healthy muse healthcare news.

- This week in healthcare: Direct contracting gets controversial, the DOJ targets United/Change deal, Teladoc unveils a new chronic care program, VillageMD’s expansion, Q4 earnings releases, and more

The Direct Contracting Debacle and a Value-Based Setback?

Disarray: All of a sudden, Medicare’s Direct Contracting (”DC”) program, a new risk-based capitation model for primary care unveiled by the Center for Medicare and Medicaid Innovation (CMMI) in 2020, is under attack by a progressive consortium of policymakers.

- What’s DC? At a high level, the program allows primary care providers operating in Direct Contracting Entities (’DCEs’) to take on risk voluntarily – through monthly lump sum payments – for their Medicare fee-for-service patients. So, CMS and the DCE get to streamline administrative $$$, the DCE pockets a bit more cash if risk is successfully managed, and the patient stays on traditional Medicare as opposed to MA. The program is only open to about 50 of these direct contracting entities so far while kinks are ironed out and public commentary is received.

- TL;DR: CMS contracts with PCP providers. Seniors on traditional Medicare keep traditional Medicare insurance while the primary care provider entity (the DCE) gets paid per member per month for that beneficiary behind the scenes. Goal of the program = reduce costs, increase quality of care, move toward value-based arrangements.

The Attack: The cohort of progressives, including Elizabeth Warren, sent a letter to HHS accusing the payment model of catering to ‘corporate profiteers.’ They assert that the DC model will only serve to further privatize Medicare, which might result in reduced choice for traditional Medicare beneficiaries.

- There’s some other nuanced concerns in there too, like taking advantage of risk score adjustments (fair) and that the entities are able to pocket more $$$ if care is managed effectively. Here’s a good write-up of the specific grievances from Fierce: (Link)

The Defense: Of course, the letter attracted a frenzied response. Over 200 healthcare entities ranging from Intermountain, agilon, Babylon, a multitude of ACOs, and more, signed a letter urging HHS to ‘Plz fix, thx’ the program instead of ending the program altogether, arguing that ending any sort of pioneering program like this would severely affect the value-based movement as a whole. (Read the Letter Here)

Hot Take: I find the take by progressives pretty perplexing considering DCE is one of the largest tailwinds powering value-based care in the U.S. – a model that has at least shown promise in predictable cost control for a nearly bankrupt Medicare trust fund.

- Progressives of all people should want to test out new things in healthcare, even if there are kinks in the model currently.

Still, this rhetoric is not going to go away – I’m seeing headlines all over the place, like ‘Medicare privatization experiment puts Ohio seniors at the mercy of for-profit entities.’ As if damn, they forgot the entirety of healthcare is already for-profit. Let’s do some research here folks and at least attempt to align profits with quality incentives.

- This is a pioneering program in Medicare and one that needs to continue forward in some form. The progress of value-based care and related payment models depends heavily on CMMI and Medicare. There’s too much momentum (and funding) in the space to back out now.

- Keep an eye on the tweaks and mutations of the direct contracting model, because it heavily affects the prospects of companies like Privia, Oak Street, One Medical, and health systems who manage large Medicare populations or are in the value-based care space.

Handy resources & perspectives:

- Olivia Webb wrote a solid overview of the direct contracting program here. She does the best job possible explaining all of the relevant nuances. (Link)

- Here’s a viewpoint in opposition to direct contracting. (Link)

- What do you think? If you have a perspective, I’d love to hear it.

DOJ brings down the hammer on UnitedHealth – Change Healthcare Deal

Antitrust: After what seems like an eternity since the transaction was announced, the DOJ is allegedly planning to sue to block the $13 billion United / Change Healthcare deal.

- Background: The merger announcement brought intense opposition from the AHA and other provider interest groups, claiming that an acquisition of Change would give UNH unprecedented access to data that would cause anticompetitive practices. The DOJ is sympathetic toward those concerns and has a keen eye on M&A in general across most industries. (Link)

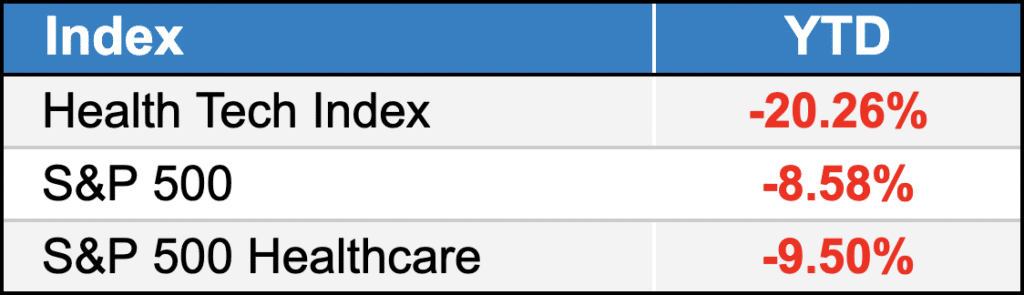

public market update.

Top 3 weekly performers: GoHealth (+16%); P3 Health Partners (+15%); LifeStance (+11%)

Bottom 3 weekly sandbaggers: Clover (-19%); Oak Street Health (-18%); Augmedix (-17%). Lots of volatility in the market. I’d expect that to stay for a while.

- Full List YTD performance: (Link)

Digital Health:

$TDOC: Teladoc unveiled a new chronic care primary care program this week. Called Chronic Care Complete, the offering will help patients with conditions like diabetes and high blood pressure. Say what you will about the stock performance, Teladoc is still the top dog in virtual care. (Link)

$HIMS: Hims announced a partnership with GNC Wellness this week to offer certain wellness products inside of GNC stores. (Link)

Medical Devices:

$OM: Dialysis at-home device maker Outset Medical shot up after posting its Q4 earnings and a solid revenue beat as well as an upbeat 2022 forecast. (Link)

$HLTH: Remember that one Super Bowl commercial about the at-home COVID test? Cue Health is partnering with Cardinal Health on distribution of that bad boy. (Link)

Services:

$CYH: Community Health dropped after releasing Q4 earnings that showed weak admissions growth. Interestingly, the hospital operator did signal expectations for lower travel / contract staffing costs later on in 2022. (Link)

$EHC: Encompass opened a new inpatient rehab facility in Southern Illinois as it continues its quest to gobble up IRF market share. (Link)

$MD: Despite a seemingly solid Q4, Mednax shares dropped this week after reporting earnings. (Link)

Biz Hits

Trend Watch:

- VillageMD: Not only is Walgreens’ VillageMD planning to open 200+ co-branded clinics this year, the primary care operation just bought chronic care management company Healthy Interactions. Look for an IPO from VillageMD in 2022 or 2023 as the company benefits from COVID testing and direct contracting tailwinds. (Link)

Strategy & Partnerships:

- St. David’s Healthcare in Austin is planning a nearly $1 billion expansion to fund new hospitals and other initiatives as the city outgrows its current infrastructure. (Link)

M&A:

- Antitrust: The FTC is now trying to block the previously announced merger between Care New England and Lifespan Health after the Rhode Island attorney general noted market power concerns related to the tie-up. (Link)

Fundraising:

- Ro: Everyone’s favorite DTC ED company Ro completed a $150 million internal fundraise and is now valued at $7 billion. Would love to see some financials here. (Link)

Policy Hits

Masks: The CDC is expected to update its mask guidance soon to focus on hospitalizations rather than case numbers. (Link)

Reimbursement: After discussing mental health in recent weeks, Senators are now mulling the idea of increasing reimbursement rates to alleviate mental health provider shortages. Amazing what some money can do to increase the workforce supply. (Link)

Other Hits

Shortage: The national guard is now filling in as nursing assistants amid nationwide shortages. Is there an end in sight here? (Link)

FDA: Biden finally managed to get an FDA nominee through Congress – Robert Califf. (Link)

Hot Takes

They’re all above 🙂

Healthy Muse Top Picks

Platforms: This was a good read on Amazon’s ability to deploy platforms in healthcare. I personally believe they’re the best positioned to do so as far as Big Tech is concerned. (Link)

MA: The Commonwealth Fund wrote a great overview of Medicare Advantage, including how the risk adjustment program works for payers. Highly recommend glancing at this just to understand the inner workings of MA. (Link)

VBC: Health Affairs wrote a great 2-part series on a single-payer system that already exists in the U.S. – Maryland – and takeaways we can mirror in value-based care payment models. Very timely!(Link)

- Along with the above, I enjoyed this piece from TCHB about value-based care and lessons from the pandemic. (Link)

- Final piece on value-based stuff this week – the Keckley report also dove into what to expect for value-based care in 2022 and gives some insightful context for previous value-based initiatives in healthcare. (Link)