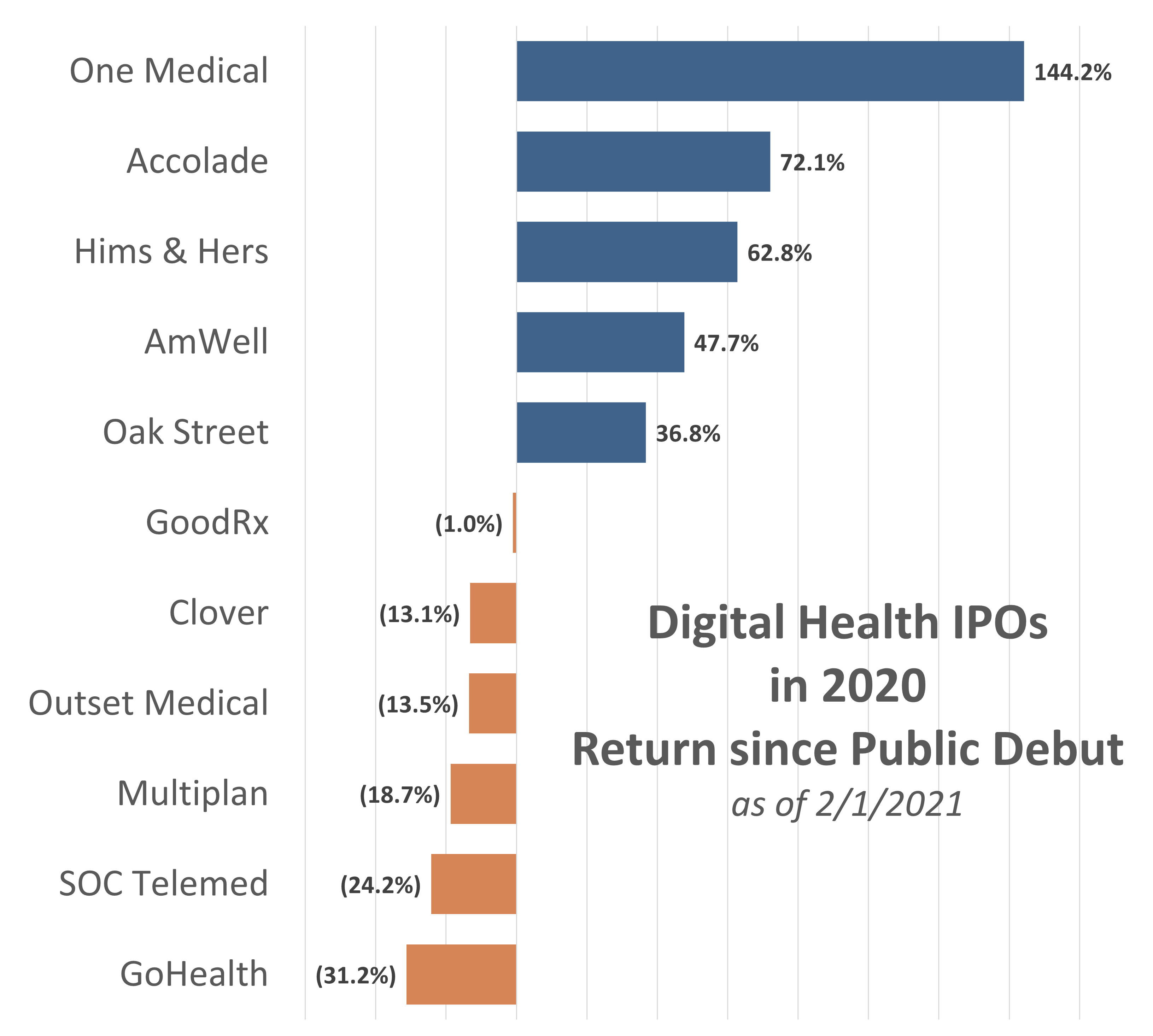

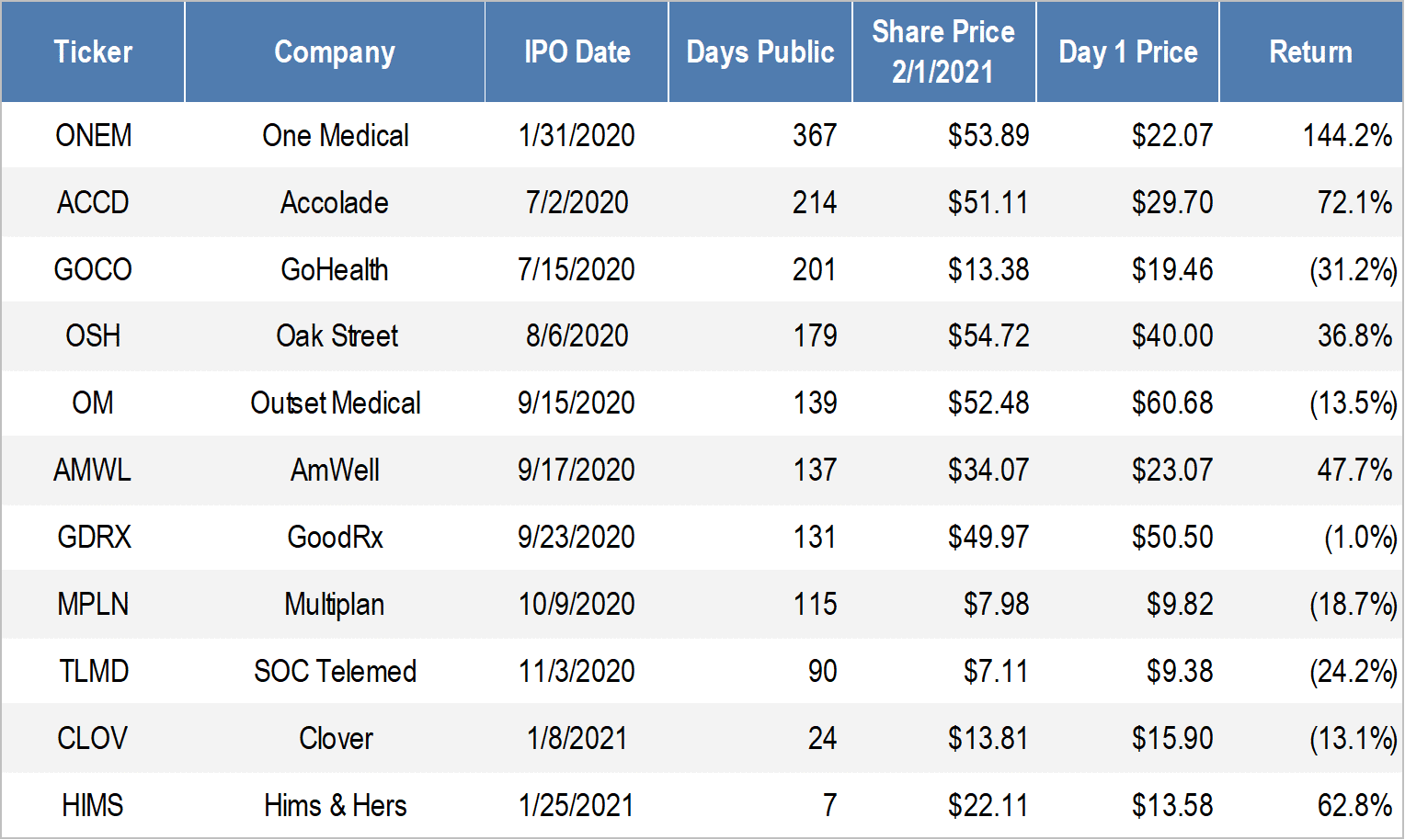

2020 was undoubtedly the year of the digital health IPO…or SPAC. However you want to spin it, 2020 brought the public markets 12 new digital health firms with some big names involved.

Digital health firms that IPO’d in 2020.

One Medical: The health tech primary care platform backed by Google went public in January. (Link)

Ardent: Interestingly, privately-owned hospital operator Ardent Health Services called off its IPO plans in January. I can’t help but think the firm would have benefitted from such frothy market conditions, but of course hindsite is 2020, and I’m not a hospital operator. (Link)

Accolade: The firm associated with helping employers navigate health benefits, debuted on the public markets in early July. (Link)

GoodRx: Debuted to much success in late September, popping as high as $57 per share in its initial day of trading. Interestingly, since the Amazon Pharmacy announcement, GoodRx has traded down to $43. (Link)

GoHealth: The tech enabled insurance enrollment platform raised more than $913 million in its IPO in mid-July. (Link)

Oak Street Health: Went public in early August to – as expected – much success. The firm raised more than three times what it intended as the IPO market stayed red-hot in the back half of the year. (Link)

Outset Medical: successfully debuted on the public markets in late September. The portable dialysis firm is looking to capitalize on the recently finalized end-stage renal disease payment model that encourages at-home dialysis treatment.

SOC Telemed: As a part of another SPAC deal, SOC Telemed joined the public markets early November under the ticker $TLMD, valued initially at $720 million. The firm provides telemedicine and other tech services to hospitals in almost every state and is taking advantage of the boom in remote health care.

Amwell: skyrocketed in its IPO in late September. That same week, Teladoc hit Amwell with several intellectual property accusations, claiming that Amwell infringed on several of Teladoc’s patents.

Multiplan: Churchill Capital’s SPAC took Multiplan, a healthcare solutions provider that partners with managed care companies, public at an $11 billion valuation. (Link)

Hims & Hers: Is expected to go public via SPAC with Oaktree Acquisition Corp. The unicorn will hold a value of about $1.6 billion when the deal closes. (Link)

Clover Health: The health-tech managed care firm was acquired by Social Capital Hedosophia Holdings Corp III in October, valuing Clover at about $3.7 billion initially. (Link). Read this analysis of the Clover SPAC.

Other recently announced digital health IPOs.

Eargo: The hearing aids tech co. raised $141 million in its IPO in mid October. (Link)

UpHealth and Cloudbreak: In healthcare’s latest SPAC deal, UpHealth and Cloudbreak are merging with blank-check company GigCapital2 to become the latest digital health conglomerate unicorn on the public markets. The new combination is a fascinating PROFITABLE play into telemedicine, patient care management, medical interpretation, prescription drugs, and more. (Ticker: $UPH).

CareMax Medical Group and IMC Medical Group: Healthcare SPAC Deerfield is merging with the two in order to bring the firms to the public markets. The combination will create what I imagine to be similar to Oak Street Health – medical clinics for seniors under value-based contracts. (Link)

What to expect for digital health IPOs in 2021.

With frothy market valuations and the forced shift to virtual and digital health in 2020, we saw a number of digital health IPOs – and IPOs in general – along with the emergence of special purpose acquisition companies (SPACs) which also helped a few healthcare firms hit the public markets. Expect the same to continue in 2021.

On deck for 2021: Telehealth player MDLive, Highly touted unicorn Oscar Health, and more. The health tech IPO boom goes on! (Link)

In one of the most anticipated health tech moves, Oscar Health confidentially filed for IPO a week after raising $140 million in a pre-IPO funding round in late December 2020.

- As other digital health unicorns continue to raise money at astronomical valuations in the billions of dollars, expect other big digital health names to follow suit toward the IPO/SPAC play.

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse is the alternative to boring healthcare news. It’s one weekly e-mail updating you on all the major strategy news, policy news, broader trends, big stories, and everything in between. Learn more about our vision here.

Get smarter and sign up below today.