healthy muse healthcare news.

- This week in healthcare: Digital health deal-making begins with several suitors, Amazon Care expands nationwide, Doximity, Oscar, CVS, and more earnings, Tenet continues its outpatient expansion, telehealth expansion in Congress gets major progress, and more.

The Digital Health Consolidation Tsunami.

Tremors in the Water: As we’re now well underway into 2022, deal-making is just getting started. Several digital health and other mergers have been announced in recent weeks, all between players making strategic acquisitions. Firms are now realizing that offering one specialized endpoint solution isn’t enough anymore:

Specialized telehealth firm Thirty Madison and remote prescription drug firm Nurx are merging into one platform caring for about 750k ‘active’ patients and $300 million in revenue.

- There doesn’t seem to be much overlap between the two as far as patients are concerned, so I imagine the combined co now has a much larger patient base to cross-sell, larger scale to negotiate with payors, and a more attractive offering to sell to employers. (Link)

Doximity bought Amion for $82.5 billion, continuing to offer lots of useful products for physicians to bolster its ridiculously profitable advertising biz

Signify Health bought Caravan Health for $250 million (including payout incentives) to help it create an “end-to-end suite of value-based care” tools (notice a theme here?). Caravan will give SGFY access to 200 health systems and 3k providers. (Link)

Bottom Line: Digital health is no longer immune to the wave – or, rather, tsunami – of consolidation happening widespread in healthcare. This trend is just getting started as frothy private valuations fall apart, rates rise, and savvy competitors snap up the strategic pieces to create attractive offerings. (Link)

Something you’ll probably read at least 20 times over the next few years: “This acquisition is just the beginning of our evolution toward a holistic, end-to-end care model…”

Amazon Care isn’t going away.

Scaling: After reshuffling some of its executive team on the pharmacy side and naming a former head of Amazon Prime to grow its healthcare biz, Amazon announced this week that the retail giant is expanding its virtual care services nationwide. (Link)

- Details: Amazon Care will also offer a hybrid service offering (AKA, in-person and virtual) to 20 more cities this year. Basically all of the big ones. Amazon is also growing its contracted employer base by tacking on Silicon Labs and Hilton Hotels. No, I’m not counting Whole Foods in there. Amazon putting that in their press release as a badge of honor is essentially the same thing as saying that I sold my car to my wife…who happened to need a car.

Steady: Amazon is slowly scaling its health operation outside of its existing employee base and seems to be hyper focused on the consumerization of healthcare, which is the retail giant’s bread and butter. I wouldn’t be surprised to see a Pharmacy-Care-future health related offering as a tack-on to your normal Prime subscription within the next few years.

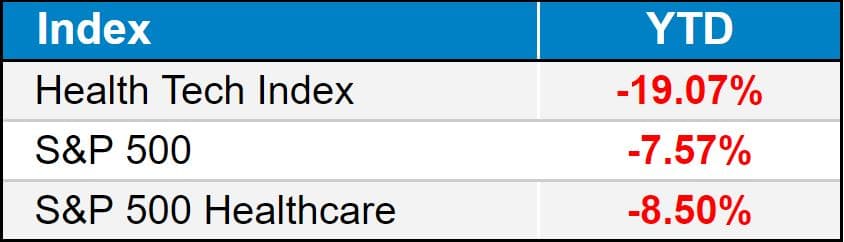

public market update.

Top 3 weekly performers: Doximity (+23%); Augmedix (+21%); Agilon (+20%)

Bottom 3 weekly sandbaggers: GoHealth (-22%); Convey (-9%); Aveanna (-9%)

- Full List YTD performance: (Link)

Health Tech:

- $DOCS: Along with its announced acquisition of Amion, Doximity blew its earnings out of the water. The digital pharma advertising firm is expecting revenues of $450 million (which is probably conservative) and adjusted EBITDA margins north of 40%. Amazing what you can do when you have a highly valuable audience (like you guys!) (Link)

- $TRHC: Ironically, Tabula Rasa is divesting its non-core assets, including DoseMeRx. (Link)

Services:

- $THC: Tenet continues to build out its outpatient ambulatory surgery center biz through USPI and is scaling quickly through acquisitions. The hospital and outpatient giant announced the acquisition of 30 more facilities from SurgCenter Development expected to take place this year. (Link)

Payers:

- $CVS: CVS, the diversified healthcare behemoth, reported its full-year 2021 earnings this week. While ACA enrollment was lower than expected, CVS shed light on several new services initiatives, including a more intentional move into home health, potential acquisitions or build-outs of management services for primary care, and more. (Link)

- $OSCR: On Oscar’s 2021 earnings call, analysts seemed to be pleased with the G&A expense management. Also lots of conversation related to the +Oscar platform and the opportunity there with Medicare Advantage. (Link)

- $BHG: Bright Health’s CEO is stepping down next month. Current CEO Simeon Schindelman will resign effective March 11 and will be replaced in the interim by CFO Jay Matushak. (Link)

Biz Hits

Trend Watch:

- Sky High: Record high valuations are causing deal-makers to get creative in how firms are getting acquired…earn-out provisions? More? Exits are getting out of hand. (Link)

- Competition: Larger managed care players are losing Medicare Advantage market share to smaller challengers like Oscar, Devoted, and Bright. This is a good thing. (Link)

- Plastic: Remote work and social media are creating a plastic surgery boom…those damn filters, eh? (Link)

M&A:

- ChristianaCare is planning to purchase Crozer Health from Prospect Medical Holdings. The two have signed a letter of intent and assuming it’ll pass regulatory checks, will create a strategically focused health system in Delaware. (Link)

- Dialyze Direct bought Compass Home Dialysis to add 9 SNFs to its portfolio. Did you know that Dialyze is the ‘leading SNF dialysis provider’ in the US with 130 SNFs in its portfolio? I truly had no idea. (Link)

Strategy:

- Ops: Here’s a solid dive into Henry Ford Health System’s 100% virtual behavioral care program and its inner workings. (Link)

- Labs: Ascension and Labcorp partnered on laboratory testing this week – Ascension will contribute around 10 of its hospital-based labs (usually a cost center for hospitals), and Labcorp will scale its presence through Ascension’s national 142-hospital footprint. (Link)

- Enhabit: This was a good conversation from HHCN with Encompass’ new home health (Enhabit) CEO, Barb Jacobsmeyer, on the current landscape for home health and her expectations moving forward with the spun-off company. (Link)

Policy Hits

Telehealth: Current telehealth waivers are set to expire as soon as the public health emergency designation ends. Senators this week introduced a bipartisan bill to expand telehealth access thru 2024, and also introduced a separate bill to allow those with high deductible health plans to permanently have access to telehealth. (Link)

Granny: Elizabeth Warren is not a fan of Medicare’s direct contracting program and discussed reforms to the MA risk adjustment payment structure. I’m personally a fan of innovation in payment models – any change or end to these models would likely need a replacement in order to continue the value-based care movement. (Link)

ACA Enrollees: Similarly to the telehealth waivers, certain ACA subsidies and enrollment freezes are set to expire after this year or after the public health emergency, which would cause a lot of folks to lose their health coverage. (Link)

Other Hits

Euphoria High: The Commonwealth Fund highlighted overdose deaths in the first half of 2021 – too many. (Link)

Hot Takes

Mental Health: A good read from the Atlantic (soft paywall) on what we need in mental healthcare. This quote was pretty cool: “Current [mental health] treatments work; mental illness is not a life sentence; people can recover.” (Link)

Healthy Muse Top Picks

Shortages: This from the Atlantic (soft paywall) was a solid historical overview of the physician shortage. (Link)

Hybrid: Timely as ever, Olivia Webb walked through hybrid care models and the future of primary care. (Link)

Generics: The FDA released its annual report on generic drug approvals, noting the most significant generic drugs that hit the markets in 2021. Did you know that 90% of drugs in America are generic? (Link)