Welcome back to the Healthy Muse, where we cover all of the must-read healthcare stories in a quick, easy 5-minute read. We make healthcare easy.

- Here’s a link to last week’s edition.

This week’s healthcare stories.

Your need-to-know coronavirus stories:

- As of this writing – 1,290,896 confirmed cases and 70,653 deaths from the coronavirus

- A live look at the U.S. COVID-19 situation – by county

- Trump invoked the Defense Production Act to increase ventilator manufacturing. The administration is making sure the federal government is first in line to receive crucial medical supplies by invoking the act.

- Hospitals are facing shortages of critical supplies, according to a watchdog report – to the point that states and counties are squabbling and outbidding each other over supply needs.

- The CDC recommends face masks for everyone.

- Molina Healthcare is expanding Teladoc services to all of its members. As we’ve mentioned, Teladoc has been a huge winner in all of this.

Health insurance stuff. Is Trump creating his own Medicaid?

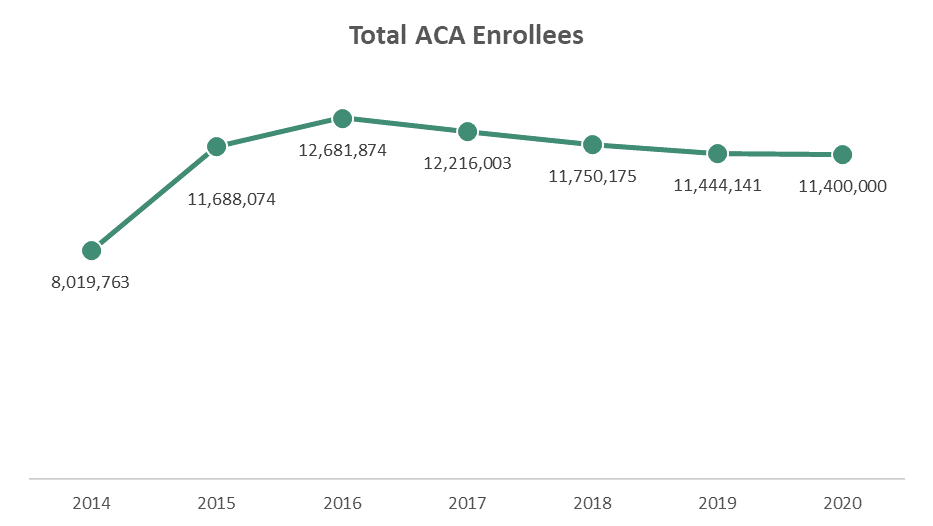

Despite the administration’s fight against Obamacare in the Supreme Court, total ACA enrollees remained steady (WSJ paywall) at about 11.4 million people in 2020. The exchange is notably stable amidst all of the political noise.

- The WSJ report comes at a time when many wanted the ACA exchanges to re-open for those who had just lost jobs (and health insurance) amid the pandemic. Despite criticisms, the administration opted to keep the exchanges shut.

Why didn’t they re-open enrollment? The Trump Administration opposes the ACA and decided not to defend the healthcare law in court.

- Because of the pending SCOTUS ACA case review and the Admin’s position, it makes sense why they wouldn’t want to re-open something they’re trying to shutter.

Okay, so what about uninsured people? Instead of opening back up the exchanges, the Trump administration is actually considering using the emergency $100 billion in healthcare funding to cover uninsured cases. I would argue that this policy is essentially the emergency version of Medicaid.

- On that note, the American Hospital Association is asking for $25,000 per hospital bed from that same $100 billion emergency fund. Wonder who’s going to end up with it?

Some are comparing this policy to Medicare-for-All. But the two policies really aren’t all that similar apart from the government funding aspect.

- In fact, this policy is MUCH narrower in scope than fully-fledged M4A and is simply a pseudo-expansion of Medicaid. Private health insurers still exist and are even fully covering out of pocket costs related to COVID-19.

From the White House.

The Trump administration is touting the potential effectiveness of hydroxychloroquine to treat COVID-19. Pence told us that trials for the anti-malaria drug are underway.

- Meanwhile, there seems to be an internal rift in the White House over hydroxychloroquine and the potential for misrepresenting how effective the drug actually might be.

Other White House things. The White House tried to slip in a simple surprise billing solution into the third stimulus package, but in the end, the proposal was left out altogether.

Struggling healthcare firms.

A hoard of healthcare firms – especially on the outpatient side – announced slowing growth, furloughed employees, and other restrictive measures to counteract the financial impact of COVID-19 and stay afloat operationally. To name a few:

- Select Medical (Post-acute facilities, outpatient physical therapy) withdrew its 2020 guidance.

- Tenet (hospitals and outpatient elective surgery) pulled its guidance and is furloughing employees.

- Walgreens is seeing markedly lower foot traffic despite its increase in healthcare related sales.

- HCA Healthcare (hospitals, elective surgeries) is cutting executive pay to avoid layoffs.

- Radnet (diagnostic imaging) withdrew its 2020 guidance and is cutting executive pay.

- Staffing firms are cutting physician pay.

- Finally, Quorum Health (hospitals) is facing bankruptcy. RIP (almost).

- Nonprofits aren’t immune, either. Large names like Trinity Health and Bon Secours Mercy Health are unfortunately furloughing employees.

Of course, the broad economy is the most affected right now. People are losing jobs and filing for unemployment at unprecedented rates. Last weeks’ jobless claims totaled a record 6.6 million people. Outpatient healthcare jobs in particular were destroyed on the latest jobs’ report.

Read more: hospitals and providers are feeling the financial squeeze during the COVID-19 pandemic. (WSJ)

What to look for: healthcare firms report first quarter earnings reports next week, starting with UnitedHealthcare on April 15th.

- Fortune Teller: Be prepared for a slew of M&A across industries as businesses fail and get snatched up.

Other things to know.

- CVS is rolling out drive thru testing in Rhode Island and Georgia.

- Italy might be undercounting thousands of deaths, a WSJ analysis indicates.

- In that same vein, U.S. intelligence officials concluded that China has been under-reporting coronavirus cases.

- Bankrupt hospitals, once a pretty undesirable asset, are surging in demand during the ongoing coronavirus crisis.

- A silver lining for surgery centers: they may start leasing their space to health systems in an effort to serve as ‘makeshift hospitals.’

- To Stop The Pandemic, CMS Head Seema Verma Is ‘Getting Rid Of A Lot Of Regulations‘

- Fauci: ‘We’re starting to see glimmers’ mitigation is having ‘dampening effect‘

- Chinese scientists seeking potential COVID-19 treatment find ‘effective’ antibodies

- DaVita and Fresenius, the dialysis duopoly dynamic duo, have partnered to create a nationwide network of dialysis clinics catered toward treating COVID-19 patients.

Quick Hits

Biz Hits

- J&J announced a $1 billion deal with the U.S. to develop coronavirus vaccines.

- More than 400 long-term care facilities have reported coronavirus cases

- UCSF is partnering with Oura – yes, the smart ring company – to detect coronavirus early on.

State Hits

- California Hospitals are facing the coming surge with proven fixes…and some Hail Mary’s.

- Unsurprisingly, Utah has delayed its Medicaid work requirements policy amid the global pandemic.

Other Hits

- Taxpayers paid millions to design a low-cost ventilator for a pandemic. Instead, the company is selling versions of it overseas. (ProPublica)

- The simulations driving the world’s response to COVID-19. (Nature)

- At risk: the geography of America’s senior population. (Visual Capitalist)

- The 7 best COVID-19 resources we’ve seen so far. (Visual Capitalist)

- COVID-19 is projected to be the #7 cause of death in the US in 2020 (based on annualized data)

- Autism rates continue to increase.

Thought-Provoking Editorials

- World Health Coronavirus Disinformation. (WSJ)

- Bet big on coronavirus treatments – certain therapies are showing promise. (WSJ)

- The real tragedy of not having enough COVID-19 tests. (NY Times)

- The pandemic’s most powerful writer is a surgeon.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

- The Healthy Muse was created to educate people on the healthcare system. It’s one weekly e-mail updating you on all the major election news, broader trends, big stories, and policy updates. Learn more about our vision here.

Get smarter and sign up below today.