healthy muse healthcare news.

- This week in healthcare: Honor acquires Home Instead to create huge home health player, vaccine mandates gain traction, DOJ challenges Change Healthcare acquisition, the new $1 trillion budget for healthcare, and more.

Home Healthcare startup Honor acquires Home Instead to create $2 billion Home Care firm.

Honor, a technology and back-office home care infrastructure firm, announced its acquisition of home care provider Home Instead. The acquisition gives Honor access to 1,200 locations throughout the U.S. and abroad.

This is big: The newly combined co would generate more revenue than Addus, Pennant Group, and would be on par with LHC Group and Amedisys’ consolidated reported revenue of about $2.1 billion.

- About Honor: Interestingly, Honor started as a back-office partner that provides infrastructure to home health and home care agencies. With the acquisition, Honor will pivot into a vertically integrated home-care provider and a major player in the industry. (Link)

Delta Surge update: Vaccine mandates gain traction, hospital beds in short supply.

Vaccine mandates: As the U.S. hits 100k cases per day, over 53 health systems and hospitals have mandated vaccines for their employees. California has followed suit, issuing a state-wide mandate for healthcare workers. New York is requiring proof of vaccination for indoor activities.

- Labor Day: The FDA is expected to fully approve Pfizer’s vaccine by Labor Day. Currently the vaccine is only approved for emergency use. Full FDA approval might sway some vaccine hesitant folks. (Link)

DOJ expected to challenge UnitedHealthcare’s $13 billion purchase of Change Healthcare

After complaints from providers concerned about potential antitrust in the revenue cycle and claims space, the DOJ is expected to challenge UnitedHealthcare’s deal for Change Healthcare. (Link)

- Despite the news, Change Healthcare will continue its integration with Optum, so the firms appear to be pretty confident the transaction will go through. (Link)

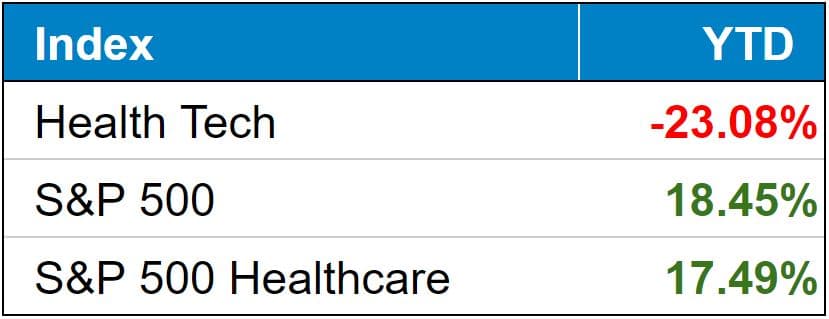

public market update.

Top 3 weekly performers: 23andMe, One Medical, Cano Health

Bottom 3 weekly sandbaggers: Bright Health, Doximity, Oscar. Bad week for the insur-tech gang

- Full List YTD performance: (Link)

$Hospitals: Hospitals across the board experienced a volume rebound this quarter, but the Delta variant obviously poses a threat to capacity and ‘non-emergent’ surgeries. (Link)

$Payors: This Dive article provides a pretty solid overview of payors’ earnings. Although the return of utilization in Q2 dinged medical loss ratios, only Cigna experienced any sort of sell-off, down 8% this week. (Link)

$BHG: Bright Health Group dropped 20% after releasing its Q2 earnings report. Since going public in late June, the firm has lost more than 50% of its value as the market dismisses its private valuation and growth prospects.

$LHCG, $AMED: Home Health leaders dropped quite a bit on Q2 earnings as hospice growth stalled due to Covid and labor shortages squeezed margins. The labor shortage issue seems to be widespread across the U.S., aka, not just limited to healthcare companies. Could be a short term buying opportunity if you still buy into the investment thesis here!

- The linked article also discusses how Amedisys is planning to integrate its most recent acquisition, hospital-at-home specialist Contessa. (Link)

Biz Hits

One Medical: This was a good insight into how One Medical is thinking about integrating value-based care provider Iora Health into its business to create a national presence in the primary care market. (Link)

GoodRx: GoodRx announced a partnership with Surescripts, a firm that holds a giant medications pricing database, to disclose its cash price information on Surescripts’ platform. Side note, GoodRx has been busy with deals lately… (Link)

Hospitals: In Wisconsin, Aspirus Health is acquiring 7 hospitals and 21 clinics from Ascension. (Link). On the East coast, MUSC finalized its purchase of three South Carolina hospitals from LifePoint. (Link) Finally, Tenet completed the sale of five of its hospitals to Steward Health Care down in Florida. (Link)

- Prices: Also related to hospitals, a study from Health Affairs this week shared that hospitals with a higher share of Medicare patients were more likely to close or be acquired. The analysis seems to show that hospitals face a wide array of expense pressures and rely on price increases to expand margin. (Link)

Policy Hits

Budget: This was a good overview from Larry Levitt on Twitter as to what Democrats are trying to change in healthcare during the budget reconciliation process.

- Big changes include adding supplemental benefits to Medicare Advantage, investment in home care, drug pricing changes, and more. Actually quite a few impactful changes here. (Link)

Payments: CMS finalized a $2.3 billion payment increase to hospital reimbursement for 2022. Notably, CMS excluded the hotly debated price transparency rule that would have required providers to disclose privately negotiated median Medicare Advantage rates. CMS estimates that this will save hospitals a collective 60,000 hours in admin time. (Link)

Fraud: The DOJ is joining a lawsuit against Kaiser Permanente alleging that Kaiser Permanente submitted inaccurate codes when billing Medicare in order to receive higher reimbursement. (Link)

Other Hits

Investigation: This was a damning report from ProPublica on how patients received a heart pump despite the FDA’s knowledge of its defective nature. (Link)

Opinions

Vaccine Mandates: I don’t have any articles to link to here, but figured I’d leave you guys with a question to think about. Can the government forcibly require its citizens to get vaccinated?

- On one hand, I can obviously understand the public benefit to forcing vaccines on people. On the other hand, I understand the more political argument associated with government interference in personal liberties and ‘discrimination’ against unvaxxed people.

- This was a good discussion I found on the issue. TL;DR – it seems to be legal at the state and local level. (Link)

Healthy Muse Top Picks

Insurance: This was another great read from Out of Pocket as Nikhil discusses the individual insurance market and what improvements can be made. (Link)

Dialysis: I really enjoyed this analysis of the kidney care industry by the Margins of Medicine – challenges the industry faces, interesting details on how reimbursement is structured, and parting thoughts on solutions to the above. (Link)

Funding: Olivia Webb analyzes the rapid growth of digital health funding – and what might be driving it – in her latest on Acute Condition. (Link)