The numbers behind the rise of Teladoc during COVID-19.

COVID-19 hit the American economy hard – that’s no secret. Despite its recession-resistant reputation, healthcare has been especially vulnerable as a result of canceled elective procedures, lower ER visits, and slashed outpatient visits.

While healthcare sub-sectors like acute care hospitals, diagnostic imaging (looking at you, RadNet), and physical therapy temporarily collapsed, other areas of healthcare have flourished.

Like we’ve discussed in our weekly newsletter, health insurance companies, or payors, are on track to meet their 2020 Wall Street financial guidance due to markedly lower medical costs in the front half of the year.

Payors aren’t the only winners, though.

People sheltering in place nationwide (and globally, for that matter) have turned to telehealth solutions during the pandemic.

- Telehealth has allowed individuals to meet with physicians during the COVID-19 crisis in order to discuss chronic conditions, receive prescription refills, and order tests.

So who’s the biggest public player in the telehealth market?

Teladoc.

As of May 18, 2020, Teladoc’s market capitalization has more than doubled this year to $13.7 billion despite only reporting net patient revenues of $606 million through Q1 2020.

What caused Teladoc’s rise during COVID-19?

Teladoc holds the biggest brand name in telehealth services. It’s flashy and easy to remember.

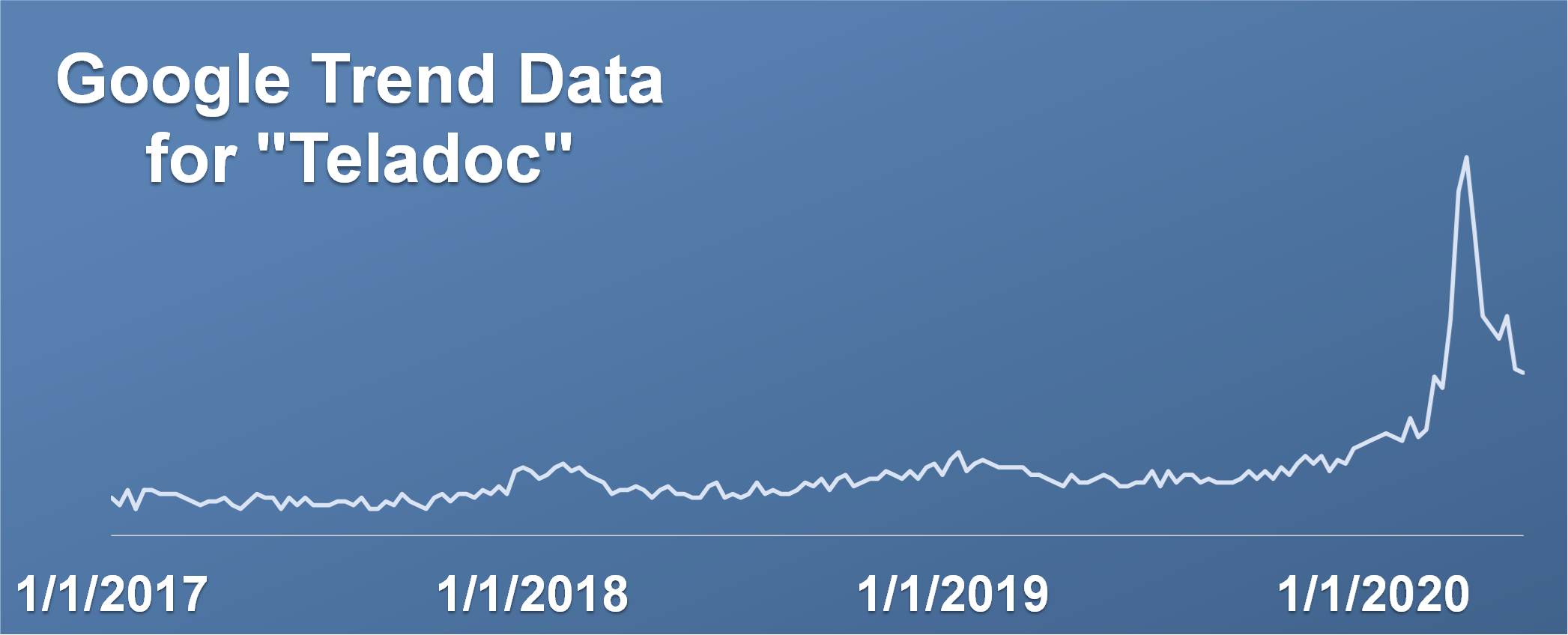

Just look at the exponential number of Google searches Teladoc received during 2020. I’ll give you three guesses as to when its stock price started ramping.

Alright, fine. Here’s Teladoc’s stock price chart over that same time period:

Prior to COVID-19, Teladoc struggled with the widespread adoption of telehealth. Many insurance providers didn’t see the same value in telehealth as they did in regular, old-fashioned physician office visits and reimbursed virtual visits significantly less.

- Others worried about the growth of fraud in telemedicine, especially among the elderly population. We’ve all seen grandma in front of the computer – she’s not the best at spotting scams, unfortunately.

As a result of the headwinds mentioned above, telehealth has seen steady, but unremarkable growth over the past several years.

Of course, this all changed drastically in the short-term, and Teladoc gave us some remarkable highlights in its Q1 earnings report.

Teladoc’s unprecedented Q1 growth.

Citing its critical role during the global pandemic, Teladoc experienced the strongest growth in company history during Q1:

“We are playing a critical role during the global outbreak of COVID-19 and have seen a significant increase in inquiries from both existing and new potential clients. Our clients are turning to us to expand our service offering to new populations and add new products during this time of need.

Requests from new potential clients are increasing as the outbreak of COVID-19 has highlighted the value of access to a comprehensive virtual health care solution.

During the first quarter alone, we onboarded over 6 million new paid members in the U.S. across government and commercial populations. And we anticipate onboarding an additional 6 million to 7 million new members during the second quarter, culminating in the strongest first half membership growth in company history.”

Teladoc Q1 2020 Earnings Call

Along with ‘significantly’ increasing its sales guidance by $100 million, we can easily see the rise of Teladoc during COVID-19 and why its stock price has performed so well:

- 60% of Teladoc’s visits in Q1 were from new users from mainly younger demographics.

- Patients using Teladoc don’t have any insurance co-pays right now, and this contributed to the adoption of Teladoc’s platform

- During the pandemic, Medicare adopted widespread use of telehealth for its beneficiaries and announced its intention to reimburse telehealth services at the same rates as in-office services. This action was a huge win for telehealth.

- If outcomes are good, Medicare could continue to reimburse telehealth at the same rates post-pandemic.

The largest question remaining is whether Teladoc can pivot this short-term growth and black swan event in healthcare into a long term, structural change in healthcare demand.

Challenges ahead for Teladoc.

Despite all of the good news, Teladoc still faces challenges ahead:

- Will health insurers continue to reimburse virtual visits at the same rates as in-office visits?

- Will patients still seek out telemedicine rather than in-office visits after the pandemic, and can Teladoc convert those first-time patients into recurring patients?

- Will the pandemic solidify telehealth as an integral part of the healthcare delivery system?

The rise of Teladoc during COVID-19 was no mistake. The telehealth giant benefited greatly from the global pandemic and the required responses from local, state, and federal governments.

- Whether this success continues in a post-COVID environment will be interesting to watch as the company continues to execute on its healthcare delivery strategy.