healthy muse healthcare news.

- This week in healthcare: Amazon launches a new elder care subscription service called Alexa Together, an insur-tech comeback, CVS investor day and HealthHUB expansion, Medicare sequestration gets further delayed, vaccine mandates halted, surprise billing lawsuits, and more.

Amazon Launches new Elder Care Service Alexa Together to capitalize on Aging in Place Trend

Aging in Place: Previously announced in September 2021, Amazon is expanding its Care Hub program to create a new service to help loved ones and caregivers check in on elderly folk. Called Alexa Together, the subscription service will provide a number of convenient offerings including customized alerts, 24/7 urgent response availability, fall detection and more. It’s pretty cool and could definitely be a major catalyst in speeding up the Aging in Place movement overall. (Link)

- Check it out on Amazon’s site yourself to see the full list of features available for loved ones. (Link)

- Related Content: There’s seemingly endless upside for startups looking to make their mark on the aging-in-place market. (Link)

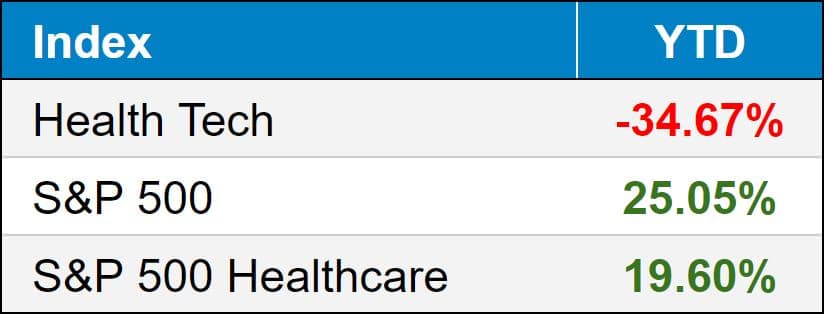

public market update.

Top 3 weekly performers: Bright Health (+29.5%), Oscar Health (+24.5%), P3 Health Partners (+20.7%). Interesting tidbit – despite their performance this week, Oscar and Bright are down 40.4% and 34.0% respectively on the month.

Bottom 3 weekly sandbaggers: Phreesia post-earnings report (-24.5%), Pear Therapeutics (-19.8%), Doximity (-9.9%)

- Full List YTD performance: (Link)

$CVS: CVS had their investor day – projecting $304-309 billion in revenue for 2022..small change. The retail health giant believes the pivot to HealthHUBs will drive higher growth and consumer engagement at their stores as people view their stores more as a one-stop shop healthcare destination. They’re also going to start acquiring more primary care physicians probably to employ them in HealthHUBs or bring them in network, similar to Optum or Neue Health strategy.

- CVS probably has one of the most complicated business models on the planet between its PBM, retail footprint, health insurance business, and now HealthHUBs. It’s really interesting that CVS has an enterprise value of around $180 billion when UnitedHealth is closer to $450 billion. You could make an argument that CVS is extremely undervalued if they’re able to succeed on the pivot to HealthHUB and keep executing on the healthcare strat including the building of its provider base.

- Final point…CVS retail spaces are generally very prominently displayed, which is a key indicator of success for urgent care operations. So that’s an immediate synergy / tailwind for the pivot. The main block here is probably just getting consumers to view HealthHUBs as a place to get healthcare services when before CVS’ were just for picking up snacks or prescriptions, but that shouldn’t be an issue given Aetna’s huge captured membership base.

- Link to Investor Day HUB. (Link)

$BHG: Bright Health received a $750 million investment from big names including Cigna’s investment division Evernorth. Acquisition incoming? Now would be the time. (Link)

- BHG’s Investor Day (Link)

$CLOV: Clover announced a partnership on December 9 with value-based chronic kidney care company Cricket Health to help manage chronic kidney disease. (Link)

$PHR: Phreesia bought Insignia Health, a firm that licenses patient activation measures. (Link)

Biz Hits

Deal Volume: Services deals have risen by 56% (!!!!) through November compared to last year, according to PwC. This is crazy levels of activity driven by multiple tailwinds including the easy access to capital, tax changes potentially going into effect in 2022, and value-based care plays. (Link)

Platforms: This series on healthcare platforms was a helpful explainer to understand new healthcare companies and how they’re combining to create new-age healthcare conglomerates. (Link) (Link – Part 2)

Funding: Adding fuel to the mental health wave fire, SoftBank backed mental health co Cerebral’s most recent fundraise, giving it a $4.8B valuation. (Link)

M&A: In an interesting move, City of Hope which is an oncology nonprofit in the California area, purchased radiation oncology biz Cancer Treatments of America for $390 million, an organization that received backlash in the past for patient practices. The acquisition allows City of Hope, which has a solid brand, to expand geographically. CTCA currently operates in 3 states with 3 hospitals and 5 clinics. (Link)

Policy Hits

Mandates: A judge temporarily halted nationwide vaccine mandates imposed by the Biden Administration as the case makes it way through court. Bottom line: the court case comes down to whether the Biden Admin exceeded authority when he issued a nationwide vaccine mandate public health measure

- Key quote: “However, even in times of crisis this Court must preserve the rule of law and ensure that all branches of government act within the bounds of their constitutionally granted authorities.”

- (Link)

Medicare: Lawmakers passed the Supporting Health Care Providers During the Covid-19 Pandemic Act (not even a fun acronym…sigh) that significantly reduces planned reimbursement cuts in Medicare spending.

- Details: The bill would delay sequestration (what is sequestration?) further while also delaying the 4% PAYGO cut until 2023. So in summary, the bill would delay a 6% cut in Medicare reimbursement to physicians but still cut reimbursement slightly.

- Bigger picture: Medicare reimbursement is in a weird state, especially during the emergency period. Providers are asking for a more permanent solution than having to constantly lobby Congress to delay the planned cuts to reimbursement. In actuality, it seems as if there’s a lot of irresponsible spending going on, but let’s not get too political in this newsletter! (Link)

Surprise Billing: Providers are suing the No Surprises Act’s implementation prior to the bill going into effect on January 1, 2022. They’re mainly suing due to the way that disputes would be handled between out of network providers and insurers – the arbiter is supposed to look to median in-network rates for that service in that geography, which providers argue vastly favors insurance companies.

Why? Because they handle thousands of claims and have access to reimbursement information, and providers argue that the bill dis-incentivizes insurers to even go in-network with provider groups if they can 1) delay the payments process further which makes them money and 2) set the in-network median rate based on their own data. Interesting stuff and I can see where it’s coming from. Unfortunately any delay to this bill would impact patients. I think any solution is better than none here.

- This Health Affairs article does a great job of breaking down the key issues. (Link)

Agenda: The Biden Admin released its 2022 agenda for regulations in the upcoming year, and so far HHS is looking at the following issues:

- Short-term health plans, previously approved by the Trump Admin

- Prior authorization and interoperability

- Dispute resolution guidelines for 340b spats between hospitals and drugmakers

- Updated safety and other requirements for rural hospitals (critical access hospitals)

- Full link here. (Link)

Other Hits

Compensation: A Health Affairs article published recently found that hospital employment for physicians resulted in slightly lower pay, a conclusion that I frankly can’t believe. I wish I could access the full HA article to understand exactly what they’re defining as compensation, but something doesn’t seem to be adding up here. (Link)

Premiums: Employer insurance costs rose by 6.3% in 2021. Employers are expecting less-intense growth in 2022, but this still eats into profit margins along with the rest of the inflationary effects from the pandemic. (Link)

Stress: Gen Z is getting hit much worse by stress than other Gens as a result of the pandemic – it makes sense given that this is the most plugged-in generation. That being said, the trend highlights the continual need for accessible mental health services. (Link)

Urgent Care: Of all of the primary care offerings, urgent cares have seen a boon from shifting visit volumes to testing and immunizations. It’s why you’re seeing such a dramatic shift in strategy from CVS and Walgreens. EHRN had some interesting data to outline what’s going on with urgent care volumes. (Link)

Hot Takes

Data: It’s time to open up health care’s secret analytics – Stat First Opinion’s write-up on insurance and health systems who have key consumer data and how that affects their strategy. Pretty eye-opening stuff. (Link)

PE: This was a good little insight into the athenaHealth private equity transaction and the ROI involved from THCB. (Link)

PA or PA? Here’s more opinions on that whole ‘Physician Assistant’ renaming thing. (Link)

Healthy Muse Top Picks

Digital Health 150: Read more from CB Insights about the 150 digital health startups shaping the future of healthcare. Buzz words!! (Link)

Pharmacies: This was an insightful read from McKinsey on the pharmacy’s future in the home. (Link)

Diabetes: Reuters’ third part to an ongoing series about diabetes, the news reporting firm dove into JnJ’s response into a popular diabetes drug despite red flags popping up. (Link)

GoodRx: This was a great deeeeeep deep dive into GoodRx’s business model from Stock Market Nerd covering just about everything you could possibly dream of for free. (Link)