healthy muse healthcare news.

- This week in healthcare: Ginger merges with Headspace, Teladoc partners with Aetna, Definitive Healthcare files for IPO, Warby Parker’s direct listing, CareMax’s value based care agreement with Anthem, Carbon Health’s busy summer, and more.

Ginger merges with Headspace in $3 billion deal.

In a deal announced August 25, virtual mental health coaching and therapy provider Ginger is merging with Headspace, a direct to consumer app that provides mindfulness and meditation programs. The merger is a notable move among two very well-known names in the digital behavioral health space. Moving forward, the combined firms will be named Headspace Health. (Link – Press Release)

- By the numbers: As a combined org, Headspace Health will generate $300 million in annual revenue (ARR) to about 100 million users worldwide. The merger creates a private valuation of about $3 billion.

- How the model works: The merger creates a vertically integrated behavioral health org for lower acuity patients. Think of the model this way – consumers find Headspace in the app store and subscribe to its mindfulness services. At that point, Headspace could funnel those patients into coaching and therapy services provided by Ginger. Although the model currently lacks services for higher acuity patients (clinical depression, etc.), Headspace Health could potentially add those offerings through partnerships or employment of psychiatrists.

More resources:

- Want to be a more holistic healthcare company? Add some Ginger. (Link)

- Ginger and Headspace plan merger to rapidly scale up digital mental health services. (Link)

- Inside the Giant Ginger-Headspace Merger, What It Means for Behavioral M&A. (Link)

Managed Care Partnerships: Aetna – Teladoc and CareMax – Anthem

Partnerships: There were a few notable managed care partnerships announced in August. First off, CVS-Aetna is partnering with Teladoc to unveil a nationwide primary care telehealth service to its members. (Link)

- CareMax: In a similar vein, Anthem is partnering with recent gone-public CareMax to open 50+ value-based care medical centers. Some of the identified states for this partnership include Indiana, Texas, Kentucky, Wisconsin, Georgia, Connecticut and Virginia. (Link)

Carbon Health’s Busy Summer.

As the header mentions, primary care digital health firm Carbon Health has been deal-making and fundraising all summer long. After acquiring remote patient monitoring firm Steady Health, Carbon raised another $350 million and quickly put some of those funds to use by purchasing two major urgent care retail footprints in California and Arizona.

Given the acquisition of these 13 clinics, the tech-enabled primary care platform now operates 83 clinics across 12 states.

- Bigger picture: These new-age health tech enabled services firms are consolidating and are starting to boast major market presences across the U.S. (Carbon Health, Teladongo, Ginger-Headspace, Accolade, and more). It’s a fascinating time to observe the trends and seemingly changing tides for health tech.

- More reading: about Carbon Health and its founder. (Link)

Definitive Healthcare files for IPO, and Warby Parker Lists Direct.

Definitive Healthcare: Data analytics firm Definitive Healthcare announced its IPO filing in August. The firm boasts health systems, PE firms, and consulting firms among its clients who access its healthcare databases. (Link – Press Release) (Link to S-1 Prospectus)

Warby Parker: In other anticipated news, Warby Parker is going public via direct listing – similar to how Slack and Spotify went public. Warby Parker’s business model revolves around direct to consumer eyewear offerings – a flat price of $95 for eyeglasses, and its own line of contacts to boot. (Link)

Full FDA Approval for Pfizer’s Vaccine.

After its standard review process, the FDA has finally fully approved Pfizer’s vaccine. Previously, the vaccines were only approved for emergency use. This long-awaited approval, coupled with rising Delta cases, may convince some vaccine holdouts to get vaccinated. (Link)

- Pfizer has named the vaccine ‘Comirnaty.’ So many fails here. (Link)

Boosters: The Biden Administration along with the CDC is now recommending booster shots for vulnerable populations. Is anyone else tired of all of these pandemic-related buzzwords? (Link)

Anti-Vax: Something I’ve noticed recently is drastically decreasing levels of sympathy for those who are not vaccinated by choice.

- Companies like Delta are now beginning to charge employees more for health insurance if they are unvaccinated. Vaccination mandates are now widespread for many employers, and those who do not comply risk their jobs. (Link)

Final note: Please don’t use horse de-worming treatments as a home remedy for Covid…please. (Link)

public market update.

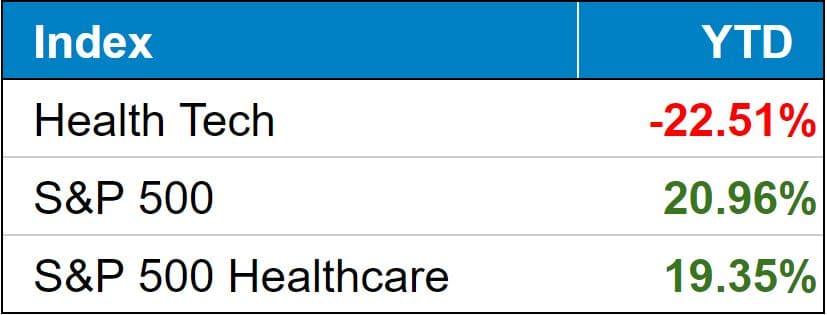

Health tech saw a bit of a comeback this week, with a majority of the Index in the green.

Top 3 weekly performers: Cano Health, Pennant Group, Outset Medical

Bottom 3 weekly sandbaggers: UpHealth, Talkspace, Alignment

- Full List YTD performance: (Link)

$DOCS: Doximity blew out its first earnings as a public company and popped 30%. Doximity is up about 40% since its IPO amid major organic growth expectations in the digital marketing biotech boom.

$OSH: Oak Street dropped 17% after its Q2 earnings.

$BHG: Bright Health is planning to expand into 42 new markets in 2022. (Link)

$ALHC: Alignment Healthcare is planning to expand into 16 new markets in 2022. (Link)

$SHCR: Here’s an interesting partnership announcement from Sharecare – the digital health firm is entering the home health market with its acquisition of CareLinx, giving the company access to a platform with a network of over 450,000 tech-enabled caregivers. (Link)

Biz Hits

Buy-Out: Long-Term care provider Diversicare Healthcare is going private, getting acquired by DAC Acquisition, for $10.10 a share – a 256% premium to its last closing share price. (Link)

CityBlock: Cityblock Health announced a partnership with Blue Cross North Carolina to provide care at its clinics across multiple cities. (Link)

DTC: Optum is encroaching on Ro’s and Hims and Hers’ space by adding a cash pay option to its virtual care services, including its online pharmacy. I’ll be interested to see if this dampens expectations for these DTC players. (Link)

Google reorganizes its health division as Google Health head leaves company.

This week’s notable ‘Big Tech in Healthcare’ news was Google announcing the dismantling of its Google Health division amidst the departure of its former head, Dr. David Feinberg, to Cerner. (Link)

- Although some viewed this news with dismay as another failed attempt into penetrating healthcare, Google intends to continue its healthcare related projects within other divisions. (Link)

Policy Hits

No jab, no job: Biden is now requiring vaccine mandates before providing federal funding to nursing homes, potentially adding pressure to an already tight labor market in nursing homes. (Link)

Drug Pricing: Biden is calling on Congress to make changes to drug pricing. Specific policies Democrats like include allowing Medicare to directly negotiate drug prices and increasing access to generic and biosimilar drugs. (Link)

Medicaid: In his drive to dismantle Trump-era Medicaid policies, the Biden Admin rescinded Ohio’s Medicaid work requirements. (Link)

Other Hits

Medicare Advantage: A KFF analysis indicated that CMS payments to Medicare Advantage plans raised overall Medicare spending by $7 billion in 2019, meaning that we are paying more for privately managed Medicare Advantage plans than traditional fee-for-service Medicare – so not really working out too great for taxpayers. (Link to Analysis)

- This article from Axios is a great overview of the Medicare and Medicare Advantage programs. (Link)

Elder Care: Vox dives into the ‘staggering, exhausting, invisible costs’ of caring for America’s elderly. (Link)

Diabetes: As diabetics have been disproportionately affected by the pandemic, Reuters analyzed how the pandemic laid bare America’s diabetes crisis. (Link)

Opinions

GoodRx: Several independent pharmacies have reached out to Surescripts, asking the firm to rescind its deal with GoodRx to disclose GoodRx’s prices on its platform. Independent pharmacies are claiming that GoodRx’s prices don’t actually account for the true cost of medications. (Link)

- Speaking of GoodRx: Here’s a good article from Drug Channels on its business. (Link)

One Medical: An NPR article published this week disclosed that some ONEM employees accused the concierge care platform of putting profits over patients. (Link)

Healthy Muse Top Picks

Comp Models: Nikhil Krishnan crowdsourced some interesting thoughts on how physicians should actually be paid. (Link)

Pharmacy: This was a great read from the Commonwealth Fund on the Pharmacy industry, including key players, market dynamics, and reimbursement structure. (Link)

Transparency: Of course, one of the hottest ‘mainstream’ healthcare articles centered around price transparency – the NY Times took a dive into hospital price disclosures and the variation between procedures. (Link)