healthy muse healthcare news.

- This week in healthcare: SOC Telemed goes private, Privia closes a major partnership with Surgery Partners, Humana starts its hospice sale process, hospital staffing issues, Athelas raises $132 million, and more.

SOC Telemed Goes Private for $300 Million

The first domino: After going public via SPAC at about a $720 valuation 15 months ago, SOC Telemed will be bought out and taken private by Patient Square Capital.

- Details: The healthcare investment firm announced its intention to purchase SOC Telemed at a 366% premium to its share price on February 3rd, or about a $300 million enterprise value at $3.00/share. For all you smart folks out there, that’s a 60% decay in value in one year.

- SOC’s stock price had tumbled from $8.33/share one year ago to $0.64/share prior to the announcement and is now trading just under the take-private price. It makes sense that the board unanimously jumped on the opportunity to go private in the market’s current state.

- The firm still has attractive assets, so it makes sense why someone wanted to buy them out. SOC Telemed bought Access Physicians, a specialty telemedicine provider, for $194 million or 2/3rds of its take private price (lol) back in April 2021.

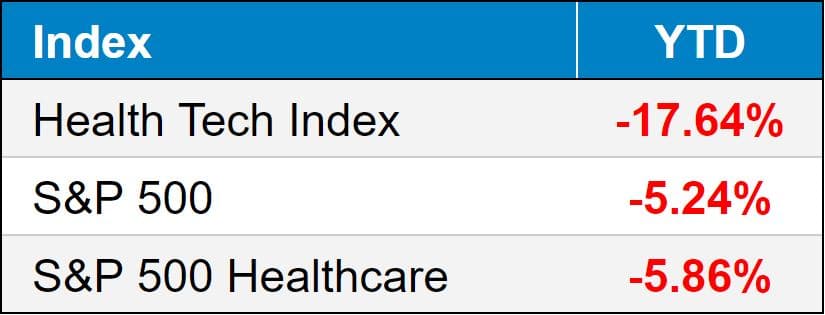

Bigger Picture: If you’ve been following the Health Tech Index for any period of time, SOC Telemed isn’t the only publicly traded digital health company suffering in the markets. We’re going to see some more activity here in 2022 & 2023 or I’ll sell my newsletter. (Link)

Privia Health becomes a Surgery Partner

Strategy: Surgery Partners announced a strategic partnership with Privia Health on February 3rd.

- How it works: Privia will buy into Great Falls Clinic, a physician practice wholly owned by SGRY. The buy-in will give Privia the ability to expand in the Montana market, acting as Privia’s ‘anchor practice’ in the state (65 providers, 24 specialties). The two companies will also establish a management company, of which Privia will be the majority owner.

- Bigger picture: Privia’s primary pursuit is to transition traditional fee-for-service practices into value-based arrangement in order to take on risk. Surgery Partners is a significant partner to have, so keep an eye on future announcements between the two firms. (Link)

public market update.

Top 3 weekly performers: SOC Telemed (+366%); Skylight Health (+26%); GoodRx (+20%)

Bottom 3 weekly sandbaggers: The Pennant Group (-8%); Babylon (-7%); GoHealth (-7%)

- Full List YTD performance: (Link)

Health Tech:

$HIMS: Hims & Hers launched a new line of mental wellness supplements this week. (Link)

SPAC: Interesting little tidbit here…Healthcare Merger II, a SPAC, withdrew its plans to go public. The folks behind this SPAC also took SOC Telemed public…so I wonder if there’s a connection there or if nothing is attractive enough valuation wise to take public. (Link)

Payors:

$HUM: Humana finished up on the week after announcing its intention to invest $1 billion into its Medicare Advantage biz. (Link)

- Another interesting tidbit from this week – Humana is looking to offload Kindred’s hospice segment and fetching a multiple reportedly up to 12x EBITDA, implying around $3 billion purchase price. (Link)

Services:

$MD: Mednax is buying a pediatric specialty chain of urgent cares – Night Lite Pediatrics, a 13 location biz in Florida. (Link)

$AMED: Amedisys is acquiring Evolution Health to reboot its M&A aspirations. (Link)

$ADUS: Addus HomeCare completed its acquisition of JourneyCare Hospice. (Link)

Biz Hits

Trends to know: The name of the game in Q1 so far has been STAFFING.

- Nursing shortages across the country are causing hospitals to look internationally for staff. (Link)

- Staffing firms are under fire as industry groups accuse them of profiteering. (Link)

- Hospital margins are suffering, per Kaufman Hall. Pretty much every services based business is concerned with staffing shortages. (Link)

Strategy:

- Data firm Komodo Health partnered with the Chan Zuckerberg Initiative this week. The data analytics and AI startup is allegedly looking to go public within the near future. (Link)

- Uber Health is building out a “one-stop shop” for health logistics. Shocking. (Link)

- Cigna is trying to find ways to grow synergies between its payor and provider division (Evernorth), identifying areas including behavioral health. (Link)

- CVS is partnering with clinical research company Medable to expand access to clinical trials in their stores. (Link)

Funding:

- RemotePM: As Athelas announced its $132 million fundraising round, valuing the company around $1.5 billion, the remote patient monitoring space is receiving troves of cash from venture capitalists. (Link)

M&A: A few notable deals & rumors this week…

- Spectrum Health and Beaumont Health completed their 22-hospital merger on February 1st. The new system will be temporarily named BSHS Health until they spend an ungodly amount of marketing dollars on a spunky new name likely ending up with a circular logo and a sans serif font. (Link)

- PointClickCare bought Audacious Inquiry to expand their care coordination network. (Link)

- Over on the Biotech side, investment firms Blackstone and Carlyle are in talks to jointly take over Novartis’ generic drug unit, in what would be one of the largest buyout deals in recent memory – around $25bn. (Link)

- Calm acquired fellow health tech startup Ripple Health Group, which seems like a health tech development co. Calm will reportedly use Ripple to build out its new B2B product offering, Calm Health as well as future products. (Link)

- Physician staffing firm US Acute Care Solutions acquired Alteon Health – forming a huge practice of post-acute care providers (9 million patients, 500 programs, 25 states). My bet is on at least a handful of PE backed physician practice platform co’s going public in 2022/2023 and my guarantee is that the multiple here was in the double digits. (Link)

Policy Hits

Fact Sheet: CMS released its 2023 proposed MA fact sheet this week. Based on a risk score trend increase of 3.5% and general reimbursement increase of 4.75%, among other items, the total adjustment for 2023 is expected to be around 8% (inflation am I right). (Link)

Telehealth Waivers: Lots of different organizations are requesting for Congress to extend the current telehealth waivers through 2024. Current telehealth waivers only exist as part of the public health emergency. (Link)

Mental Health: In the first hearing in more than a decade on mental health, Congress is tackling behavioral health inequities and other mental health related topics. Makes you wonder if mental health funding will be part of a future stimulus package. (Link)

- Related: A somewhat unfortunate side effect of the No Surprises Act – mental health providers are asking to be exempt from the bill, since the price transparency provision surrounding Good Faith Estimates disproportionately affects mental health providers over most other providers. (Link)

Other Hits

Bennies: Here’s a rising workplace benefit: Fertility services. (Link)

Physicians: This was a short data-driven read from the Definitive blog into the physician shortage. (Link)

Coverage: As internet access limits telehealth’s reach, insurers are starting to cover the bill. (Link)

Hot Takes

TCHB: Spotify, Joe Rogan, and Health Care. (Link)

Debates: An interesting back and forth on certain Medicare Advantage assertions in the Health Affairs blog. (Link)

MA: Gotta hear all sides.. The Dark History of Medicare Privatization. (Link)

What’s next for digital mental health companies? (Link)

Healthy Muse Top Picks

Shkreli: The annual Shkreli Awards are here (#FreeShkreli) with a list of some bad actors in healthcare from 2021. (Link)

MA: Medicare Advantage, Call Centers, Startups, and the rapidly evolving space. (Link)

Watson: A great read from Slate – How IBM’s Watson went from the future of healthcare to sold off for parts. (Link)