Primary Care Digital Health Platform One Medical hires its bankers and is eyeing an IPO in early 2020.

Yet another “digital” healthcare company has aspirations for the public markets. One Medical, which is essentially a high-tech urgent care platform with about 70 locations, has hired bankers (wimps – go for the direct listing) and is planning an IPO for early 2020.

Notably, One Medical’s largest investor is Google, which might earn the company some cred on the ‘ole Street.

A Tech company, or just a healthcare services company with a splash of tech?

One Medical will need every morsel of that credibility for public investors to look past a company that seemingly just operates as a primary care platform.

It will be interesting to see what the company includes in its initial prospectus and roadshow to win institutional investors before any IPO – especially since primary care services typically command lower profit margins and subsequent low multiples.

Yet another digital health company. Progyny, a fertility benefits company, files to go public.

In other IPO news, Progyny, which manages fertility type benefits at companies, just filed to go public. Fertility has been a hot market for private investment, so it’s interesting timing for a fertility player to exit to the public markets.

The fertility firm claims to give employees better pregnancy outcomes as compared to the fertility industry’s average pregnancy rates.

- Read Progyny’s S-1 Prospectus here.

Digital Health IPO performance woes.

One Medical and Progyny might face a tough time in the public markets given the current slaughter happening to IPOs.

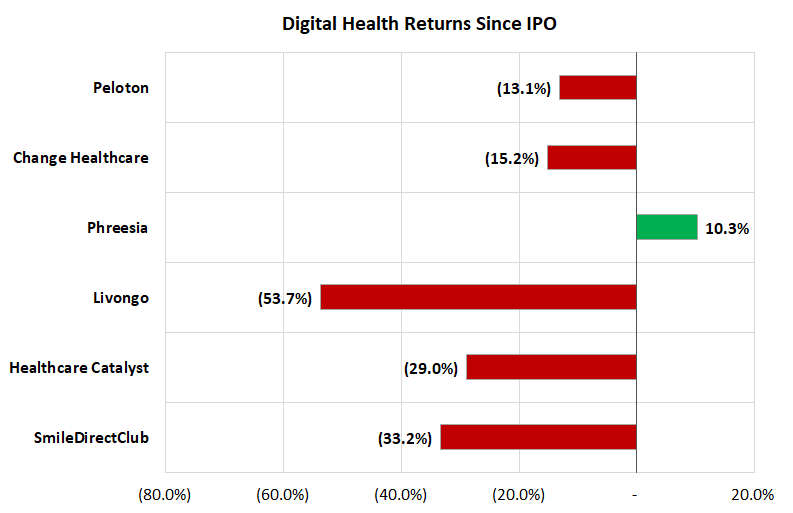

Livongo, Health Catalyst, Change Healthcare, Phreesia, Peloton, and SmileDirectClub all went public earlier this year.

And all but one are down over 10% as of this writing. Most of that might be due to overall volatility in the markets, but the optimal time to IPO – especially for digital health companies – may well be in the past.

Subscribe to our newsletter for more updates like this.