healthy muse healthcare news.

- This week in healthcare: Chamath takes Akili Labs public, ApolloMed’s Value-Based acquisition, HCA Q1 earnings, the great healthcare staffing squeeze, and more relief funding

Chamath is SPACing Digital Therapeutic Firm Akili Labs

Anotha One: On the heels of taking ProKidney public at a $2.6 billion valuation, one of Chamath’s many SPACs is taking Akili Labs, a pre-revenue digital therapeutics firm, public, at around a $1.1 billion valuation. (Link)

- About Akili: The digital therapeutics firm will become the second of its kind on the public markets. Pear, a close peer, went public in December at a $1.6 billion valuation. These companies are highly speculative in nature, similar to clinical stage biotech firms, as their products are largely unproven and they don’t have recurring cash flows. Akili’s claim to fame is its video game product that helps kids with ADHD gain focus. (Honestly they should just play Runescape instead).

More: Here’s a link to Chamath’s write-up on reasoning for the transaction. (Link)

Analysis: This was a hard assessment from Scott Xiao’s In Silico related to Akili’s FDA clearance as he displayed skepticism related to the endpoints used in Akili’s study. (Link)

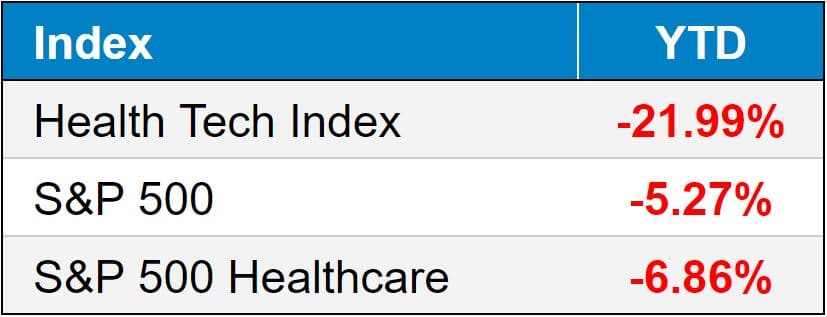

public market update.

Top 3 weekly performers: SmileDirectClub (+24%); Definitive (+13%); AmWell (+11%)

Bottom 3 weekly sandbaggers: ATI PT (-11%); Oak Street Health (-10%); LifeStance Health (-10%

- Full List YTD performance: (Link)

$AMEH: ApolloMed, a value-based care company you really should be paying a lot closer attention to (I mean check out this spiffy investor deck), acquired Orma Health, a value-based care tech company focused on risk stratificatio and identifying patients for clinical programs. As a part of the transaction, two top execs from Orma Health will transition over to AMEH’s leadership team. (Link)

$HCA: Heavy battle-tested hospital titan HCA released earnings this week which led to some interesting insights: (Link)

- HCA is building 5 acute care hospitals in Texas in areas with hot population growth (honestly everyone is moving to Texas so stay away) (Link)

- Amid broader staffing issues, HCA is still slowly integrating post acute assets into its portfolio, including Brookdale’s home health biz that HCA bought last year for $400 million) (Link)

- Related: Read about the labor trends affecting hospitals in 2022, including staffing agency and travel nursing prices through the roof, resigning and burnt out clinicians, and more labor union activity. (Link)

- Staffing agency costs are so bad that provider lobby groups sent Congress

- Related: Read about the labor trends affecting hospitals in 2022, including staffing agency and travel nursing prices through the roof, resigning and burnt out clinicians, and more labor union activity. (Link)

$ANTM: It’s no United, but Anthem doubled its profit to $1.1 billion. However, similarly to Humana, Anthem issued muted expectations for 2022. Anthem is trading flat after its Q1 release. (Link)

- Related: How much do you think the top 7 insurers (including all of CVS) made in revenue in 2021? (Answer)

$DH: Definitive Healthcare launched an interesting product this week – called Latitute Discovery, the software aims to estimate total addressable markets and patient cohorts for pre-commercial biotech and med device companies. (Link)

$LHCG: Although LHC Group is acknowledging ongoing labor challenges, the firm is looking past the short term pain toward long-term tailwinds. (Link)

Biz Hits

Partnerships: Big partnership news in Texas – GI Alliance and USPI are forming a partnership to expand their joint gastroenterology presence in Texas. Like I mentioned before, Texas is a hotbed for population growth and all these millennials have plenty of digestive issues (lol). (Link)

Medicare: This article from McKinsey was a solid discussion of what’s going on in healthcare, but more specifically Medicare and Medicare Advantage. (Link)

Funding: SoftBank led health tech unicorn Alto Pharmacy’s $200 million series E this week, joining other unicorns in raising hundreds of millions of dollars. (Link)

M&A: JnJ made certain comments on its earnings call that signal the healthcare conglomerate is on the prowl for more acquisitions. (Link)

Product: Cigna’s MDLive division is initiating its first virtual first – remote patient monitoring program. (Link)

Trends: VCs love themselves some subscription healthcare services companies. (Link)

Antitrust: To stave off certain antitrust concerns, Change Healthcare is considering selling some of its segments so that it can finally merge with UnitedHealthcare. (Link)

Exec: Uber Health appointed its first Chief Medical Officer for all of the diverse healthcare services they’re offering (non-emergent medical transportation, that’s it – just look at their health division on their site lol) (Link)

Policy Hits

Relief: Providers want Congress to give them more funding and relief on a few fronts:

- Continuing to suspend the mandated sequestration (cut to Medicare reimbursement)

- More funding relief in general for omicron and delta related losses (Link)

ACA: A Record 14.5 million people signed up for ObamaCare. (Link)

Other Hits

Mental: Federal departments are claiming that insurers fall short in their provision and coverage of mental health and substance abuse benefits. (Link)

Referral Patterns: Here’s an interesting little datapoint – post-acute referrals are shifting given the stigma surrounding nursing homes and SNFs. (Link)

‘Rona: Myocarditis risk is17 times higher for unvaccinated patients ages 12-30 who get COVID-19 as compared to COVID-vaccinated patients. Hmm. (Link)

Hot Takes

VBC: this Health Affairs article was a good deep dive into VBC payment models and the market dynamics keeping them at bay. (Link)

Healthy Muse Top Picks

MA: This article from Axios highlighting the Medicare Advantage space, and all of the players, was a good brief read on the current landscape. (Link)

Substacks: I tweeted about these reads earlier this week, but I really enjoyed the following from Olivia Webb and Jan-Felix Schneider: