healthy muse healthcare news.

- This week in healthcare: Mark Cuban gets into Drugs, Encompass Spins off Home Health, Chamath’s latest SPAC is ProKidney, big funding rounds from digital health unicorns Transcarent and Lyra Health, and more.

Encompass Officially to Spin off Home Health & Hospice Biz

Breaking up: Encompass announced its plans to spin off its home health and hospice business into a separate publicly traded company called Enhabit.

- The details: If interested, I wrote a quick thread on Twitter breaking down the high points of what this means for Encompass. TL;DR, each segment’s management will be able to focus more wholeheartedly on their specific strategy. (Link)

- Link to Encompass’ announcement: (Link)

Chamath takes ProKidney Public

SPAC Daddy: Chamath is taking biotech kidney firm ProKidney public at a $2.6 billion valuation. The deal will give ProKidney a pretty decent chunk of change to continue its phase 3 trials in the kidney and dialysis space. Chamath wrote up a quick one-pager on the deal. Let’s hope this one fares a bit better than Clover (lol). (Link)

- Cool tech: ProKidney is developing some tech to treat chronic kidney disease and kidney failures by repurposing the patient’s own cells to restore kidney function. Pretty amazing stuff if it ends up working.

Mark Cuban gets into Affordable Drugs

Drugs: Mark Cuban just announced the launch of Mark Cuban Cost Plus Drug Company. Yeah. That’s the name of the company. Pretty amazing marketing when you can just put your first name in front of a firm and it’s instantly recognizable. #mediagoals

- Details: Through help from Truepill, MCCPDC will target the generics market and offer a flat 15% mark-up to every drug they can possibly get a hold of. It’s a cool play on transparency, and while the jury is still out as to whether or not it can make an impact when Wal-Mart’s generic list and GoodRx type players exist, I can always applaud an effort like this.

- Link to press release (Link)

- Check the site out yourself here: (Cost Plus Drugs)

Big Funding Rounds from Transcarent and Lyra Health

Funding Secured: Digital Health unicorns Transcarent and Lyra Health both successfully raised $200 million and $235 million respectively in recent fundraising rounds.

- Lyra has raised $915 million to date, the vast majority of which has been raised in the past 12 months. The company must be absolutely trailblazing through cash to grow internationally and through acquisitions (Link):

- August 2020 ($110 million raised) – $1.1 billion valuation

- January 2021 ($187 million raised) – $2.3 billion valuation

- May 2021 ($200 million raised) – $4.6 billion valuation

- January 2022 ($235 million raised) – $5.9 billion valuation

- Related: Lyra also announced its acquisition of ICAS World to continue to expand globally. If it wasn’t the largest mental health player before, it likely is now. (Link)

Transcarent raised $200 million at a $1.6 billion valuation. The firm specializes in patient navigation for employers as an Accolade-type player. (Link)

HHS Extends ‘Rona Health Emergency & SCOTUS Halts Vaccine Mandate

Emergency: HHS extended the Covid-19 health emergency for another 90 days. The emergency was about to expire on January 16 so this news was pretty expected. In fact, I was frantically Googling ‘public health emergency extended’ since I hadn’t seen anything come through yet.

- What this means: All of the loosened healthcare regulations and flexibilities around telehealth, waivers, Medicaid enrollment freezes, and stipulations in the CARES act, will remain in place for another 90 days (Link)

Mandate: The Supreme Court struck down OSHA’s vaccine mandate on 100+ employee-count employers nationwide earlier in January, ruling that OSHA, under the executive branch, doesn’t have that scope of authority.

- They argued that such a national public health measure should be implemented via an act of Congress

- Here’s a good summary of the mandate positioning (Link) and here’s a link to the full opinion. (Link)

public market update.

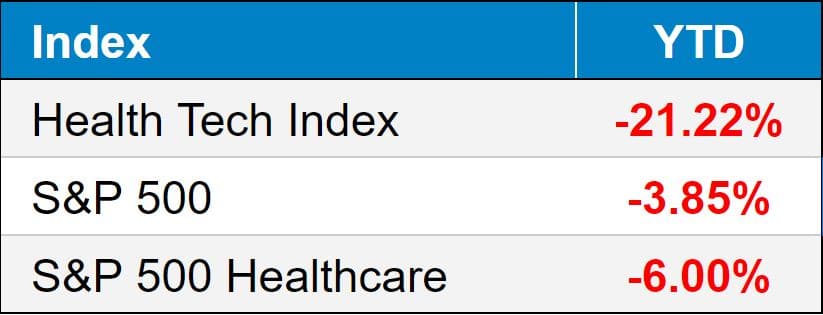

Top 3 weekly performers: Outset Medical (5.4%). That’s it. That was the only green digital health firm this week.

Bottom 3 weekly sandbaggers: The Oncology Institute (-23%); Augmedix (-22%); Oak Street Health (-21%)

- Full List YTD performance: (Link)

$UNH: UnitedHealth released its earnings, and the machine rolls on per usual. Optum is an absolute beast, as its revenue rose 33% thorugh value-based care arrangements and other optimizations. Despite Humana’s MA growth struggles, UnitedHealth reiterated its expectations for its own MA member growth for 2022. (Link)

$BBLN: Babylon raised 2022 revenue guidance at JPM and announced its acquisition of DayToDay Health, its second deal in two weeks. (Link)

$HUM: Humana dropped 20%, its biggest drop ever, after cutting its guidance for Medicare Advantage members in half. Humana cited increased competition and pricing pressure as the main reason for the guidance slash. (Link)

$TDOC: Teladoc upped its visit and revenue expectations for 2022 but still continues to underperform. You have to wonder when the bottom is in on this once-high flying growth stock. (Link)

$SEM: Select issued preliminary financial guidance this week. As a result of labor shortage issues in its LTACH segment primarily, Select is expecting lower than estimated results for Q4 and full-year 2021. Sounds familiar and I have to wonder how long this is going to be an issue for services firms. (Link)

$SMFR: Sema4 secures a deal to acquire GeneDx, capturing $200M in private investment. (Link)

$AUGX: I had a great conversation with Ian Shakil, founder of Augmedix which recently went public in the ambient documentation space. Look for more coming from this conversation – and the landscape of the space – in the near future.

$SGRY: Surgery Partners went full acquisition mode at the end of 2021, spending $185 million on three deals. SGRY is expecting a 20% bump in revenue in 2022. (Link)

Biz Hits

Partnerships: Humana is expanding its partnership with PE firm Welsh-Carson over its primary care senior clinics into 12 more states. I feel as if this partnership, announced in 2020, is somewhat in the radar, but it’s gaining serious traction. (Link)

It’s Over: Providence is ending its affiliation with Hoag at the end of January. (Link)

M&A: Revenue cycle operator R1 RCM is acquiring Cloudmed, a fellow revenue cycle management platform, for $4.1 billion, or about 2.5 Transcarent’s. Chump change. (Link)

M&A: Convey Health Solutions is acquiring HealthSmart International, a home health supplemental benefits company, for $77.5 million. (Link)

M&A: Circulo, a startup focused on the Medicaid population, acquired Huddle for an undisclosed sum. (Link)

Partnerships: Here’s an interesting little announcement – HCA Healthcare is partnering with Diana Health – a maternal health startup – to open a location inside of one of HCA’s facilities. Women’s health space is heating up. (Link)

Retirement: Amedisys’ Paul Kusserow is retiring from his CEO Role after about 7 years in the role. (Link)

Fierce JPM Week: I thought this was an interesting read on Verily and a dive into its 2022 strategy and expectations from JPM 2022. (Link)

Fundraising: Wheel raised $150M in to continue its investments in virtual-first care. (Link)

M&A: IBM finally sold Watson Health to a private equity firm for about a billion. (Link)

Policy Hits

CMS: After a long, drawn out saga, Medicare has decided to limit the coverage of Biogen’s controversial Alzheimer’s treatment Aduhelm to JUST clinical trial patients (AKA, only if patients are enrolled in ongoing trials). As a result of the significant coverage decrease, lawmakers are now pressing CMS to reduce Part B premiums. (Link)

Covid Response:

- The Biden Admin is giving away 400 million masks to Americans. (Link)

- You can now order at-home COVID tests thru the government…2 years in to the pandemic. In true infomercial fashion: “limit 4 per household.” (Link)

Medicaid: Georgia sued the Biden Administration this week, saying CMS pulled a bait and switch on them after previously approving their proposal for Medicaid work requirements (under Trump) and then revoking that proposal (under Biden). (Link)

Imbecile: Fauci called a GOP senator a ‘moron’ during testimonies last week. I couldn’t help but include it. (Link)

SCOTUS: Gear up for the next Roe v. Wade challenge in the Supreme Court. Here’s an explainer for the challenge from Mississippi. (Link)

BBB: Here’s a good read from the Commonwealth fund on how the Build Back Better Act might improve ACA coverage. (Link)

Other Hits

Interoperability: How interoperability, increased reimbursement options will drive digital health in 2022. (Link)

Free Shkreli: Martin Shkreli was ordered to pay $65 million in fines and was banned for life from the Pharma industry after his wire fraud antics. Oof. (Link)

Hot Takes

Violations: Instagram pulled an ad from mental health unicorn Cerebral (a close peer of Lyra) after the ad depicted a woman who was essentially ‘cured’ from impulsive eating by taking ADHD medication. I have a feeling that over-prescribed ADHD medication will continue to be a thing for a long time to come. (Link)

Healthy Muse Top Picks

Packy’s Not Boring took a deep dive into Oscar, albeit from more of a techy perspective. Keep in mind this is a sponsored post, so the bull case is presented pretty nicely – but no real challenges or bear case was presented. Still a good overview of what Oscar does. (Link)

Health Systems: This dive into health system incentives showed that fee-for-service, at least for the foreseeable future, is here to stay. (Link)

Headspace: This was an interesting watch from THCB about Headspace’s merger with Ginger and its go to market strategy, and where it positions against the Lyra’s of the world. (Link)

Shortages: You should be aware by now of the staffing shortages going on nationwide, but especially in healthcare. Here’s a good read from NPR on how it’s affecting nursing homes. (Link)

LifePoint and Scion: This was an insightful read into the integration between LifePoint Health and Scion Health. It sounds like all systems are a go at the combined organizations. (Link)