drug price negotiation might get implemented and what that means regarding access to medicines. (Link)

Costs: Health Populi dives into how the healthcare system might address waste and save about a quarter of a trillion dollars. (Link)

MA: The CTO and President of Clover, Andrew Toy, wrote an editorial on how we might fix Medicare Advantage – especially the risk adjustments involved. (Link)

RPM: I thought this was a timely discussion surrounding remote patient monitoring and the importance of getting it right. (Link)

PE: I thought this was a fantastic overview of private equity and physician practice acquisitions and how they can be harmful if implemented poorly. (Link)

Healthy Muse Top Picks

OOP: Out of Pocket’s latest dives into EMR integration and Epic’s dominance. I know next to nothing about this part of healthcare, so it was a fascinating read. (Link)

Babylon: gearing up to go public, Babylon’s CEO provided an interesting insight into the company’s long-term game in digital health. They have a long road ahead of them. (Link)

DTC: This was a great discussion from Christina Farr and colleagues as to why direct-to-consumer health products and firms are winning investors – product first. (Link)