healthy muse healthcare news.

- The ACA stays undefeated, a major digital health dialysis partnership between Strive Health and Outset Medical, Beaumont Health tries to merge again, Steward buys hospitals from Tenet, what’s next for health policy, and more!

The ACA wins again.

3-0: For the third time in a decade, the ACA has been upheld by the Supreme Court in a 7-2 decision. SCOTUS decided in its opinion that states did not have standing to sue over whether the removal of the individual mandate (AKA, the $$$ penalty for not having insurance) made the entire ACA illegal.

- To be candid, this prosecution was an embarrassingly weak legal argument, as the court decided that no harm had been done to the states that brought the suit. As a result, the case will be dismissed. (Link)

- It’s probably a good thing that the ACA stayed in place considering enrollees are at an all time high – above 80 million individuals. (Link)

Outset Medical and Strive Health team up on Dialysis Home Care.

Partners: On June 16, Value-based kidney care firm Strive Health announced its partnership with publicly traded medical device firm Outset Medical

- Details: Strive Health will use Outset Medical’s kidney care machine called the Tablo Hemodialysis System, which intends to simplify the dialysis process and even allows patients to administer dialysis at home rather than in an outpatient clinic setting.

- Why you should care: The $74 billion end stage renal disease industry is mainly dominated by DaVita and Fresenius. This partnership is an extremely significant foray into challenging that traditional duopoly, so you should pay close attention to this one. (Link)

Major Hospital Mergers.

Beaumont tries again: This week, Beaumont Health and Spectrum Health announced their intention to merge into what would create the largest health system in Michigan, with 22 hospitals and about $13 billion in revenue.

- Long time readers might remember that Beaumont Health has attempted to sell itself off twice already – once to Summa Health and then again to Advocate Aurora Health. Both attempts failed due to antitrust and cultural issues. Can Spectrum succeed where others have failed? Stay tuned! (Link)

Ochsner’s buying spree: Louisiana-based Ochsner Health announced its intention to acquire Rush Health Systems, a 7-hospital system in the Mississippi and Alabama areas. This announcement comes on the heels of Ochsner’s acquisition of Lafayette General Health in late 2020. (Link)

Steward buys Tenet hospitals: To round out the hospital activity, Tenet is selling 5 hospitals to Steward Health Care for $1.1 billion in the Florida area. The hospitals will continue to use Tenet’s rev cycle software Conifer and continues to signal Tenet’s push toward outpatient operations and its focus on USPI.

- Remember that Steward was bought back from private equity group Cerberus by a group of physicians in the summer of 2020 – this acquisition marks Steward’s first real activity since then. (Link)

public market update.

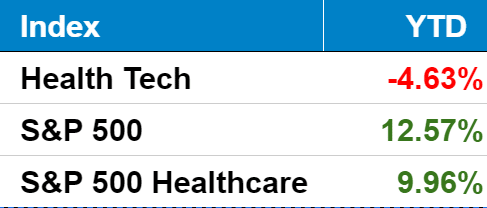

Intro: Welcome to the first official Healthy Muse public market update. I wanted to start off this section by introducing the Healthy Muse Health Tech Index, which will be a key part of this section.

- The custom index will track publicly traded digital health firms and comparing their performance to the broader stock market and healthcare index. You can learn more about the companies included here: (LINK).

- Here’s the summary table that will be included each week below:

Finally, I’ll round up market-specific healthcare news here:

- Talkspace won shareholder approval to SPAC on June 15. (Link)

- ATI: ATI Physical Therapy won SPAC approval this week. It’ll begin trading under the ticker $ATI soon enough. (Link)

- Bright Health: The managed care org is shooting for a $14 billion valuation. (Link)

- Alignment Healthcare: Announced its intention to expand into 12 counties in North Carolina in 2022. (Link)

- 23andMe: Began trading this week under the ticker $ME. (Link)

- Convey: Medicare Advantage focused-tech company Convey Health Solutions went public this week under the ticker $CNVY. (Link)

Biz Hits

Acquisition: In its first few weeks as a public company, Cano Health acquired University Health for $600 million. (Link)

Billing: An Axios report found that 10 hospitals are responsible for 97% of court actions against patients. (Link)

Cash: Mental health funding just hit an all-time high. (Link)

Settlement: Centene had to shell out $143 million to settle certain PBM disputes in a couple of states. The firm has allocated over a billion already in anticipation of settling court cases. (Link)

Generics: Along with its hospital partners, generic drug maker Civica Rx has created a new subsidiary called CivicaScript which announced a partnership with Anthem this week to address generic drug shortages. (Link)

Policy Hits

What’s next for healthcare policy after the ACA? Things you should be looking out for next include:

- Public options instituted at the state level (**AKA, Nevada** and Colorado) but not really at the national level…

- …UNLESS Democrats try to push major healthcare reforms through budget reconciliation, which would allow just a simple Senate majority to pass.

- More policies to watch include lowering Medicare eligibility age to 60, allowing Medicare to negotiate directly on drugs, expanding Medicare benefits to dental and vision, and more.

- Most agree that these policies would be unlikely to pass the Senate given the majority is so slim. (Link)

Other Hits

Pricey: That new Alzheimer’s drug might have a pretty outsized effect on healthcare spending…Axios dives deeper. (Link)

Blood: There’s a pretty substantial blood shortage in America, and the Red Cross is asking the public to donate blood to address it. (Link)

Cool story: A charity called RIP Medical Debt reached an agreement to wipe out $278 million worth of medical debt for 82,000 people. (Link)

Thought-Provoking Editorials

Vaccine: Interestingly, a judge decided to throw out a lawsuit against Houston’s Methodist Hospital, where 117 employees sued the hospital after Methodist decided to require vaccinations to work there. Pretty crazy how polarizing this topic has become. (Link)

Healthy Muse Top Picks

Prior Auth: Olivia Webb’s latest dives into the prior authorization process. (Link)

Reports: MedPAC, a committee that presents recommendations on healthcare funding to Congress, released its June report this week. I found Chapter 3 particularly interesting as the contents discussed the pros and cons of private equity investment in healthcare. I’d love to hear my readers’ thoughts on this topic as there’s likely a wide diversity of opinion. (Link)

Shout-out: I wanted to draw attention to a friend of mine, Nick Weber, who just launched Ucardia, an at-home cardiac and pulmonary rehabilitation program. Give it a look here and feel free to follow their journey. Super excited for this company. (Link)