healthy muse healthcare news.

- This week in healthcare: Cerner acquired by Oracle for $30bil, Centene’s CEO steps down, Teladoc partners with NLA, Amazon’s health division restructures, Select partners with pickle ball, Omicron ramps up, and more.

Oracle buys Cerner for $28.3 Billion

Cash to burn: Oracle, the traditional database software giant, is making its biggest acquisition EVER by acquiring electronic health record giant Cerner for $28.3 billion, or $95 a share in an all-cash deal. (Link)

- Why Oracle: Oracle likely thinks the acquisition gets their cloud offering on a closer playing field with that of Amazon and Microsoft

- According to Oracle’s disclosures, the acquisition is almost immediately accretive to earnings

- athenahealth was just purchased by private equity for $17 billion with $1.2 billion in revenue, whereas Cerner was valued publicly at $28.3 billion with $5 billion in revenue, so on a true numbers basis, a $30 billion acquisition is a ‘value play’ – but athena is better positioned for growth

- Cerner gives Oracle access to the department of Veterans Affairs, as Cerner won a huge contract with the org for EHR services

Personally, Oracle must believe that Cerner gives them a ton of synergy, because the EHR giant has been bleeding market share to Epic, its second largest competitor. Cerner experienced revenue decline in 2020 with marginal growth so far in 2021. Kind of seems like two second-tier businesses combining with the idea of making something better overall.

- I halfway predicted this acquisition in 2020. Sort of. It’s close, right?

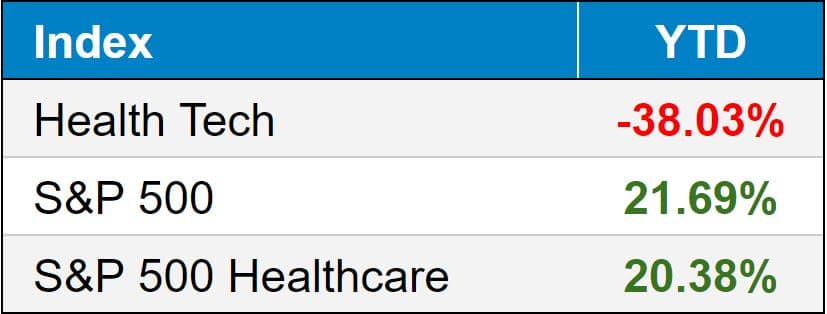

public market update.

Top 3 weekly performers: Phreesia (+8.4%); Oak Street (8.0%); Privia (+6.8%)

Bottom 3 weekly sandbaggers: P3 Health Partners (-30% – yikes); Oscar Health (-24%); The Oncology Institute (-23%)

- Full List YTD performance: (Link)

$CNC: Centene had an active week including its investor day. The managed care giant reached a deal with activist investor group Politan Capital Management – they’ll get 5 board seats. Further, Centene announced a succession plan as its current CEO Michael Neidorff will step down. (Link)

- Centene is also considering selling non-core assets, including its international business, currently generating around $2 billion in revenue. (Link)

- Amidst all of this news, Centene’s stock price hit 52 week highs as investors welcomed the updates and changes in strategy. (Link – Investor Day Presentation)

$UNH: UnitedHealth pushed back its deadline for its previously announced $13 billion Change Healthcare acquisition to April, meaning the DOJ is likely asking for more info on the deal. (Link)

$GDRX: GoodRx and telehealth provider Wheel announced a partnership to give Wheel providers GoodRx coupons and increases the medication discount effort. (Link)

$TDOC: Teladoc has announced a slew of partnerships in recent months. This most recent announcement expands Teladoc’s existing partnership with the National Labor Allicance. The partnership grant TDOC’s full suite of services to 6 million NLA members. (Link)

$SEM: This is awesome: Select Medical is partnering with the PPA Tour to provide therapy services. Select becomes the official PT partner of Pickleball! Apparently pickleball is the fastest growing sport in America. (Link)

$ACHC: Behavioral health co Acadia Health announced a joint venture with Fairview Health Services for a new Minnesota-based facility. (Link)

$AMZN: Amazon is centralizing its healthcare operation under one subsidiary and assigned a former Prime executive to run the health division. The restructuring follows in the footsteps of other Big Tech health division restructures at the likes of Apple and Google. (Link)

Biz Hits

M&A: Despite antitrust concerns, Intermountain and SCL Health are chugging right along with their plan to merge into a 6 state, 33 hospital, $11 billion system. The combined entity is going to have some serious scale, which may assist with its value-based care, population health management plans. (Link)

Physicians: Physician practices are selling in droves to end out the year boosted by easy money policies, PE prevalence, and potential tax reforms coming to top earners in 2022.

- According to PwC, the average EBITDA (AKA, operating profit) multiple was 15.2x…now compare that multiple with publicly traded physician services counterparts. There’s a huge gap there! (Link)

Integrations: UnityPoint Health and Carle Health are considering a partnership in Illinois. (Link)

Akumin: Here are some updates to Akumin’s financials and operating performance post-acquisition with Alliance. The combined org is anticipating around 20% in EBITDA margins for 2022. Not sure if that’s adjusted, though! (Link)

- Related: What’s the endgame for private equity in radiology? (Link)

Settlers: A Judge rejected Purdue Pharma’s $4.5 billion opioid settlement, arguing that the civil court did not have the right to grant immunity to the Sackler family. Man, what a headache this has become. (Link)

IPO: Loosely healthcare related – private equity conglomerate TPG is planning to IPO. The firm has a smattering of healthcare investments across a number of verticals. TPG has $109 billion in assets under management and is based in Texas (shout-out DFW). (Link)

Cerebral: Hot off its equity raise and $4.6 billion valuation, mental health unicorn Cerebral is partnering with Alto Neurosciences to offer its members the ability to participate in at-home clinical trial research for Alto’s depression drug and identification of potential candidates for those trials. Pretty cool stuff here. It’ll be the first ever clinical trial for depression. (Link)

Policy Hits

Coronavirus: The Omicron variant is ramping up.

- Biden unveiled a “test to stay” strategy to keep kids in school rather than those kids having to stay at home previously. Is anyone else worried about the state of education given the disruptions? (Link)

- New York is experiencing a surge in cases, but the peak is expected within the next few weeks. (Link)

- Despite the surge in cases, outcomes are expected to be less severe because of ….the vaccine! Booster shots appear to be highly effective against Omi. (Link)

Relief: HHS is sending another $9B in relief funds to providers. The latest influx of funds favors smaller providers (Link)

HC Costs: ****Healthcare costs rose 9.7% in 2020 due to the influx of cash from the CARES Act relief funds. Healthcare services didn’t actually expand in 2020, so this is kind of fake. Private spending from commercial payors was probably way lower than normal. (Link)

Antitrust: Humana and Centene (ironic) are suing pharmaceutical companies over Big Pharma’s alleged scheme to stifle HIV competition. I swear these stories happen 5x a year. (Link)

Other Hits

Comp: Doximity released its 2021 Physician Compensation Report which highlights compensation by region by specialty and by gender. Some pretty insightful things all around. (Link)

JPMorgan: The banking giant moved its 40th annual healthcare conference to all-virtual after Omicron fears. Fewer megadeals as a result? We’ll see. (Link)

Rebates: Insurers paid out $2B in medical loss ratio rebates for 2020 claims. (Link)

Hot Takes

Fintech: This was a cool take on the intersection of fintech and healthcare: buy now pay later companies could boost collection rates in historically poor markets. (Link)

Healthy Muse Top Picks

OOP: Nikhil Krishnan’s latest about the intersection of decentralization, crypto, and blockchain applications in healthcare…that are actually practical. (Link)

Policy: The Commonwealth Fund provided a solid breakdown of all of the policy decisions and happenings that affected America in 2021. (Link)

Rural: KHN highlighted the impact of pharmacy deserts in rural America. Rural America in general is struggling healthcare-wise. (Link)