healthy muse healthcare news.

- This week in healthcare: Teladoc partners with Microsoft, Amazon unveils AWS for Health, a $26 billion opioid crisis settlement, hospital monopolies, everything about the Delta variant, Akumin acquires Alliance, ATI Physical Therapy’s rough quarter, SNF at home pilots, increased price transparency fines, and more.

A $26 Billion Opioid Settlement for McKesson, Cardinal Health, and AmeriSource Bergen.

The Grand Finale: After a multi-year slog in the courts, drug distributors McKesson, Cardinal Health, JnJ, and AmeriSourceBergen have settled on a combined $26 billion multi-year payout to states involved. Assuming states approve the settlement, this agreement would largely put to bed the companies’ liability stemming from the opioid crisis. (Link)

- Deeper: The news comes at a time when drug overdose deaths were at an all time high during the pandemic. (Link)

Return of the (Delta) Variant.

Here we go again: The latest coronavirus variant, Delta, is causing a notable resurgence in cases in the U.S. – it’s twice as infectious and is rarely causing breakthrough infections in vaccinated individuals.

Since only 50% of Americans are vaccinated, this is bad news for states with high levels of unvaccinated individuals, namely Florida. The state is now the new U.S. pandemic epicenter as cases are ramping above 20k per day there.

- Bigger Picture: Delta has caused the CDC to reverse course on its mask guidance by once again recommending mask wearing in hot spot areas, warning that the “war has changed” with the latest variant.

- Vaccines: Based on the latest research, those who are vaccinated can apparently still spread the Delta variant, but are still much less likely to be infected or hospitalized

- Good news: The Delta variant also hit the U.K. hard initially too, but cases went up quickly then nosedived just as fast – and deaths are way lower. Hopefully the same holds true for the U.S.

Here’s a good summary of everything Delta variant from The NY Times (soft paywall). (Link)

Akumin acquires Alliance Healthcare Services to create National Imaging Company

Imaging: Publicly traded imaging operator Akumin announced its intention to acquire fellow radiology provider Alliance Healthcare Services this quarter for around $820 million, in what would create a major national competitor to RadNet and U.S. Radiology.

- Big picture: the transaction would expand Akumin’s national footprint from 7 to 46 states with over $700 million in revenue. Interestingly, Akumin appears to be acquiring a larger company in Alliance and is raising $700 million in debt to do so. The deal is expected to close in the third quarter, at which point Akumin will get busy with integration. (Link)

Teladoc, Microsoft Partner, Google’s Interoperability Push, and Amazon’s AWS for Health.

Integration: In this week’s digital health news, Teladoc announced a major collaboration with Microsoft to integrate Teladoc’s Health’s Solo platform into Microsoft Teams. The announcement is notable as Microsoft and Teladoc continue to partner on virtual care and easing administrative burden to health system clients. (Link)

- Google also announced new interoperability tools this week as well. (Link)

- Finally, Amazon unveiled AWS for Health – cloud services for a host of healthcare companies including genomics and biotech firms. (Link)

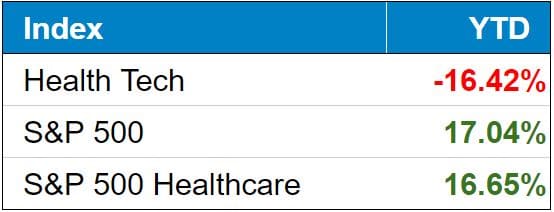

public market update.

ATIP: Recently SPAC’d ATI Physical Therapy had a notable earnings release this quarter. The stock dropped 35% on the release and revised its EBITDA guidance FROM ~$120 million to $60m – $70m based on the following headwinds:

- Staffing attrition in both support staff and physical therapists, leading to wage inflation and increased competition for workers

- Decreased net revenue per visit driven by “continuing less favorable payor and state mix when compared to pre-pandemic profile, with general shift from workers compensation and personal injury to commercial and government.”

ATI is also lowering its estimate for new clinic openings – previously planned for 90 openings this year, now expecting to acquire / start 55 – 65 clinics instead. They attributed this to staff attrition. (Link to Press Release).

USPH: ATI’s peer, U.S. Physical Therapy, was quick to release its own press release stating that it was NOT facing the same pressures. Very interesting to see how management execution in the same sector can cause drastically different business results.

Insurers‘ earnings growth is outpacing the market. Expect that to continue. According to Moody’s analysts, the eight managed care behemoths combined for EBITDA of around $65 billion, an increase of 10% per year since 2010. Pretty insane how these managed care players seemingly just print money and always perform during earnings season. (Link)

TDOC: As it it’s not in the news enough, Teladoc reported its Q2 earnings as well. Although its core telehealth biz is firing on all cylinders, Teladoc’s integration with Livongo seems to be taking longer than expected and membership numbers stalled, which is making some shorter term investors skittish.

- We’ll see if Teladoc can successfully integrate its collection of virtual and remote offerings to continue to create a compelling product for businesses and beat out other digital health conglomerates. The firm did note some bullish growth prospects, including rising revenue-per-member metrics and a substantial new contract with the Blues. (Link)

GoodRx: Announced on August 2, GoodRx and GoHealth, an insurance broker, announced an ‘exclusive’ agreement to bring GoHealth’s Medicare enrollment and engagement solutions directly to GoodRx users on its platform. Seems like a win-win. (Link)

Biz Hits

Primary Care: As one of the largest primary care unicorns, Carbon Health raised another $350M with the intention of becoming the largest primary care provider in the U.S. (Link)

Platforms: This substack write-up was a good brief overview of certain digital health platforms / conglomerates being created and who the big players are. (Link)

Monopolies: Lots of discussion surrounding monopolies in healthcare over the past few weeks:

- Piedmont: After making several hospital and other acquisitions in Georgia, Piedmont Healthcare is getting called out by a national nurses union for fear of creation of a local Georgia monopoly. (Link)

- Policy: The Biden admin is ordering agencies to take a closer look at hospital consolidation. Bottom line – regional health system mergers is likely to get much more difficult. (Link)

- Analysis: This was a decent overview of concentrated hospital markets and how these dynamics affect consumers. (Link)

- da Vinci: Ironically, hospitals are taking on another kind of monopoly – that of Intuitive Surgical’s da Vinci machine, used in certain types of surgeries. Hospitals are accusing Intuitive of anticompetitive practices on pricing. (Link)

Ginger: is adding a new behavioral health service directed at teenagers. (Link)

Ro: the direct-to-consumer firm is launching its own mental health platform – Ro Mind – that will allow patients to seek care and prescriptions for generalized anxiety disorder and major depressive disorder. (Link)

Amwell: the Teladoc competitor snatched up two digital health startups – SilverCloud Health and Conversa Health – for a combined $320 million. More digital health conglomeration! (Link)

PBM: Managed healthcare behemoths Anthem and Humana are partnering with hedge fund SS&C Technologies Holdings to create a new pharmacy benefit manager called DomaniRx. The firms have already committed $925 million to the joint venture. (Link)

Disputes: Speaking of hospitals, payor-provider contract disputes are back! Dignity and Anthem Blue Cross in California saw their contract negotiations break down. As a result, several Blue commercial plans are no longer in network with Dignity hospitals as of July 15. (Link)

SNF at Home: Huge nonprofit health system CommonSpirit Health is piloting a SNF at home program in Nebraska after patients have pushed back against getting discharged into nursing home facilities. (Link)

Policy Hits

Price Transparency: CMS issued stiffened guidelines for the hospital price transparency mandate. The fine, which used to be a paltry $300 a day, now scales with hospital bed size. Did you know that only about 5% of hospitals are compliant with the rule? Pretty crazy. (Link)

Missouri Medicaid: It turns out after all that Missouri will get to expand Medicaid after the Supreme Court decided unanimously to overturn a lower court’s decision. ICYMI: Here’s a recap of what happened. (Link)

- Missouri voters passed a ballot initiative to expand Medicaid

- State legislatures refused to provide funding for the expansion

- A lower court upheld the legislature decision

- The state Supreme Court overturned the lower court

Generics: In late July, the FDA approved a policy to allow pharmacists to automatically swap out pricier brand name insulins for cheaper, biosimilar versions. This is the first time that the FDA has approved the use of an ‘interchangeable’ biosimilar and could be the beginning of a larger trend that incentivizes other drug makers to make biosimilar drugs. (Link)

Telehealth: Read a summary of the letter that major telehealth operators sent to Congress urging them to keep the changes to telehealth that occurred from the public health emergency during the pandemic. (Link)

Other Hits

Debt: American medical debt is a whopping $140 billion – much higher than previously known – according to The NY Times. (Link – NY Times – Soft Paywall)

Vaccine Mandates: Over 50 medical groups are calling for mandatory vaccinations for health care workers. Many health systems and employers have begun mandating vaccines as the contention heats up. (Link)

Proactive: Anthony Fauci is vouching for a program to create vaccines in advance of any future pandemic. Could be a great way to use the remaining healthcare relief funding, but I’m not a policymaker. (Link – NY Times – Soft Paywall)

Opinions

SNFs: Nursing homes have gotten a bad rep during the pandemic. Skilled Nursing News dove deeper into how nursing homes could change for the better. (Link)

Mental Health: Simone Biles’ controversial decision to drop out of the Olympics is sparking a nationwide conversation on mental health. (Link)

Healthy Muse Top Picks

Out-of-Pocket: The latest from my favorite healthcare newsletter dives into healthcare data – who’s buying it, who’s selling it, and how it can be manipulated. Sign up for Nikhil’s newsletter here. (Link)

Cross Contamination: An interesting piece from Bloomberg this week highlighted a lesser-known issue in drug distribution – that drug cross-contamination is rampant. (Link – soft paywall)

Genome: This week’s cool healthcare story from Nature dives into Google’s DeepMind AI and its ability to predict structures for a vast trove of proteins. (Link)

Unvaccinated: The NY Times took a deep dive into who comprises the 50% of unvaccinated people in America, including interviews with individuals who comprise different camps of thought. Worth a read to understand the perspectives here, but what’s it going to take to end this thing? (Link – NY Times – Soft Paywall)