5 things to know regarding relief funding for public healthcare companies.

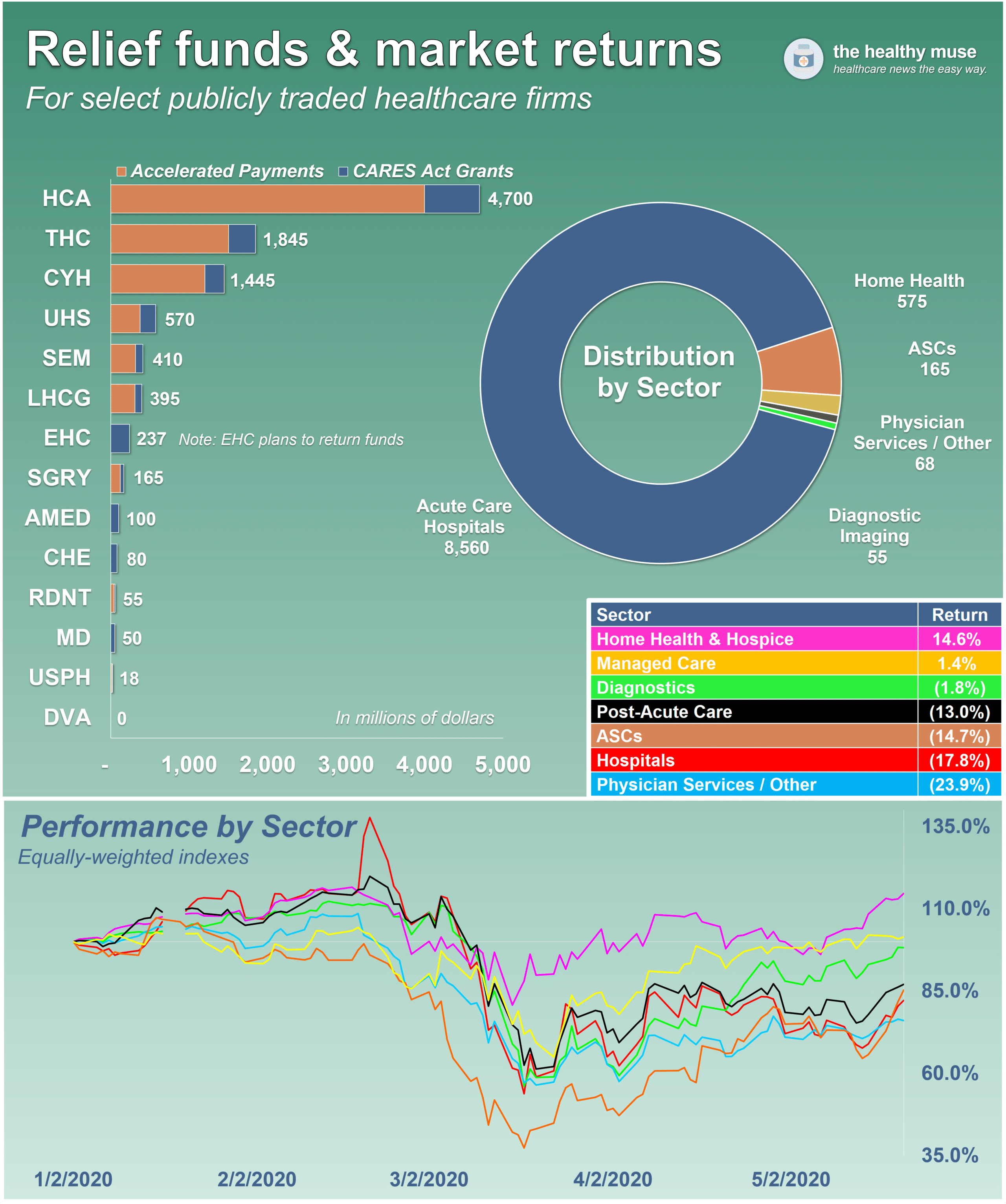

1. Acute care hospitals received the most funding support amid huge losses.

Of all the public healthcare services sectors, acute care hospital firms received by far the most funding as of Q1 2020.

- Almost 90% of CARES Act grant funding and Medicare accelerated payments went to hospital operators.

Hospitals are the biggest losers during the pandemic.

How much are hospitals losing without elective procedures in a pandemic environment?

- The American Hospital Association (AHA) published a report this week estimating that hospitals and health systems would lose about $202 billion over 4 months, mainly related to the cost of caring for COVID-19 patients and suspension of elective procedures.

Net that against the emergency healthcare funding of ~$175 billion, and you can spot the $27 billion difference hospitals might need just to break even over the coming months, according to the AHA.

To expand on hospital losses, publicly traded hospital operators reported interesting insights during their Q1 earnings releases.

- The highlights: most were seeing strong volumes until COVID lockdowns began (March 15). All hospital operators pulled their guidance for fiscal year 2020 and expect a big downturn in Q2.

It’s not just hospitals, either: Most outpatient healthcare settings experienced 30% to 75% patient volume declines during the Great Lockdown.

- This loss of volume is consistent across the board. You can see this effect in the April jobs report, too. Healthcare lost 1.4 million jobs almost entirely in outpatient settings.

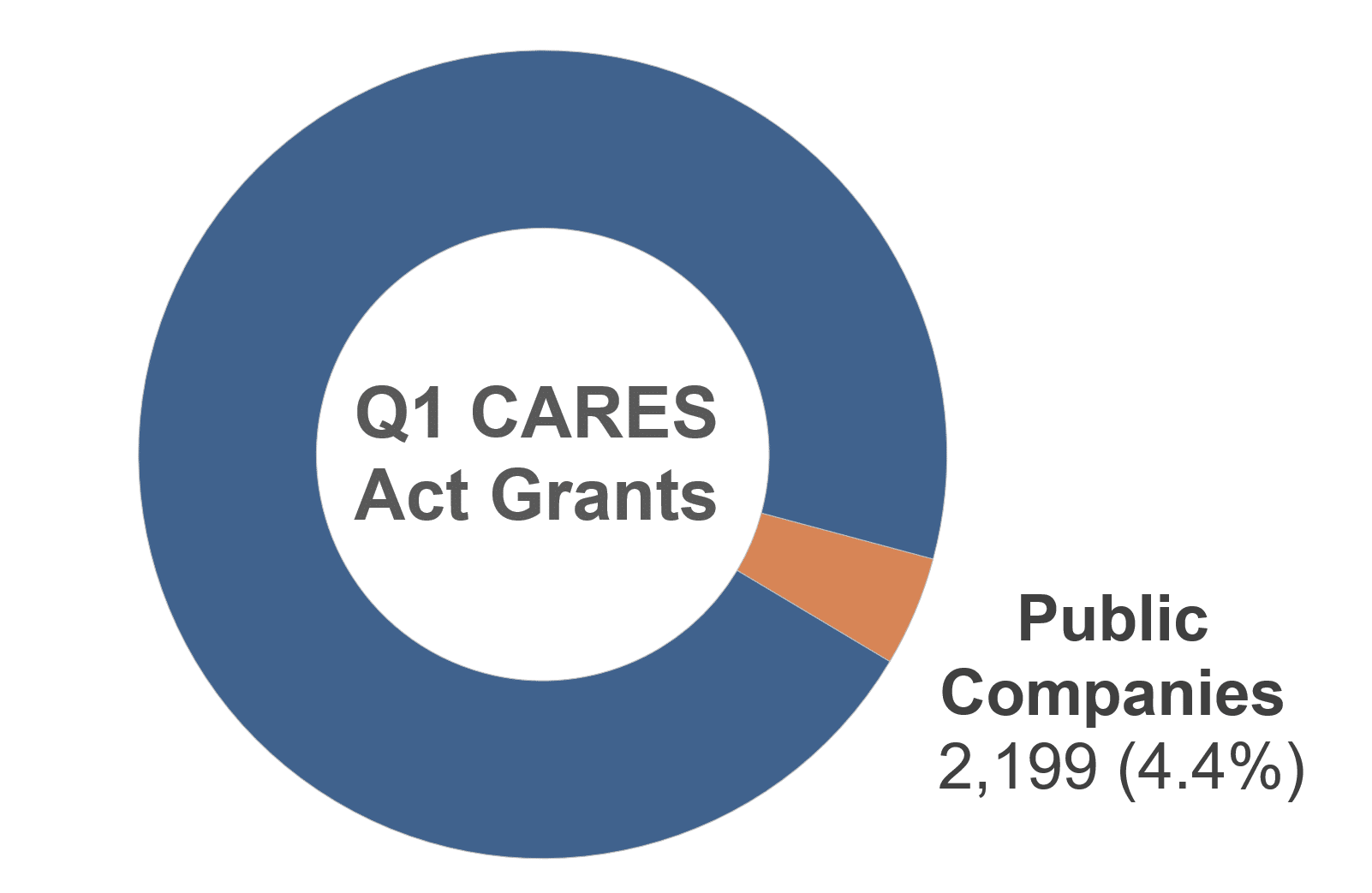

2. Public healthcare companies received very little CARES Act grant $$ in Q1.

In Q1 2020, HHS distributed about $50 billion in grants to hospitals and providers struggling during COVID-19. Of that $50 billion, public healthcare companies received about $2,200, or 4.4% of total grant funding.

Notably, most public healthcare services firms received much more funding in the form of accelerated payments from CMS.

- Providers will have to start repaying these ‘advance loans’ in August, unless that deadline is pushed back.

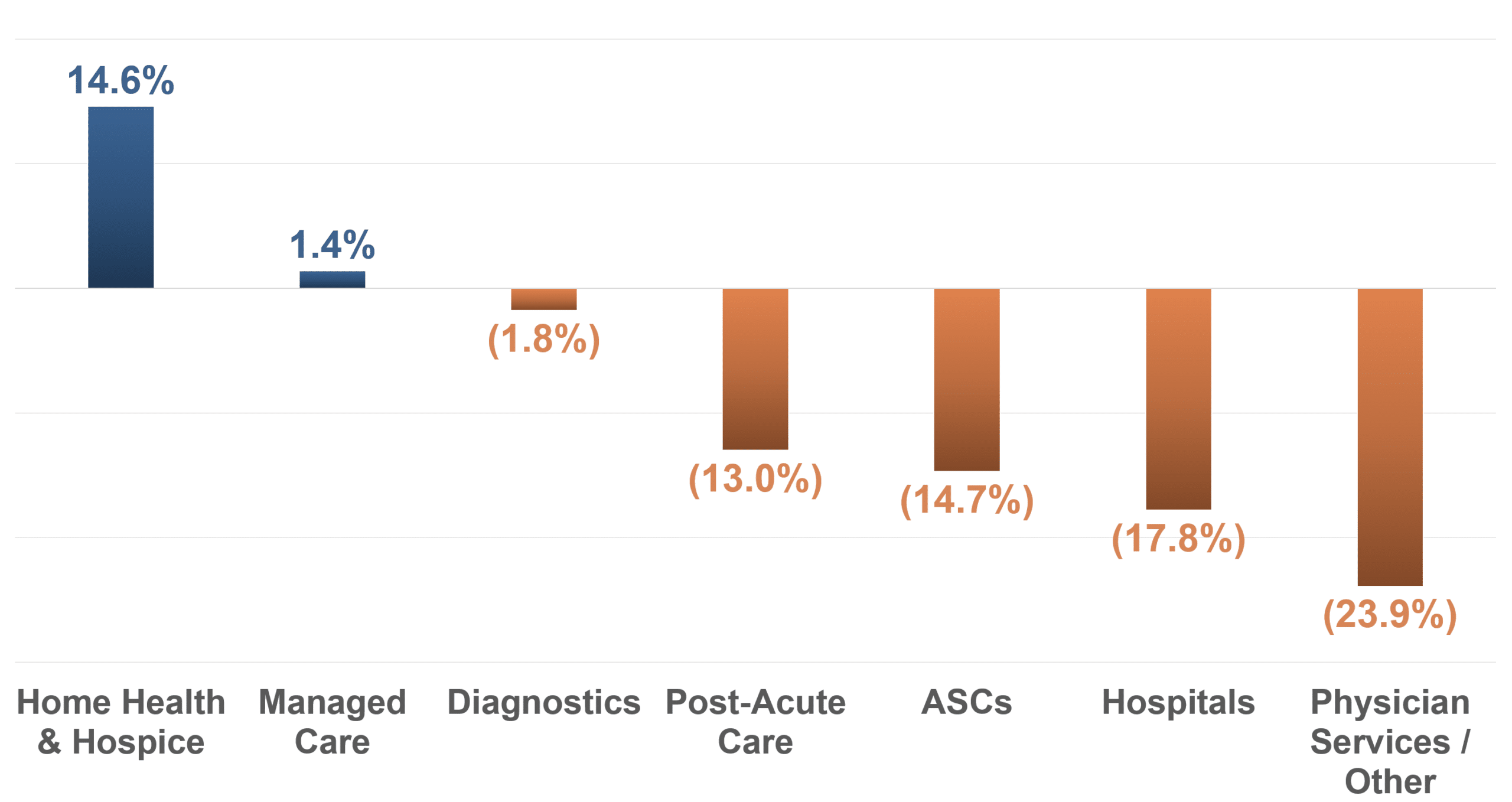

3. More relief funding for public healthcare companies did not correlate to stronger stock performance.

While public hospital firms received the most relief funding, the sector as a whole (meaning an equally weighted index following the share price performance of HCA Healthcare, Universal Healthcare Services, Community Health Systems, and Tenet Healthcare) under performed the S&P 500 by a wide margin.

- Sectors that rely on outpatient healthcare services have performed the worst so far this year. This basket of companies includes Surgery Partners, hospital operators mentioned above, Mednax, and U.S. Physical Therapy.

4. The home health and hospice sector once again outperforms.

Similar to historical trends and the poster child for growth in the healthcare industry, home health and hospice – e.g., LHC Group, Amedisys, and Chemed – displayed resilience and strength when compared to other healthcare services sectors.

This performance is probably attributable to investor speculation. With payment changes underway through PDGM, many believe the pandemic will only exacerbate consolidation in the home health and hospice industry.

- Who wins in a consolidating industry? The biggest players – and these operators are at the top of that list.

5. There are ‘strings attached’ to CARES Act grant money.

Providers are growing increasingly concerned that the relief funds come with hidden strings attached – like quarterly reporting on where the money is going.

- Other concessions that providers may need to make if they take the money: no surprise (out of network) billing, disclosing reimbursement rates from private insurance (AKA price transparency), and more.

We’ve already seen providers speak cautiously about relief funds.

Encompass Healthcare mentioned on its earnings calls that it had no plans to use the relief funds until the firm better understands the implications from HHS. Now, the post-acute giant is returning its funds to HHS.

- Expanding on that, home health providers are shying away from the funding too, fearing a CMS, WWE-style smackdown.

Thanks for reading.

Save yourself some time by subscribing to our all-in-one newsletter. Subscribers get the first edition – every Monday night.

About the Healthy Muse.

The Healthy Muse was created to educate people on the healthcare system.

- It’s a once weekly e-mail updating you on all the major election news, broader trends, big stories, and policy updates. Learn more about our vision here.

Get smarter and sign up below today.