healthy muse healthcare news.

- This week in healthcare: Intermountain is merging with SCL Health to create a $14b system, Teladoc loses its COO, a Centene takeover? Tia’s focus on women’s health, Aetna’s dead physician network, and more.

Intermountain Announces Merger with SCL Health

Big-time: Utah-based Intermountain Healthcare announced its intention to merge with SCL Health on Thursday, September 16 in what would create a 33-hospital, $14 billion in annual revenue system. The combined system would employ more than 58k caregivers across six states – Utah, Idaho, Nevada, Colorado, Montana, and Kansas.

- I know what you’re thinking: “But hospital mergers result in higher prices.” That’s the general consensus around hospital mergers. But Intermountain seems to be focused more on value-based care initiatives and population health, which this merger would allow them to execute on.

- Merger quote: “This is the opposite of those mergers where people come together and try to exert leverage over commercial insurance to get more money,” he said. “What we’d really love in the long run is for some of those payers to engage with us in risk-based contracts where we can really work hard at keeping people well. That would be the most exciting thing for us, I believe.” Marc Harrison, MD – Intermountain CEO

- Links: (Press Release) (Article Summary)

NorthShore University Health System, Edward-Elmhurst Health unveil merger plans

More: Also along the Midwest, the combined health systems of NorthShore and Edward-Elmhurst would create a 9-hospital conglomerate, serving about 4.2 million Illinois residents across 6k physicians and 300 facilities. (Link)

- Antitrust: These merger announcements are coming at a time when Biden regulators are increasing scrutiny on vertical and horizontal mergers. Hospital mergers are among the most heavily scrutinized when it comes to antitrust, so it’ll be interesting to see whether the above deals actually get done. (Link)

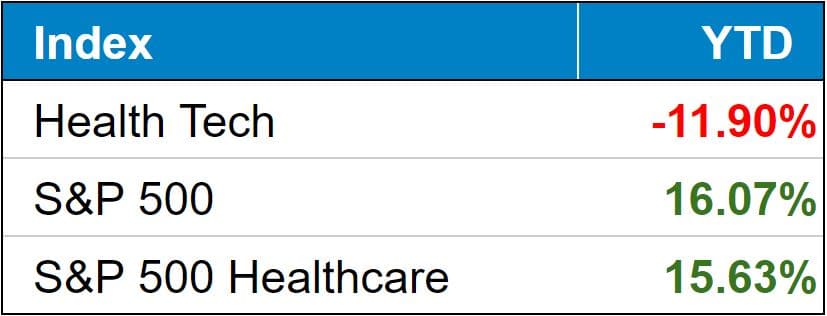

public market update.

Top 3 weekly performers: SmileDirectClub (+30%), GoodRx (+11%), Cano Health (+9%)

Bottom 3 weekly sandbaggers: ATI Physical Therapy (the pain continues -11%), agilon (-9%), Privia Health (-8%)

- Full List YTD performance: (Link)

$DH: Health data analytics firm Definitive Healthcare was wildly in its IPO on September 15th, raising $420 million and skyrocketing. I wonder if the stock will continue down the path of somewhat-software-health-tech-peer Doximity. (Link)

$CLOV: Meme stock Clover is partnering with MedArrive to offer in-house COVID vaccinations to its members. (Link)

$HUM: A Humana-branded private jet was spotted near Centene’s headquarters this week, sparking rumors for a potential acquisition. Remember that Humana previously tried to purchase Centene two years ago. Side note: people are crazy but also really smart for noticing things like these. (Link)

$TDOC: The Department of Veterans Affairs is offering four potential vendors a contract to offer VA members telehealth and remote patient monitoring services. The contract is worth $1 billion in total and seems like a total slam dunk for Teladoc, matching up perfectly with what the company offers these days. (Link) Also, Teladoc’s COO is departing. (Link)

Biz Hits

I missed this one: P3 Partners, a physician enablement, population health management platform, is going public via SPAC with Foresight Acquisition Corp. at a $2.3 billion valuation. The announcement was back in May, meaning this press release was one of the few I’ve missed since starting the Healthy Muse…ugh.

- About P3: Similar to peers ApolloMed and Privia Health, the firm aims to enable physicians to take on value-based contracts and remain in independent while providing back-office support and electronic health platforms to make their lives easier. (Link)

Women’s health: You should keep an eye on Tia, which is a concierge health startup focused only on women. After raising $100 million in funding announced this week, the firm is looking to invest more heavily into providing care for all facets of women’s health. Side note – these startups are expanding access not only primary care, but specialized, comprehensive care services focused on specific populations.

- In Tia’s case, the firm wants to cover the spectrum of women’s health services. That includes everything from puberty care, to partnering with health systems on labor and delivery, and more. I’ll be interested to see if Tia can continue to execute on its growth strategy as it plans to roll out 15 more clinics next year, up from two or three this year. (Link)

MSK: Here’s an interesting partnership – Google, ProMedica Health, and Include Health are partnering on virtual musculoskeletal (MSK) care. MSK care at home – fit with sensors and other technologies – has taken off rapidly since the pandemic, and these types of partnership announcements suggests that the trend has some staying power. (Link)

JV: Walgreens and NY based health system Northwell Health signed a 5 year agreement to expand digital health services and collaborate on expanding primary care, increasing telehealth offerings, and providing pharmacy services for Northwell’s employees. (Link)

Policy Hits

Monopolies: Furthering the rhetoric from the current administration, the FTC signaled this week that it is planning to escalate scrutiny of vertical mergers. Of course, this news has big implications in healthcare as payers snatch up providers and hospitals try to merge into larger health systems. (Link – WSJ Paywall)

Opioid: In the never ending saga of Purdue Pharma and the Sackler family’s involvement with the opioid crisis, the DOJ has decided to move to block the bankruptcy deal that gives the Sackler family immunity from future lawsuits. Can’t say I don’t have news fatigue with this one. (Link)

No Surprises: Who else is surprised that the ‘No Surprises’ bill leaves huge questions for payers and providers as well as vast portions of the bill up to state interpretation? Not me. (Link)

Telehealth: Several physician groups want CMS to permanently expand Medicare telehealth reimbursement. The way things are going, they’ll likely eventually get their way. However, a big obstacle that remains for telehealth is the amount of rampant fraud channeled through it. Hopefully we can crackdown on bad actors while still incentivizing telehealth’s use. (Link)

Other Hits

Dead: Aetna took some major heat this week after former employees alleged that the managed care firm listed dead – deceased – no longer living – physicians in its provider network.

- According to the government’s lawsuit, Aetna was able to leverage this network that included dead – perished – physicians to win big Medicaid contracts in Pennsylvania.

- Hopefully this lawsuit incentivizes payers to update their physician networks on their sites, because some accuracy for consumers would be nice at some point. (Link)

ACA: The Pandemic special enrollment period enabled by the Biden Administration led to a record number of ACA enrollees. (Link)

Obesity: According to the CDC, the rate of high obesity has nearly doubled since 2018. (Link)

Postponed: Non-emergent medical procedures are once again getting postponed at COVID-overwhelmed hospitals. One can only hope that the Delta wave is subsiding similar to the pattern observed in other countries. (Link)

Opinions

Primary Care: It’s time to make primary care our nation’s primary specialty once again. (Link)

Healthy Muse Top Picks

Here’s a good read from the NY Times about how exactly 23andMe is leveraging your DNA data. (Link – Soft Paywall – NY Times)