healthy muse healthcare news.

- Hims & Hers debuts on the public markets, home care provider Signify Health files for IPO, a slew of Biden healthcare executive actions on Day 1, M&A heats up, J&J’s trial is near completion, UnitedHealthcare’s 40% profit slump in Q4, and more.

Hims & Hers debuts on the public markets.

Going public: This week, Hims & Hers tied the knot with the public markets and started trading under the ticker ‘HIMS.’ (Link)

What to know about HIMS. The company – which offers a variety telehealth and medication delivery services – has exhibited a meteoric rise in scale since its inception in 2017. 3ish years to go from inside someone’s brain to a $1.6 billion company today? That’s impressive.

Drastically scalable: Since its inception in 2017, Hims & Hers expanded dramatically:

- Once only known as Hims, the firm started with selling just four products, the most popular of which was its ED medication business.

- Hims rebranded into ‘Hims & Hers’ when the company added a women’s health service line.

- More recently, Hims & Hers expanded into a wide array of virtual services, including behavioral and mental health, primary care, and now a partnership with Privia Health – an extension of its primary care offering.

Bottom line: pay attention to Hims & Hers and other firms like it as COVID accelerates telehealth and digital health adoption, while easy money and low interest rate policies allow digital health players the capital to make a realistic foray into our sluggishly innovative healthcare system.

- If you want to learn more about Hims & Hers, I highly recommend this Bloomberg article (note – soft paywall) which dives into how the firm grew so quickly and effectively, but also takes a critical look at its business practices and prescription services.

- One more thing: Interestingly, during its earnings call, UnitedHealthcare mentioned that telehealth and online pharmacy services are key focuses for the business in 2021 which is…basically what HIMS offers. (Link)

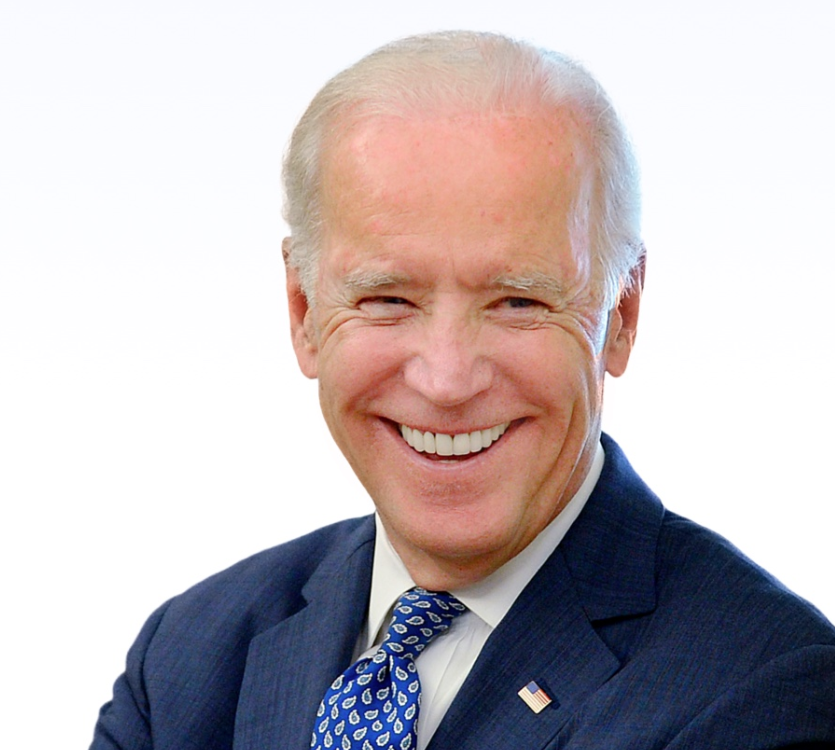

Biden’s Executive Action in Healthcare.

Biden got to work quickly in unraveling several Trump-admin policies as well as pushing his own agenda through a multitude of executive orders. Here’s what he did healthcare-wise during his first week in office:

OSHA: Biden issued an executive order calling for OSHA to look into ways to improve safety for healthcare workers in vulnerable positions working on the frontlines of Covid. (Link)

WHO: The U.S. immediately rejoined the World Health Organization after Trump’s scuffle with the org last summer. Fauci will head this committee. (Link)

Mask Mandates and Travel Bans: Biden instituted a nationwide mask mandate on federal property (Link) while also banning non-U.S. citizen travel from South Africa – where a new variant was recently identified. (Link)

Vaccination Goals: Biden set the goal of 100 million vaccine doses in 100 days in the U.S. (Link)

About that Stimulus: This one requires Congressional action – but Biden’s $1.9 proposed injection into the economy would expand ACA subsidies, institute a $20 billion national vaccine program (rather than the state-led initiative currently in place), and increase testing, among plenty of other funding proposals. (Link)

Coronavirus updates.

Cases: The U.S. surpassed 25 million cases this week. (The Latest Numbers).

Vaccinations: 22.4 million doses have been administered in the U.S., about 1.2 million per day so far as of this writing. Follow along with the Bloomberg’s vaccine tracker. As previously mentioned, Biden’s goal is 100 million doses administered in 100 days. Hopefully, vaccine adoption continues and no supply shortages occur so we don’t see a slowdown in this number.

- Moderna announced this morning that its vaccine is still effective against emerging coronavirus variants in the U.K. and South Africa. The company will still test a booster shot, just in case. (Link – Press Release)

Johnson & Johnson: J&J vaccine trial has enough data to analyze soon, according to Fauci. Be on the lookout for data release from the trial in the coming weeks and keep in mind that JnJ’s candidate is a single-dose shot. (Link – Bloomberg – soft paywall)

Merck: Just discontinued its coronavirus vaccine candidate after trials did not produce a strong enough immune response. The failure exemplifies how extraordinary the Pfizer and Moderna vaccines were. Merck will focus on treatments and therapies for coronavirus instead. (Link – Stat)

Allergic Reactions: This week, the CDC reported stats on the rare allergic reactions to the vaccines we’ve all been reading about. In reality, anaphylactic reactions to the vaccinations are 2.1 per million doses and 6.2 per million doses in Moderna and Pfizer’s vaccines, respectively. (Link – Stat)

Vaccine logistics: Private companies like Starbucks, CVS, Microsoft, Costso, Walmart, and Amazon are offering their assistance at the state and federal levels to use their logistical prowess in order to help vaccine distribution nationwide. Easy PR, am I right? (Link – Washington Post)

- Along with the logistical challenges, there are already huge disparities forming regarding who has received the vaccine along racial lines – in addition to those who live in ‘pharmacy deserts.’ Read more about these issues here.

Quick Hits

Biz Hits

- IPO: Home-care firm Signify Health filed for an IPO (yes, the traditional one) this week. Read more about the company here. Read its S-1 here.

- Earnings: UnitedHealthcare reported its Q1 earnings. Its 40% drop in profits and higher than normal medical loss ratio was expected as pent-up demand released for elective surgeries. (Link – Forbes)

- JPM21: Here’s an interesting article from the JP Morgan healthcare conference around Oak Street and One Medicals’ CEOs – how healthcare models can scale. (Link – Fierce)

- Diversity: Read about how Amedisys’ diverse board sets the tone for the company at large. (Link – HHCN)

- M&A: Both home health and physician practice transactions have been climbing again after a slow 2020.

Policy Hits

- Pay bump: CMS has proposed increasing Medicare Advantage and Part D plan reimbursement by 4.08% in 2022, significantly up from its initial estimate of 2.82%. (Link – FierceHealthcare)

- Drug costs: PhRMA – the lobbying group representing drug companies – sued to block Trump Administration 340B rule (Link – Stat Plus Paywall)

- Emergency Declarations: The U.S. public health emergency designation was extended for another 90 days, meaning that stipulations put into the CARES act bills will remain. Many believe that the public health emergency will last through the end of 2021 at a minimum. (Link)

- Dubious Pardons: Trump’s healthcare pardons include executives who were involved in massive frauds. (Link – KHN)

Other Hits

- HIV Meds: The FDA approved the first monthly injectable medication to treat HIV. (Link – Stat)

- Certificates of Need: CON markets can mean big businesses for home health buyers, but opportunities are growing scarce. Read about how CONs affect home health businesses in various states. (Link – HHCN)

- Charity: The American Hospital Association estimates that uncompensated hospital care costs have reached $660 billion since the year 2000. (Link – HFMA)

Thought-Provoking Editorials

- Policy: A public option won’t serve the public. (Link – The Hill)

- Public Health: The Commonwealth blog dives into what public health investments the federal government should focus on after Covid exposed the cracks in funding. (Link)

Healthy Muse Top Picks

- The next frontier of Digital Health – the consumer. (Joe Connolly)

- Health Affairs lists the 5 trends to watch in 2021, including telehealth growth, policy changes from a Democratic-led government, manufacturing shifting to the U.S., public health infrastructure, and maternal health. (Link – Health Affairs)

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse is the alternative to boring healthcare news. It’s a 5-minute weekly e-mail updating you on all the major strategy news, policy news, broader trends, big stories, and everything in between. Learn more about our vision here.

- Get smarter and sign up below today.