healthy muse healthcare news.

This week in healthcare: Pear Therapeutics and P3 Health Partners go public, Omicron, a major digital health selloff, CVS partners with Microsoft on digital health, and more

Pear Therapeutics goes full SPAC

Therapy: Digital therapeutics firm Pear Therapeutics began trading on the public markets on December 6 after its previously announced SPAC with Thimble Point Acquisition Corp.

- The details: Pear Therapeutics is expecting $4 million in revenue this year and went public via SPAC at a $1.6 billion valuation. Yes, you read that correctly. Investing in Pear is very similar to investing in an early stage biotech firm developing a potentially game-changing drug. Digital therapeutics are on the cutting edge of digital health

- Link to initial press release. (Link) Link to 12/6 press release. (Link)

- Shockingly, I can’t seem to find any sort of investment prospectus or investor presentation related to this acquisition. It’s likely coming soon, but nothing currently on the Pear website or SEC EDGAR system.

P3 Health Partners hits the public markets

New VBC Comp: P3 Partners, a physician enablement, population health management platform, is going public via SPAC with Foresight Acquisition Corp. at a $2.3 billion valuation. The announcement was back in May, meaning this press release was one of the few I’ve missed since starting the Healthy Muse…ugh.

- About P3: Similar to peers ApolloMed and Privia Health, the firm aims to enable physicians to take on value-based contracts and remain in independent while providing back-office support and electronic health platforms to make their lives easier. (Link)

What to know about Omicron.

Greek: In what has become the slowest way to learn the Greek alphabet, the WHO sounded the alarm about Covid’s next figher: the Omicron variant. (Link)

- According to South African officials, the new variant is ‘very different’ from its predecessors. That doesn’t mean the vaccine won’t protect you, though. In fact, Scott Gottlieb pointed out that those with booster shots will likely be highly protected from Omicron. We’ll stay updated as the world learns more about the latest variant. (Link)

- The variant has been found in at least 10 states so far, which probably means it’s everywhere, right? (Link)

- It’s possible that the variant may cause less severe Covid, according to early indications from South Africa data. (Link)

public market update.

Top 3 weekly performers: LifeStance (+9.61%, InnovAge (+9.20%), DocGo (+4.97%)

Bottom 3 weekly sandbaggers: Clover (-20.52%), ApolloMed (-20.12%, 23andMe (-16.30%)

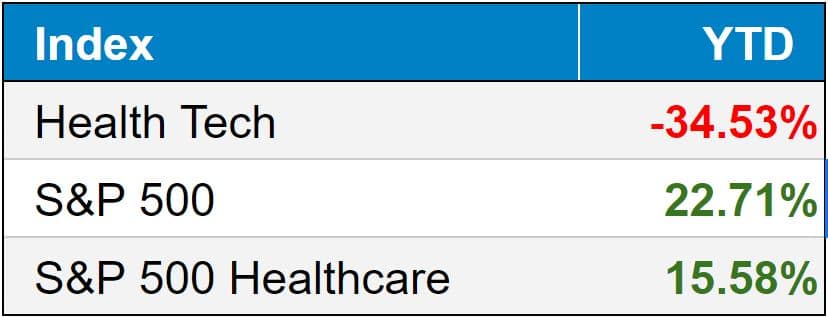

- Of note, the entirety of digital health and related firms sold off in droves over the past couple of weeks, which is creating a VAST disconnect between publicly traded valuations and privately held valuations. My prediction is that we see fewer digital health firms go public next year unless there’s a major narrative shift here.

- Full List YTD performance: (Link)

$AVAH: Aveanna Healthcare acquired home health operator Comfort Care for $345 million. More recently, the publicly traded firm bought Accredited Nursing Services for $180 million not including post-acquisition incentives. Some big acquisitions from the home health operator. (Link)

$UHS: Hospital operator Universal Health Services partnered with Riverside Medical Clinic, a 180-doc group in California along with an MSO affiliation. (Link)

$UNH: UnitedHealthcare held its investor day and Health Tech Nerds had a great write-up in their weekly post. (It’s not quite published on their site yet). Most notable – UNH is expecting $317 billion in revenue for 2022 and expects Optum to become the face of the company. (Link)

Biz Hits

Drug Pricing: Axios revealed some documents in its latest article about drug pricing and how closely held to the vest a wholesale drug distributor keeps its pricing. Very informative and concise in true Axios fashion. Also, the entirety of drug pricing is just insane. (Link)

M&A: Post Acute Medical, a post-acute care (ha) operator acquired 8 LTACHs and 8 IRFs from Curahealth and Nautic Partners across a broad array of states. As I’ve touched on before, the post-acute market is experiencing a huge land grab amidst consolidation in home health, hospice, inpatient rehab, and other settings. (Link)

Uber: Hims & Hers announced a partnership with Uber to deliver personal care products. Looks like you can get your ED pills and condoms together now, which make sense as a package deal? (Link)

Best Buy: As Best Buy diversifies its revenue a bit, the retail giant disclosed that it paid around $300 million for Current Health, a remote patient monitoring firm. Makes sense when you think about the synergies with Geek Squad and other in-home services there. But it really seems like BBY is keeping one toe in the healthcare water while otherwise focusing on optimizing its core biz. Hmm. (Link)

M&A: In an interesting merger announced November 24, Clinigence, a population health management firm and Nutex, an operator of micro-hospitals and hospital outpatient departments, will merge to operate 19 facilities in 8 states. It’s a super under the radar but interesting transaction in what combines a future-ready platform with a hospital services business. (Link)

VBC: Humana and Allina Health expanded their value-based care partnership in Minnesota. (Link)

RPM: Carbon Health becomes the latest digital health firm to jump into remote patient monitoring by launching a continuous glucose monitoring program for diabetics. (Link)

Digital: CVS inked what appears to be an extremely robust tech partnership with Microsoft to accelerate its ‘digital-first’ strategy across all of its services. It really appears as if Microsoft is taking a behind-the-scenes approach to entering healthcare by building out infrastructure and partnering with firms like CVS, Teladoc. (Link)

Competition: In what seems like a move into GoodRx’s space, Express Scripts announced a partnership with Amazon through the launch of ESRX’s new prescription discount card. Members can then access Amazon Pharmacy’s pricing and look at discounted options through that interface. (Link)

Policy Hits

Roe: The Supreme Court heard arguments Dec. 1 in a case from Mississippi that tests whether all state laws that ban pre-viability abortions are unconstitutional. The NPR link was very handy in providing background into what’s at stake here. (Link)

Reimbursement Stuff.

- 2022 Fee Schedule: My firm wrote up a great summary of the key changes in the 2022 Physician Fee Schedule. (Link)

- CMS is slashing reimbursement for certain common lab procedures. (Link)

- Hospitals lost the fight to delay Medicare sequestration further, in a similar vein to the lab reimbursement cuts above. (Link)

- 340B: I’ve mentioned this case a few times, but keep an eye on the 340B ruling. The American Hospital Association is suing HHS over HHS’ decision to cut drug reimbursement to hospitals who were 340B eligible, meaning that they get favorable rates for drug purchases. Check out the Weekly Gist’s great infographic here on what’s at stake. (Link)

Relief Funding Updates:

- HHS is rolling out over $7 billion to rural healthcare providers from the relief funding pool sourced from the 2020 CARES Act. (Link)

- The Biden Admin announced a $1.5 billion plan to train about 23k new healthcare workers to help alleviate shortages. (Link)

Other Hits

Hacked: As if abortion weren’t in the news enough, a ransomware attack stole 400,000 patient records from Planned Parenthood. (Link)

Data: Medicare telehealth visits increased 63-fold from 2019 to 2020. (Link)

Mandates: After courts issued temporary injunctions on imminent vaccine mandate deadlines, major hospital operators have paused their company-wide mandates to alleviate staffing pressures. (Link)

Halo: In a nod to Pear therapeutics and digital therapeutics in general, scientists are developing video games to diagnose and monitor depression. It’s interesting – a kid’s tendencies in a video game or what they choose are probably more telling than what they put on a survey or what they tell mom or dad. (Link)

Opinions

Post-Acute: It’s not often that you get an opinion piece about post-acute care! The article dives deeper into why ‘systemness’ in post-acute care (aka, more scale) can be a good thing. (Link)

Private Equity: Here’s another thoughtful write-up from the NEJM about how providers can successfully partner with a private equity firm to achieve healthcare objectives – choosing the right investors, making sure incentives are aligned from a financial and operational standpoint, and define what success means for both organizations. (Link)

PAssistant or PAssociate? In what I would consider the most petty drama of this week’s healthcare news, physician assistants are fighting for a title change to physician ‘associates.’ I personally cannot believe this has made the news. (They should all be called APPs or physician extenders anyway.) (Link)

Healthy Muse Top Picks

Patents: This was a great insight into how pharma companies can take advantage of the patent system to maintain their drug exclusivity (looking at you, Humira) – (Link)

Digital Health: Rock Health released its list of top 50 firms in digital health and it’s a great way to dive into the landscape and see the companies changing the healthcare landscape. (Link)

Child Care: Bloomberg covered the broken industry of child care. If you have any free articles left, know how to delete cookies, or are a BB subscriber, it’s a solid read. (Link)