healthy muse healthcare news.

- This week in healthcare: Medicare Direct Contracting gets a rebrand to ACO REACH, Teladoc and LOTS of 2021 earnings releases, Humana shakes up its board, antitrust concerns for Lifespan and Care New England, UnitedHealthcare and Change Healthcare sued by DOJ, a healthcare REIT megamerger, and more.

CMS Revamps Direct Contracting to ACO REACH

Whoa. BIG Medicare news dropped today from CMS about direct contracting.

— Blake Madden (@B_Madden4) February 24, 2022

Details 👇

-CMS is replacing all direct contracting programs (Global/Professional/Geo) with a re-skinned model called ACO REACH, the next iteration of the program – essentially DC with some added features

On Friday, CMS dropped a next-gen program slated to replace the current Direct Contracting starting in 2023.

- Details: CMS is replacing all direct contracting programs (Global/Professional/Geo) with a re-skinned model called ACO REACH. The new program is essentially DC with some extra bells & whistles.

ACO REACH aims to continue to move traditional Medicare toward risk-based and capitation payment models through…

- Allowing mainly provider-controlled groups into the program. 75% of applicant boards have to be provider-controlled. Non-provider groups have to demonstrate a certain level of direct patient care to be included in REACH.

- Addressing health equity (SDOH) – Every entity has to identify & determine ways to address health disparities in specific markets & geographies – dope

- Preventing the abuse of risk score adjustments. CMS is capping adjustments based on population trends & traditional Medicare risk score trends among other more specific items.

- Maintaining a similar PMPM payment structure to DC by keeping the professional and global payment tracks, but ditching the controversial geographical track.

- Alleviating Progressive concerns about ‘corporate profiteering’ and ‘getting rid of Medicare’ – Beneficiaries will keep all provider choice freedom that traditional Medicare provides. This is in contrast to Medicare Advantage programs that typically create narrower networks.

- Providing greater transparency into the program. AKA, more reporting on how entities are doing, how health equity is being addressed regionally, etc.

ACO REACH will start accepting new applicants in Jan. 2023. It’ll run thru 2026 and by that point I’m sure we’ll have some new acronym and the next iteration of VBC payments.

- Companies expected to leverage the new ACO REACH model include all of the normal VBC names – ApolloMed, Privia, agilon, Alignment, Clover, and plenty of others. I’ll personally be reading management commentary at investor days to see what the general sentiment is for each company specifically.

Resources:

- Link to CMS announcement. (Link)

- A link to the actual RFP if you’re interested in checking that out. (Link)

- A recent Aledade podcast discussing ACOs, payment models, and the future of Medicare. (Link)

Humana Shakes up its Board

After shaky Medicare Advantage membership numbers and its worst performing day ever in the stock market post-earnings, Humana bent the knee to an activist investor group, Starboard Value. Humana finally gave in to adding two directors to its board, including one from Starboard. (Link)

- Humana isn’t the only struggling managed care firm dealing with activist investors – keep in mind that Centene is also implementing certain expense improvements and c-suite transitions as a result of its deal with Politan Capital Management. Centene has really struggled to integrate WellCare and more recently, Magellan, in addition to being marred with scandal & settlements in its state PBM practices. (Link)

- Side note – I always find it hilarious when news like this is dropped and the company’s stock price immediately jumps. If I were at the C-suite I’d be thinking ‘damn, am I really doing that bad of a job?’

What’s up with Teladoc?

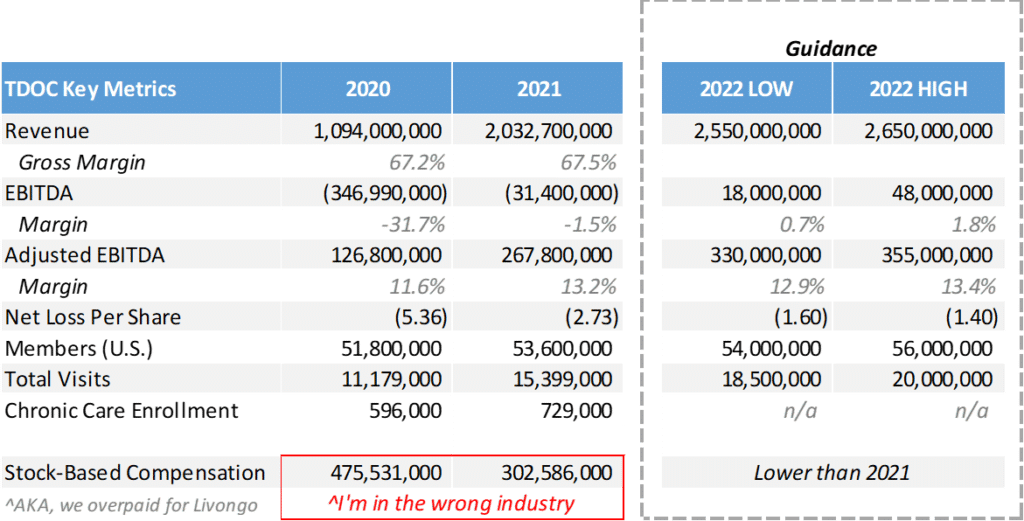

Everyone’s favorite struggling virtual care firm reported full-year earnings this week. Teladoc posted solid trailing results, but I was less than impressed with the firm’s 2022 guidance. The whole earnings release was kinda…meh.

Numbers: Teladoc generated ~$268 million in adjusted EBITDA on over $2 million in revenue on a membership base of 54 million people (!!!!), seeing an average of 42.2k visits per day, which is actually nuts.

- The Good: Stock-based compensation aside, Teladoc turned a profit and generated a fair bit of cash this year. There’s also a very positive uptick in net revenue per member (a 52% increase YoY), which should continue to increase as chronic care enrollment expands and as Teladoc implements other programs.

- The Bad: SOFT 2022 guidance, which caused another steep selloff after-hours. With Teladoc’s level of scale and a platform of 54 million potential customers to cross-sell services to, investors are getting antsy. Unfortunately, it doesn’t really work like that in healthcare. Scaling is hard, and whole person virtual care is brand spankin’ new. Let’s give them a minute to figure some things out. Also, maybe hiring a COO would help.

Bigger Picture.

Since maxing out at almost $300 a share in early 2021, Teladoc is down bad at around $60 at last glance.

What went wrong: After its run as one of the hottest ‘Rona stock trades on the planet, Teladoc used its newfound capital to panic-buy Livongo for $18 billion. I’d consider this move more of a defensive play than anything since Livongo was courting other telehealth suitors.

- Still…if you break it, you buy it. Post-merger, Teladoc has failed to unlock Livongo’s real value during its first year at the helm. To be fair, doing so is objectively a tough ask – AKA, convincing employers and others to pay for a somewhat unproven solution. Did I mention they way overpaid?

What’s Next for Teladongo.

As one of the first true ‘whole person care’ conglomerates, Teladoc needs to take better advantage of that first-mover edge. Teladoc will 100% lose market share over the coming years if they can’t get their shit together.

Promising tailwinds I’m eyeing:

- Teladoc’s products are slowly gaining traction. There’s a clear runway toward growth in taking on more risk and cross-selling services. Really, execution and sales is the bottleneck at this point. A decent number of Teladoc’s Q4 bookings were multi-program which is a step in the right direction.

- The firm is launching new programs in Chronic Care Complete and I’m super bullish on BetterHelp (mental health, super hot space) and Primary360 (whole person care) as those programs expand.

- New programs and solutions are super easy to pilot given Teladoc’s scale and existing membership platform.

- Customer acquisition costs are shrinking.

- Valuation-wise, Teladoc sits in an interesting spot. On one hand, I’m seeing digital health unicorns like Ro ($7 billion), Cerebral ($5 billion), Lyra ($5.6 billion), and Hinge ($6.2 billion) that are likely burning through cash yet valued crazy high. Teladoc is sitting at around an $11 billion enterprise value with vast scale compared to some of its private counterparts. Where’s the disconnect? Plus, competition with firms like Amazon are likely overblown.

Crazy how Amazon goes from

— Blake Madden (@B_Madden4) February 28, 2022

'about to destroy all other telehealth players'

to

'now offering Teladoc services on Alexa'

all in the span of 3 weeks $AMZN $TDOChttps://t.co/178C6FuNFZ https://t.co/n3vfn5Bi27

Concerns with Teladoc:

- They lost almost the entire executive suite from Livongo post-merger. Bad signal.

- If permanent telehealth legislation doesn’t pass prior to the end of the public health emergency, virtual care as a whole will take a step back. Also, Medicaid will lose a ton of members which is something that Jared covered recently.

- Competition is brimming beneath the surface as other virtual care operators slowly consolidate.

- I’m speculating that morale is super low after recent stock price action.

Resources:

- TDOC Q4 earnings release. (Link)

- TDOC Q4 call transcript. (Link)

- TDOC launches its chronic care program. (Link)

Biden’s Antitrust Hammer

Not even UnitedHealthcare is safe from Biden’s Ban Hammer. The FTC and DOJ announced their meddling in two high profile mergers this week:

- After some initial back and forth, the DOJ will in fact be suing UNH over its $13 billion takeover of Change Healthcare. The AHA and other provider groups called foul on the deal from the get-go over data sharing and IT related antitrust concerns, and the Biden Admin is VERY sympathetic to antitrust sentiments. I would expect Change Healthcare to either have to divest some assets, or UNH will have to just…beat the DOJ in an antitrust case. (Link)

- Rhode Island health systems Lifespan Health and Care New England just straight up cancelled their previously announced merger plans after they caught wind of a potential FTC intervention amid local provider concerns. It’s like they got caught with their hands in the cookie jar, backed up and said “haha, my b.” (Link)

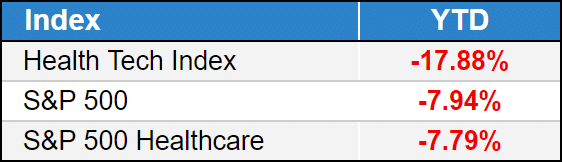

Health Tech Index Update.

Top 3: Hims & Hers (20%), Clover (19%), The Pennant Group (15%)

Bottom 3: ATI Physical Therapy (-18%), Cano Health (-15%), Skylight Health (-14%)

- Full List YTD performance: (Link)

Providers & Services:

Nonprofit Earnings Releases:

$ONEM: One Medical released Q4 earnings delivering a 34% increase in membership as the struggling primary care subscription operator continues to integrate its $2 billion acquisition of Iora. The firm also announced a partnership with Connecticut-based system Hartford Healthcare (Link)

- Revenue: $623mil, up 64% YoY

- Members: 736k; 33; are risk-bearing (AKA, from Iora)

- Full-Year MLR: 92%

- Adjusted EBITDA: -$40.6mil – are we ever getting to profitability?

$AMEH: ApolloMed reported strong beats on both top and bottom line analyst estimates. The firm jumped in after hours trading, but fell 9% the next day, which surprised me given management’s upbeat tone on the call and revised upward guidance. (Link)

- Revenue: $774 million – guided for $1.05 billion for 2022

- Adjusted EBITDA: $174.2 million (23% margin)

$CANO: Care platform Cano delayed its Q4 filling today, causing the stock to drop over 10%. The delays are related to non-cash Medicare risk accounting adjustments. Honestly, I can imagine being an accountant and having to accrue / guess on risk adjustments for VBC companies isn’t fun.

- Delaying a quarterly filing – especially full year 2021 – is never good news, but Cano is saying the delay is a ‘technical’ difficulty and not related to the underlying business’ operations, which I’m inclined to believe until they prove me wrong. (Link)

$AMED: Amedisys acquired a couple of home health biz’s in the mid-Atlantic region, including AssistedCare Home Health and RH Homecare Services. They don’t report earnings til Thursday. (Link)

$ATIP: ATI Physical Therapy once again unfortunately sold off after reporting its 2021 earnings. The therapy operator is trying to turn it around in 2022 by investing early on in increasing its clinical headcount and higher marketing spend. It might be 2023 til ATI gets back to normal operations considering management is projecting a 3% ADJUSTED EBITDA margin in ‘22. (Link)

$SEM: Select Medical experienced staffing woes in its LTACH and inpatient rehab segment due to a shift in operational protocols, increased turnover, and general staffing shortages nationwide. Select now fully owns Concentra after buying the remaining piece from investment partners. Despite a solid earnings beat, dividend declaration, and share repurchases, Select’s shares are down 20% on the year. (Link)

- Select expects $6.2 to $6.4 billion in revenue but retracted its EBITDA guidance given the uncertainty around staffing. I don’t blame them at all.

$CHE: Despite the ugliest company website in history (which I kind of love), Chemed reported largely in-line earnings. In its hospice segment though, Chemed’s volume numbers left me wanting – a 4.8% decline in revenue, 4.2% decline in census, and a 9.5% in admits resulted in big profitability declines. I feel like nobody is really discussing the impact of COVID on post-acute volumes given the sensitivity of the topic, but this is a real issue affecting these businesses. (Link)

$LHCG: LHC reported upbeat guidance and continued interest in the home health M&A pipeline post-’Rona in its Q4 report. (Link)

Managed Care:

$CLOV: Clover popped 30% after hours after an impressive revenue beat. Those losses though…another story. (Link)

- Revenue: $1.47bil, up over 115% YoY

- MLR: 106% (!!!) – the growth is clearly coming at a cost and I’m wondering if investors have the stomach to bear Chamath’s cesspool of a company for much longer. I’m personally pulling for Clover to turn it around.

Digital Health:

$HIMS: DTC virtual care firm Hims posted a solid Q4 earnings and impressive growth metrics, jumping 13%. (Link)

- Revenue: $272mil, up 83% YoY

- Subscriptions: 609,000, up 95% YoY

- Adjusted EBITDA: ($7.1)mil but that don’t matta, we in growth mode.

$AMWL: Amwell reported an adjusted EBITDA loss of $41mil in Q4 2021 which is insane considering the company tailwinds. Management chalked it up to strategic investments in key assets so we’ll see if Amwell can turn some profit after posting a full-year loss of $123mil (Link)

Biz Hits

Trend Watch:

IP → OP: This was a good write-up from Healthcare Dive on health system shifts to outpatient strategies, a trend that has, and will continue, to happen. (Link)

Strategy & Partnerships:

Cerner: If Oracle wants to turn the Cerner boat around, they have a long road ahead of them – this article dove deeper into the strategic acquisition that I’m personally extremely bearish on. (Link)

Primary Care: This Bloomberg (soft paywall) deep dive discusses the hottest physician market, which is currently primary care due to CMS’ new ACO payment models and the emergence of risk-based contracting in the space. Highly recommend a read to understand the massive land grab going on in the space! (Link)

M&A:

HC REIT: Healthcare Trust of America and Healthcare Realty Trust are rumored to be merging in what would create an $18 billion healthcare REIT and one less generic-sounding healthcare company. That’s a win in my book. (Link)

Fundraising:

- Kidneys: Joining the likes of Strive, value-based kidney care company Somatus raised $325 million in a Series E, putting the startup in unicorn territory ($2.5bil valuation). We’re just handing out that status these days, but kidney care is in sore need of competition so I’ll let it slide. (Link)

- Livongo’s half-brother: Omada Health, another chronic care management firm, raised $192mil also coincidentally in a Series E. I wouldn’t be surprised if this capital were used to make a few acquisitions.

- Omada will hurdle the $1bil valuation mark with the raise and you can see why Teladoc has a limited timetable – Virta Health, also in the RPM space, raised $133mil at a $2bil valuation in early 2021. (Link)

- Ro lost a couple key executives after announcing its most recent fundraising round. Sounds like they were waiting to cash out and move on. (Link)

Policy Hits

Settlement: JnJ and other distributors finalized a $26 billion opioid settlement. (Link)

Public Option: Color me shocked that Washington state’s public option has failed to get off the ground after struggling to get in network with hospitals. (Link)

Maskless: The CDC published new guidelines letting people ditch masks if hospitalizations remain low. (Link)

Surprise Billing: In a win for providers related to surprise billing, a judge threw out part of the No Surprises Act related to arbitration, saying that it favored insurers. That’s because it does – the arbiter was directed to resolve disputes by referencing the median in-network rate for that service in that region. Which side do you think has thousands of data points of claims data to set those rates?

- This whole thing is so very messy, but I’m not surprised this provision was struck down. (Link)

Other Hits

#FreeShkreli: Martin Shkreli has been banned from running public companies 🙁 (Link)

Hot Takes

This was a good interview between Christina Farr and former Livongo exec Lee Shapiro on the future of digital health, and valuation bubbles. Seems pretty qualified to discuss bubble valuations lmao (Link)

Healthy Muse Top Picks

Oncology: Olivia Webb wrote on value-based oncology arrangements and how we define value in cancer. (Link)

Single-Payer: The New Yorker dove into the history of the AMA’s dispute related to single-payer healthcare. (Link)

Placebos: Nikhil Krishnan brought out another banger, this time writing about the power of placebos in healthcare. (Link)

Therapy: With my wife being a speech pathologist, she pointed out that the CDC published HIGHLY controversial new guidelines related to child development & autism milestones without consulting any therapists prior to releasing those guidelines. Seems like an…interesting decision? (Link)