healthy muse healthcare news.

- This week in healthcare: New IPOs from Ensemble and Cue Health, Walgreens pursues Evolent, athenaHealth going public again, payor market consolidation, right wing antivax fraud, payor consolidation, and more.

IPO Watch: Ensemble and Cue Health

Cue: At-home and B2B lab testing firm Cue Health debuted on the public markets on September 24. After an initial pop, the stock has since drifted down below its IPO $16 reference price to $10 as of this writing. Cue is trading under the symbol $HLTH.

It seems as if Cue is trying to take full advantage of the at-home testing trend – first with Covid testing, and I would imagine expanding into other kinds of tests. (Link)

- Link to S-1 prospectus: (Link)

Ensemble: New-age revenue cycle management (AKA, all the billing and management and behind the scenes stuff that nobody wants to deal with) Ensemble Health Partners filed for IPO on September 29. The firm is owned by PE firm Golden Gate Capital after Bon Secours Mercy Health sold a majority stake back in 2019. Ensemble will likely try to raise between $100 – $500 million (tbd) and is profitable according to its S-1 prospectus. (Link)

- Link to S-1 prospectus: (Link)

Health IT Deals Continue with Evolent and athenaHealth.

Evolent: Reports from Bloomberg indicated that Walgreens is considering acquiring health IT firm Evolent, which assists providers with managing value-based care programs among other segments. Evolent’s stock initially rose 18% on the news and is up 20% as of this writing since the announcement on September 29. (**Link – Bloomberg soft paywall**)

athenaHealth: Three years after a $5.7 billion public-to-private acquisition, Veritas Capital and Elliott Management are exploring taking athenaHealth public at a valuation potentially as high as $20 billion – quite the return for a three year hold period.

- Bigger picture: Health IT and software is a hot space right now especially after recent IPOs and private transactions (Definitive, Doximity, Datavant). There’s definitely a sell-high strategy being implemented here, and it all depends on whether investors value athenaHealth at Cerner multiples or Doximity multiples. (Link)

Market Consolidation – it’s not just hospitals.

Consolidation: An AMA report released this week disclosed that it’s not just hospital consolidation the Biden Admin should worry about – nearly 75% of U.S. metro areas are highly concentrated with health insurers, meaning that these markets have little to no competition between payors.

- It’s concerning that healthcare in general is becoming less competitive for both payors and providers and I can’t help but be concerned for how the patient fares as these healthcare conglomerate amoeba titans battle each other in the skies above. (Link) (Article Summary)

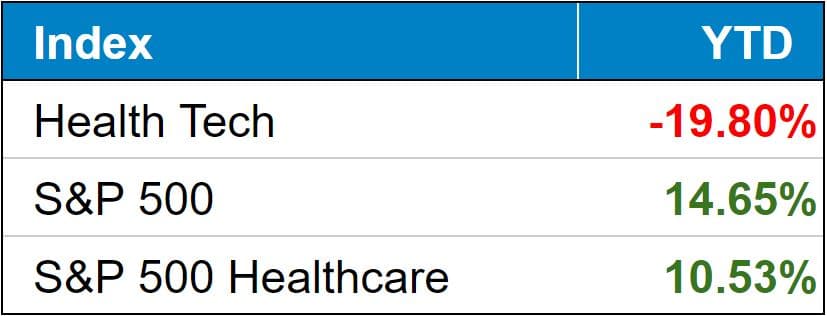

public market update.

Top 3 weekly performers: CareMax (+13.4%), Convey (+6.25%), Oscar (+3.95%)

Bottom 3 weekly sandbaggers: UpHealth (-20.5%), Signify (-13.8%), Skylight Health (-12.5%)

- Full List YTD performance: (Link)

$HCA: Is buying 5 Utah hospitals from fellow hospital operator Steward Health Care. (Link)

$AMED: Amedisys to Acquire Home Health Regulatory Assets in Charlotte and Raleigh, N.C. (Link). Along with this acquisition, AMED’s recent acquisition of Contessa closed a deal with Henry Ford Health System to expand its SNF at Home program. (Link)

$GDRX: GoodRx launched GoodRx Health last week, which is a content-driven guide to health resources. GoodRx Health is intended to provide its consumers with research-based answers to vital health questions and is a great marketing but also educational strategy. (Link)

$INNV: The PACE provider dropped 25% on Q2 earnings (and continued to drop) after CMS initiated an audit into the operator’s Colorado and California facilities – 50% of the firm’s members. Is the selloff overblown? We’ll know in Q1 2022 when the report gets published. (Link)

$PFE: The FDA authorized Pfizer’s Covid booster shots for people 65 and older and other vulnerable Americans. (Link)

$EAR: Smart hearing company Eargo is the target of a criminal investigation by the DOJ over some reimbursement claims. Its stock plummeted 70% on the news. Yikes. (Link)

$OSH: Oak Street Health announced an exclusive partnership with the AARP. (Link)

$WRBY: The eyewear start-up Warby Parker made its public debut Wednesday, via a direct listing, at $54.05 per share, soaring more than 30% above a $40 reference price. (Link)

$OSCR: Oscar Health teams up with Chicago health systems to offer tech-enabled health plans. (Link)

Biz Hits

Imaging: Intermountain launched an outpatient imaging business this week called Tellica Imaging as insurers crack down on HOPD pricing. Intermountain plans to offer flat-rate prices on CTs and MRIs. (Link)

Walmart: The retail giant is partnering with recently merged Grand Rounds and Doctor on Demand to launch a virtual program targeting health disparities among African American workers. (Link)

- Along with this announcement, Walmart is clearly trying to soothe some administrative woes in its health clinics by installing the least-worst option, Epic. (Link)

Kidney: End-stage renal disease provider Strive Health announced a partnership with a large nephrology group in Illinois and Indiana to provide risk-based contracting for chronic kidney disease patients. (Link)

- The news comes at a time when care for kidney disease plummeted during the pandemic. (Link)

SPAC: This was a great overview of recent SPACs in healthcare. Of course as a subscriber to the Healthy Muse you should already know about all of these 🙂 (Link)

Policy Hits

Surprise billing: Surprise! Someone doesn’t like HHS’ latest proposed ruling with surprise billing legislation. Doctors slammed the new proposal, saying that the dispute resolution process overly favors insurers as the arbitration process relies on median, benchmarked rates for that service for that given geography. At least the patients are finally winners here. (Link – HHS) (Link – Article)

Relief: HHS is awarding nearly $1 billion to 1,300 health centers to support renovation, health equity at its federally qualified health centers. (Link)

Other Hits

Mandate: How many employees have hospitals lost to vaccine mandates? This Fierce article breaks down how many personnel have been fired from health systems that have disclosed numbers. I don’t think it’s as bad as feared, but it could get worse, of course. (Link)

NBA: The NBA announced it will withhold pay of unvaccinated players. Pretty significant pay cuts here. (Link)

Monopoly: Centene and Humana are suing Merck for its alleged ‘monopolistic scheme’ to delay generic development of Merck’s blockbuster cholesterol drug. Maybe that’s why Humana was meeting with Centene on that private jet…(Link)

Depression: Apple is reportedly working on a way for its phones to detect depression and cognitive decline. (Link)

Opinions

A.I.: What’s the best use case for artificial intelligence in healthcare? Certain big tech execs argue that AI should be designed to support and not replace providers. (Link)

Primary Care: This HBR article from Kyna Fong argues that the current U.S. healthcare system isn’t built for primary care and highlights solutions to fix the issues present in primary care (including more reimbursement, lol). (Link – HBR soft paywall)

Healthy Muse Top Picks

MA: This deep dive from Health Affairs was a great analysis of Medicare Advantage and what’s going on from a business perspective behind the scenes with adjusting risk scores, direct contracting, and more. (Link)

This long-form read from the Cut dives into a woman who used drugs while pregnant and was charged with murder after having a stillborn. Crazy stuff and an impactful longform read. (Link)

Nutrition: This dive into nutrition labels is worth a read, because really, nobody knows how to make sense of nutrition labels and I’m personally infuriated by it. (Link)

Fraud: This investigation from the Intercept was an absolutely ridiculous dive into the world of America’s Frontline Doctors, who are apparently actively sowing distrust in the Covid vaccine in order to prescribe medication like hydroxychloroquine and Ivermectin and make millions off the duped folks. (Link – soft paywall)