Healthy Muse Healthcare News

A digital health giant takes shape.

In the most notable healthcare deal of 2020, Teladoc and Livongo will merge in a deal that values Livongo at $18.5 billion. Combined, the two digital health giants boast a market cap a little south of $40 billion.

- Take a look at the investor presentation here.

Read more about this transaction’s implications:

- Is the first digital health megadeal ridiculously overvalued, or is this just the beginning? (Dive)

- How Teladoc’s blockbuster deal could impact the entire virtual care landscape. (Fierce)

- How Livongo and Teladoc closed an $18.5 billion deal during a pandemic. (CNBC)

Purdue Pharma gets railed by the Justice Department.

- As part of Purdue Pharma’s involvement in the opioid crisis, the Justice Department is seeking as much as $18.1 billion from the pharmaceutical company, according to the WSJ (paywall). Oof.

Medicaid expansion rolls on.

On August 4, Missouri became the latest state to expand Medicaid – narrowly. While most rural counties voted against the measure, the more densely populated urban counties voted for expansion.

- Missouri joins Oklahoma as a couple of traditionally red states that have voted to expand Medicaid this year. Here’s the status of all 50 states.

Deals, deals, and more deals.

Some interesting deals announced during the week of August 4:

Financial giant Blackstone is buying Ancestry.com in a $4.7 billion deal. Even though the DNA testing craze is over, Blackstone must think there’s a good amount of monetizable value to be found here.

Oak Street Health debuted on the public markets on 8/13 to a wildly successful IPO – while the primary care company wanted to raise $100 million to pay down debt, the firm actually raised $328 million in its IPO. That goes to show you how hot the IPO market is right now. Oak Street was up over 90% on Thursday.

- Speaking of public markets…telehealth startup Hims could potentially go public via a so-called ‘blank check’ company. The transaction is rumored to value Hims as high as $2 billion, per Bloomberg.

More healthcare executive orders.

Trump unveiled a host of executive orders over the week, including several more related to healthcare. The first order aims to revamp the U.S. based drug supply chain.

In doing so, the FDA would prioritize American-made essential drugs and purchase from them first. This executive order comes on the heels of the U.S. and Kodak deal to produce generic drug ingredients – a deal that now has Kodak under investigation.

- Other executive orders this week cut payroll taxes (which is how Medicare gets funded) and protected pre-existing conditions. The pre-existing conditions order drew the irk of many Democrats who pointed out that Obamacare already protects for pre-existing conditions.

Coronavirus

- The latest numbers here: 5.2 million infected, 165k deaths in the U.S. Cases are generally trending downward.

- 40% of Americans continue to put off medical care

- The U.S. reached a deal this week for $1 billion worth of a potential Johnson & Johnson vaccine.

- Similar to preliminary data from other pharma giants, Novavax’s vaccine showed a promising immune response in patients.

- Pharma giant Merck is placing its bets on a one-shot vaccine in the COVID-19 race. Remember that Moderna’s, one of the closest to market, requires a booster shot 30 days later.

- Clinical trials are attracting thousands of people who want to help test COVID-19 vaccines, per KHN.

- School stuff: some schools are considering outside classes as the airborne spread of COVID-19 comes into question. And college is going to look quite different this fall – especially if football gets canceled.

Quick Hits

Biz Hits

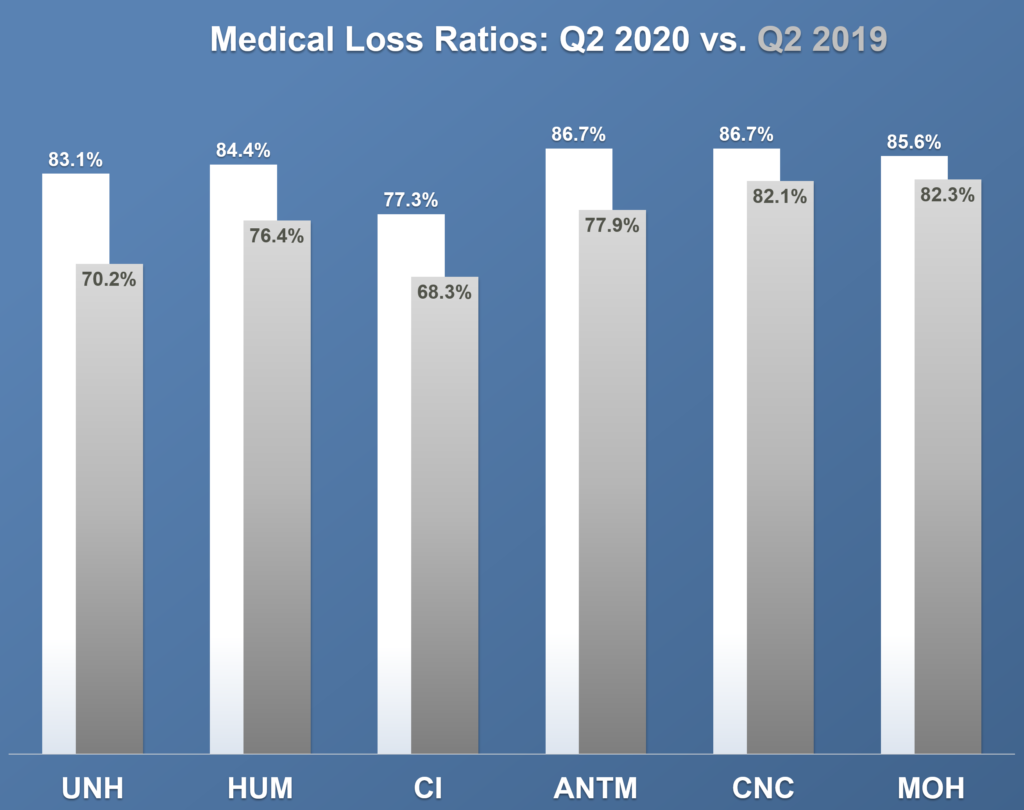

- Health insurance payors reported historically low medical costs and high profits during Q2.

- Public home health operator LHC Group thinks that the sector’s consolidation opportunity is as ‘Ripe as ever.‘

- The DOJ is suing Cigna, alleging over $1.4 billion in Medicare Advantage fraud. (Dive)

Policy Hits

- Remember all of those advanced loans that providers took from Medicare to get through COVID? They’re coming due.

CMS released several payment proposals this week:

- Inpatient rehab facilities: +2.4%. (Beckers)

- Physician fee schedule: 6 things to know, including expanded telehealth coverage. (Beckers)

- CMS proposes changes to docs’ Medicare payments for 2021, including payment cuts for some specialties. (Fierce)

- From the outpatient proposed ruling: +2.6%; 30% cut to the 340B program, and site neutral payments

- Very notable news: As a part of its attempt to bolster primary care payments, CMS proposed a 9% cut to Medicare therapy rates. (Skilled Nursing News)

Other Hits

- The latest trend: states deeming racism a public health crisis. (The Hill)

- Some hospitals opted to ‘unfile’ bankruptcy to get federal aid. (Beckers)

- Telemedicine is booming — but many people still face huge barriers to virtual care. (Stat)

Thought-Provoking Editorials

- How the pandemic defeated America. (The Atlantic)

- How to gamify healthcare (Medical Futurist)

- Headspace is a popular mental health app. But how effective is it, really? (Stat)

- How Siemens stands to gain from its $16.4 billion acquisition of Varian. (HIT)

- Femtech is expansive—it’s time to start treating it as such. (Rock Health)

Healthy Muse Top Picks

- I’m a Nurse in New York. Teachers Should Do Their Jobs, Just Like I Did. (The Atlantic)

- Read this article/video from Andreesen Horowitz about how the coronavirus has unlocked major changes in healthcare. (Andreesen Horowitz)

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse was created to educate people on the healthcare system. It’s one weekly e-mail updating you on all the major election news, broader trends, big stories, and policy updates. Learn more about our vision here.

Get smarter and sign up below today.