The 19 Biggest Healthcare Stories from Q2 2021

Bright Health’s $10 Billion IPO

Managed care player Bright Health filed its S-1 in April, chock full of interesting information and commentary related to their business. Later at the end of June, Bright raised just under $1 billion in its IPO with a market cap at about $10 billion.

About Bright: The insurance platform serves just over 600,000 members across 14 states mostly in the individual insurance market, but more recently started to dabble in Medicare Advantage. Structure-wise, think of Bright Health as a mini UnitedHealthcare (yes, a $20 billion company is considered mini to UHG) in the sense that Bright separates its provider platform (AKA, Optum) from its insurance business.

- Alignment: Compared to a Clover or maybe even an Oscar, Bright is focused on vertical alignment in the markets it serves – identifying quality providers, acquiring providers in markets, etc. with the goal of delivering higher quality care to its participants.

- Tech Stack: Of course, Bright has its own health tech platform to build on – called NeueHealth, the segment provides a platform for primary care physicians to transition to value-based contracts.

- Thoughts: Compared to other recent managed care entrants into the public markets (Clover, Oscar, Alignment, Agilon, etc.) Bright seems to have its strategy together and is building its product well from the ground up in markets. I’ll be very curious to see how the public market perceives differences between Bright and other recent entrants. Personally, Bright’s business model is compelling and this is a company I’ll be following closely.

Resources:

- Here’s a link to Bright’s S-1 to read for yourself. (Link)

- Here’s a very thorough deep dive into key points in Bright’s S-1 from Kevin O’leary. (Link)

- The firm also recently acquired Zipnosis, a telehealth provider, to bolster its offering prior to going public. (Link)

Smaller Offerings:

- Physician enablement company Privia Health is planning a $100 million public offering. (Link)

- Aveanna, an in-home care firm, is also planning a $100 million IPO in the coming months. (Link)

Babylon announces its $3.6 Billion SPAC

Babylon: announced its intention to merge with Alkuri Global Acquisition Corp at about a $3.6 billion enterprise value.

- About Babylon: Since starting as a virtual chatbot service in the UK, Babylon has since expanded into value based primary care (aka, Capitation). The firm recently acquired two provider groups in the U.S. and is expecting continued growth in membership with a similar strategy to that of Oak Street Health or One Medical’s latest acquisition…more on that in a sec.

- (Link to Investor Presentation) – provides a solid, rosy overview of Babylon’s business and market

- (Link to a good analysis from Kevin O’leary)

Doximity, a ‘Social’ Network for Physicians, files for IPO

Social: Doximity went public the traditional way, via IPO at the end of June along with Bright Health. Its stock skyrocketed in its trading debut; as a result, the firm had a successful IPO.

- About Doximity: It’s essentially the Facebook of physicians, APPs, and graduating medical school students with a few bells and whistles attached – including free telehealth and scheduling tools for its members. According to its S-1, the firm has 1.8 million users which makes the platform a compelling advertising opportunity for recruiters, health systems, and pharma organizations trying to reach medical professionals.

- Notably, Doximity is profitable and growing, which lends itself to a potentially robust valuation once it hits the public markets later this year. Most interesting – Doximity is reserving a portion of its shares for physicians on its platform – similarly to Uber drivers or AirBnB hosts. The firm sold 10,000 pre-IPO shares to those physicians, which gives itself a compelling foothold on those physicians.

- (Link to S-1)

- (Link to article write-up)

LifeStance Health IPO – Outpatient Behavioral Health

Also going for the IPO route, LifeStance operates outpatient mental health facilities and employs about 3,300 mental health clinicians. The firm successfully began trading in mid-June.

- About LifeStance: LifeStance was founded in 2017 and has since grown to operate in 27 states and 370 facilities with almost 2.3 million patient visits in 2020. Notably, the firm operates under a fee-for-service model – 89% of its $377 million in 2020 revenue was derived from commercial in-network payors. The growth and number of increasingly larger players in the mental health spaces confirms bullish sentiment around this particular sector of healthcare, and I’m curious to see how Talkspace, LifeStance, and others grow and execute on their strategy.

One Medical acquires Iora Health.

Two Medicals: In big news released early June, One Medical announced its intention to acquire value-based primary care chain Iora Health for $2.1 billion.

- Why you should care: One Medical’s typical business model to this point has been to focus on fee-for-service primary care. This acquisition fully plunges the firm into the value-based Medicare Advantage side of things and allows for a major diversification in revenue service lines. (Link)

- Matthew Holt had some decent initial thoughts on the acquisition on Twitter (Link)

Google Plows further into Hospital Data with HCA Partnership

Data: Google and HCA are partnering to focus on building a healthcare data analytics platform. The end goal here is to streamline HCA’s provider workflow to improve decision making and cut down on admin time. Of course, the data uploaded to Google’s cloud healthcare offerings would be de-identified.

- Why you should care: Google seems to be building a treasure trove of healthcare data after announcing recent partnerships with the Mayo Clinic, Meditech, Allegheny Health Network, Ascension, and now HCA. I’m not an expert here, but I also wouldn’t be surprised if the search giant made some compelling moves over the next 5 years. (Link)

Microsoft’s Nuanced $20 Billion Healthcare Cloud Play

In big news announced in mid April, Microsoft is dropping about $20 billion to acquire Nuance for $56 a share. According to folks on Twitter smarter than me, the acquisition appears to be a smart, natural play for Microsoft to dive deeper into cloud-based healthcare infrastructure and physician workflow. The firm also recently announced an integration with Teladoc, which could create a powerful clinical tool for providers nationwide. (Link to Partnership)

- I found this quote provided solid context for the acquisition: “Last year, Nuance launched nationwide an AI tool co-developed with Microsoft that — with a patient’s explicit consent — can listen in on a medical visit, transcribe the conversation into text, pull out relevant medical information and auto-populate that data into the EHR, for the physician to review and sign.”

- Link to press release

- Link to deal analysis

VillageMD – is an IPO in the works?

- VillageMD, a primary care provider backed by Walgreens as its competitor to CVS’ HealthHUB, is reportedly planning an IPO at a valuation up to $10 billion, which would allow the firm to raise up to $1 billion, according to Bloomberg’s report. VillageMD runs an urgent-care like operation and is Walgreen’s competitive offering to other primary care providers, including CVS’ healthHUBS. (Link)

Accolade Buys PlushCare and Digital Health Convergence Continues.

Anotha One: In the next major push to become a digital health player offering a conglomerate of services for employers, Accolade is purchasing PlushCare for $450 million and becomes the latest firm to offer telehealth for its platform. (Link)

- The larger trend: These new-age healthcare firms are starting to compete for employers by offering a suite of services – care navigation, telehealth, chronic care management, and more – especially as the push toward value based care materializes. Read the company’s blog post about the acquisition here. (Link)

The Home Health Land Grab and Kindred Healthcare Exchanges Hands

After its transaction alongside private equity giants TPG and WCAS in 2017 to take post-acute operator Kindred Healthcare private, Humana is exercising its option to purchase the remainder of Kindred at Home in a $5.7 billion deal. This transaction price values Kindred’s home health and hospice assets at a separate $8.1 billion enterprise value. (Link)

Why you should care: Especially after Covid and the accelerated push toward home-based care, home health and hospice are a hot transaction market as major healthcare players pivot their strategies toward the home. We’ve seen quite a few acquisitions by a consortium of operators:

- Encompass purchased Frontier Home Health and Hospice, which operates in 5 states mostly in the Northwest U.S. (Link)

- Home care operator Aveanna Healthcare debuted on the public markets in late April. The firm raised about $460 million and now trades under the ticker ‘AVAH.’ (Link)

- Optum purchased Landmark Health for $3.5 billion. (Link)

- HCA also recently bought Brookdale’s home health and hospice assets for $400 million. (Link)

As you can see, the space is only seeing an increase in activity. I have to wonder if this entices Encompass to field more offers for its home health and hospice segment, as the firm is in the process of exploring strategic options for those assets. According to their management, we’ll have an update on their decision after the firm’s Q2 earnings release. My vote is on a spinoff! (Link to transcript)

LifePoint acquires Kindred’s Facilities Service Lines.

Post-Acute Plays: On the heels of Kindred at Home’s divestiture, private, for-profit acute care hospital operator LifePoint Health is buying Kindred’s facility-based post acute business (AKA, long-term care hospitals, inpatient rehabilitation facilities, and skilled nursing facilities). The deal was announced on June 21, but unfortunately no financial terms were disclosed. (Link)

- Why you should care: Hospital operators seem to be snatching up post-acute assets. Avid Healthy Muse readers will remember back in our **March 1 edition** that HCA purchased Brookdale’s home health and hospice business.

- Although the deal is focused on facility based care, LifePoint’s acquisition seems to be similar strategically from an alignment perspective and also provides LifePoint with huge scale – they’ll now operate in over 200 facility-based settings.

- Antitrust: Since this deal is so large and involves hospitals, it’s very possible that the FTC challenges the transaction.

Remember: Once this transaction clears, all of Kindred’s service lines will have changed hands, and it looks like that trend will continue – Humana indicated on its earnings call that it plans to sell off the Kindred hospice segment for a juicy valuation multiple. (Link)

- In fact, Home health and hospice multiples are the highest in all of healthcare, and really have been for quite some time. (Link)

Walmart buys a no-name telehealth provider, MeMD.

Walmart announced on May 6th its intention to purchase MeMD, which is a multi-specialty telehealth provider that nobody had really heard of until…now. (Link to press release)

It’s an interesting addition to Walmart’s health clinic rollouts and a notable play in the retail giant’s overall healthcare strategy considering recent rumors that the firm was scaling back its healthcare clinic rollout goals. (Paywall – Insider)

Bigger picture: Based on comments from the press release and others, Walmart seems to want to complement its in-store healthcare offerings with a telehealth option for customers. The move seems to indicate that if you want to be taken seriously as a healthcare player, you NEED to have a telehealth option.

- The move could be reactive in nature too – considering that Amazon Care just announced its intention to expand nationwide for employees – and has its first B2B client – Walmart might be playing defense to stay competitive in the employment market against its #1 competitor. Also, while this is the first acquisition Walmart has made into the space, the firm has partnered with other telehealth firms like Ro and Doctor on Demand in the past couple of years.

- Both Amazon and Walmart are laying the foundation for scalable healthcare presences nationwide.

The Hospital at Home Trend.

As a new venture into the Hospital at Home care model, Kaiser and the Mayo Clinic (AKA, massive players in the healthcare space) announced a $100 million joint investment into Medically Home. (Link)

This blog post gives a unique insight into how Mayo Clinic and Kaiser will scale Medically Home’s operations.

- In order to provide higher acuity care in the home, the firm will have a centralized HUB that communicates with caregivers, and connects all aspects of that patient’s care. This care could include everything from medication delivery to dialysis treatments.

Why you should care: Obviously with Covid, there’s been a huge push for more at-home care. This partnership, and other programs similar to Medically Home, will allow seniors to age comfortably in place as healthcare innovation allows care for more complex medical conditions in the home. (Like, Best Buy?)

Hospital at Home: Adding to the trend, Amedisys announced on June 30 that the home health and hospice operator purchased Contessa Health, a provider of hospital and skilled nursing at-home services, for $250 million.

- With the acquisition, Amedisys estimates that its total addressable market just drastically increased from $44 billion to $73 billion. We’ll see if the lofty growth expectations come to fruition! (Link to Press Release)

- This was a good write-up from HHCN on the strategic benefits of the acquisition. (Link)

Amazon Care Scales its Presence Nationwide

Amazon: Another headline that made waves this quarter – after Teladoc shrugged off concerns of Amazon as an entrant into telehealth during its Q1 call, a Wall Street Journal report disclosed that Amazon has signed ‘multiple companies’ to its new Amazon Care telehealth service.

- Remember that Amazon just took this operation nationwide and already offers it to employees. To continue scaling, Amazon will need to hire ‘thousands of employees.’ Very interesting to see the telehealth arms race heat up! (Link)

Convey Health Solutions IPO

Digital: Yet another health tech platform, Convey Holdings focuses on working with payors and PBMs to ‘improve government-sponsored health plans.’ The firm went the IPO route and debuted at a $1.1 billion value. (Link) (Link to S-1)

The ACA wins again at the Supreme Court.

3-0: For the third time in a decade, the ACA has been upheld by the Supreme Court in a 7-2 decision. SCOTUS decided in its opinion that states did not have standing to sue over whether the removal of the individual mandate (AKA, the $$$ penalty for not having insurance) made the entire ACA illegal.

- To be candid, this prosecution was an embarrassingly weak legal argument, as the court decided that no harm had been done to the states that brought the suit. As a result, the case will be dismissed. (Link)

- It’s probably a good thing that the ACA stayed in place considering enrollees are at an all time high as of this writing – above 80 million individuals. (Link)

Outset Medical and Strive Health team up on Dialysis Home Care.

Partners: On June 16, Value-based kidney care firm Strive Health announced its partnership with publicly traded medical device firm Outset Medical

- Details: Strive Health will use Outset Medical’s kidney care machine called the Tablo Hemodialysis System, which intends to simplify the dialysis process and even allows patients to administer dialysis at home rather than in an outpatient clinic setting.

- Why you should care: The $74 billion end stage renal disease industry is mainly dominated by DaVita and Fresenius. This partnership is an extremely significant foray into challenging that traditional duopoly, so you should pay close attention to this one. (Link)

Major Hospital Mergers. Beaumont Health and Spectrum, Oschner’s 7-hospital Acquisition of Rush Health Systems, and Steward’s Acuisition of 5 Tenet-run Hospitals

Beaumont tries again: This quarter, Beaumont Health and Spectrum Health announced their intention to merge into what would create the largest health system in Michigan, with 22 hospitals and about $13 billion in revenue.

- Long time readers might remember that Beaumont Health has attempted to sell itself off twice already – once to Summa Health and then again to Advocate Aurora Health. Both attempts failed due to antitrust and cultural issues. Can Spectrum succeed where others have failed? Stay tuned! (Link)

Ochsner’s buying spree: Louisiana-based Ochsner Health announced its intention to acquire Rush Health Systems, a 7-hospital system in the Mississippi and Alabama areas. This announcement comes on the heels of Ochsner’s acquisition of Lafayette General Health in late 2020. (Link)

Steward buys Tenet hospitals: To round out the hospital activity, Tenet is selling 5 hospitals to Steward Health Care for $1.1 billion in the Florida area. The hospitals will continue to use Tenet’s rev cycle software Conifer and continues to signal Tenet’s push toward outpatient operations and its focus on USPI.

- Remember that Steward was bought back from private equity group Cerberus by a group of physicians in the summer of 2020 – this acquisition marks Steward’s first real activity since then. (Link)

Pear Therapeutics to become Latest SPAC

SPAC me: In the latest SPAC deal, Pear Therapeutics is set to go public at a $1.6 billion valuation. Pear is set to become the first digital therapeutics firm to go public, which is notable because the space’s potential is largely unknown. (Link)

- Digital Therapeutics? For a precursor on the digital therapeutics trend, and what to expect, Nikhil Krishnan put together a nice piece last year on the emerging industry. (Link)

Q2 Public Healthcare Market Update.

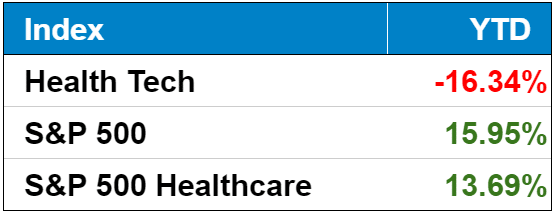

Performance hasn’t been great for digital health firms in 2021. The Healthy Muse Health Tech Index is down around 16% as of this writing, while the S&P 500 has returned around 16%. Yikes.

- What does this mean? It seems as if the public is heavily discounting private digital health valuations as well as these companies’ growth potential post-COVID. Personally, I’m firmly situated in the bullish camp.

In summary, this year, at least 19 digital health and healthcare services firms have gone public as of the second quarter of 2021:

- Clover

- Hims & Hers

- Signify Health

- Oscar Health

- InnovAge Holdings

- Alignment Healthcare

- Agilon Health

- Aveanna Healthcare

- Privia Health

- Cano Health

- UpHealth

- LifeStance Health

- Convey Health Solutions

- ATI Physical Therapy

- 23andMe

- Talkspace

- Bright Health

- Doximity

- Sharecare

Q2 Healthcare Policy Update

What’s next for Biden’s healthcare agenda.

After setting several coronavirus-related goals in the first few months in office, the Biden Administration is now pivoting to other hot-button healthcare issues that took a bit of a backburner during COVID.

Here are the major issues you’ll need to keep in mind during Biden’s term:

- Medicare to 60 and Medicare Expansion: As one of Biden’s original campaign issues, several Democratic senators are now asking Biden to expand Medicare. The thinking here is that individuals aged 60-64 (current Medicare eligibility age is 65) would be allowed to ‘buy-in’ to Medicare

- Expansion: Not stopping there, the Biden Admin also wants to expand traditional Medicare benefits to include hearing, dental, and vision care, among other things. Currently, only Medicare Advantage plans provide these supplemental benefits. (Link)

- Drug Pricing: Biden wants to allow Medicare to negotiate lower prices with drug manufacturers.

- Surprise Billing: Although surprise billing was banned in 2020, the specifics of the bill are a bit fuzzy, which is the next fight the Biden Admin is facing in this arena. Recently, the Biden Administration released guidance – a sort of roadmap – to achieve no surprise billing effective January 1, 2022. (Link)

- Medicaid Expansion: After expanding subsidies for the ACA in the latest stimulus bill, the Biden Admin turned its focus toward the 12 remaining holdout states which haven’t yet expanded Medicaid through the ACA. One of these states is Texas, where Biden recently rescinded Texas’ 1115 Medicaid waiver, essentially meaning that the Admin is trying to strong-arm Texas into expanding the social safety net healthcare service. (Link)

The Healthy Muse Favorite Reads from Q2

Epic: This was a fascinating read about one of the most successful female entrepreneurs in the U.S.: Judy Faulkner, who founded Epic Systems. (Link – soft paywall – Forbes)

Therapy Apps: How great are therapy apps, anyway? Diving into the therapy app fantasy. (Link)

Telehealth: employer tele-mental health is new branding on an old model. (Link)

Supply Chain: Read this fascinating deep dive into the drug industry: a drug’s convoluted journey from factory to patient. (Link)

Digital Health: This is a fantastic overview of digital health from Triple Tree – trends to watch, major players to follow, and more. (Link)

Status Vax: This was a fascinating read about how Pfizer’s vaccine somehow became top tier from a social perspective – the Pfizer elites (full disclosure, I’m a Pfizer elite – sorry to all you JnJ peasants). (Link)

A New Era: Here’s a good well thought out essay from Joe Connolly about healthcare’s movement toward a virtual first ecosystem – how a host of anti-consumer factors are causing a paradigm shift in the industry. (Link)

All about the FDA: This write-up was a great dive into how the FDA works – the article starts from the ground up and left me with a solid understanding of how things get done at the agency. (Link)

Racism: There were a few thought-provoking articles involving racism in healthcare. I’ve linked both of them below:

- The world’s leading medical journals don’t write about racism. That’s a problem. (Link)

- Race and Healthcare in America. (Link)

M&A: Learn more about the newly formed health system Virginia Mason Franciscan Health up in the Pacific Northwest – how the two systems integrated, the first 100 days, deciding on a dual-CEO model, and more. (Link)

GoodRx: This profile of GoodRx from Fortune was interesting, especially because while GoodRx helps patients navigate an extremely difficult drug industry, the firm technically shouldn’t need to exist. (Link)

Sewage: Here’s an interesting long-form read about sewage in the U.S., and using the system to improve our healthcare system and public health infrastructure. (Link)

The Flu: An interesting read on the potential return of the flu, with experts weighing in on what kind of flu season we might expect – if any. (Link)

Public Option Opinions: This was a pretty engaging piece from the Brookings Institute on thinking about smartly designing a public option policy that would actually set out to reduce prices for healthcare consumers. (Link)

New Look, who dis: Go check out Out-of-Pocket’s revamped site which has a fantastic design. Nikhil Krishnan does great work with his newsletter and describing healthcare business models – I highly recommend dropping a subscription if you haven’t already. Also, check out the most recent article on SWORD Health – which provides MSK care via smart sensors and virtual therapies. (Link)

Increased Complexity: This was a great (but revealing) read from ProPublica about the increased complexities in cancer cases being found in patients now after going undiagnosed during the first year of the pandemic. (Link)

Pharmacies: Here’s a good read from the NY Times highlighting the various ways that CVS, Walgreens, and others are targeting the mental health market, including providing therapy within their retail footprints. (Link – soft paywall)

Faxes: Here’s a great read from substack guild aficionado Brendan Keeler about legacy standards in healthcare, the fax machine, and why things move so slowly in our world. (Link)

Machine Learning: An interesting deep dive into the world of the FDA and how medically based machine learning devices are being regulated by the governing body. (Link)

Direct Contracting: We’ve heard a lot about the new direct contracting model (capitation, value based arrangements) coming out from CMS and the parties involved are very bullish on the program. This article breaks down the Direct Contracting program and what to expect with its implementation. (Link)

One Medical: This was a good read from the Washington Post on One Medical, and diving into whether a subscription model is the right approach for primary care in the U.S. (Link)

Value-Based: Since we’re apparently obsessed with value based care this year, Olivia Webb posted a good write-up on primary care capitation. (Link)

Patient Outcomes: Following up on that whole value-based care thing, here’s an equally good article from Kevin Wang about how patient surveys are converted into an actionable performance measure for providers. (Link)

Women’s health: This was a great overview of the women’s health space and a solid attempt at killing off the buzzword ‘Femtech’ (Link)

Cityblock: Here’s a solid read from a great newsletter – Not Boring – giving a great operational overview of Cityblock Health, a super interesting player in healthcare. (Link)

Iora Health: Read more about Iora’s deal with One Medical from Kevin O’leary. I really enjoy his summaries and perspectives from both a bull and bear point of view. (Link)

DTC: This piece from Ro’s CEO was a cool insight into how the firm thinks about direct-to-consumer principles. (Link)

FHIR: Brendan Keeler’s write-up on the Fast Healthcare Interoperability Resources had me rolling. Great read for anyone wanting to learn more about this standard. (Link)

Quick Hits: Business, Partnership, and Strategy Stories

Agilon: After announcing its intention to go public in late March, MA player Agilon is targeting a $9 billion valuation. Check out our 3.22 edition for more info on Agilon. (Link)

Anticompetitive? US Anesthesia Partners, a multistate group of anesthesiologists, is suing UnitedHealth Group for alleged anticompetitive practices by forcing the doctors out of UNH’s network. I should note that anesthesia groups are notorious for being out of network and dropping surprise bills on patients. (Link)

Come and Go: Encompass Health announced that April Anthony is stepping down as CEO of its home health and hospice segment. She is the original founder of the business and will step down over the summer officially. (Link)

- In related executive news, Brian Thompson was named CEO of UnitedHealth Group (the insurance segment, at least) in early April. (Link)

- Finally, Walmart’s chief medical officer is quitting. (Link)

Antitrust: As a trend expected to continue under the current regime, the FTC is challenging the recently announced Illumina-Grail $7 billion biotech deal. (Link)

Hospital finances: The latest Keckley Report dives into hospital financials during the pandemic with insights from Kaufman Hall’s hospital flash report from March. Mr. Keckley notes that, while from a high level perspective hospitals appeared to come out unscathed from 2020, there are major headwinds facing these healthcare stalwarts. Worth a read if you have 5-10 minutes. (Link)

- Deals: On a related vein, Kaufman Hall noted that the value of hospital deals rose during Q1 2021; however, total volume of deals decreased year-over-year. (Link)

Interesting partnerships:

- Despite shutting down its Watson Health segment, IBM and Cleveland Clinic are launching a 10-year quantum computing deal. (Link)

- CommonSpirit Health and women’s health startup Tia are partnering on a primary care network. (Link)

- Publicly traded medical device operator Medtronic inked an interesting value-based care deal with Spectrum Health in early April. The deal is centered around preventing readmissions in patients who use a certain Medtronic device. (Link)

M&A: SOC Telemed is acquiring Access Physicians, a telehealth provider, for $194 million. (Link)

- Speaking of telemedicine, Verizon of all companies is joining the telehealth trend with its Bluejeans provider platform. How bizarre. (Link)

- Radiology Partners, the largest radiology physician group in the country, is continuing its rapid rollup and acquired 6 more deals in 8 states. After these deals and the Mednax Radiology Solutions acquisition, RP is up to a 33-state geographical footprint. (Link)

Integration: Take a peek at what HCA’s plans are for its recent acquisition of Brookdale’s home health biz. Hint: integration of HCA’s existing services with Brookdale’s post-acute services. (Link)

Amedisys: Is piloting a SNF-at-Home program, asserting that 20-25% of SNF volumes could potentially go into the home. (Link)

M&A: Learn more about the newly formed health system Virginia Mason Franciscan Health up in the Pacific Northwest – how the two systems integrated, the first 100 days, deciding on a dual-CEO model, and more. (Link)

Mental Health: A few articles related to mental health:

- This was a solid overview of how mental health works from a business perspective – how investment in the space was neglected, drivers causing mental health to come to the forefront, and catching up after years of neglect. Note – perhaps a touch more opinion-based (Link)

- In a similar vein, CVS is planning to expand into providing mental healthcare in its stores. What CAN’T HealthHUBs do?? (Link)

M&A: This was a solid high level overview of transaction trends for hospitals, payors, and healthcare staffing deals. (Link)

M&A: HCA is selling four hospitals in Georgia for just south of $1 billion to Piedmont Healthcare. (Link)

Partners: Encompass Health and Georgia health system Piedmont announced a JV to jointly operate three inpatient rehab facilities in Georgia. The announcement comes on the heels of Piedmont purchasing several hospitals from HCA. (Link)

Physician Losses: In a reversing trend to what’s happening nationwide with physician employment, Philadelphia system Tower Health is restructuring its medical group, which includes terminating some provider contracts. (Link)

Healthcare IPOs: Per S&P Global, healthcare IPOs during the first quarter of 2021 have more than doubled when compared to 2020. The article attributes the change to increased demand for Covid-related therapies and diagnostics, as well as a push for more innovation in the healthcare space. Not sure – is there enough money in healthcare yet? (Link)

Cedar buys Ooda Health: As probably the biggest news in the digital health world this quarter, healthcare payments firm Cedar agreed to purchase its peer, Ooda Health, for $425 million. Cedar partners with health systems and payors in efforts to cut down on administrative waste, make healthcare payments more transparent, and improve the overall revenue cycle management process.

- This transaction is one of those ‘un-sexy’ acquisitions you hear about, but probably makes the combined company into a pretty interesting player in the administrative space. (Link)

Signify Health: This was a good dive into Signify’s Q1 and provided some insights into the segments that the firm operates in. (Link)

Amazon vs. GoodRx: Amazon unveiled its highly anticipated drug price comparison tool, in direct competition with GoodRx. Prime members are now able to compare a drug’s price at Amazon Pharmacy and 60,000 pharmacies nationwide. (Link)

- Notably, GoodRx execs are downplaying Amazon’s emergence in their territory. (Link)

Hospital M&A: This article dives into Piedmont Healthcare’s recent acquisitions in Georgia, including purchasing 7 hospitals THIS YEAR. Piedmont is definitely picking up the pace. (Link)

One Medical: Saw its losses steepen in Q1, but is bullish about its growth prospects in the near future including its partnership with Baylor Scott & White in Texas. (Link)

Oak Street Health: Similarly to One Medical, OSH continued its bullish commentary on rolling out new clinics and expanding in its value-based care mission. (Link)

Cano Health: Keep this MA player on your radar, as Cano Health is expected to go public soon at a $4.4 billion valuation. (Link)

M&A: This is a fantastic deep dive into the M&A environment across a multitude of healthcare sectors, highlighting key trends and changes to valuations in the ‘new normal’ of 2021. (Link)

Digital Health: A few big digital health stories you should know about. Here’s what happened:

- Ro acquired Modern Fertility and wrote a Medium post about it. The acquisition is an interesting foray into women’s health. (Link)

- Behavioral health platform Lyra Health is raising money like wildfire. The firm has doubled its valuation in the first 6 months of the year. Why go public when people just throw money at you? (Link)

- Babylon, a virtual care platform, purchased ****what appears to be an IPA called Meritage Medical Network out in California. The network contained about 700 physicians. (Link)

Prior Auth: Anthem and Epic announced a data sharing partnership to ease the burdens associated with prior authorizations. (Link)

Dealbreaker: Following nurse and provider complaints, CommonSpirit and Essentia are calling off their 14 hospital deal. It’s a somewhat interesting development and makes me wonder whether antitrust concerns were at play as well. If I recall correctly, a key consideration into antitrust concerns is related to the potential impact on salaries like nurses. (Link)

Haven 2.0: JP Morgan announced its plan to launch Morgan Health, the new firm will attempt to build on Haven’s ashes. Interestingly, the startup is receiving $250 million to invest in promising partnerships, which almost sounds like a venture capital firm? (Link)

Medline: Several private equity firms combined forces to purchase a majority stake in Medline – a medical supplier akin to Cardinal Health or Stryker. The deal values Medline at around $30 billion and also goes to show that private equity is still out there looking for undervalued assets in healthcare. The deal marks the largest leveraged buy-out in a decade. (Link)

Cano Health: started trading on June 7th under the symbol ‘CANO’. I feel like this guy is flying under the radar a bit, but the firm focuses on managing low-income patients in underserved communities through value-based primary care contracts. (Link)

Rumor Mill: Could Cerner be an acquisition target for one of the big tech firms? The rumor mill thinks so. (Link)

Merger Denials: Sentara Healthcare and Cone Health have decided to scrap their previously announced merger in the North Carolina and Virginia area stemming from internal pushback and pressure from external voices.

- Bigger picture: Several other health systems have called off mergers in the past couple of years. Merger announcements will continue, and I’d wager that mergers will be called off more often than not as hospital consolidation remains in lawmaker focus. (Link)

Merger Approvals: Three previously announced healthcare mergers were cleared for takeoff this quarter.

- First, shareholders gave the green light to the UpHealth and Cloudbreak SPAC. The newly formed company will start trading on June 9 under the ticker ‘UPH.’ (Link)

- Second, Microsoft’s $16 billion purchase of Nuance won antitrust approval. (Link)

- Finally, Deerfield’s SPAC shareholders approved its acquisition of senior care provider CareMax. (Link)

FIGS: Scrub maker FIGS completed its IPO on June 1. The healthcare apparel brand is built on a direct-to-consumer model and currently trades at a $5 billion market cap as of this writing. (Link)

Labor: Seems like the tight labor market is affecting healthcare as well – health systems are offering large signing bonuses to combat nursing shortages. (Link)

Data: Health data giants Ciox and Datavant are merging in a $7 billion deal to form a ‘health data ecosystem’ conglomerate. Post-merger, the firm will be called Datavant and generate about $700 million in revenue. The goal – according to Bloomberg reporting – is to exit via IPO someday, joining the digital health party going on there. (Link to article)

Geode Health: on June 9, private equity player KKR announced its intention to create Geode Health, a new platform company focused on in-person and virtual outpatient mental health treatment in the U.S. The formation news comes at a time when LifeStance health, another similar mental health player, announced its IPO plans . (Link)

Definitive Healthcare: Another healthcare data analytics firm Definitive Healthcare announced its intention to go public via IPO. S-1 to come, but there are some interesting data platform announcements this quarter. (Link)

Clover: The MA plan has had quite the trading experience so far in 2021. After being subject to a short-selling attack, Clover has become a meme stock, following in the footsteps of GameStop and AMC. (Link)

Generics: In recent weeks over the summer, both Walmart and Amazon have added cheap generic discounts to their respective memberships (Prime and Walmart+). (Link)

Costs: PwC is estimating a 6.5% rise in healthcare costs in 2022 after a flat year in 2020. Interestingly, the report expects 2021 to maintain muted healthcare spending as the effects of the pandemic seem to be sluggish in shaking its way out of healthcare. (Link)

Blood: CNBC profiled several new types of blood testing breakthroughs that are close to commercialization. (Link)

Acquisition: In its first few weeks as a public company, Cano Health acquired University Health for $600 million. (Link)

Billing: An Axios report found that 10 hospitals are responsible for 97% of court actions against patients. (Link)

Cash: Mental health funding just hit an all-time high. (Link)

Settlement: Centene had to shell out $143 million to settle certain PBM disputes in a couple of states. The firm has allocated over a billion already in anticipation of settling court cases. (Link)

Generics: Along with its hospital partners, generic drug maker Civica Rx has created a new subsidiary called CivicaScript which announced a partnership with Anthem this quarter to address generic drug shortages. (Link)