healthy muse healthcare news.

This week in healthcare: MA payor Alignment goes public, DOJ to review Unitedhealthcare’s $13 billion acquisition of Change Healthcare, Uber Health expands its prescription delivery service, 200 million vaccinations in 100 days, AstraZeneca’s bad data, and more.

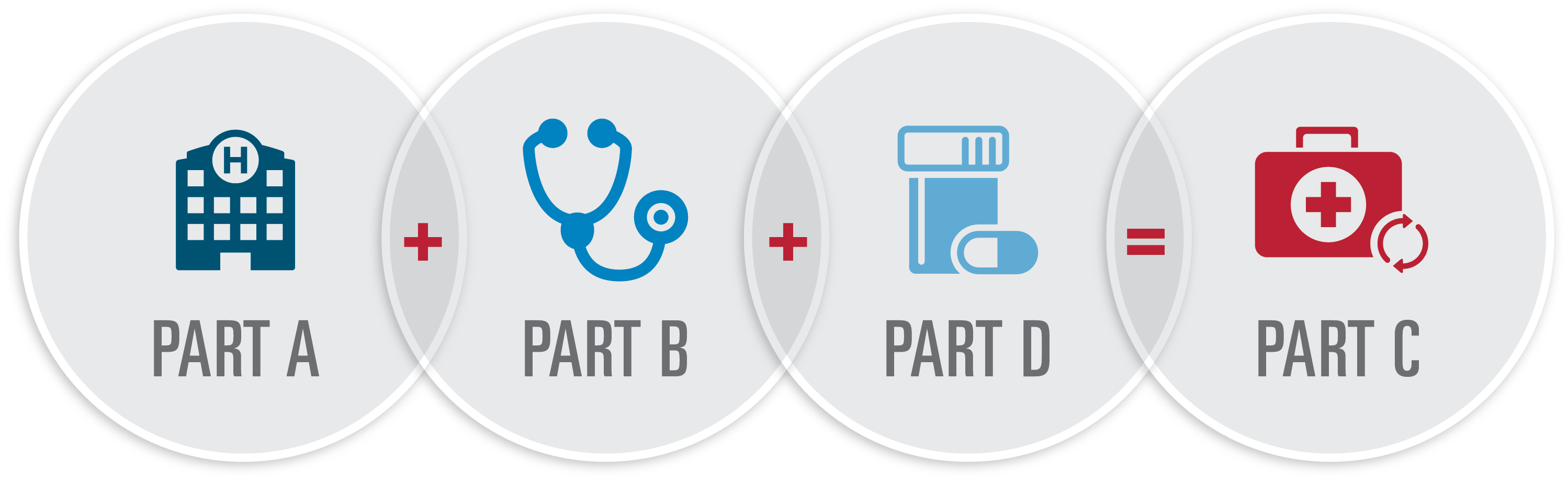

Rise of the Medicare Advantage Startup.

More Payors: Alignment Healthcare, which is a managed care player focused on Medicare Advantage, debuted on the public markets this week, finishing at $19/share Friday after pricing its IPO between $17-$19 per share. The firm operates ‘technology enabled’ Medicare Advantage plans in California, North Carolina, and Nevada and seems to operate those plans well. I’ll be watching how Alignment tracks compared to its recently beaten-up peers (AKA, Oscar and Clover). (Link)

Bigger picture: MA firms who have recently gone public or plan to in 2021 include Clover (58k members), Agilon (131k members), and now Alignment (81k members). Kevin O’leary has had some great write-ups about each of these firms:

DOJ to review Unitedhealthcare’s $13 billion acquisition of Change Healthcare

Litigation: At the request of the American Hospital Association, the DOJ is investigating UNH’s previously announced $13 billion acquisition of Change Healthcare – a revenue cycle and data analytics platform.

About the challenge: As more of an infrastructure-esque purchase, the acquisition was more behind the scenes in nature. But the AHA claims that the acquisition may result in less competition for IT and revenue cycle management services among providers.

- The DOJ case is just delaying the inevitable: that everyone in healthcare will eventually work for United. (Link)

Coronavirus updates.

Cases: Are picking up in certain states while dropping in others. The U.S. seven day average is 63k – up from last week’s report of 54k – as of this writing. (Link)

- Many states are releasing restrictions on vaccines – Biden announced that he expects 90% of Americans to be eligible for the vaccine by April 19. (Link)

Vaccines: are trending at 2.76 million per day, up from last week’s 7-day average of 2.5 million. (Link).

- At this rate, we’re set to clear Biden’s new goal of 200 million coronavirus doses administered in the first 100 days. This next cohort will likely be more challenging as we move into the ‘voluntary’ vaccinations camp. Adoption will need to continue to improve. (Link)

- Good news came from the never-ending studies mill: both Pfizer and Moderna’s vaccines are 90% effective in real-world conditions, according to the CDC. (Link)

- AstraZeneca found itself in a bit of a pickle after a quality review board noted that it had used outdated data in order to get to its 79% vaccine efficacy conclusion for its vaccine candidate. After the hysteria died down, AstraZeneca updated its data, and now, unfortunately, the vaccine is only 76% effective. Sigh. (Link)

The next step in travel: The Biden Admin and other companies are working on digital ‘vaccine passports’ that would allow Americans to travel more easily by confirming they’ve been vaccinated. (Link)

Quick Hits

Biz Hits

Uber: Is expanding its prescription delivery service big-time. Uber Health will now deliver prescriptions to 37 states after its deal with ScriptDrop announced this week. I’ll be interested to see if mail-order and prescription delivery takes hold in the near future. (Link)

Private Equity: Pay attention to the booming hospice market. M&A, and valuations, continue to rise in the space and I imagine hospice will continue to be an attractive space to enter as the U.S. population ages. (Link)

Signify Health: This was an interesting article shedding more light on what space recently public home care analytics and staffing firm Signify Health operates in. (Link)

Cigna: released some interesting claims data related to behavioral health – namely, that demand for virtual behavioral health services remains high. (Link)

Hims & Hers: The firm’s stock has been pummeled lately despite impressive revenue growth. (Link)

Trinity Health: Announced a national urgent care partnership with Premier Health this week after acquiring a majority ownership stake in the firm. (Link)

Policy Hits

Drug prices: In a headline as old as time itself, Democrats are preparing themselves for another push to lower drug prices – centered around allowing HHS to directly negotiate drug prices for Medicare. (Link)

Sequester: This week, the Senate passed the House-led bill extending the Medicare sequester cut pause. All of that jargon basically means that providers will continue to temporarily receive higher reimbursement from Medicare. (Link)

Private Equity: Investments in nursing homes by private equity firms were slammed during a House hearing this week. (Link)

Audio: An interesting new bill is making its way through Congress, where CMS would reimburse for audio-only telehealth visits. (Link)

Other Hits

Out of Pocket: Match Day and the Unmatched. (Link)

Medicare Advantage: If you want to learn a bit more about who the main demographics behind Medicare Advantage are, look no further than this article. (Link)

Thought-Provoking Editorials

Women: Why we need to stop treating women’s health as a ‘category.’ (Link)

Reality check: Amazon Care may not be that big of a deal. (Link)

Public Option: Covid-19 makes it ‘brutally clear’ why we need to add a public option for health insurance. (Link)

For those feeling especially conspiratorial…I just had to include this one: Why the Wuhan lab-leak theory shouldn’t be dismissed. (Link)

Healthy Muse Top Picks

Delivery: What it’s like to have a baby during a pandemic. (Link)

Family Feud: America’s Covid swab supply depends on two cousins who hate each other (Link – Bloomberg Paywall)

Doctor Fentanyl: The untold story of the doctor who fueled a drug crisis. (Link)

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse is the alternative to boring healthcare news. It’s one weekly e-mail updating you on all the major strategy news, policy news, broader trends, big stories, and everything in between. Learn more about our vision here.

Get smarter and sign up below today.