healthy muse healthcare news.

- This week in healthcare: the Oncology Institute SPAC, Dollar General’s foray into healthcare, Florida medical group fire sales, VillageMD’s expansion plans, Walmart’s new low-priced insulin, Amedisys’ hospital-at-home acquisition of Contessa, and a host of policy updates.

Dollar General’s foray into healthcare.

Dollar General hired a chief medical officer and announced its intention to add healthcare products to its stores.

- Details: Dollar General has been on a growth TEAR lately – the retail discount store has over 17,400 stores mainly in rural areas. In this move, Dollar General aims to increase foot traffic at its stores by offering staple healthcare products like cough medicine and other nutritional products. Over time, Dollar General plans to expand this healthcare offering and hopefully continue to address the accessibility gap in rural healthcare. (Link)

The latest SPAC: the Oncology Institute

SPAC: Following in the footsteps of Cano, Babylon, and other value-based care providers, the Oncology Institute is being taken public via SPAC as the first value-based care oncology (cancer care) business. The transaction values TOI at an enterprise value of about $840 million (Press Release)

- About the Biz: According the prospectus, the Oncology Institute operates out of 50 locations in four states, primarily in California. The firm did about $155 million in revenue in 2019 and expects to achieve about $350 million in 2022 through value-based partnerships with payors and expansion into ancillary service lines like pharmaceuticals, clinical trials, and M&A. (Investment Prospectus)

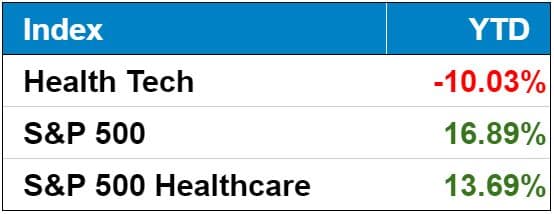

public market update.

Top 3 weekly performers: Doximity, LifeStance, Phreesia

Bottom 3 weekly sandbaggers: Skylight Health, Talkspace, Clover. A majority of the HTI was in the red this past week and month.

- Full List YTD performance: (Link)

Encompass’ spin-off news is heating up as the company considers taking its home health and hospice segment public. (Link)

Cano Health bought Doctor’s Medical Center for $300 million, an 18-clinic Miami practice at a smooth 13.6x trailing EBITDA. (Link) (Link to 8-K)

Caremax bought DNF Medical Centers for $110 million – 4,000 members and expanding its presence in Florida as well. (Link)

Bright Health’s NeueHealth purchased Centrum Medical Holdings. Per the press release, NeueHealth is now responsible for 78 risk-bearing clinics and serves 160k members under value-based arrangements. The firm has plans to expand into Texas and North Carolina soon. (Link)

Biz Hits

VillageMD: The primary care operator in conjunction with Walgreens plans to open 29 primary care practices in Texas this year. (Link)

Walmart unveiled a low-price private insulin offering in a partnership with NovoLog. According to the presser, the new drug is expected to save customers 58% to 75% off cash price of similar insulin product and will be available at Walmart pharmacies and Sam’s club pharmacies mid-July. (Link)

Hospital at Home: Amedisys purchased Contessa Health, a provider of hospital and skilled nursing at-home services, for $250 million. With the acquisition, Amedisys estimates that its total addressable market just drastically increased from $44 billion to $73 billion. We’ve touched on before that the hospital-at-home market is a hot one as higher acuity patients get served in their homes rather than in facilities. We’ll see if the lofty growth expectations come to fruition! (Link to Press Release)

- This was a good write-up from HHCN on the strategic benefits of the acquisition. (Link)

Private Equity: Tim Schier’s summary of private equity’s involvement in physician practices was a great look at the history and future prospects of physician practice management in the PE space. (Link)

Money: Rock Health’s latest digital health funding report shows that $14.7 billion in investments flooded the sector in the first quarter of the year. Absolute insanity. (Link)

Amazon: The retail giant isn’t going away, as Business Insider reported this week that Amazon Care is approaching large health insurers about contracting to expand coverage. An interesting pivot. (Link)

Policy Hits

CMS Proposals. What you need to know.

- Home health: CMS is proposing a 1.7% payment bump to home health agencies and continues to expand its value-based purchasing program. (Link)

- ACA Enrollment: CMS plans to significantly expand the ACA enrollment period to begin on Nov 1 and end Jan. 15. (Link)

- Dialysis: CMS released a proposed rule for dialysis that further incentivizes home-based dialysis treatments, including adding a payment provision for health and socioeconomic disparities. (Link)

Updates on price transparency, surprise billing, and site-neutral payments.

- Antitrust: Biden issued an executive order last week, directing the Justice Department and FTC to increase scrutiny on hospital and other healthcare mergers – which could also extend to private equity M&A activity. (Link). Of course, provider groups and hospitals opposed the order, stating that M&A is already heavily regulated and that this directive adds unneeded, redundant scrutiny. (Link)

- Surprise Billing: CMS unveiled surprise billing guidance for the rollout of the No Surprises Act slated to take effect in January of 2022. While the rule does ban surprise billing, the code appears to have scant details so far on the arbitration dispute resolution process. (Link)

- Price transparency: NPR published an article on KHN’s findings related to what hospitals are posting for common prices online. Takeaways – prices vary widely, and procedure mapping isn’t straightforward. But it’s a step in the right direction. (Link)

- Site Neutral: In a blow to hospitals, the Supreme Court declined to hear the AHA’s appeal related to site-neutral payments. As a result, site neutral payments – or, payments regardless of the site of care – will stay in place per the July 2020 appellate court’s decision. (Link)

Everything Drug Pricing.

Now that the U.S. (hopefully) continues to turn a new leaf after the pandemic, drug pricing rhetoric is returning to Capitol Hill. Here are some key developments you should probably know about:

- Pfizer is in court over its extremely expensive heart failure medication. The biotech giant argues that it should be allowed to pay Medicare beneficiaries’ out of pocket costs for administration of the drug, which lists at $225,000. This type of ‘kickback’ is currently illegal.

- Bigger picture: If Pfizer were successful in this court case, the floodgates may open to allow other biotech firms to do the same with out of pocket costs. This move would likely raise Medicare’s drug bill substantially. (Link)

- 340B: While the Supreme Court declined the site neutral case, it WILL hear the arguments surrounding the clusterbomb that is the 340B program. (Link) Here’s a good overview of the 340B program (Link)

Other Hits

Physicians: The physician consolidation trend picked up during ‘Rona:

- 49.3% of physicians are now employed by health systems

- 20.0% of physicians are now employed by corporate entities

The acceleration in consolidation between 2020 and 2021 is crazy and will only continue. (Link)

Discharge Destinations: This was a solid overview from Trella Health on post-acute discharge trends and how those changed during COVID. (Link)

Opinions

Mortality: This was an insightful tweet thread from Bloomberg on mortality rate trends for Americans and how they’ve been declining since 1950. (Link)

Primary Care: Should primary care be decoupled from insurance and be offered as a public service? (Tweet Thread)

Bias: What happened when a ‘wildly irrational’ algorithm made crucial healthcare decisions. (Link)

Policy: Here’s a highly opinionated piece detailing a potential ‘conservative’ healthcare plan which would essentially create a more intense version of an HSA for every American. Interested to hear my readers’ thoughts on such a different proposal, feel free to reply to this e-mail to share. (Link)

Healthy Muse Top Picks

The Alzheimer’s Drug: I’ve been seeing a lot of controversy and scandal surrounding Biogen’s Alzheimer’s drug, Aduhelm – how Biogen received accelerated approval despite mixed trial results, and more. Here were some of my favorite articles surrounding the topic:

- Did The FDA Mess Up With Aduhelm? (Out of Pocket)

- Background – FDA calls for investigation into controversial Alzheimer’s drug approval. (Link)

- Aduhelm approval controversy dials up as FDA seeks probe. (Link)