Hospitals are losing billions during the pandemic. Why?

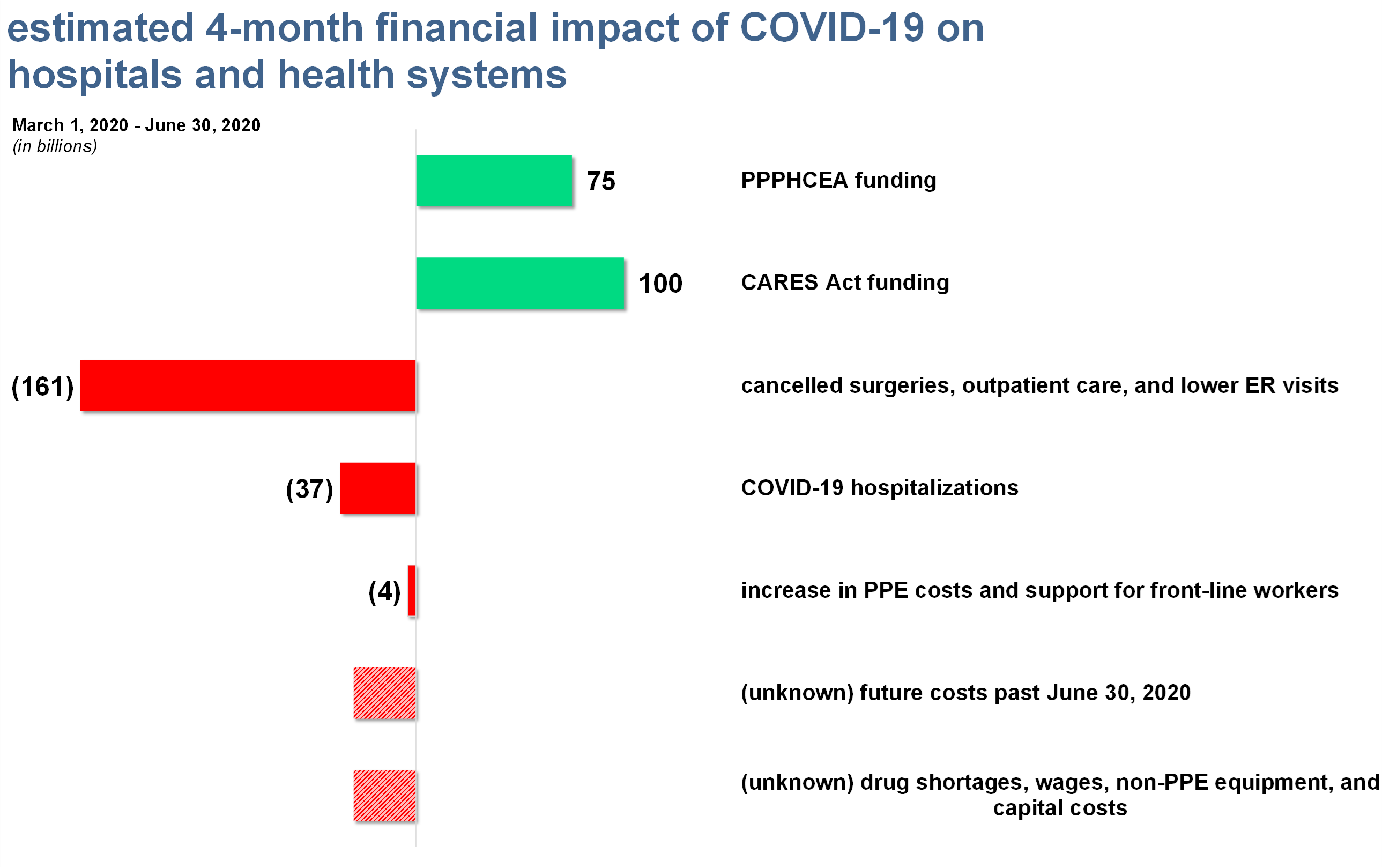

- The American Hospital Association (AHA) published a report this week estimating that hospitals and health systems would lose about $202 billion over 4 months, mainly related to the cost of caring for COVID-19 patients and suspension of elective procedures.

Net that against the emergency healthcare funding of ~$175 billion, and you can spot the $27 billion difference hospitals might need just to break even over the coming months, according to the AHA.

The biggest ways hospitals are losing money during the pandemic.

Over the four months from March 1, 2020 to June 30, 2020, the AHA estimates that hospitals could lose out on the following:

- Suspension of elective procedures: $161 billion loss

- COVID-19 hospitalizations: $37 billion loss

- PPE shortages and front-line employee support: $4 billion

The AHA analysis did not provide estimates for any losses beyond the four-month period described above.

- Furthermore, the AHA was unable to estimate certain other costs, like drug shortages, non-PPE equipment, and other capital costs.

- It’s likely that hospital losses are even higher than what’s seen in the graphic above.

- If COVID-19 continues beyond June 30, these losses will probably get worse as the $175 billion in emergency healthcare funding support dries up.

It’s not just hospitals, either: physician practices, like most other outpatient healthcare settings, experienced 30% to 75% patient volume declines during the Great Lockdown. This loss of volume is consistent across the board.

- You can see this effect in the April jobs report, too. Healthcare lost 1.4 million jobs almost entirely in outpatient settings.

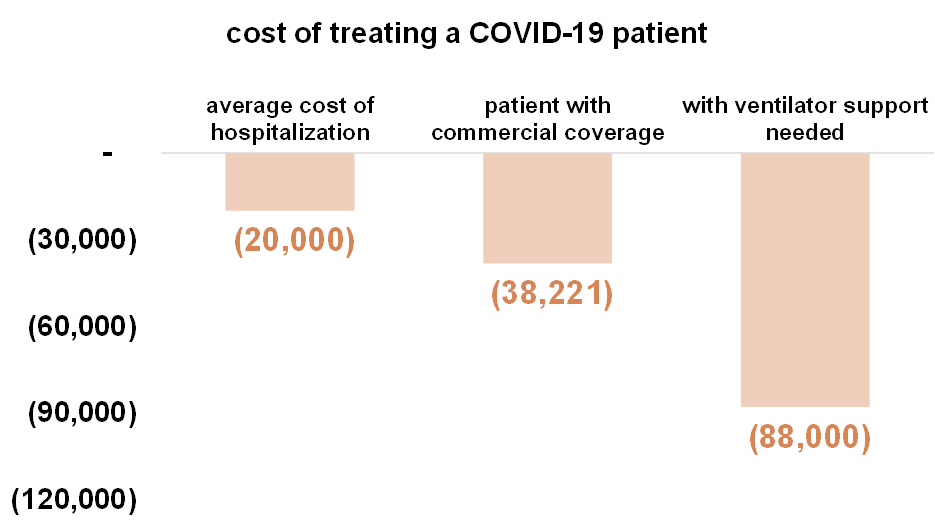

In summary, even with the government reimbursing COVID-19 cases at 20% above normal rates and the $175 billion in extra funding, hospitals are losing out because of the suspension of elective procedures, which is a broad term to describe any medical procedure that isn’t emergent – AKA, immediately necessary.

- For instance, organ transplants were considered ‘elective’ under this definition. Wild.

“I think a lot of what’s being deferred are things like cardiac procedures, pens and pacemakers, cardiac cats, surgeries like oncology surgery, neurosurgery, heavy-duty orthopedics…And I think generally, I would have described those procedures as not very deferrable…I think our perspective is that most of those procedures will wind up getting done.”

UHS Q1 2020 Earnings Call

Here’s what the public hospital operators had to say about the current hospital environment:

Most public hospital operators reported strong volumes prior to COVID lockdowns (March 15).

- After lockdown began, all hospital operators pulled their guidance for the fiscal year 2020 and expect a big downturn in Q2 related to the pandemic and the suspension of elective procedures.

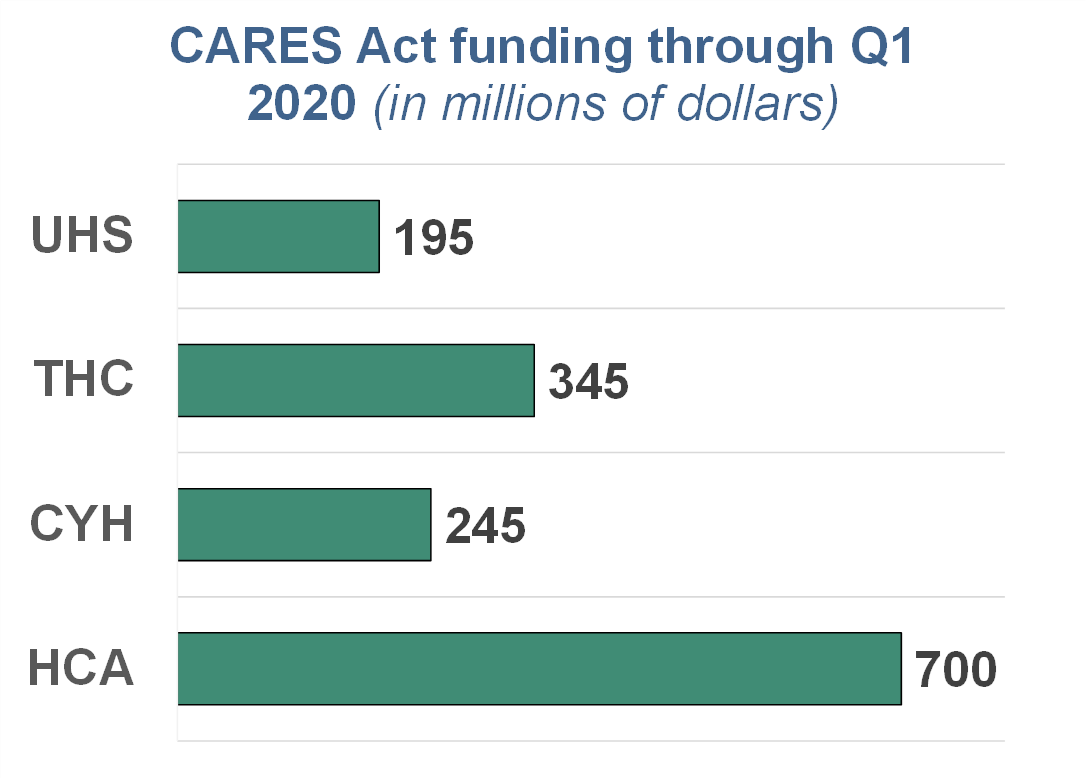

Now, all operators are in cost reduction and capital-preserving mode.

- Operators suspended buybacks and dividend payments and canceled any non-urgent capital projects like the construction of new facilities.

- Operators have received various amounts of CARES Act funding from the government’s emergency bailout pool. Here’s a breakdown.

Most of the operators reported 50% to 60% volume declines in admissions, patient days, ER visits, outpatient visits, and outpatient surgeries in April. A small silver lining: they noted that the declines ‘stabilized’ after Easter weekend.

With states reopening, hospital operators are optimistic that patient visits and the pent-up demand for elective surgeries will return. As Tenet noted below, some ‘elective’ surgeries are more urgent than others.

“If you look at which procedures are actually coming back more quickly, it’s actually probably the higher complexity cases in the area of spine, total joint, general surgery, some of those things that have been delayed but are certainly necessary to get done as soon as possible in order to avoid more complications later.

The types of procedures that are coming back a little bit more slowly are in the areas of GI and pain, ENT. That’s probably how I would differentiate between the specialties coming back more quickly than the ones that are a little bit slower to come back.

But generally speaking, as I alluded to earlier, we are seeing the demand kind of begin to improve significantly across all specialties but, of course, some are coming back a little faster than others.”

Tenet Q1 2020 Earnings Call

Questions left unanswered: will healthcare demand return?

With states beginning to lift the moratorium on elective procedures, Hospitals and health systems are hoping that patients feel comfortable in coming back to their facilities despite the current environment.

“We expect to bring on capacity in a conservative manner as markets allow and in the most efficient way possible during the reboot. At this point, we believe the reboot phase will be accomplished across most of the company by the end of the second quarter.”

HCA Q1 2020 Earnings Call

There’s no doubt that the pandemic caused a short-term shift in demand within the healthcare landscape.

- More people than ever are adopting telemedicine out of necessity.

- Nobody is getting surgery, using imaging services, or receiving physical therapy.

- Unemployment is rising. While furloughed individuals are still on the employer’s health insurance plans, we may eventually see a rise in the Medicaid and uninsured populations.

- This would have a negative effect on provider reimbursement

So,will there be structural changes in healthcare?

The shift to outpatient care settings in the healthcare industry has mostly been a positive for both patients (cost and convenience) and health systems (revenue diversification).

While the current global pandemic has affected these operations drastically, in all likelihood these effects are short-term with limited structural changes in consumer behavior.

- Maybe some regulatory changes will stick.

- Perhaps more individuals will seek out telemedicine instead of seeing a physician in-office.

- The uninsured and Medicaid population may expand due to unemployment.

HCA isn’t so sure about structural demand changes, either:

“When we think about [structural changes to revenue], we’re thinking about the demand side of the equation and the supply side of the equation.

And on the demand side, we’re trying to judge, fundamentally, has there been a demand curve shift as a result of COVID-19. By that, we mean — have income levels dropped because of unemployment and uninsured that starts to influence buying patterns and health care services demand, do patient preferences with respect to concerns about COVID-19 caused patients to avoid the health system, has telemedicine structurally changed certain buying patterns.

We don’t have a sense of that yet, but those are variables that we’re trying to understand.”

HCA Q1 2020 Earnings Call

Overall, it would generally make sense for healthcare to return to normalcy once the pandemic gets under control.